Form 56 F

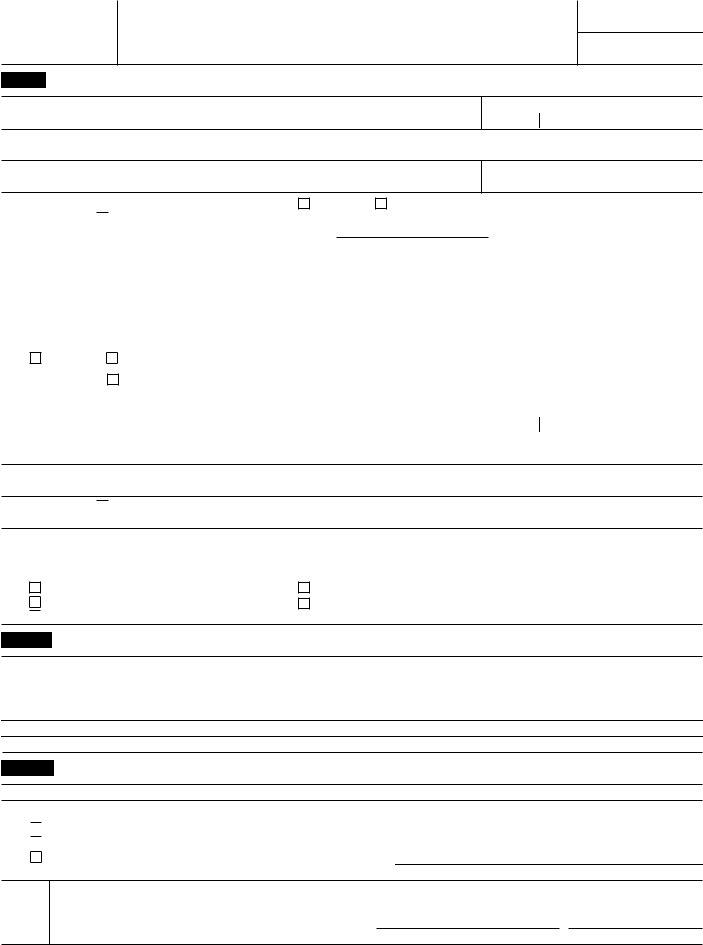

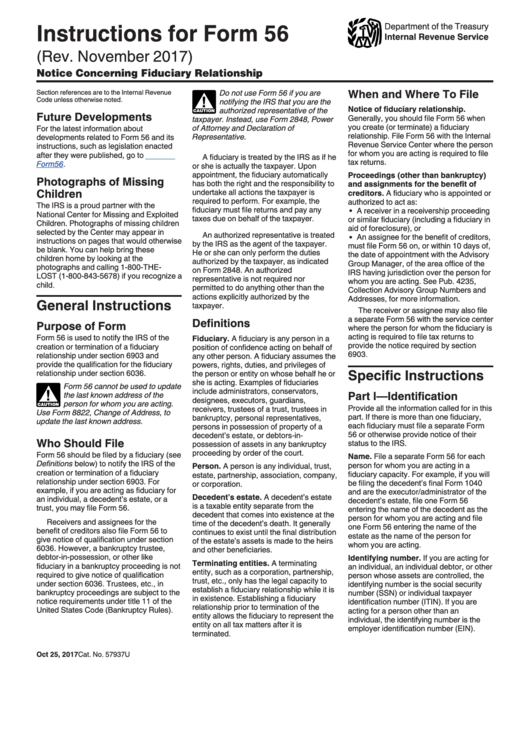

Form 56 F - File a separate form 56 for each person for whom you are acting in a fiduciary capacity. For instructions and the latest information. Web each fiduciary must file a separate form 56 or otherwise provide notice of their status to the irs. For example, if you will be filing the decedent’s final form 1040 and are the executor/administrator of the decedent’s estate, file one form 56 Download past year versions of this tax form as pdfs here: Use form 8822, change of address,. Form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). November 2022) department of the treasury internal revenue service.

Use form 8822, change of address,. Form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. 7 minutes watch video get the form! December 2022) department of the treasury internal revenue service. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Notice concerning fiduciary relationship (internal revenue code sections 6036 and 6903) go to. Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. Notice concerning fiduciary relationship of financial institution (internal revenue code sections 6036, 6402, and 6903) go to.

