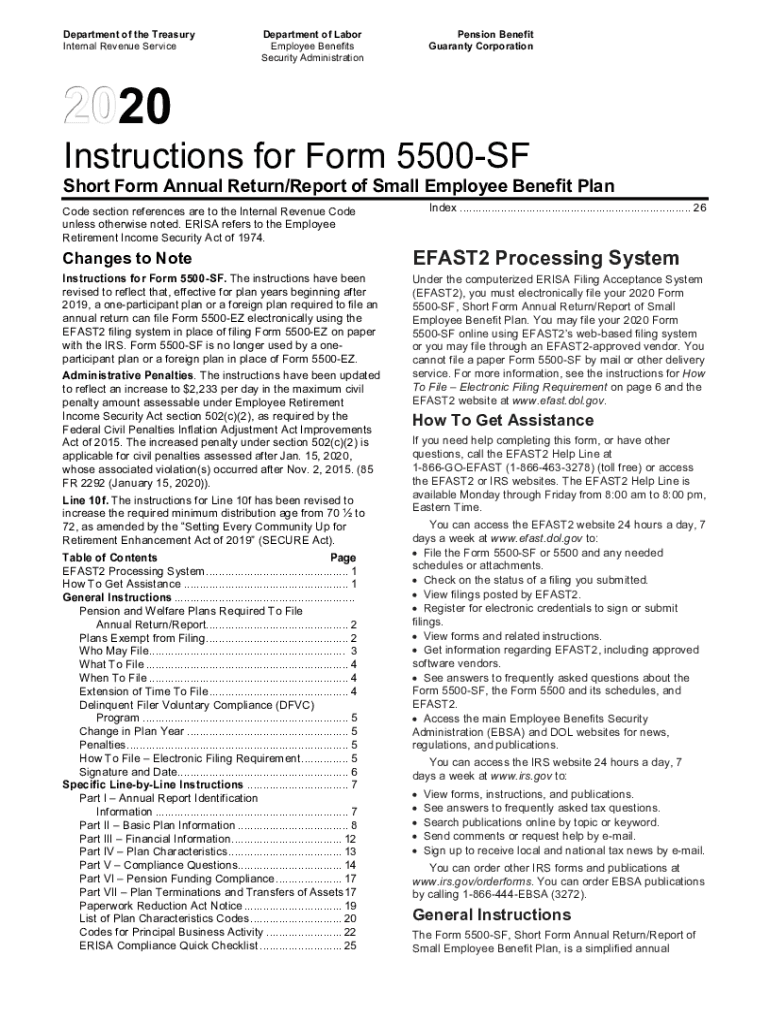

Form 5500-Sf Instructions 2021

Form 5500-Sf Instructions 2021 - Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. The dol has finalized certain revisions to the form 5500 instructions. If you are a small plan (generally under 100 participants. (if yes, see instructions and. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. An unfunded excess benefit plan. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan year, e.g., july 2022.

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. (if yes, see instructions and. Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. The dol has finalized certain revisions to the form 5500 instructions. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan year, e.g., july 2022. If you are a small plan (generally under 100 participants. An unfunded excess benefit plan. Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit.

Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. (if yes, see instructions and. Web the form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan year, e.g., july 2022. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. The dol has finalized certain revisions to the form 5500 instructions. If you are a small plan (generally under 100 participants. An unfunded excess benefit plan.

