Form 8027 2022

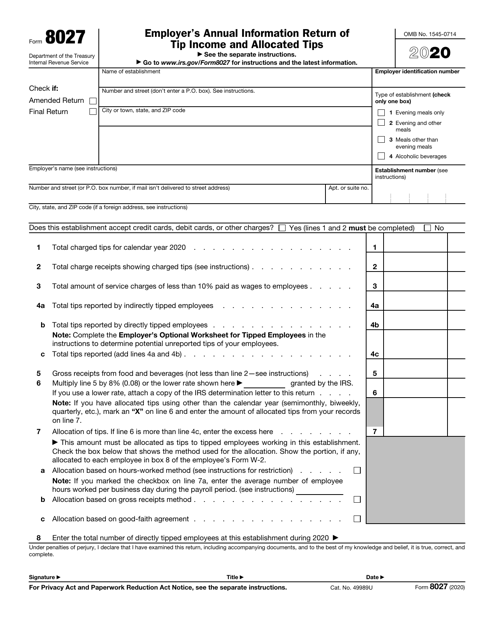

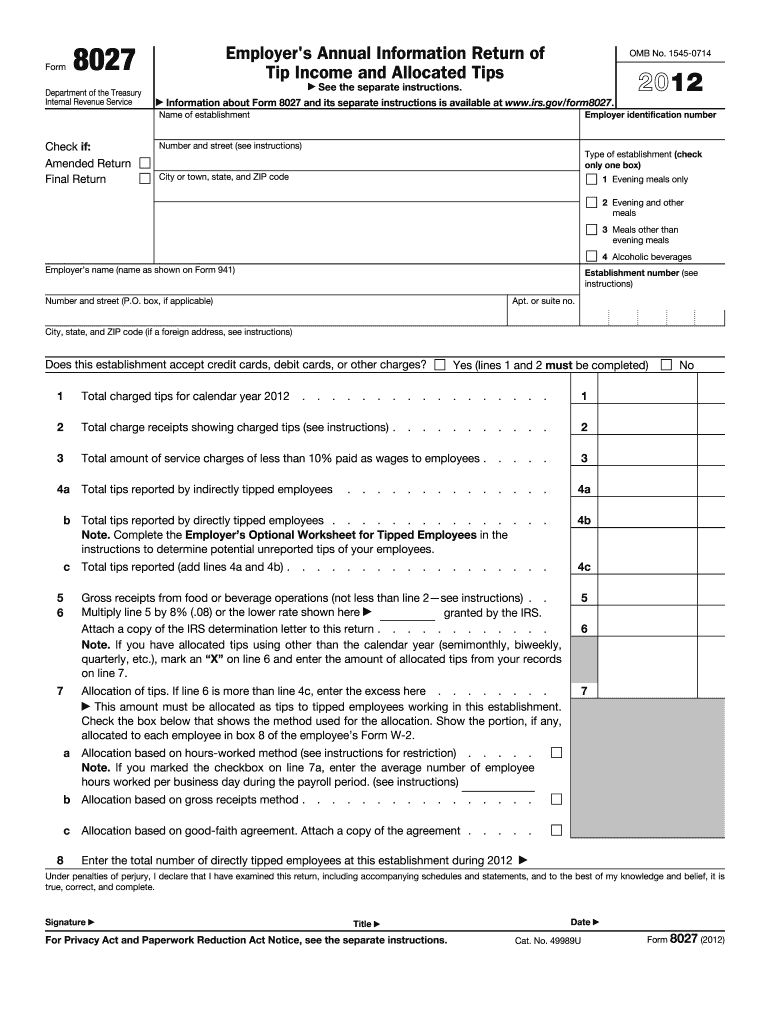

Form 8027 2022 - Go to www.irs.gov/form8027 for instructions and the latest information. Web about form 8027, employer's annual information return of tip income and allocated tips. Show sources > about the corporate income tax the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Web form 8027 for calendar year 2022. Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record the total amount of tips your food or beverage business brought in during the year. Web worksheet for determining if you must file form 8027 for calendar year 2022. Employees must report their tip income if they earn more than $20 per month in tips. Annually report to the irs receipts and tips from their large food or beverage establishments. How to file 8027 instructions for easy reporting 8027 online. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022.

Annually report to the irs receipts and tips from their large food or beverage establishments. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022. Employers use form 8027 to: Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record the total amount of tips your food or beverage business brought in during the year. Web form 8027 for calendar year 2022. Go to www.irs.gov/form8027 for instructions and the latest information. Web form 8027 2022 employer’s annual information return of tip income and allocated tips department of the treasury internal revenue service see the separate instructions. It is the average number of employee hours worked on a typical business day that determines whether or not you employed more than 10 employees. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of tips brought in by large food or beverage establishments during the year. Employees must report their tip income if they earn more than $20 per month in tips.

