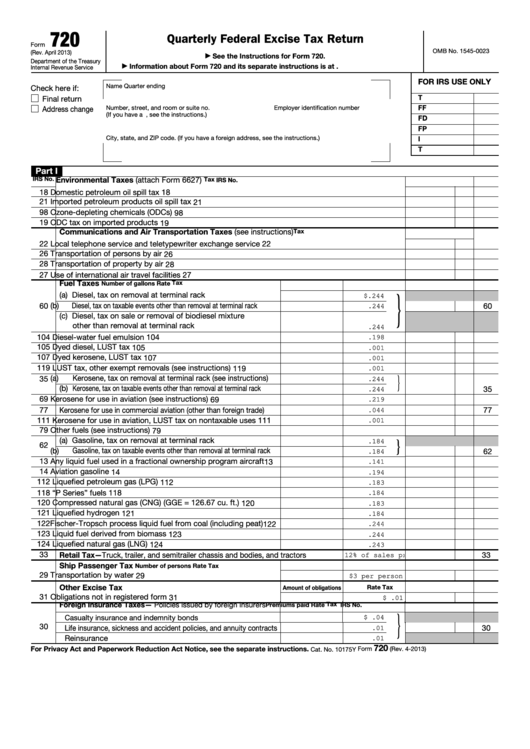

Form 720 Fillable

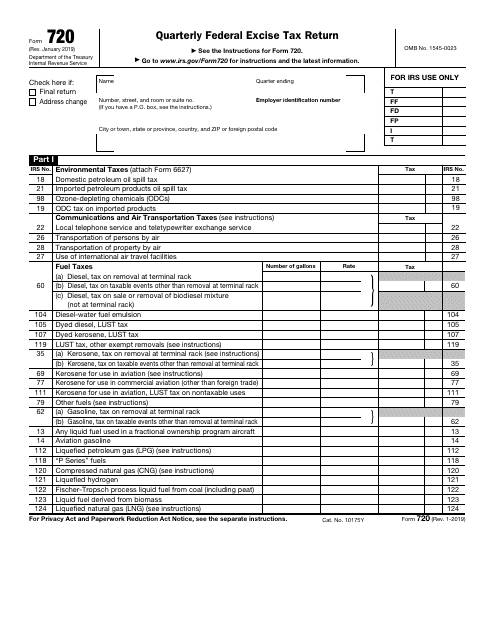

Form 720 Fillable - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Quarterly federal excise tax return (irs) form. The irs 720 form, or quarterly federal excise tax return, is a document used each quarter to report and pay your federal excise tax. Renewable diesel and kerosene changes. Web fill online, printable, fillable, blank form 720: January 2020) fill online, printable, fillable, blank f720 form 720 (rev. Web handy tips for filling out 720 online. Form 720 includes a line for each type of excise tax that you may be responsible for paying. Web fees are reported and paid annually with the submission of irs form 720 (quarterly federal excise tax return) for the second quarter, and are due by july 31 of. January 2020) form use fill to complete blank online irs pdf forms for free.

January 2020) fill online, printable, fillable, blank f720 form 720 (rev. Check out the helpful instructions with the relevant examples. Web download the irs form 720 to fill out and file quarterly federal excise tax return for u.s. A majority of the excise taxes are charged based on. Use fill to complete blank online irs pdf forms for free. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Form 720 includes a line for each type of excise tax that you may be responsible for paying. Comprehensive pcori fee examples for 2023. Web the new irs nos.

Use fill to complete blank online irs pdf forms for free. Fill out the 720 tax form following our detailed instructions. 53 and 16 are added to form 720, part i. Web handy tips for filling out 720 online. Comprehensive pcori fee examples for 2023. Web form 720 is for businesses that need to report excise tax paid on targeted goods and services. Web filling out form 720. Here's how to fill out form 720 and file it in seven steps. Quarterly federal excise tax return (irs) form. Form 720 includes a line for each type of excise tax that you may be responsible for paying.