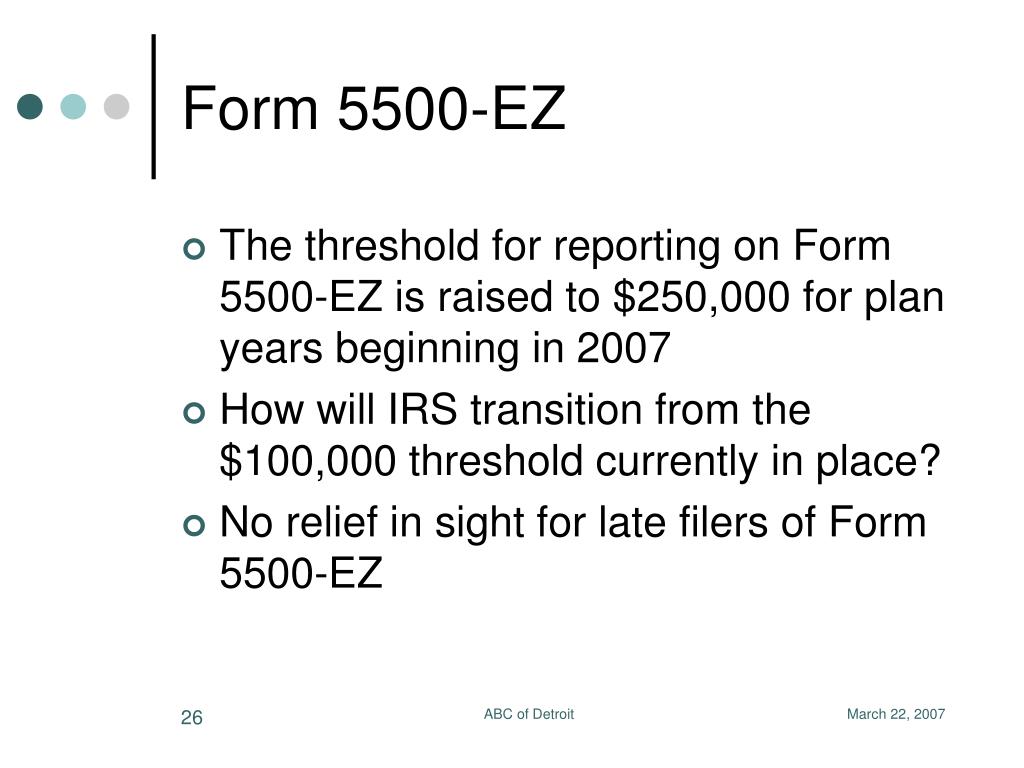

PPT Form 5500 Update PowerPoint Presentation, free download ID1268027

Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. (if yes, see instructions and. Be a small plan (i.e., generally have fewer than 100 participants at the beginning.

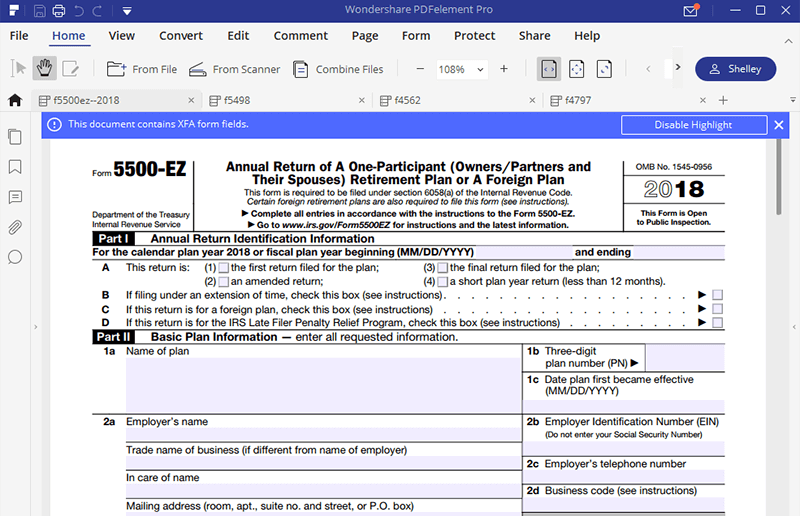

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the final revisions are.

