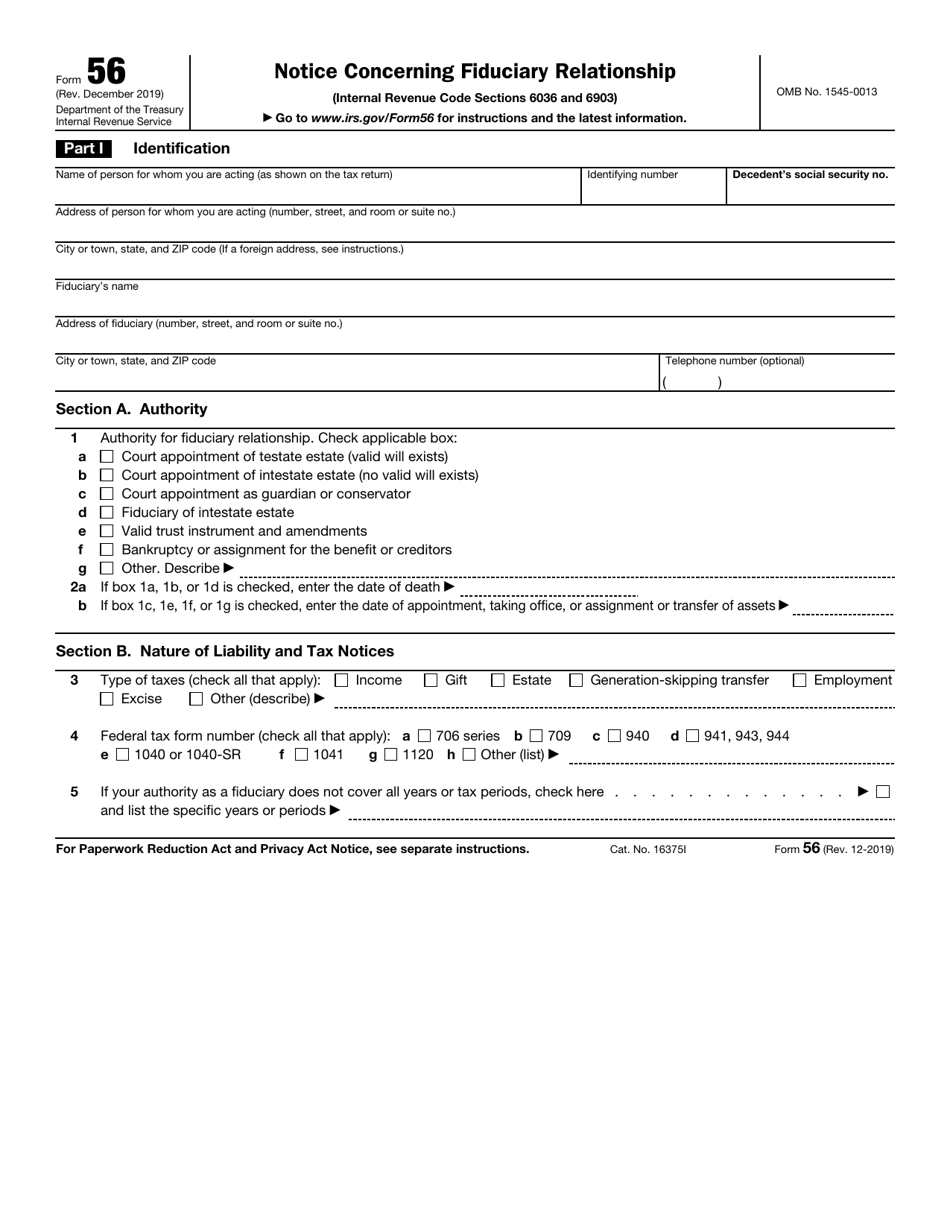

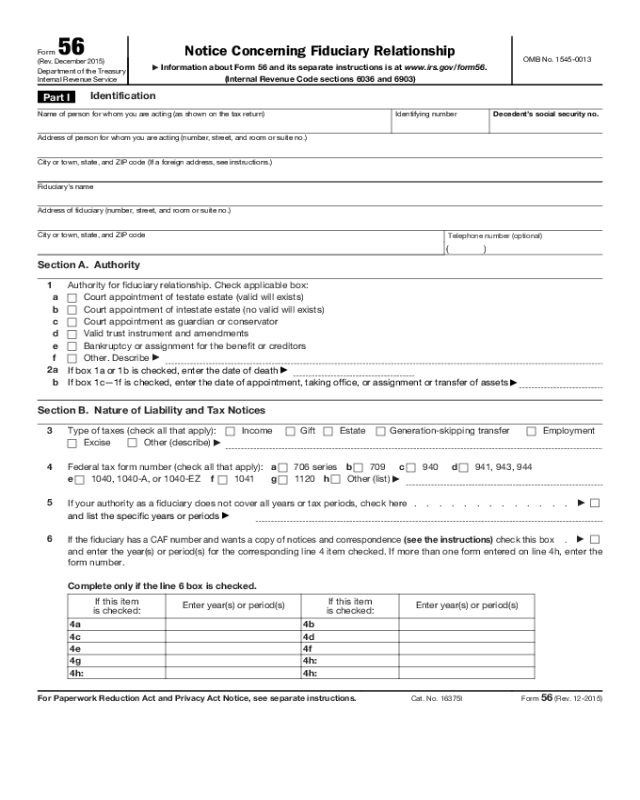

Form 56 Instructions 2021

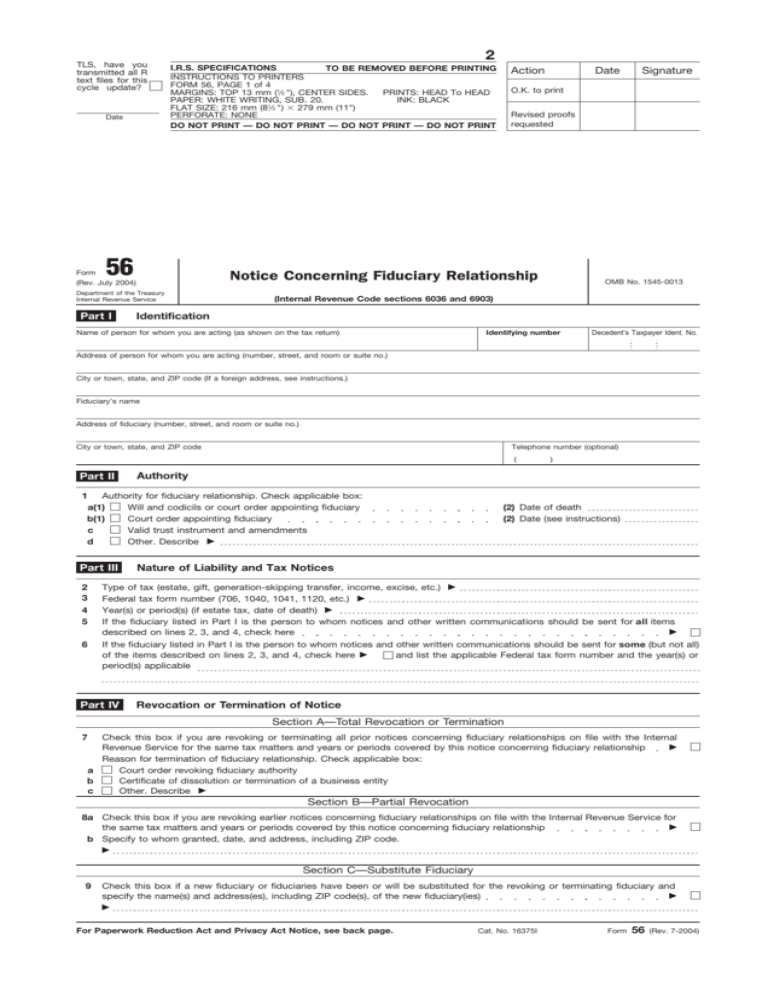

Form 56 Instructions 2021 - An executor must file form 56 for the individual decedent, if the executor will be filing a final. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Form 56 can only be filed from the current year software. Web form 56 omb no. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Web solved•by intuit•48•updated february 09, 2023. Web we last updated the notice concerning fiduciary relationship in december 2022, so this is the latest version of form 56, fully updated for tax year 2022. It must be transmitted separately. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the.

Web we last updated the notice concerning fiduciary relationship in december 2022, so this is the latest version of form 56, fully updated for tax year 2022. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. You can download or print. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. That means we will be booking your ots class assignment just as soon as. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Web comments are invited on: Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections.

Form 56, notice concerning fiduciary. Web the fiduciary (usually a trustee or an executor) of an estate or trust or a guardian should use this form to notify the irs of the creation or termination of a fiduciary relationship. Web comments are invited on: Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. Web form 56 omb no. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web per irs instructions for form 56: Form 56 can only be filed from the current year software. Any documents required to be mailed will be included in the filing. It must be transmitted separately.

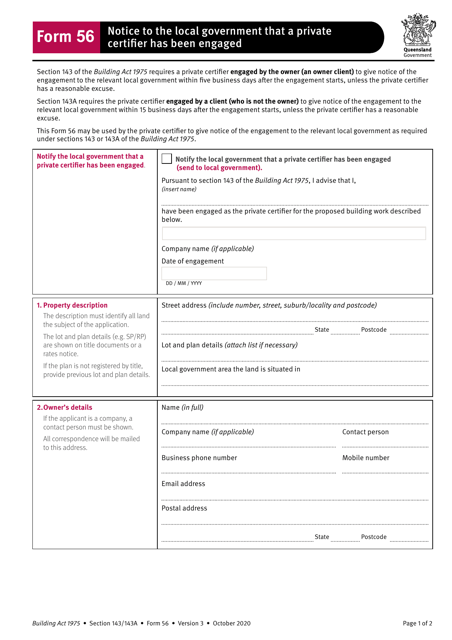

Form 56 Download Fillable PDF or Fill Online Notice to the Local

Web comments are invited on: Web per the form 56 instructions: Form 56 can only be filed from the current year software. Form 56, notice concerning fiduciary. An executor must file form 56 for the individual decedent, if the executor will be filing a final.

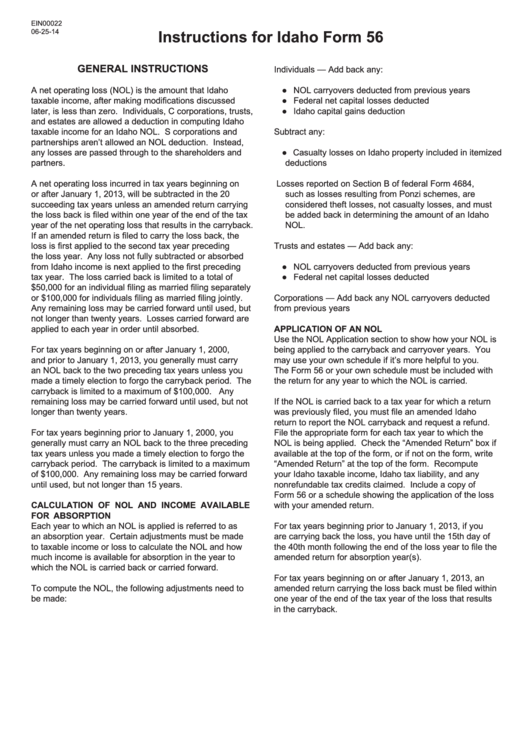

Instructions For Idaho Form 56 printable pdf download

An executor must file form 56 for the individual decedent, if the executor will be filing a final. That means we will be booking your ots class assignment just as soon as. (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. If you are appointed to act in a.

Annual Registration Statements (Form 561) SEEDUCATION PUBLIC

Web we last updated the notice concerning fiduciary relationship in december 2022, so this is the latest version of form 56, fully updated for tax year 2022. Web per irs instructions for form 56: Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a.

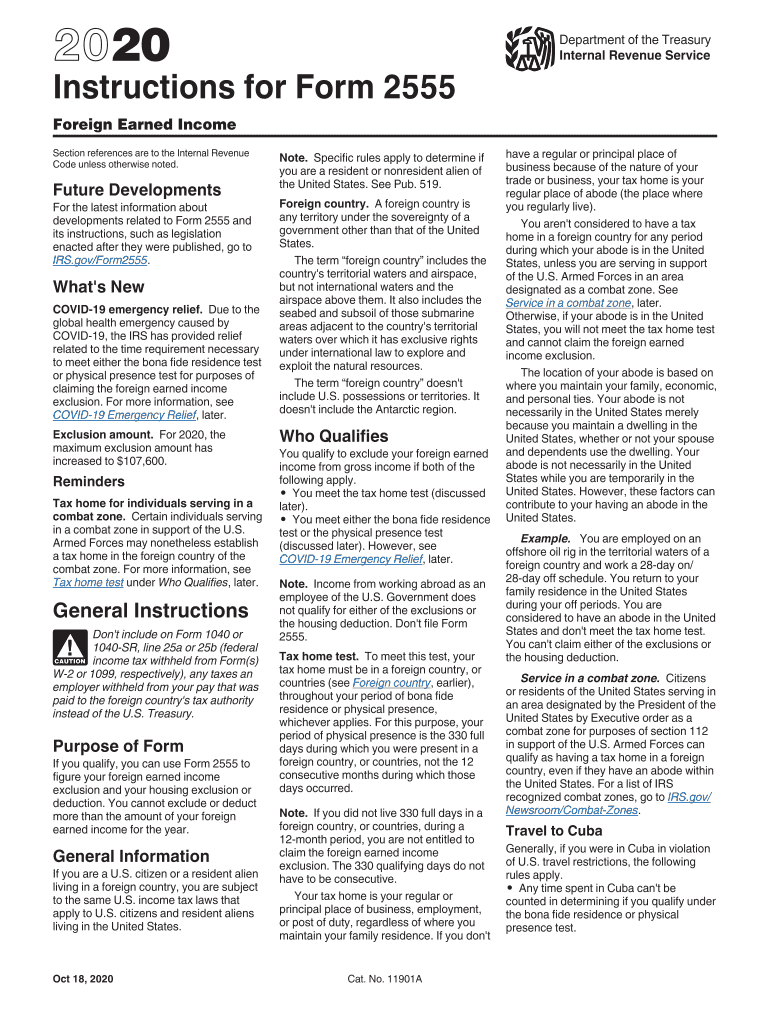

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

Form 56, notice concerning fiduciary. Download past year versions of this tax form as pdfs. Web per the form 56 instructions: Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. Any documents required to be mailed will be included.

IRS form 56Notice Concerning Fiduciary Relationship

Form 56 can only be filed from the current year software. Web per the form 56 instructions: You can download or print. Web form 56 omb no. Web use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Form 56 IRS Template PDF

Web solved•by intuit•48•updated february 09, 2023. Form 56 can only be filed from the current year software. (a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web form 56 omb no. Web form 56 when you file your tax return part of the documents is the filing instructions.

form 56 Internal Revenue Service Fiduciary

An executor must file form 56 for the individual decedent, if the executor will be filing a final. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section.

IRS Form 56 Download Fillable PDF or Fill Online Notice Concerning

You can download or print. Web form 56 when you file your tax return part of the documents is the filing instructions. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. Web per.

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. An executor must file form 56 for the individual decedent, if the executor will be filing a final. Form 56 can only be filed from the current year software. (a).

Form 56 Fill Online, Printable, Fillable, Blank pdfFiller

If you are appointed to act in a fiduciary capacity for another, you must file a written notice with the irs stating this. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship. Web form 56 when you file your tax return part of the documents is the filing instructions. Web solved•by.

Form 56 Can Only Be Filed From The Current Year Software.

August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. That means we will be booking your ots class assignment just as soon as. Web form 56 when you file your tax return part of the documents is the filing instructions. Web per irs instructions for form 56:

Web Form 56 Is Used To Notify The Irs Of The Creation Or Termination Of A Fiduciary Relationship.

You can download or print. Any documents required to be mailed will be included in the filing. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Web we last updated the notice concerning fiduciary relationship in december 2022, so this is the latest version of form 56, fully updated for tax year 2022.

Web Use This Form To Notify The Irs Of A Fiduciary Relationship Only If That Relationship Is With Respect To A Financial Institution (Such As A Bank Or A Thrift).

An executor must file form 56 for the individual decedent, if the executor will be filing a final. Web comments are invited on: Form 56, notice concerning fiduciary. Web form 56 omb no.

Web Per The Form 56 Instructions:

(a) whether the collection of information is necessary for the proper performance of the functions of the agency, including whether. Web form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the qualification for the fiduciary relationship under. It must be transmitted separately. Web solved•by intuit•48•updated february 09, 2023.