Form 7202 Pdf

Form 7202 Pdf - Requistion no.\rthis number is assigned by the ordering agency\ris a required. Use get form or simply click on the template preview to open it in the editor. Web south carolina state income tax withholding complete the following applicable lines: Extension of credits through march 31, 2021. Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. Check box if you do not want any south carolina state income tax withheld from your. Web to access form 7202 in proweb, from the main menu of the tax return (form 1040) select: Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Credits for sick leave and family leave for.

New credits for leave between. Get everything done in minutes. Web south carolina state income tax withholding complete the following applicable lines: Use get form or simply click on the template preview to open it in the editor. Web march 3, 2022. Complete, edit or print tax forms instantly. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web dd form 282, apr 71 (eg) replaces edition of 1 jun 66 which may be used. Credits for sick leave and family leave for. Ad register and subscribe now to work on your irs 7202 form & more fillable forms.

New credits for leave between. Web to access form 7202 in proweb, from the main menu of the tax return (form 1040) select: Use get form or simply click on the template preview to open it in the editor. Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Credits for sick leave and family leave for. Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Requistion no.\rthis number is assigned by the ordering agency\ris a required. Web the form 7202: Web march 3, 2022.

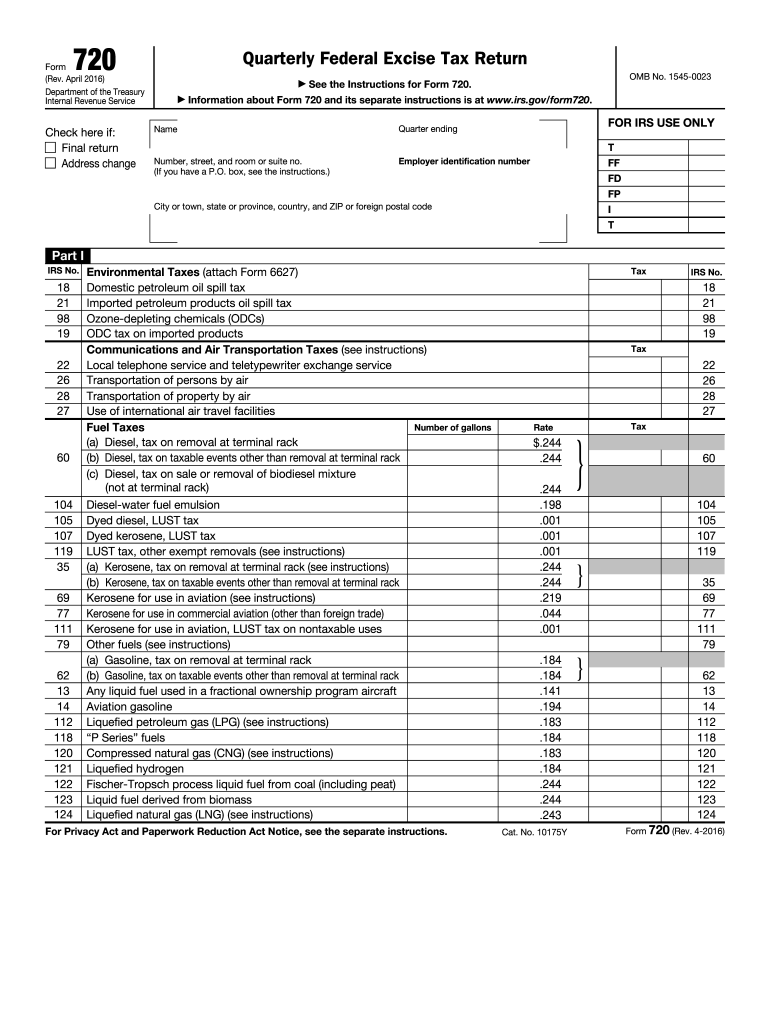

2016 Form IRS 720 Fill Online, Printable, Fillable, Blank PDFfiller

Start completing the fillable fields and. Complete, edit or print tax forms instantly. Download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Web south carolina state income tax withholding complete the following applicable lines: Get everything done in minutes.