Annually report to the irs receipts and tips from their large food or beverage establishments. How to file 8027 instructions for easy reporting 8027 online. Go to www.irs.gov/form8027 for instructions and the latest information. Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record the total amount of tips your food or beverage business brought in during the year. Web about form 8027, employer's annual information return of tip income and allocated tips. Web we last updated federal form 8027 from the internal revenue service in december 2022. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022. Employers use form 8027 to: Web worksheet for determining if you must file form 8027 for calendar year 2022. Show sources > about the corporate income tax the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company.

IRS Form 8027 Download Fillable PDF or Fill Online Employer's Annual

Employees must report their tip income if they earn more than $20 per month in tips. Web form 8027 for calendar year 2022. How to file 8027 instructions for easy reporting 8027 online. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of.

What Is Form 8027? When & How to File the IRS Tip Reporting Form

Go to www.irs.gov/form8027 for instructions and the latest information. Employers use form 8027 to: Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of tips brought in by large food or beverage establishments during the year. Annually report to the irs receipts and.

Form 8027 Software Free download and software reviews Download

Web worksheet for determining if you must file form 8027 for calendar year 2022. Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record the total amount of tips your food or beverage business brought in during the year. Web we last updated federal form 8027 from the internal revenue.

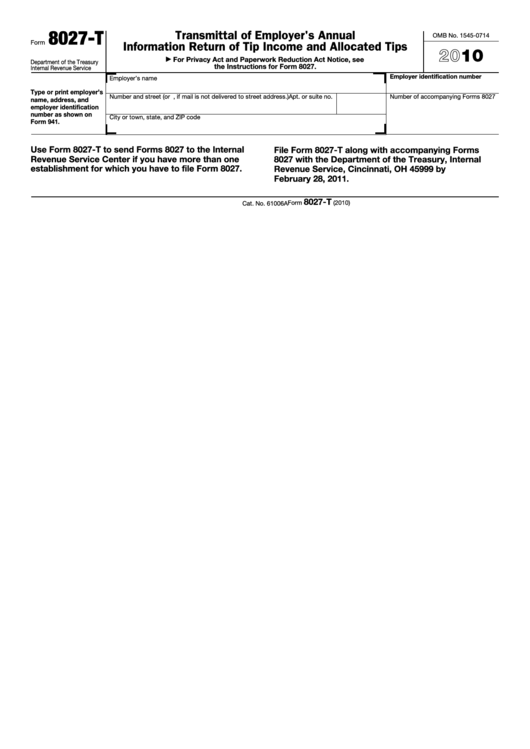

Fillable Form 8027T Transmittal Of Employer'S Annual Information

Go to www.irs.gov/form8027 for instructions and the latest information. Employees must report their tip income if they earn more than $20 per month in tips. Web we last updated federal form 8027 from the internal revenue service in december 2022. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day.

Form 8027 Employer's Annual Information Return of Tip and

Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of tips brought in by large food or beverage establishments during the year. Annually report to the irs receipts and tips from their large food or beverage establishments. You can complete the optional worksheet.

Federal Form 8027

It is the average number of employee hours worked on a typical business day that determines whether or not you employed more than 10 employees. Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record the total amount of tips your food or beverage business brought in during the year..

2017 Form 8027 Edit, Fill, Sign Online Handypdf

How to file 8027 instructions for easy reporting 8027 online. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022. Employers use form 8027 to: Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information.

Form 8027 Your Guide to Reporting Tip FreshBooks Blog

Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of tips brought in by large food or beverage establishments during the year. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during.

Instructions for Form 8027 Internal Revenue Service Fill Out and Sign

Annually report to the irs receipts and tips from their large food or beverage establishments. It is the average number of employee hours worked on a typical business day that determines whether or not you employed more than 10 employees. Web form 8027, employer’s annual information return of tip income and allocated tips, is a document you use to record.

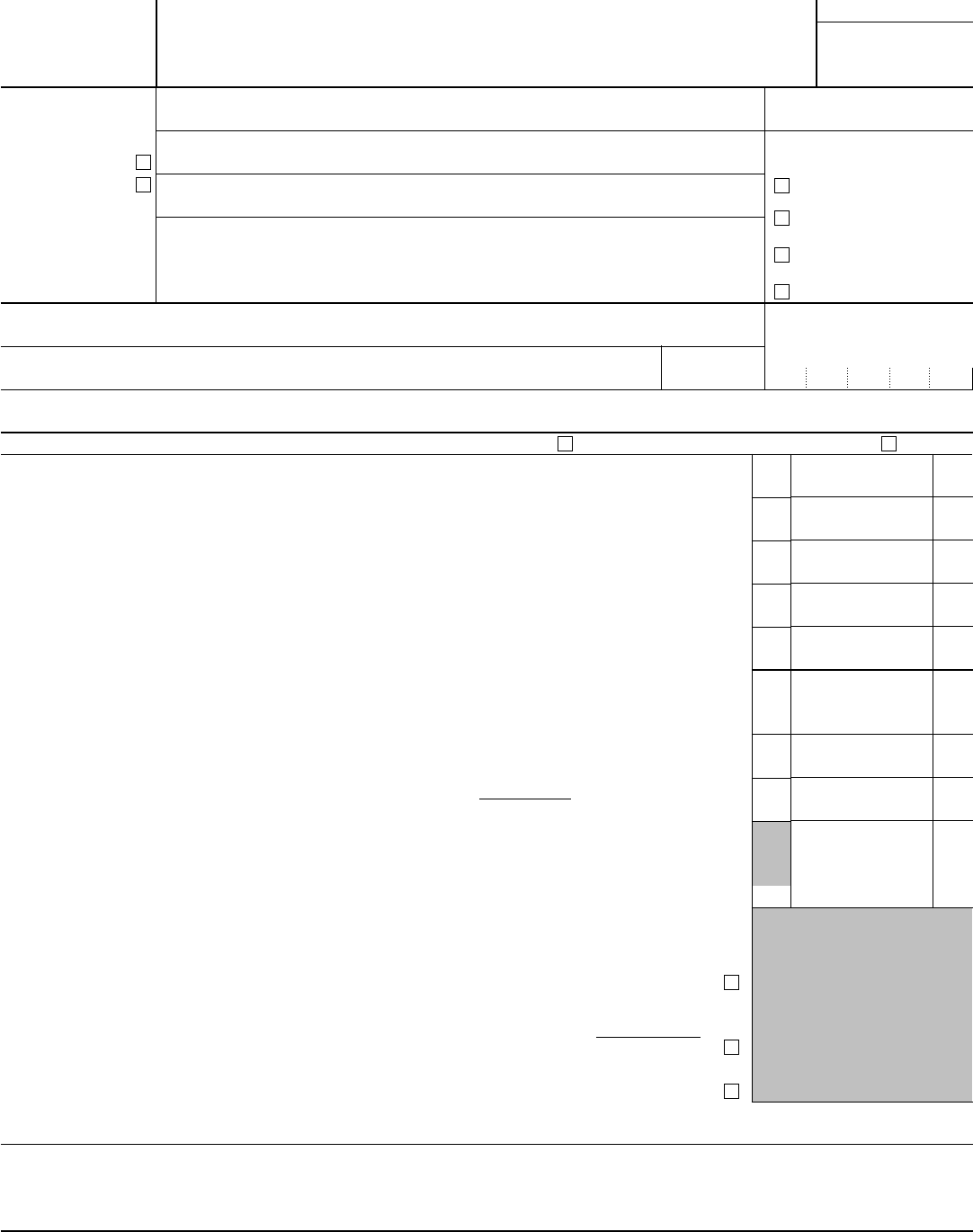

Form 8027 Worksheet

Web form 8027 2022 employer’s annual information return of tip income and allocated tips department of the treasury internal revenue service see the separate instructions. Web worksheet for determining if you must file form 8027 for calendar year 2022. Employees must report their tip income if they earn more than $20 per month in tips. Web we last updated federal.

Annually Report To The Irs Receipts And Tips From Their Large Food Or Beverage Establishments.

Employers use form 8027 to: Web form 8027 for calendar year 2022. Web the internal revenue service (irs) uses form 8027 —also known as employer’s annual information return of tip income and allocated tips—to track the total amount of tips brought in by large food or beverage establishments during the year. Web about form 8027, employer's annual information return of tip income and allocated tips.

Web Form 8027 2022 Employer’s Annual Information Return Of Tip Income And Allocated Tips Department Of The Treasury Internal Revenue Service See The Separate Instructions.

Show sources > about the corporate income tax the irs and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022. Employees must report their tip income if they earn more than $20 per month in tips. It is the average number of employee hours worked on a typical business day that determines whether or not you employed more than 10 employees.

Web Form 8027, Employer’s Annual Information Return Of Tip Income And Allocated Tips, Is A Document You Use To Record The Total Amount Of Tips Your Food Or Beverage Business Brought In During The Year.

You can complete the optional worksheet to determine if you had more than 10 employees on a typical business day during 2021 and, therefore, must file form 8027 for 2022. How to file 8027 instructions for easy reporting 8027 online. Go to www.irs.gov/form8027 for instructions and the latest information. Web we last updated federal form 8027 from the internal revenue service in december 2022.