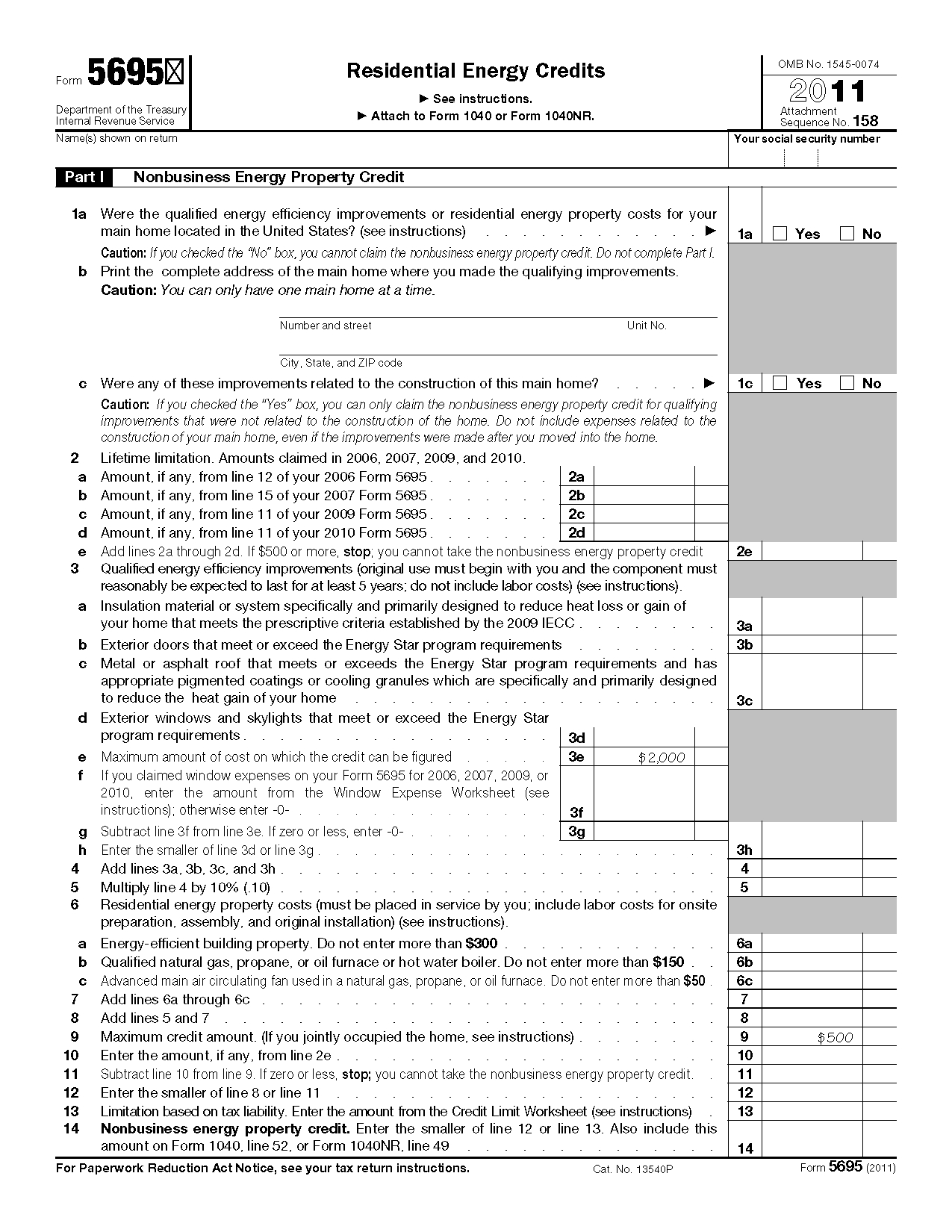

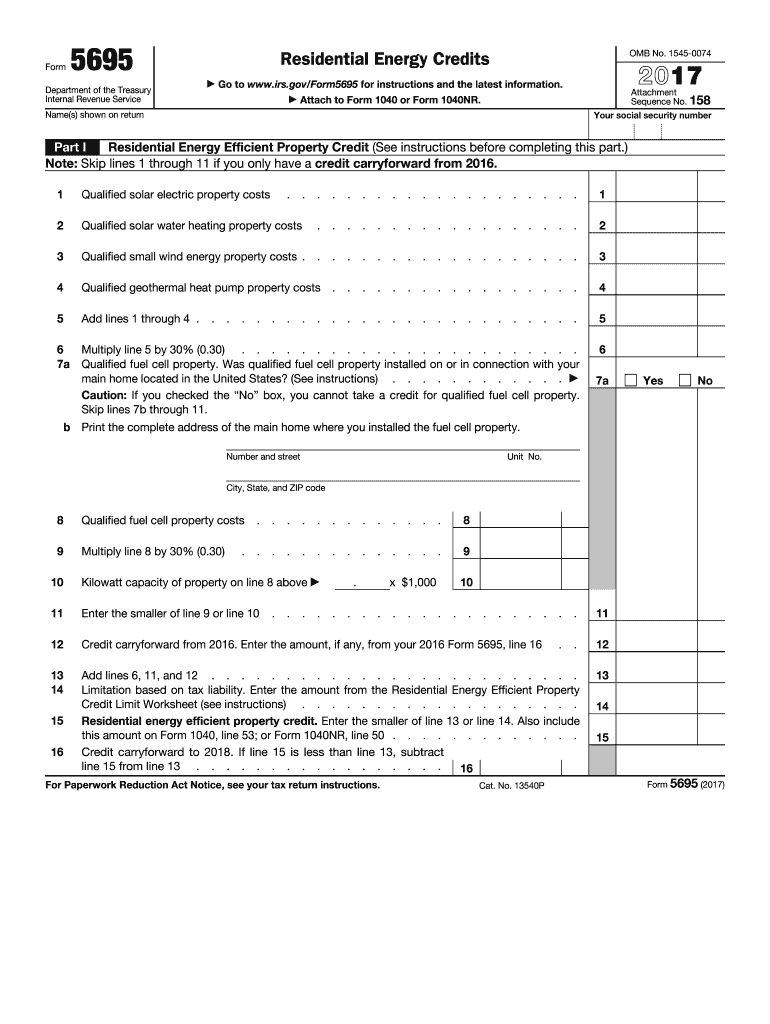

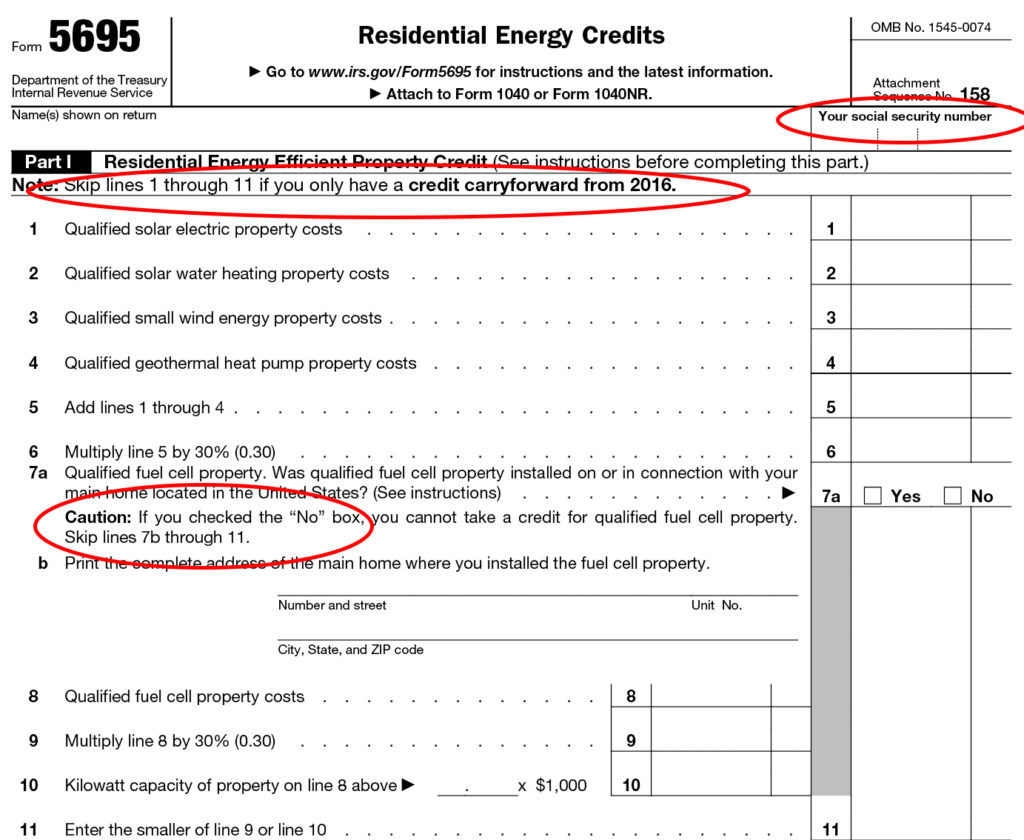

Form 5695 Instruction

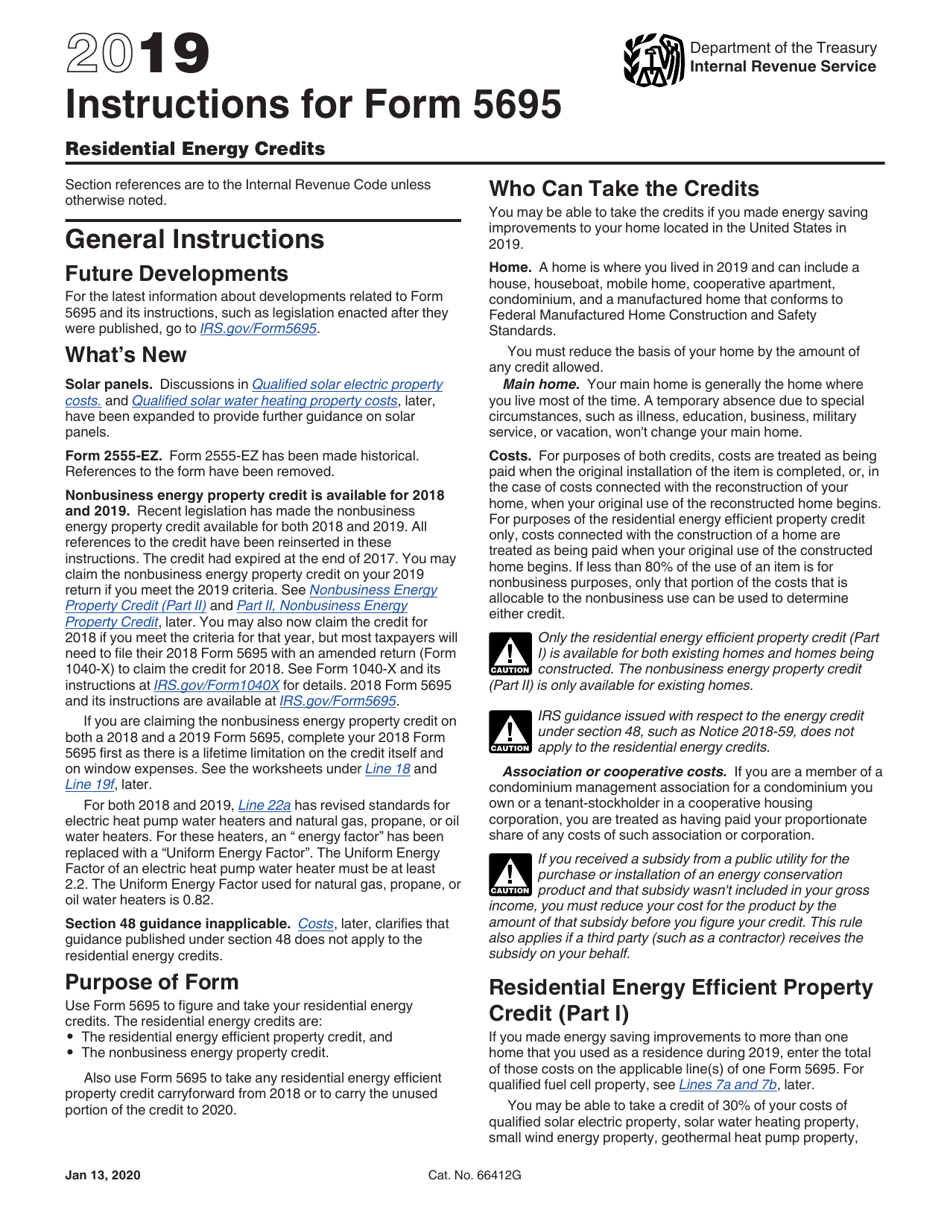

Form 5695 Instruction - Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Line 30 has the instructions you need to include the credit. Web the rce credit replaces the reep credit beginning with the 2022 tax year and runs through 2032 at its full amount with reduced amounts in 2033 and 2034. Web generating the 5695 in proseries: Purpose of form use form 5695 to figure and take your residential energy credits. General instructions future developments for. On the dotted line to the left of line 25, enter more. • the residential clean energy credit, and • the energy. The residential energy credits are: Web per irs instructions for form 5695, on page 1:

Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted. The residential energy credits are: The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential clean energy credit, and • the energy. Web generating the 5695 in proseries: Line 30 has the instructions you need to include the credit. Web what is form 5695? Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations.

Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Web instructions for form 5695 residential energy credits section references are to the internal revenue code unless otherwise noted. Press f6to bring up open forms. For instructions and the latest. Department of the treasury internal revenue service. Web per irs instructions for form 5695, on page 1: Web purpose of form use form 5695 to figure and take your residential energy credits. Web generating the 5695 in proseries: The residential energy credits are: Purpose of form use form 5695 to figure and take your residential energy credits.

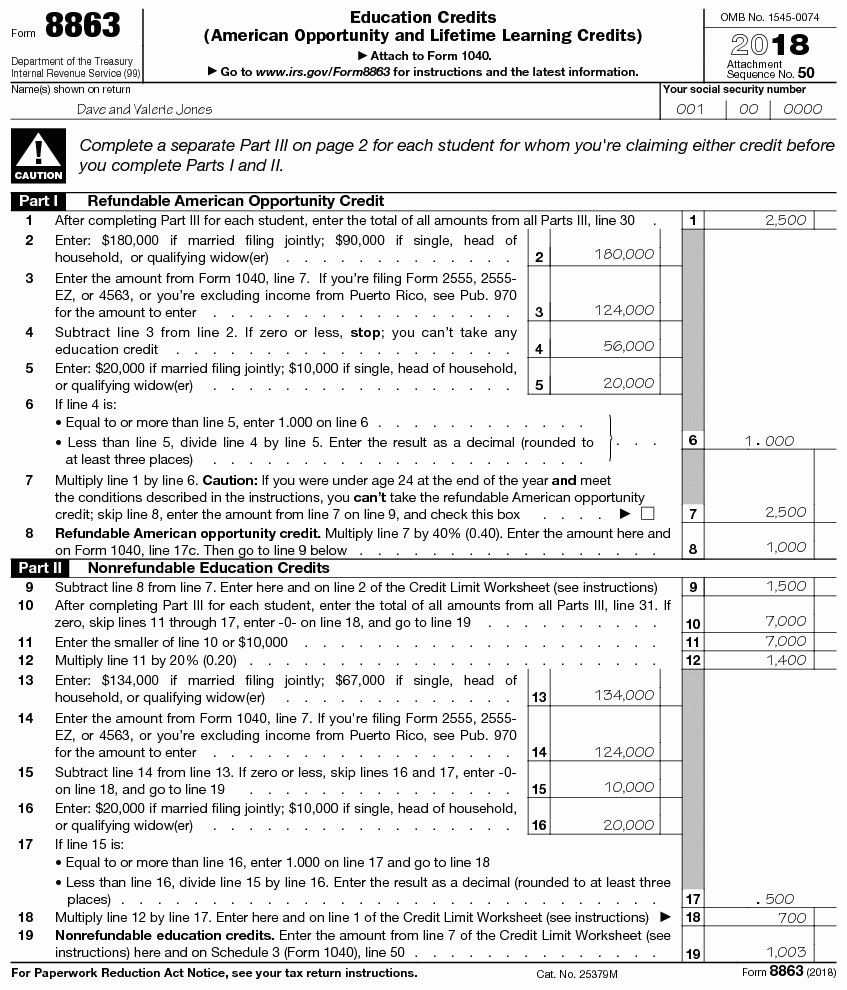

Form Instructions Is Available For How To File 5695 2018 —

Department of the treasury internal revenue service. • the residential energy efficient property credit, and • the. Web generating the 5695 in proseries: Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. On the dotted line to the left of line 25, enter more.

Form 5695 Residential Energy Credits —

Web purpose of form use form 5695 to figure and take your residential energy credits. Type 5695to highlight the form 5695 and click okto open the form. Web instructions for form 5695 residential energy credit section references are to the internal revenue code unless otherwise noted. Web on line 25 of the form with the combined amount on line 24,.

Form 5695 YouTube

Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines,. Web purpose of form use form 5695 to figure and take your residential energy credits. Line 30 has the instructions you need to include the credit. The residential energy credits are: The residential energy.

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. • the residential energy efficient property credit, and • the. Web what is form 5695? General instructions future developments for. Press f6to bring up open forms.