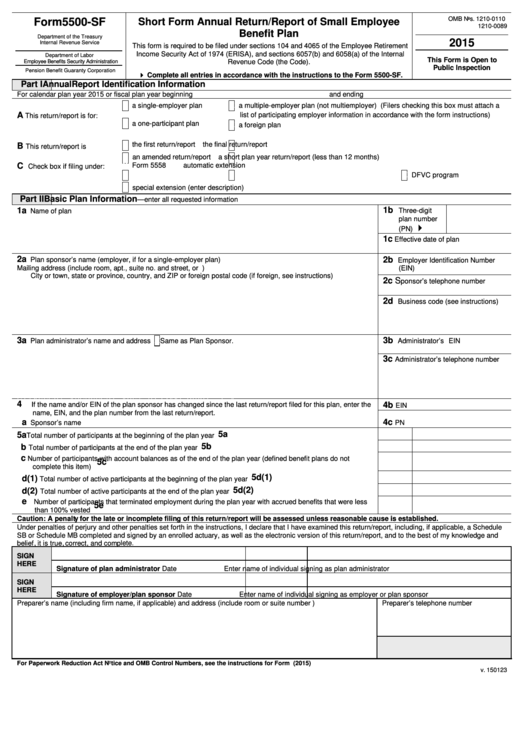

Form 5500Sf Short Form Annual Return/report Of Small Employee

Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. (if yes, see instructions and. Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form.

Form 5500 Sf Instructions 2018 slidesharetrick

Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. (if yes, see instructions and. Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan,.

Army Fillable Da Form 5500 Printable Forms Free Online

Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. An unfunded excess benefit plan. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. The dol has finalized certain revisions to the form 5500 instructions. The dol, irs, and pbgc.

Form 5500 Sf Instructions 2018 slidesharetrick

Web the form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan year, e.g., july 2022. (if yes, see instructions and. If you are a small plan (generally under 100 participants. The dol has finalized certain revisions to the form 5500 instructions. Web.

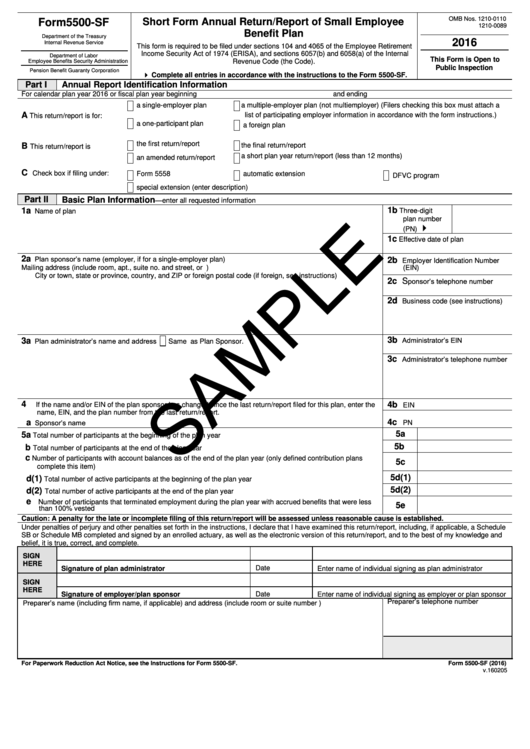

Fillable Form 5500Sf Sample Short Form Annual Return/report Of Small

Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. The dol,.

form 8821 instructions 2021 Fill Online, Printable, Fillable Blank

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. (if yes, see instructions and. If you are a small plan (generally under 100 participants. An unfunded excess benefit plan. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec.

5500 Instructions 2018 Fillable and Editable PDF Template

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. If you are a small plan (generally under 100 participants. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. Web plan administrators, employers, and others generally satisfy these.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

The dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Be a small plan (i.e.,.

Be A Small Plan (I.e., Generally Have Fewer Than 100 Participants At The Beginning Of The Plan Year), Meet The Conditions For.

Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the final revisions are limited to changes that are effective beginning with the 2021 plan year. Web a return/report must be filed every year for every pension benefit plan, welfare benefit plan, and for every direct filing entity. Web plan administrators, employers, and others generally satisfy these annual reporting obligations by filing the form 5500, annual return/report of employee benefit.

If You Are A Small Plan (Generally Under 100 Participants.

An unfunded excess benefit plan. The dol has finalized certain revisions to the form 5500 instructions. Web the form 5500 annual return/ report for the 2021 plan year generally is not required to be filed until seven months after the end of the 2021 plan year, e.g., july 2022. (if yes, see instructions and.