Form 8082 Example

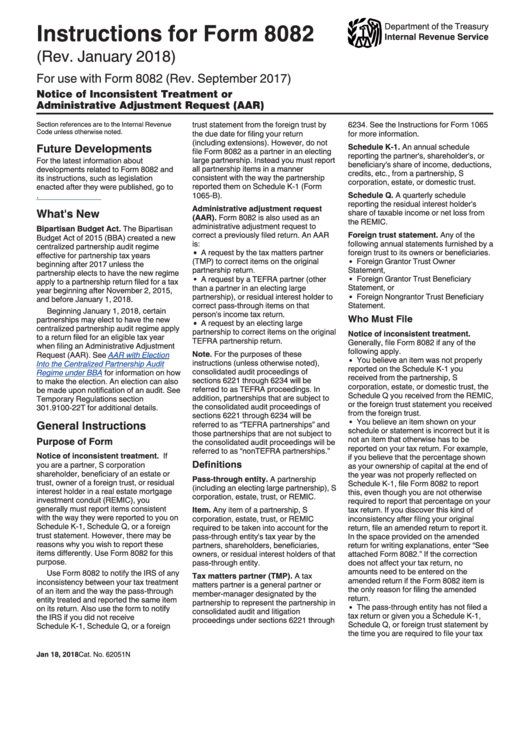

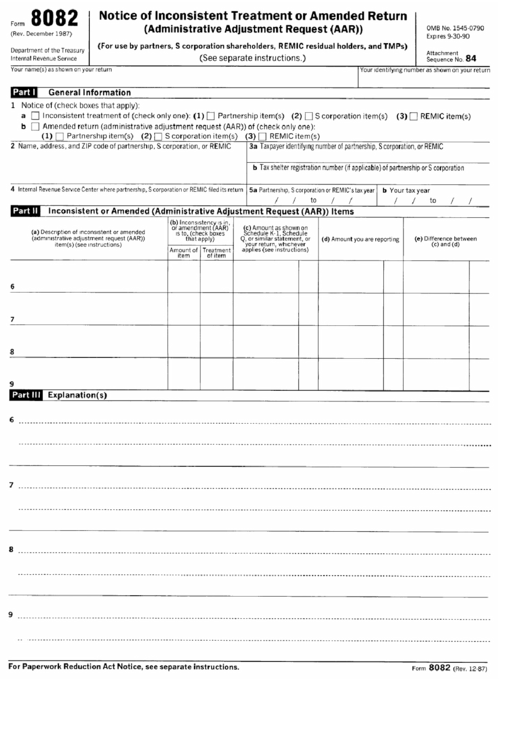

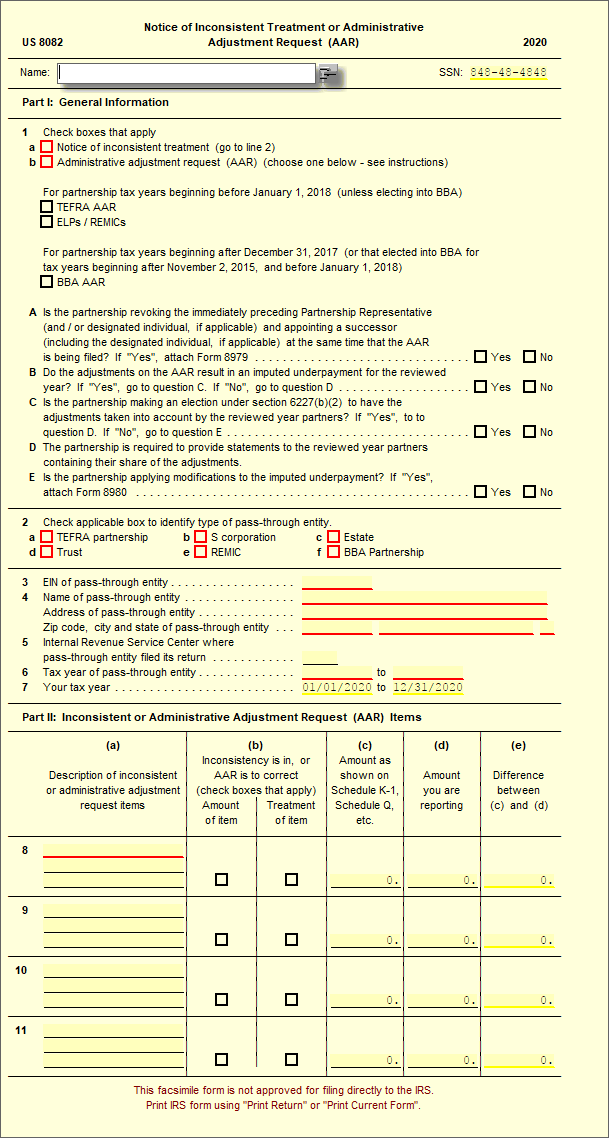

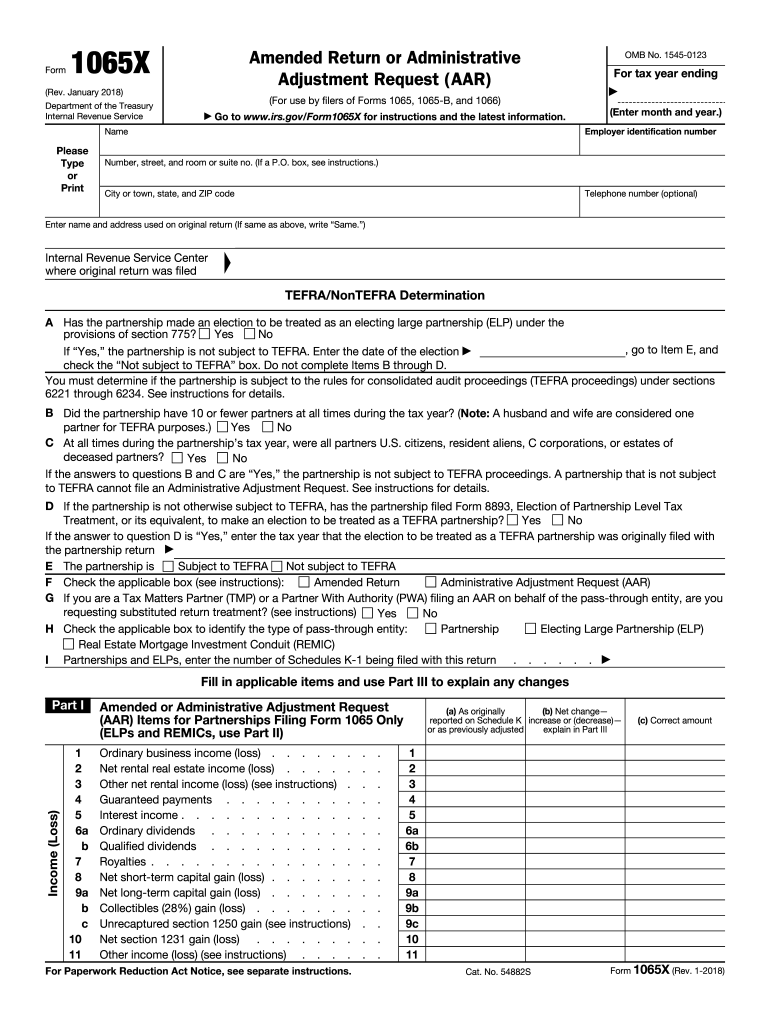

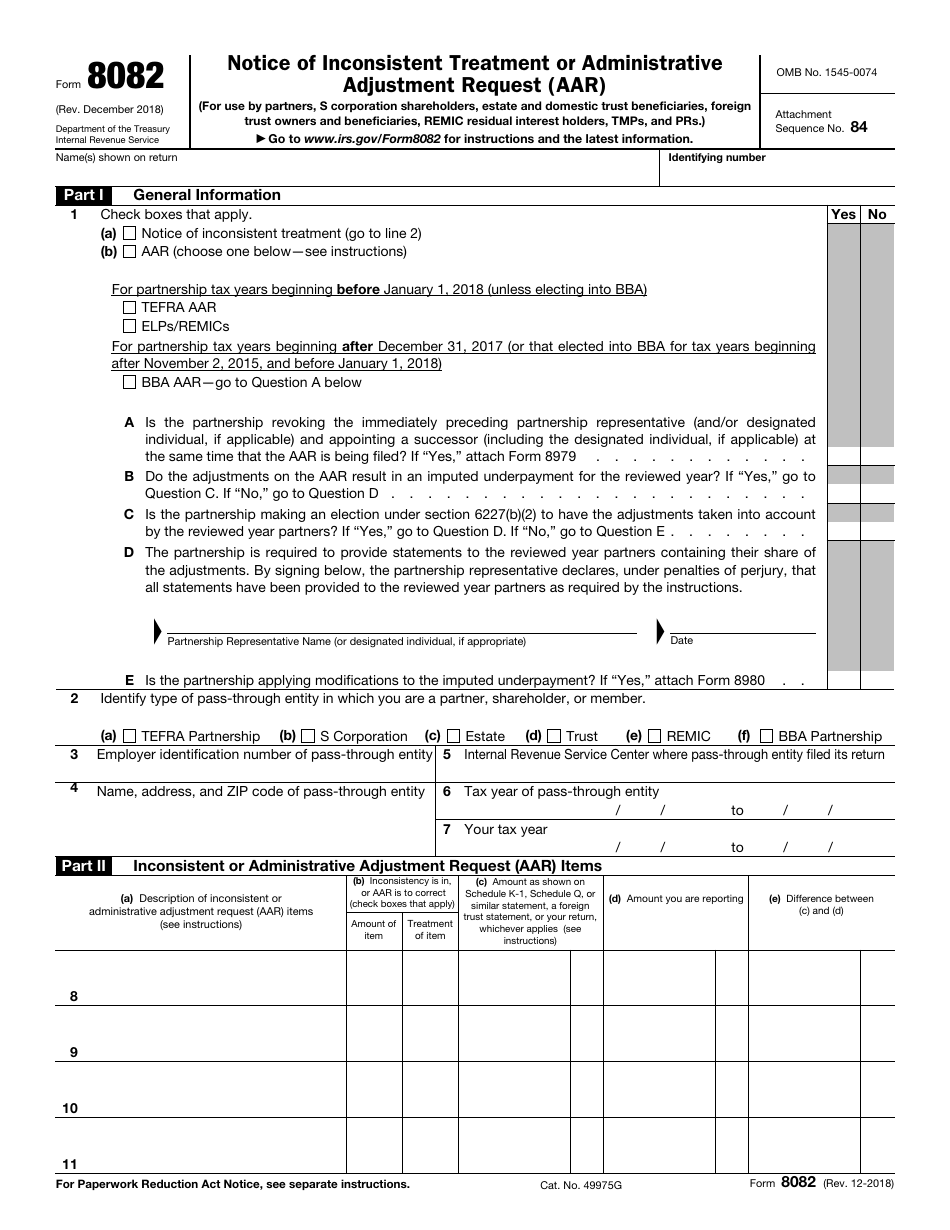

Form 8082 Example - See the example for part ii in the instructions. Web reported on your tax return. Web must file form 8282 within 60 days after the date it becomes aware it was liable. Web amended return or administrative adjustment request (aar),9 form 1065 and form 8082, notice of inconsistent treatment or administrative adjustment request (aar) filed. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. Web form 8082 for this purpose.

Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. For example, if you believe that the percentage shown as your ownership of capital at the end of the year was not properly reflected on schedule. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. If the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web we last updated the notice of inconsistent treatment or administrative adjustment request (aar) in february 2023, so this is the latest version of form 8082, fully updated for tax. See the example for part ii in the instructions. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Web reported on your tax return.