Residential Energy Efficient Property Credit Limit Worksheet

Web the instructions to form 5695, residential energy credits, indicate that if a taxpayer and spouse own and live apart in separate homes, the credit limits will apply to each spouse. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: Department of the treasury internal revenue service. • the.

Instructions for filling out IRS Form 5695 Everlight Solar

• the residential energy efficient property credit, and • the. Web the instructions to form 5695, residential energy credits, indicate that if a taxpayer and spouse own and live apart in separate homes, the credit limits will apply to each spouse. • the residential clean energy credit, and • the energy. Line 30 has the instructions you need to include.

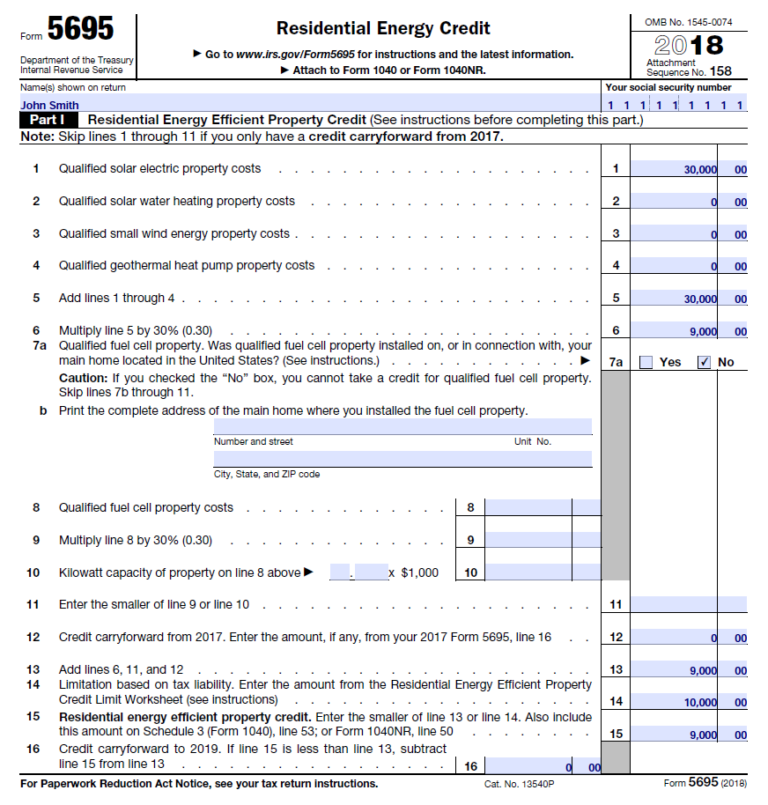

Completed Form 5695 Residential Energy Credit Capital City Solar

Web what is form 5695? On the dotted line to the left of line 25, enter more. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines,. Web per irs instructions for form 5695, on page 1: Web purpose of form use form 5695.

Steps To Complete Form 5695 Lovetoknow —

General instructions future developments for. The residential energy credits are: For instructions and the latest. Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. Web purpose of form use form 5695 to figure and take your residential energy credits.

How to Claim the Solar Investment Tax Credit YSG Solar YSG Solar

For instructions and the latest. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. General instructions future developments for. Web what is form 5695? Web per irs instructions for form 5695, on page 1:

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

Web purpose of form use form 5695 to figure and take your residential energy credits. Web the rce credit replaces the reep credit beginning with the 2022 tax year and runs through 2032 at its full amount with reduced amounts in 2033 and 2034. The residential energy credits are: The residential energy credits are: General instructions future developments for.

Web What Is Form 5695?

General instructions future developments for. The residential energy credits are: Type 5695to highlight the form 5695 and click okto open the form. Web generating the 5695 in proseries:

The Residential Energy Credits Are:

Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. On the dotted line to the left of line 25, enter more.

• The Residential Clean Energy Credit, And • The Energy.

Web the form 5695 instructions include a worksheet on page 6 to help you make the necessary calculations. • the residential energy efficient property credit, and • the. Web instructions for form 5695 residential energy credits section references are to the internal revenue code unless otherwise noted. Web the instructions to form 5695, residential energy credits, indicate that if a taxpayer and spouse own and live apart in separate homes, the credit limits will apply to each spouse.

Web The Rce Credit Replaces The Reep Credit Beginning With The 2022 Tax Year And Runs Through 2032 At Its Full Amount With Reduced Amounts In 2033 And 2034.

Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. Web on line 25 of the form with the combined amount on line 24, cross out the preprinted $500 and enter $1,000. Purpose of form use form 5695 to figure and take your residential energy credits.