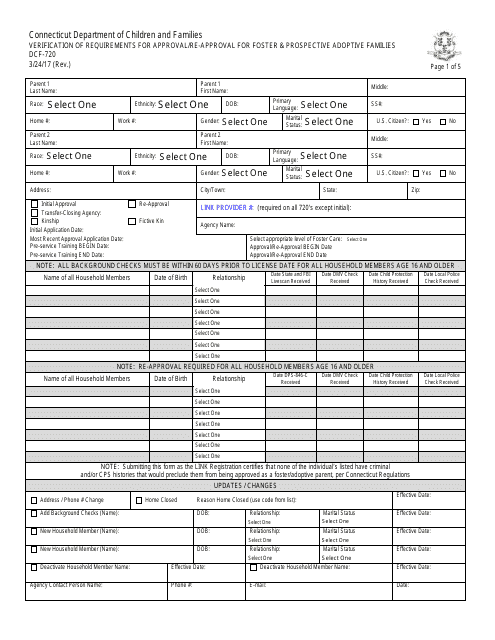

Form DCF720 Fill Out, Sign Online and Download Fillable PDF

Here's how to fill out form 720 and file it in seven steps. Web the new irs nos. Web form 720 is for businesses that need to report excise tax paid on targeted goods and services. Irs form 720, also known as the quarterly federal excise tax return, is a document required to report and calculate. Quarterly federal excise tax.

GSA Form 720 Download Fillable PDF or Fill Online Leadership Self

Printing and scanning is no longer the best way to manage documents. Quarterly federal excise tax return (irs) form. January 2020) form use fill to complete blank online irs pdf forms for free. Web download the irs form 720 to fill out and file quarterly federal excise tax return for u.s. A majority of the excise taxes are charged based.

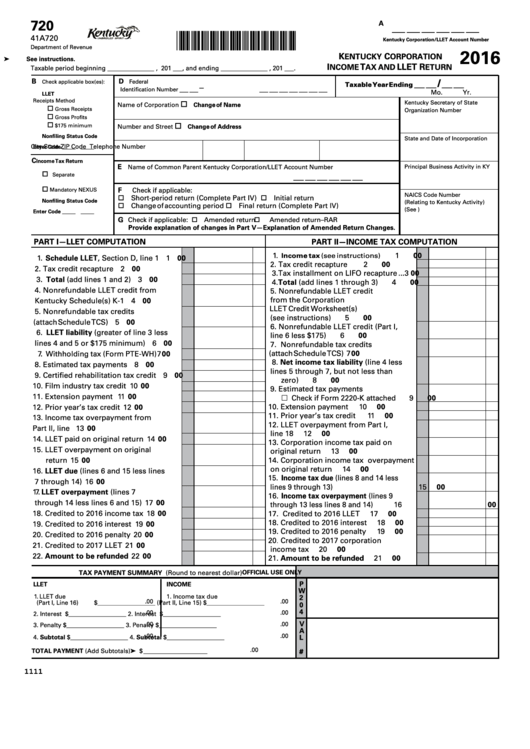

Fillable Form 720 Kentucky Corporation Tax And Llet Return

Web the new irs nos. Web fill online, printable, fillable, blank form 720: Check out our detailed instructions about pcori. Quarterly federal excise tax return (irs) form. Check out the helpful instructions with the relevant examples.

IRS Form 720 Download Fillable PDF or Fill Online Quarterly Federal

Printing and scanning is no longer the best way to manage documents. Check out the helpful instructions with the relevant examples. January 2020) fill online, printable, fillable, blank f720 form 720 (rev. Web in this part of the form, you will figure out your business’s current excise tax liability. Form 720 includes a line for each type of excise tax.