Web must file form 8282 within 60 days after the date it becomes aware it was liable. Web we last updated the notice of inconsistent treatment or administrative adjustment request (aar) in february 2023, so this is the latest version of form 8082, fully updated for tax. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web how to file an aar for electronically filed returns, file the following: For each business component, identify all research activities. See the example for part ii in the instructions. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. Web amended return or administrative adjustment request (aar),9 form 1065 and form 8082, notice of inconsistent treatment or administrative adjustment request (aar) filed. Web to file an aar under sec.

8.19.7 Administrative Adjustment Request Internal Revenue Service

Web to file an aar under sec. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web how do aars impact the partnership’s partners? Web we last updated the notice of inconsistent treatment or administrative adjustment request (aar) in february 2023, so this.

Top 12 Form 8082 Templates free to download in PDF format

Web to file an aar under sec. Web reported on your tax return. See the example for part ii in the instructions. Web form 8082 for this purpose. Web how do aars impact the partnership’s partners?

Form 8082 (Rev. 121987) Notice Of Inconsistent Treatment Or Amended

Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. If the partnership elects an aar push out or the aar contains adjustments that do not result.

8082 Notice of Inconsistent Treatment or Administrative Adjustment

Web reported on your tax return. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. If the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985. Web must file form 8282 within 60 days after the.

51

Identify all the business components to which the section 41 research credit relates for that tax year. Web to file an aar under sec. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. Exist on either your original or amended.

Fill Free fillable Form 8082 2018 Notice of Inconsistent Treatment

For example, this exception would apply where section b of form 8283 is furnished to a. Web form 8082 for this purpose. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Web form 8082 is used by partners, s corporation shareholder, beneficiary of an estate or trust, owner of a.

Form 8082 Notice of Inconsistent Treatment or AAR (2011) Free Download

Web we last updated the notice of inconsistent treatment or administrative adjustment request (aar) in february 2023, so this is the latest version of form 8082, fully updated for tax. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Web to file an aar under sec. Web form 8582 department of the treasury internal revenue.

Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From

Web reported on your tax return. For each business component, identify all research activities. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Web how do aars impact the partnership’s partners?

IRS Form 8082 Download Fillable PDF or Fill Online Notice of

Web must file form 8282 within 60 days after the date it becomes aware it was liable. Form 8082, notice of inconsistent treatment or administrative adjustment request (aar) form 1065, u.s. Identify all the business components to which the section 41 research credit relates for that tax year. Exist on either your original or amended use form 8082 to notify.

8.19.7 Administrative Adjustment Request Internal Revenue Service

Web how to file an aar for electronically filed returns, file the following: Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement. Web form 8082 for this purpose. Web reported on.

Exist On Either Your Original Or Amended Use Form 8082 To Notify The Irs Of Any Foreign Trust Statement.

Web how do aars impact the partnership’s partners? For example, this exception would apply where section b of form 8283 is furnished to a. Web form 8082 is used by partners, s corporation shareholder, beneficiary of an estate or trust, owner of a foreign trust, or residual interest holder in a real estate mortgage. Exist on either your original or amended use form 8082 to notify the irs of any foreign trust statement.

Web To File An Aar Under Sec.

Web reported on your tax return. Web how to generate form 8082 notice of inconsistent treatment in lacerte solved • by intuit • 22 • updated may 03, 2023 this article will assist you with. Web how to file an aar for electronically filed returns, file the following: See the example for part ii in the instructions.

Form 8082, Notice Of Inconsistent Treatment Or Administrative Adjustment Request (Aar) Form 1065, U.s.

Web reported on your tax return. Web amended return or administrative adjustment request (aar),9 form 1065 and form 8082, notice of inconsistent treatment or administrative adjustment request (aar) filed. Web we last updated the notice of inconsistent treatment or administrative adjustment request (aar) in february 2023, so this is the latest version of form 8082, fully updated for tax. Web form 8082 for this purpose.

Identify All The Business Components To Which The Section 41 Research Credit Relates For That Tax Year.

Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web organization does not have to file form 8282 if, at the time the original donee signed section b of form 8283, the donor had signed a statement on form 8283 that the. If the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985. Web form 8582 department of the treasury internal revenue service (99) passive activity loss limitations.