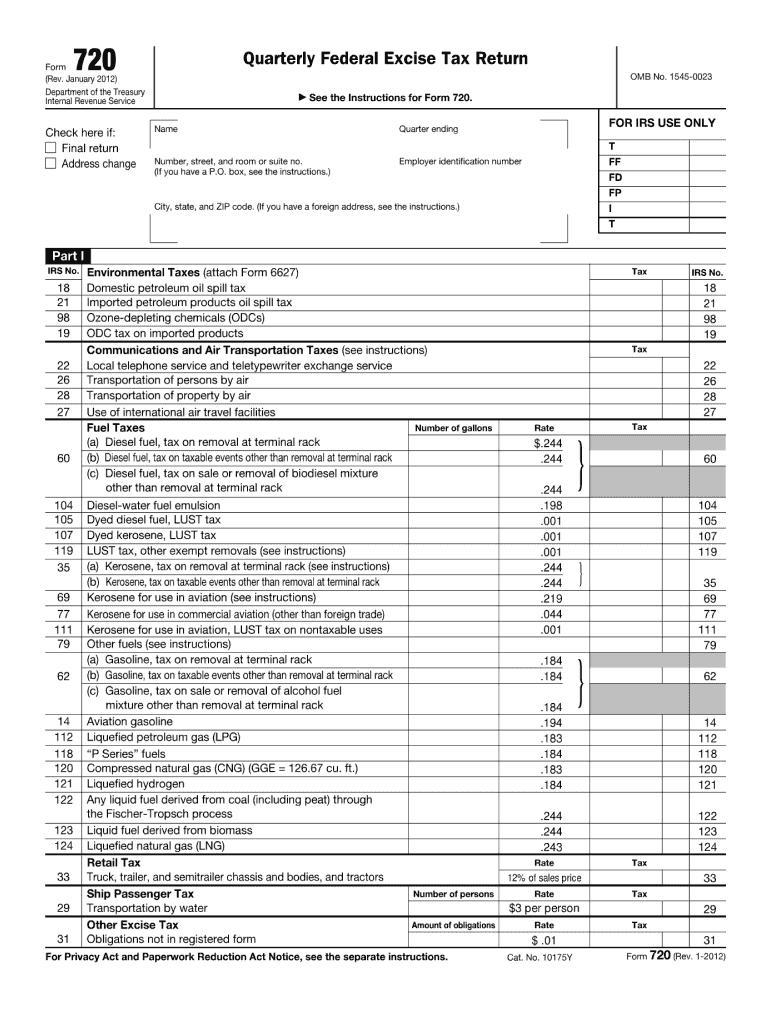

Form 720 Fill Out and Sign Printable PDF Template signNow

Download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Use get form or simply click on the template preview to open it in the editor. Check box if you do not want any south carolina state income tax withheld from your. Start completing the.