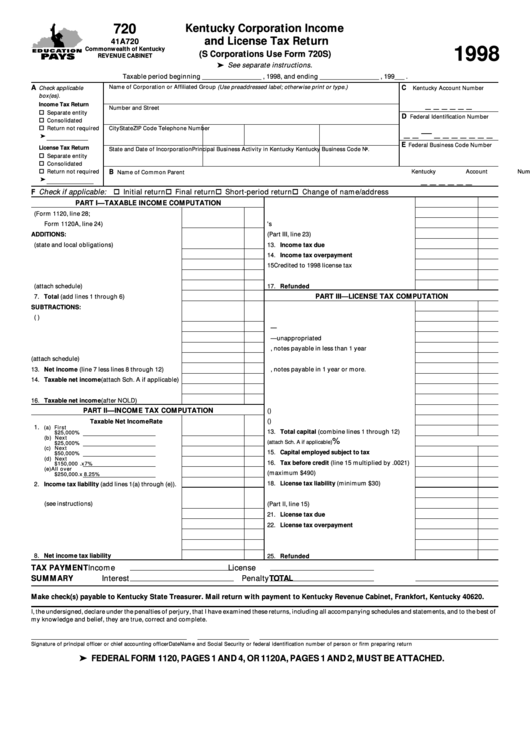

Fillable Form 720 Kentucky Corporation And License Tax Return

Business in the 2023 year. Web the new irs nos. Irs form 720, also known as the quarterly federal excise tax return, is a document required to report and calculate. Check out our checklists to. Once you finish part three, you will know whether you need to pay more in excise.

Fillable Form 720 Quarterly Federal Excise Tax Return printable pdf

Web what is form 720? January 2020) form use fill to complete blank online irs pdf forms for free. Web fees are reported and paid annually with the submission of irs form 720 (quarterly federal excise tax return) for the second quarter, and are due by july 31 of. Check out our checklists to. Form 720 includes a line for.

