Form 568 Online

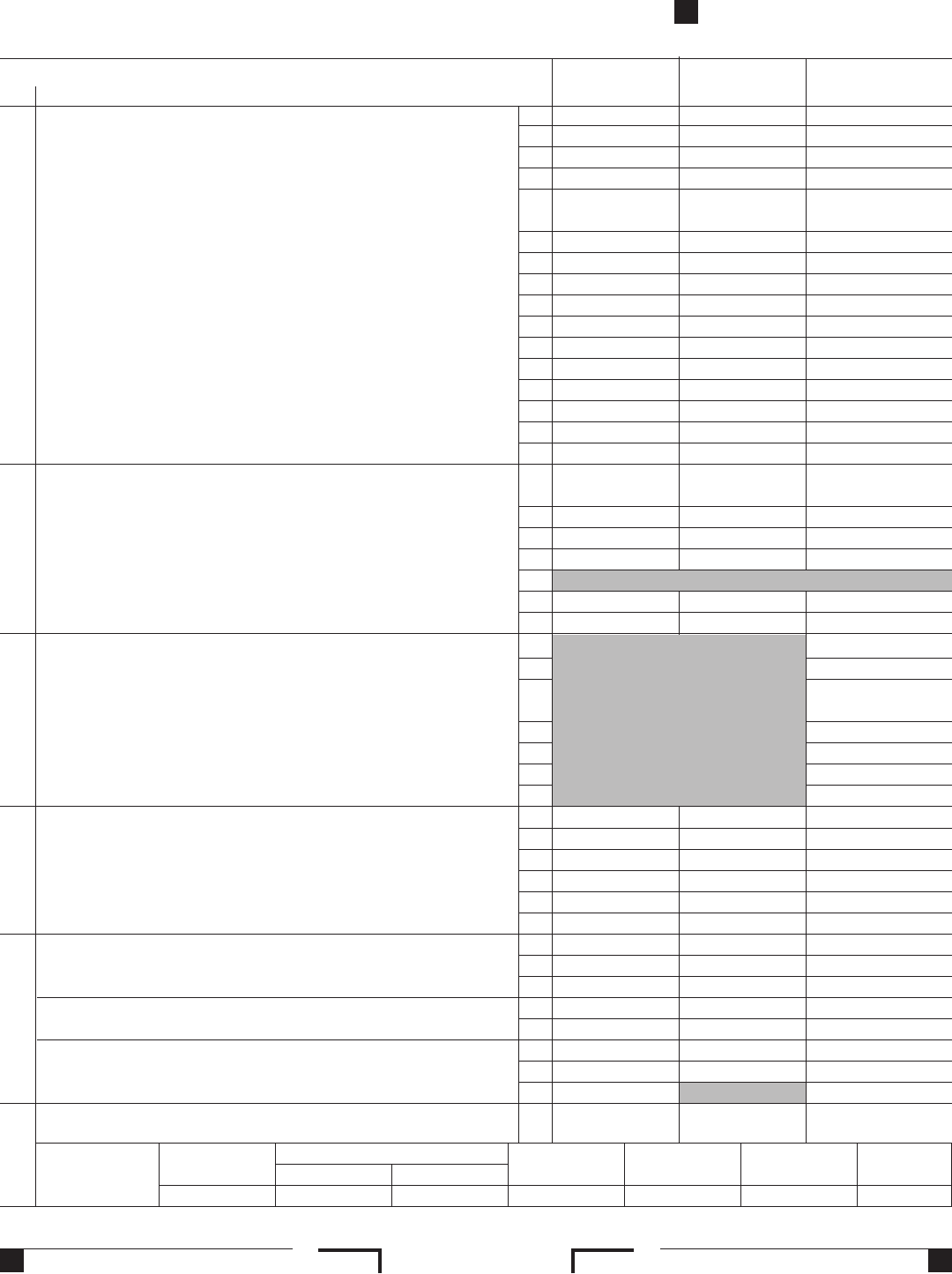

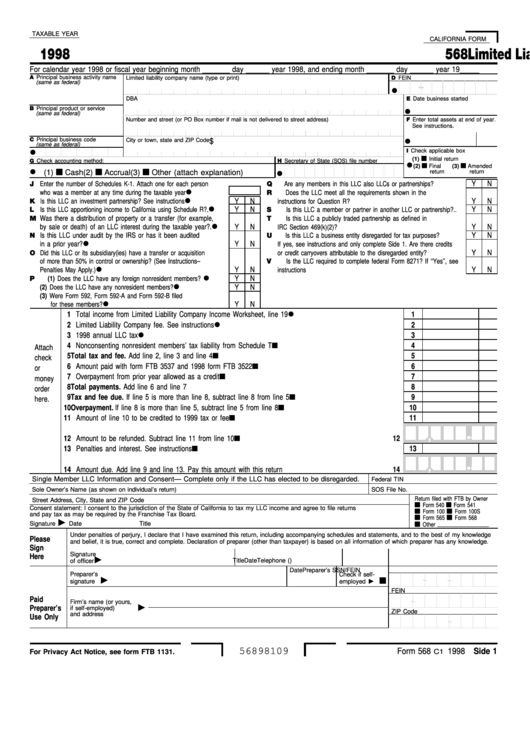

Form 568 Online - Web february 22, 2021 4:01 pm last updated february 22, 2021 4:01 pm 0 3 3,030 reply bookmark icon joannab2 expert alumni yes, california form 568, limited. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web we last updated california form 568 in february 2023 from the california franchise tax board. 2021, form 568, limited liability company return of income: Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. This form is for income earned in tax year 2022, with tax returns due in april. Form 568 is due on march 31st following the end of the tax year. Web forms you can fill out and print! Save or instantly send your ready documents. Web if you have an llc, here’s how to fill in the california form 568:

Easily fill out pdf blank, edit, and sign them. You can also download it, export it or print it out. Line 1—total income from schedule iw. Edit your form 568 online. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Web llcs classified as partnerships file form 568. You and your clients should be aware that a disregarded smllc is required to: Web send california form 568 2018 via email, link, or fax. They are subject to the annual tax, llc fee and credit limitations. Form 568 is due on march 31st following the end of the tax year.

Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web february 22, 2021 4:01 pm last updated february 22, 2021 4:01 pm 0 3 3,030 reply bookmark icon joannab2 expert alumni yes, california form 568, limited. Edit your form 568 online. Web we last updated california form 568 in february 2023 from the california franchise tax board. Web if you have an llc, here’s how to fill in the california form 568: Type text, add images, blackout confidential. Line 1—total income from schedule iw. Web form 568 due date. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

This form is for income earned in tax year 2022, with tax returns due in april. Easily fill out pdf blank, edit, and sign them. You can also download it, export it or print it out. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Llcs.

Fillable Form 568 Limited Liability Company Return Of 1998

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Easily fill out pdf blank, edit, and sign them. They are subject to the annual tax, llc fee and credit limitations. (all versions of jetform filler are. Llcs classified as a disregarded entity or.

CA FTB 568BK 2017 Fill out Tax Template Online US Legal Forms

When is the annual tax due? Edit your form 568 online. Web llcs classified as partnerships file form 568. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. This form is for income earned in tax year 2022, with tax returns due in april.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Edit your form 568 online. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Easily fill out pdf blank, edit, and sign them. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Line 1—total.

Download Instructions for Form 568 Schedule EO PassThrough Entity

(all versions of jetform filler are. Easily fill out pdf blank, edit, and sign them. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web send california form 568 2018 via email, link, or fax. This form is for income earned in.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. You can also download it, export it or print it out. Form 568 is due on march 31st following the end of the tax year. Registration after the year begins. To properly.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

(all versions of jetform filler are. If your llc files on an extension, refer to payment for automatic extension for. Web send california form 568 2018 via email, link, or fax. When is the annual tax due? Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