Instructions federal law allows for the appointment of conservators or receivers in the case of businesses that become insolvent or cannot handle their own financial affairs. Download past year versions of this tax form as pdfs here: File a separate form 56 for each person for whom you are acting in a fiduciary capacity. December 2022) department of the treasury internal revenue service. For example, if you will be filing the decedent’s final form 1040 and are the executor/administrator of the decedent’s estate, file one form 56 Notice concerning fiduciary relationship (internal revenue code sections 6036 and 6903) go to. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). For instructions and the latest information. 7 minutes watch video get the form! Use form 8822, change of address,.

Fill Free fillable Form 56 Notice Concerning Fiduciary Relationship

Use form 8822, change of address,. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Web form 56 is.

Form 56 F ≡ Fill Out Printable PDF Forms Online

Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036. File a separate form 56 for each person for whom you are acting in a fiduciary capacity. Download past year versions of this tax form as pdfs here:.

Top 7 Irs Form 56 Templates free to download in PDF format

Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. Use form 8822, change of address,. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036. Use this form.

irs publication 559 final return for decedent Fill Online, Printable

Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section.

Annual Registration Statements (Form 561) SEEDUCATION PUBLIC

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Notice concerning fiduciary relationship (internal revenue code sections 6036 and 6903) go to. Notice concerning fiduciary relationship of financial institution (internal revenue code sections 6036, 6402, and 6903) go to. 7.

Fill Free fillable Notice Concerning Fiduciary Relationship of

For instructions and the latest information. Instructions federal law allows for the appointment of conservators or receivers in the case of businesses that become insolvent or cannot handle their own financial affairs. December 2022) department of the treasury internal revenue service. Notice concerning fiduciary relationship (internal revenue code sections 6036 and 6903) go to. Web filing irs form 56 notifies.

IRS Form 56F Download Fillable PDF or Fill Online Notice Concerning

Use form 8822, change of address,. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). For instructions and the latest information. Web each fiduciary must file a separate form 56 or otherwise provide notice of their status to the irs..

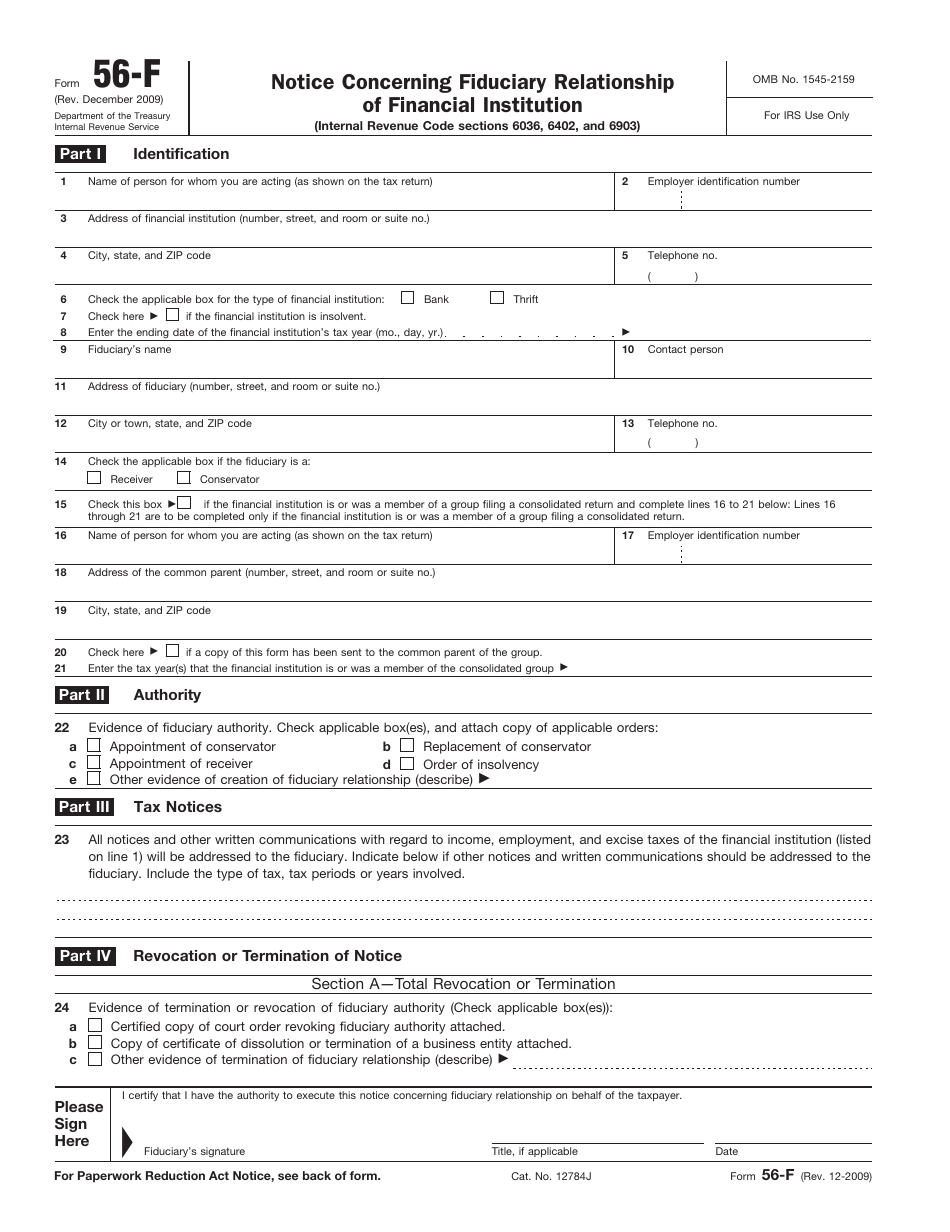

Af Form 56 Fill Out and Sign Printable PDF Template signNow

For instructions and the latest information. Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036. File a separate.

IRS Form 56 (Notice Concerning Fiduciary Relationship) Internal

Download past year versions of this tax form as pdfs here: December 2022) department of the treasury internal revenue service. Notice concerning fiduciary relationship (internal revenue code sections 6036 and 6903) go to. Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. November 2022) department of the treasury internal revenue.

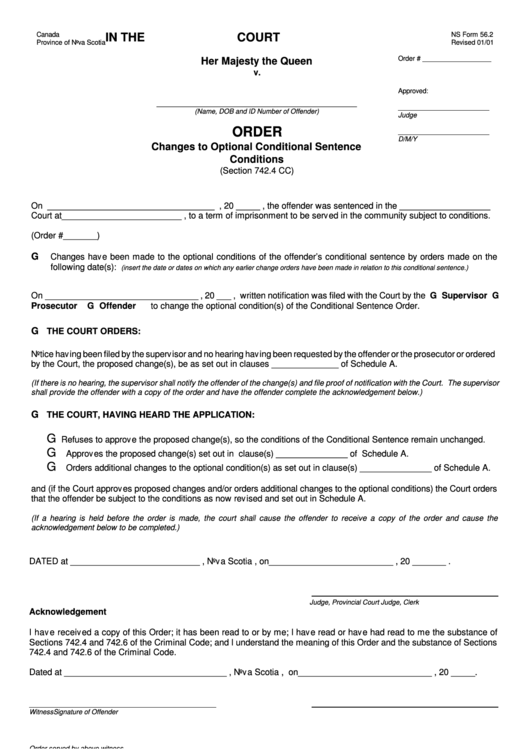

Ns Form 56.2 Order (Changes To Optional Conditional Sentence

Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. For example, if you will be filing the decedent’s final form 1040 and are the executor/administrator of the decedent’s estate, file one form 56 Web form 56 is used to notify the irs of the creation or termination of a fiduciary.

7 Minutes Watch Video Get The Form!

The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate. December 2022) department of the treasury internal revenue service. Web each fiduciary must file a separate form 56 or otherwise provide notice of their status to the irs. November 2022) department of the treasury internal revenue service.

Notice Concerning Fiduciary Relationship (Internal Revenue Code Sections 6036 And 6903) Go To.

Notice concerning fiduciary relationship of financial institution (internal revenue code sections 6036, 6402, and 6903) go to. File a separate form 56 for each person for whom you are acting in a fiduciary capacity. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under section 6036. Download past year versions of this tax form as pdfs here:

Instructions Federal Law Allows For The Appointment Of Conservators Or Receivers In The Case Of Businesses That Become Insolvent Or Cannot Handle Their Own Financial Affairs.

Use form 8822, change of address,. Web filing irs form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. Form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. For instructions and the latest information.

For Example, If You Will Be Filing The Decedent’s Final Form 1040 And Are The Executor/Administrator Of The Decedent’s Estate, File One Form 56

Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).