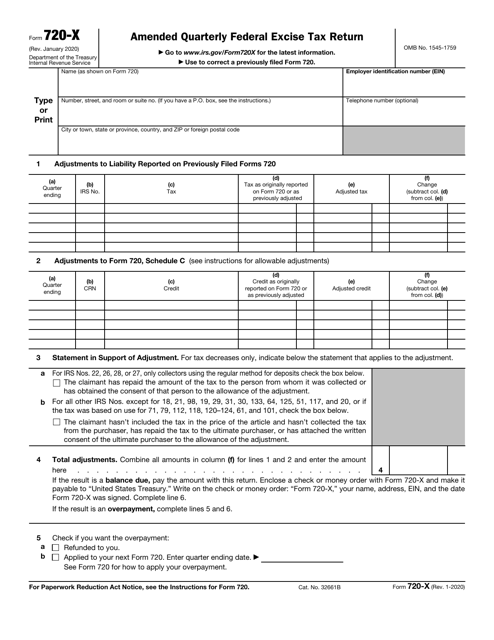

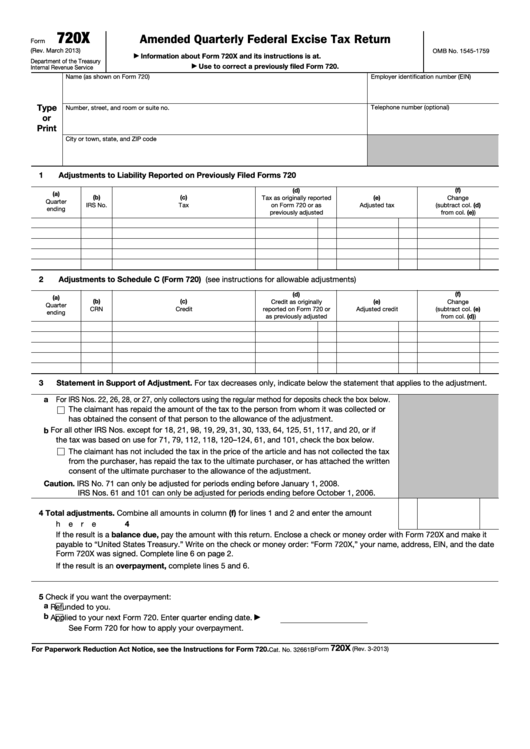

IRS Form 720X Download Fillable PDF or Fill Online Amended Quarterly

Irs form 720, also known as the quarterly federal excise tax return, is a document required to report and calculate. Web the new irs nos. See the instructions for form 6627, environmental taxes. Web download the irs form 720 to fill out and file quarterly federal excise tax return for u.s. Go digital and save time with signnow, the best.

Fill Free fillable F720 Form 720 (Rev. January 2020) PDF form

Renewable diesel and kerosene changes. The irs 720 form, or quarterly federal excise tax return, is a document used each quarter to report and pay your federal excise tax. Web download the irs form 720 to fill out and file quarterly federal excise tax return for u.s. Web fill out irs form 720 for the 2023 year. Web fillable f720.

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

Go digital and save time with signnow, the best solution for. Fill out the 720 tax form following our detailed instructions. Check out our checklists to. Web fill online, printable, fillable, blank form 720: The irs 720 form, or quarterly federal excise tax return, is a document used each quarter to report and pay your federal excise tax.

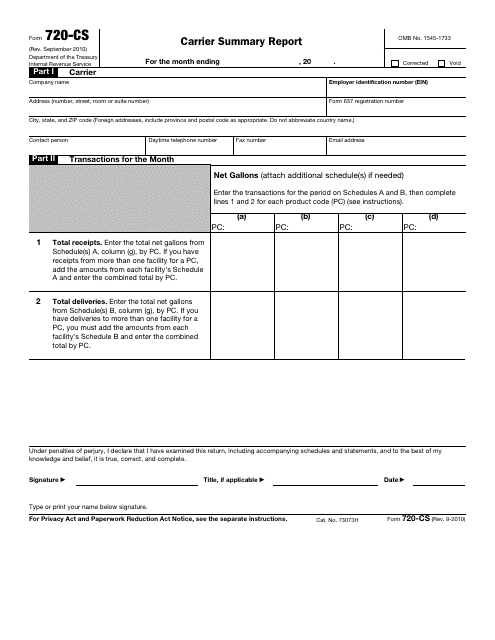

IRS Form 720CS Download Fillable PDF or Fill Online Carrier Summary

Fill out the 720 tax form following our detailed instructions. Web form 720 is a tax form required of businesses that deal with the sale of certain goods (like alcohol or gasoline) and services (for instance, tanning salons). Web the new irs nos. Web what is form 720? The irs 720 form, or quarterly federal excise tax return, is a.

Fill Out The 720 Form Online In A Friendly Editor Or Print Out The Blank Template.

Fill out the 720 tax form following our detailed instructions. 53 and 16 are added to form 720, part i. January 2020) fill online, printable, fillable, blank f720 form 720 (rev. Web the aca requires applicable employers to report and pay the fee once a year, using form 720 for the quarterly federal excise tax return that you can get from.

Form 720 Includes A Line For Each Type Of Excise Tax That You May Be Responsible For Paying.

Irs form 720, also known as the quarterly federal excise tax return, is a document required to report and calculate. Web get irs form 720 for u.s. Quarterly federal excise tax return (irs) form. Go digital and save time with signnow, the best solution for.

Business In The 2023 Year.

Printing and scanning is no longer the best way to manage documents. Use fill to complete blank online irs pdf forms for free. Web fill online, printable, fillable, blank form 720: A majority of the excise taxes are charged based on.

Check Out Our Detailed Instructions About Pcori.

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web fillable f720 form 720 (rev. Web fees are reported and paid annually with the submission of irs form 720 (quarterly federal excise tax return) for the second quarter, and are due by july 31 of. Renewable diesel and kerosene changes.