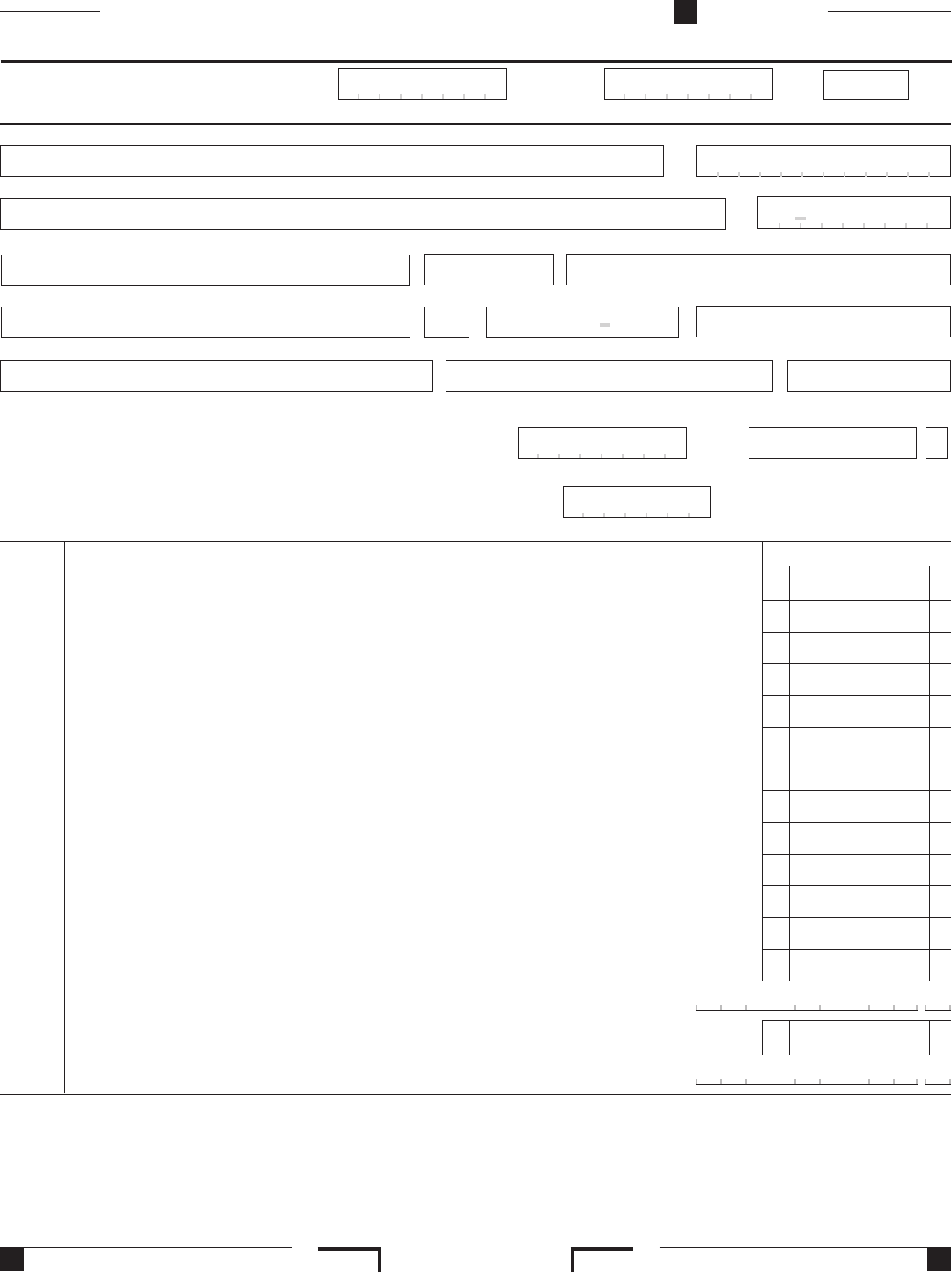

ADEM Form 568 Download Printable PDF or Fill Online Application for

I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Form 568 is due on march 31st following the end of the tax year. This form is for income earned in tax year 2022, with tax returns due in april. 2021, form.

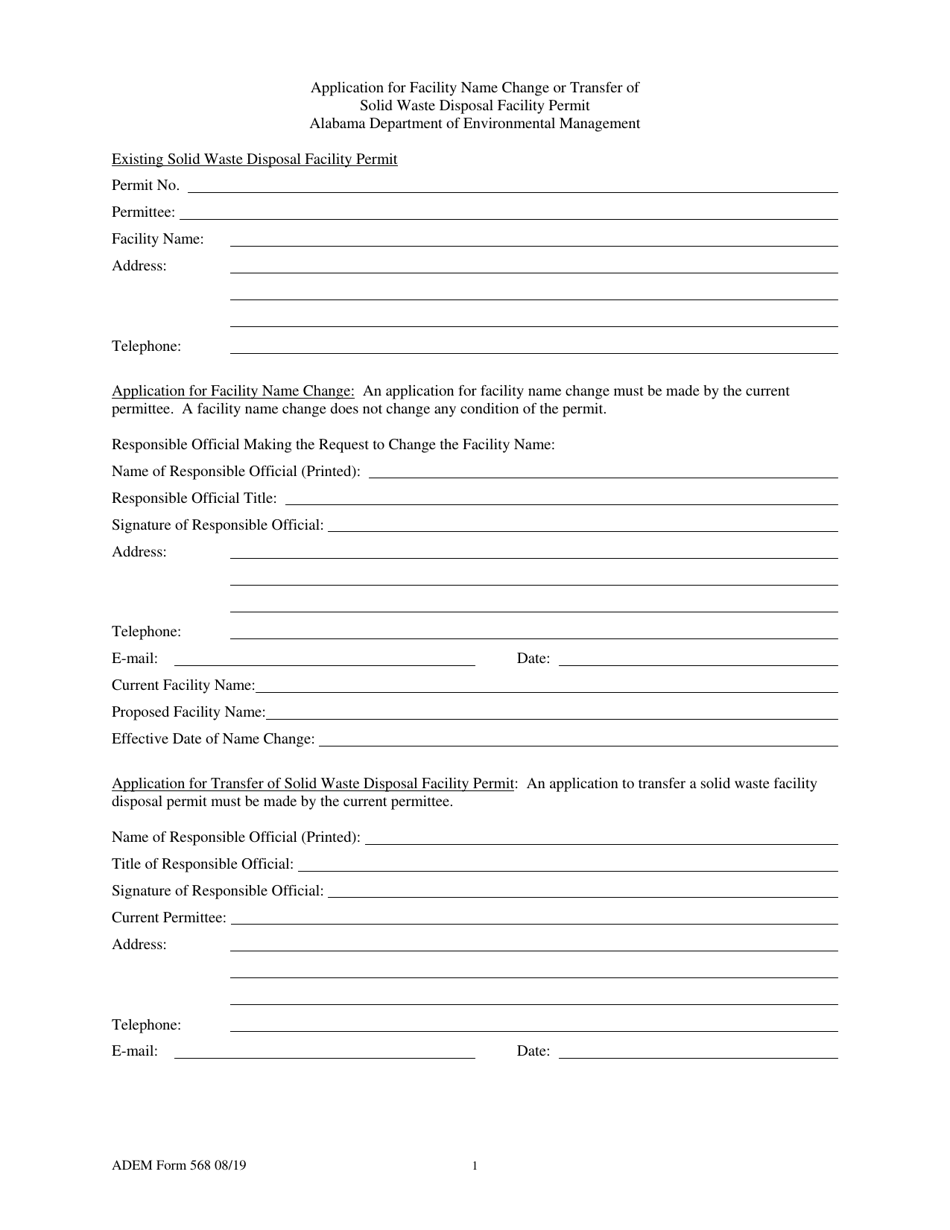

2002 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank pdfFiller

Easily fill out pdf blank, edit, and sign them. Form 568 is due on march 31st following the end of the tax year. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal. Web february 22, 2021 4:01 pm last updated february.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. To properly view forms embedded with logos*, jetform filler 4.3 or higher is required. Type text, add images, blackout confidential. They are subject to the annual tax, llc fee and credit limitations. Web we last updated the limited liability company return of income in.

Llcs May Be Classified For Tax Purposes As A Partnership, A Corporation, Or A Disregarded Entity.

Form 568 is due on march 31st following the end of the tax year. They are subject to the annual tax, llc fee and credit limitations. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april.

Web We Require An Smllc To File Form 568, Even Though They Are Considered A Disregarded Entity For Tax Purposes.

Web if you have an llc, here’s how to fill in the california form 568: If your llc files on an extension, refer to payment for automatic extension for. Web when is form 568 due? Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

Web Up To $40 Cash Back Do Whatever You Want With A 2021 Form 568 Limited Liability Company Return Of Income.

Type text, add images, blackout confidential. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. While you can submit your state income tax return and federal income tax return by april 15,. Web forms you can fill out and print!

I (1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership (More Than A 50% Interest) Of This Llc Or Any Legal.

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web february 22, 2021 4:01 pm last updated february 22, 2021 4:01 pm 0 3 3,030 reply bookmark icon joannab2 expert alumni yes, california form 568, limited. Save or instantly send your ready documents.