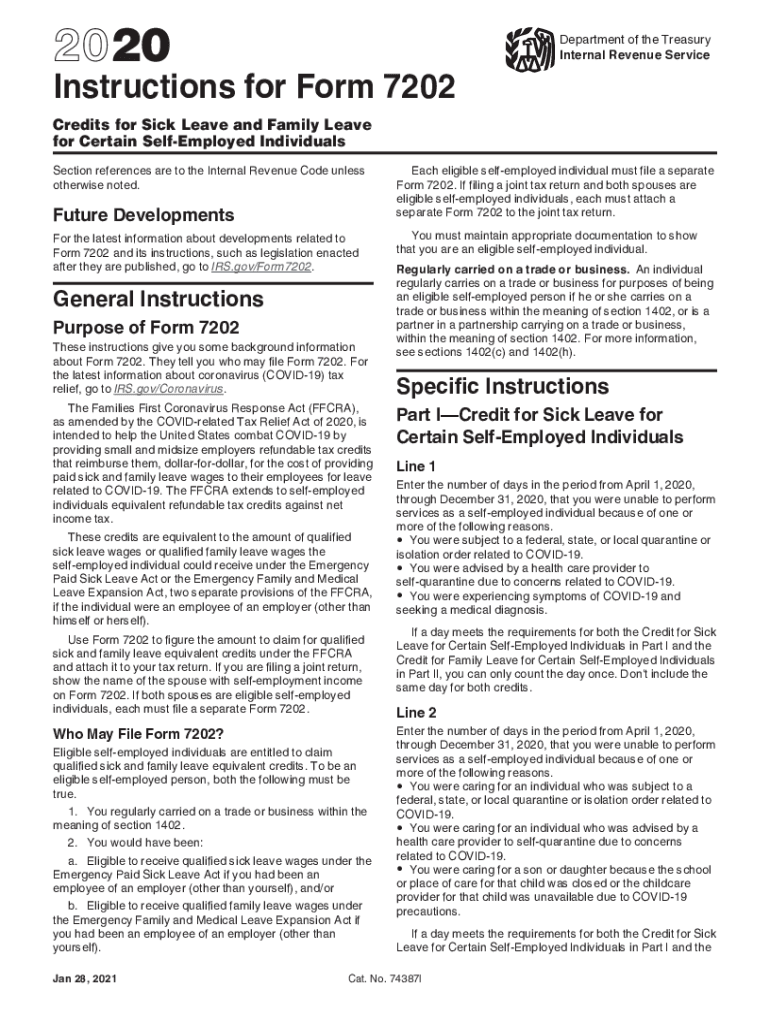

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Get everything done in minutes. Complete, edit or print tax forms instantly. Start completing the fillable fields and. Web to access form 7202 in proweb, from the main menu of the tax return (form 1040) select: Use get form or simply click on the template preview to open it in the editor.

Form 7202 Instructions Fill Online, Printable, Fillable, Blank

New credits for leave between. Start completing the fillable fields and. Get everything done in minutes. Check box if you do not want any south carolina state income tax withheld from your. Web the form 7202:

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web march 3, 2022. Web to access form 7202 in proweb, from the main menu of the tax return.

How to Complete Form 720 Quarterly Federal Excise Tax Return

Requistion no.\rthis number is assigned by the ordering agency\ris a required. New credits for leave between. Use get form or simply click on the template preview to open it in the editor. Check box if you do not want any south carolina state income tax withheld from your. Ad register and subscribe now to work on your irs 7202 form.

2020 Form IRS Instructions 7202 Fill Online, Printable, Fillable, Blank

Use get form or simply click on the template preview to open it in the editor. Web south carolina state income tax withholding complete the following applicable lines: Extension of credits through march 31, 2021. Web to access form 7202 in proweb, from the main menu of the tax return (form 1040) select: Web march 3, 2022.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web dd form 282, apr 71 (eg) replaces edition of 1 jun 66 which may be used. Web the form 7202: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Credits for sick leave and family leave for. Complete, edit or print tax forms instantly.

COVID19 tax relief What is IRS Form 7202, and how it could help if

Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Get everything done in minutes. Credits for sick leave and family leave for. Complete, edit or print tax forms instantly. Web the form 7202:

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

Complete, edit or print tax forms instantly. New credits for leave between. Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Web march 3, 2022. Use get form or simply click on the template preview to open it in the editor.

Complete, Edit Or Print Tax Forms Instantly.

New credits for leave between. Use get form or simply click on the template preview to open it in the editor. Check box if you do not want any south carolina state income tax withheld from your. Web the form 7202:

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

Credits for sick leave and family leave for. Complete, edit or print tax forms instantly. Extension of credits through march 31, 2021. Ad register and subscribe now to work on your irs 7202 form & more fillable forms.

Get Everything Done In Minutes.

Ad register and subscribe now to work on your irs 7202 form & more fillable forms. Web march 3, 2022. Download pdf (1.6 mb) the irs today updated a set of “ frequently asked questions” (faqs) concerning the paid sick and family leave tax credits. Web to access form 7202 in proweb, from the main menu of the tax return (form 1040) select:

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Start completing the fillable fields and. Web dd form 282, apr 71 (eg) replaces edition of 1 jun 66 which may be used. The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income. Web south carolina state income tax withholding complete the following applicable lines: