Form 5695 Line 17C

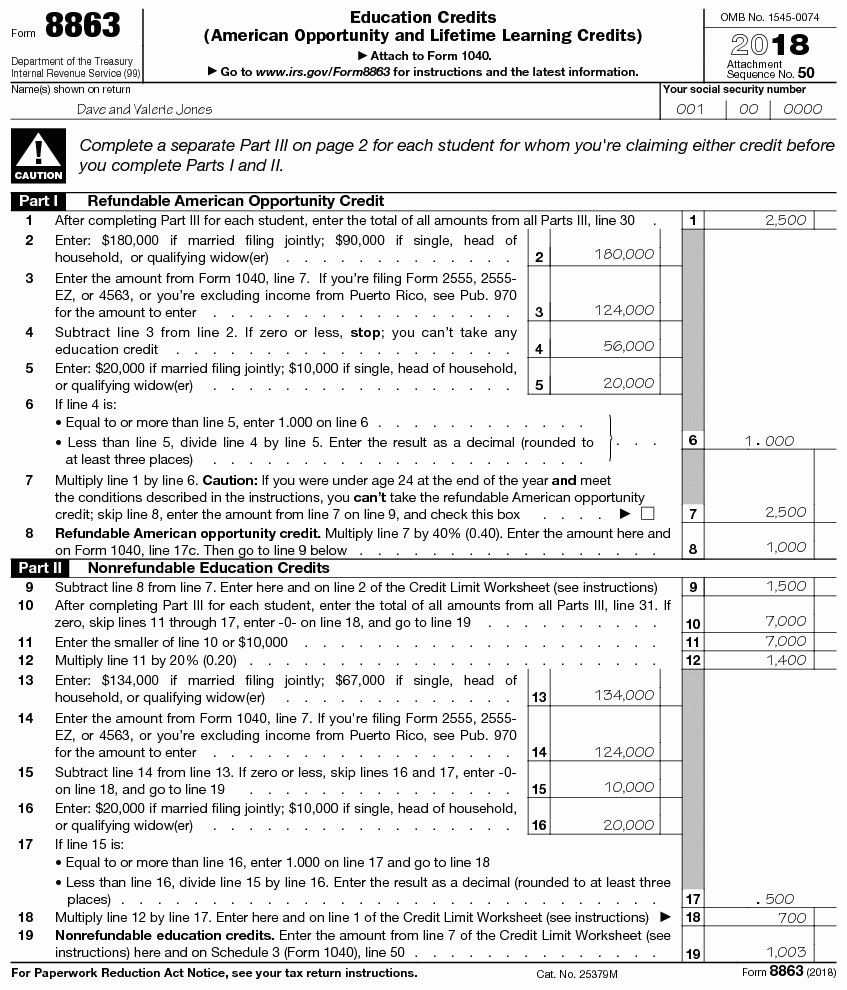

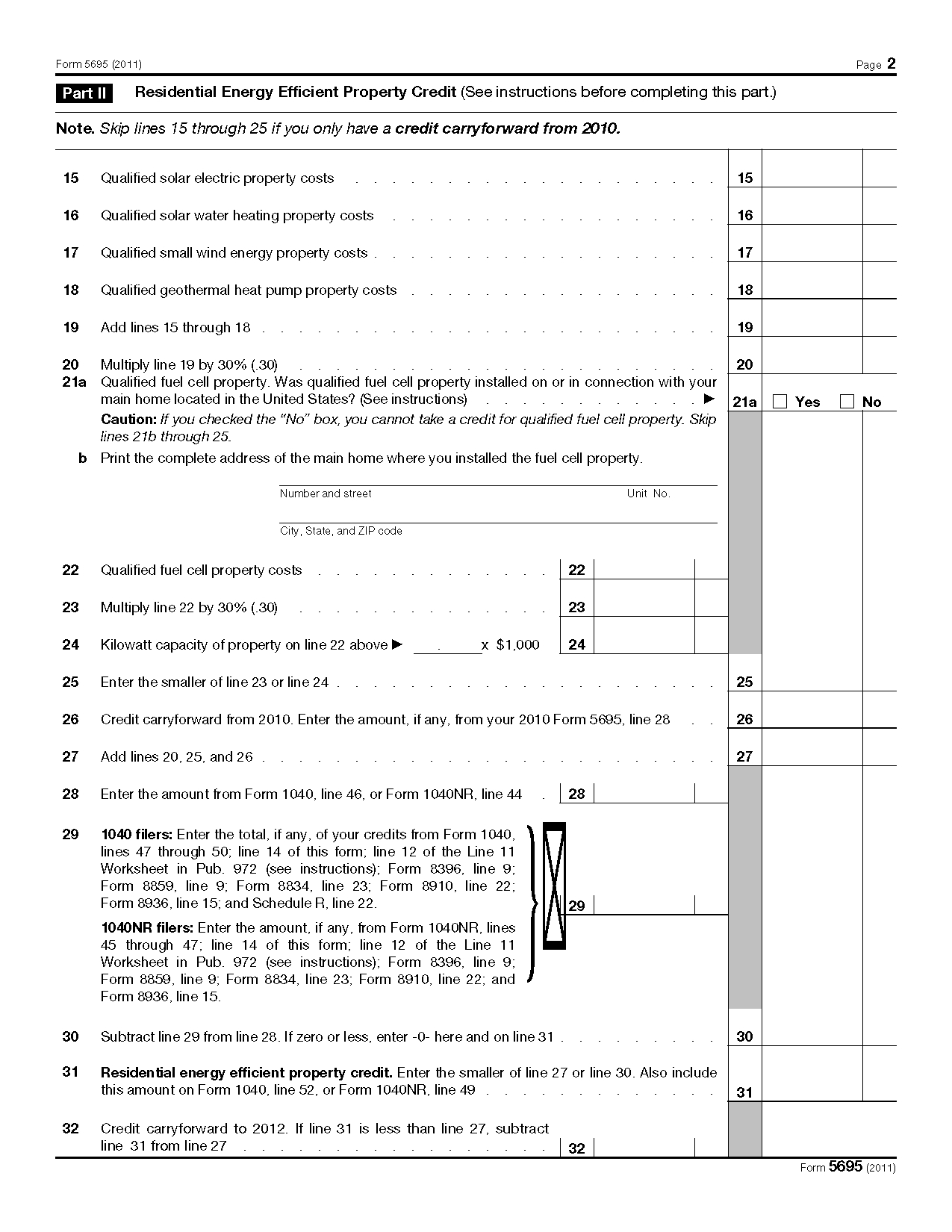

Form 5695 Line 17C - Web 1= improvements and costs were not made to main home located in u.s. Use form 5695 to figure and take. Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential energy efficient property credit, and • the. 1= some expenses used in construction (form 5695, part ii, line 17c). Web zestimate® home value: Condo located at 317 w 95th st unit 5c, new york, ny 10025 sold for $745,000 on jan 19, 2022. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: It contains 1 bedroom and 1.

Web 1= improvements and costs were not made to main home located in u.s. (form 5695, part ii, line 17a) enter a 1 in 1= some expenses used in. Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. It contains 1 bedroom and 1. The residential energy efficient property credit, and the. • the residential energy efficient property credit, and • the. You can download or print current. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are:

Web purpose of form use form 5695 to figure and take your residential energy credits. Web purpose of form use form 5695 to figure and take your residential energy credits. • the residential clean energy credit, and • the energy. • the residential energy efficient property credit, and • the. Web 1= improvements and costs were not made to main home located in u.s. (form 5695, part ii, line 17a). The residential energy credits are: Web we last updated the residential energy credits in december 2022, so this is the latest version of form 5695, fully updated for tax year 2022. Web zestimate® home value: (form 5695, part ii, line 17a) enter a 1 in 1= some expenses used in.

Form Instructions Is Available For How To File 5695 2018 —

• the residential clean energy credit, and • the energy. Web purpose of form use form 5695 to figure and take your residential energy credits. It contains 1 bedroom and 1. Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? The residential energy credits are:

Instructions for filling out IRS Form 5695 Everlight Solar

Figure the amount to be entered on line 24 of both forms (but not. 317 w 95th st apt 5c, new york, ny is a condo home that contains 696 sq ft and was built in 1908. Web purpose of form use form 5695 to figure and take your residential energy credits. View sales history, tax history, home value estimates,.

5695 form Fill out & sign online DocHub

Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. The residential energy credits are: The residential energy credits are: Web zestimate® home value:

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Web 1= improvements and costs were not made to main home located in u.s. Web enter a 1 in 1= improvements and costs were not made to main home located in u.s. Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. View sales history, tax history, home value estimates, and.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

February 2020) department of the treasury internal revenue service. Web 1= improvements and costs were not made to main home located in u.s. (form 5695, part ii, line 17a). Web zestimate® home value: The residential energy credits are:

Form 5695 Residential Energy Credits —

• the residential energy efficient property credit, and • the. Web purpose of form use form 5695 to figure and take your residential energy credits. Our templates are regularly updated. • the residential clean energy credit, and • the energy. Figure the amount to be entered on line 24 of both forms (but not.

Form 5695 YouTube

Web information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? Web.

Form 5695 Instructional YouTube

Web irs form 5695 helps you apply for a credit that is equivalent to 30% of your investment, thus, saving a lot of your energy consumption. The residential energy credits are: Web 1= improvements and costs were not made to main home located in u.s. Web we last updated the residential energy credits in december 2022, so this is the.

Ev Federal Tax Credit Form

317 w 95th st apt 5c, new york, ny is a condo home that contains 696 sq ft and was built in 1908. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. 1= some expenses used in construction (form 5695, part ii, line 17c). It contains 1 bedroom and 1. Use form.

Filing For The Solar Tax Credit Wells Solar

1= some expenses used in construction (form 5695, part ii, line 17c). The residential energy credits are: Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? Figure the amount to be entered on line 24 of both forms (but not. Web follow the simple instructions below:

Web Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

• the residential energy efficient property credit, and • the. 1= some expenses used in construction (form 5695, part ii, line 17c). Web 1= improvements and costs were not made to main home located in u.s. (form 5695, part ii, line 17a).

317 W 95Th St Apt 5C, New York, Ny Is A Condo Home That Contains 696 Sq Ft And Was Built In 1908.

Web 17 a were the qualified energy efficiency improvements or residential energy property costs for your main home located in the united states? • the residential clean energy credit, and • the energy. The residential energy efficient property credit, and the. Condo located at 317 w 95th st unit 5c, new york, ny 10025 sold for $745,000 on jan 19, 2022.

Our Templates Are Regularly Updated.

February 2020) department of the treasury internal revenue service. The residential energy credits are: The internal revenue service (irs). View sales history, tax history, home value estimates, and overhead.

The Residential Energy Credits Are:

Web enter a 1 in 1= improvements and costs were not made to main home located in u.s. Use form 5695 to figure and take. You can download or print current. Web zestimate® home value: