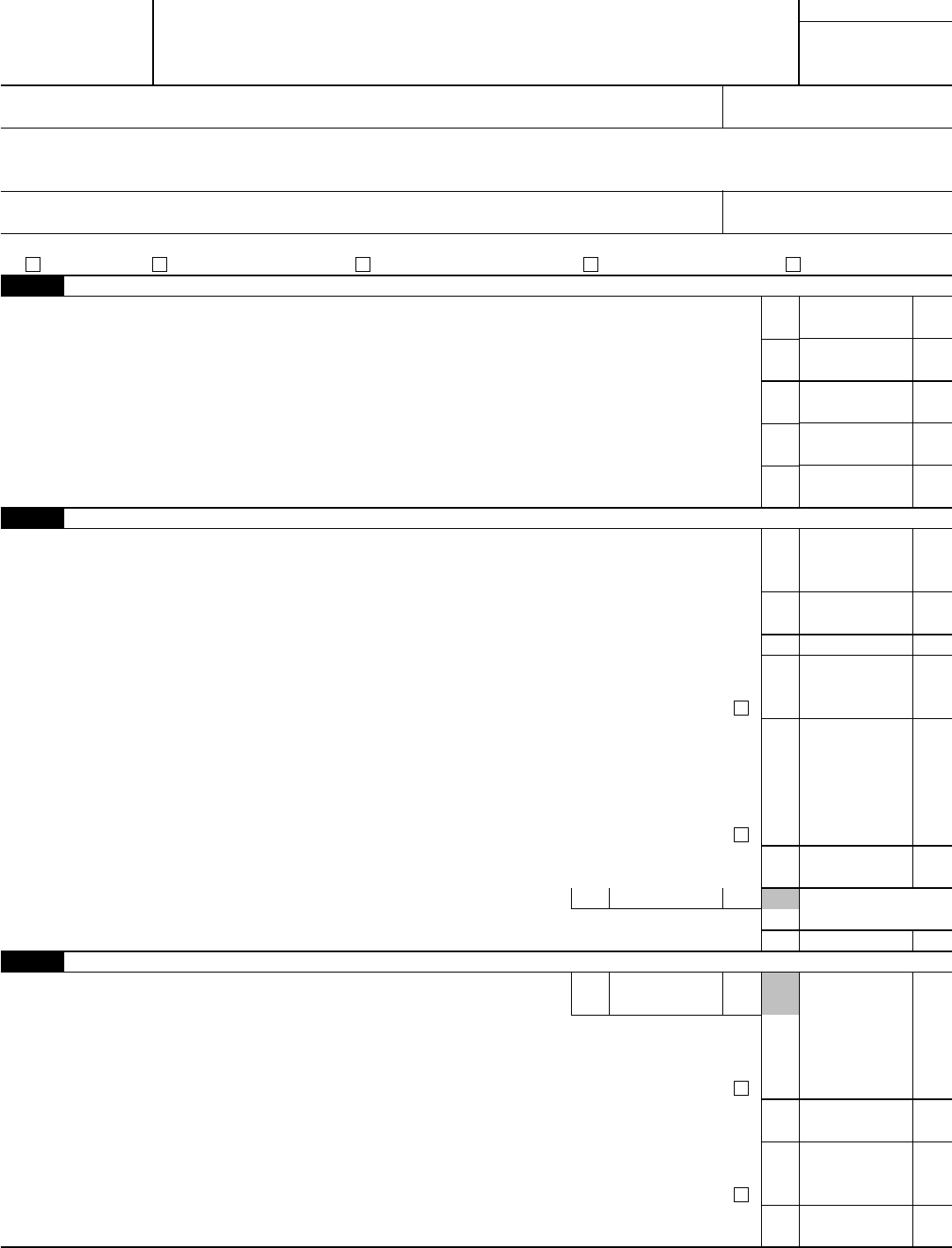

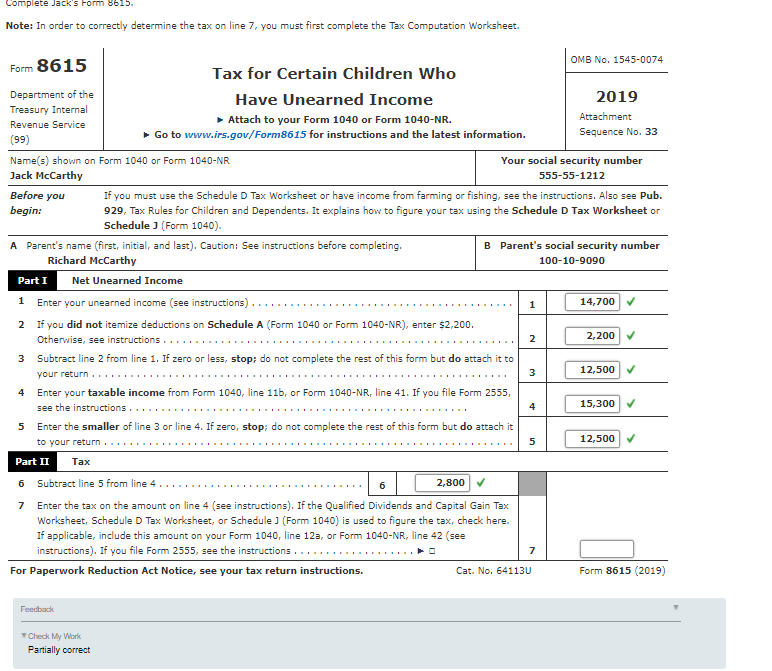

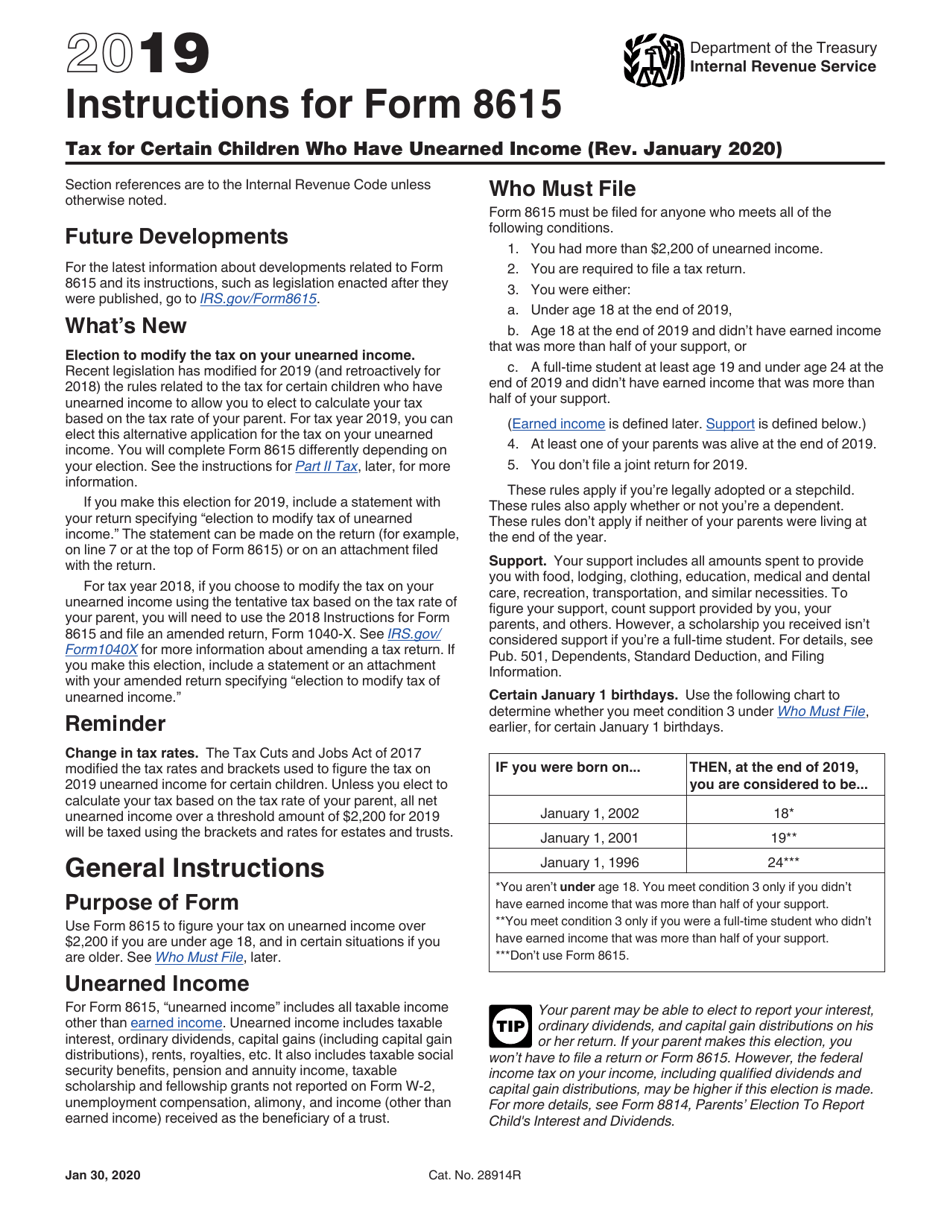

Form 8615 Instructions

Form 8615 Instructions - For 2022, form 8615 needs to be filed if all of the following conditions apply: Each billable service event must have a begin and end time. The child does not file a joint tax return with a spouse; At least one of the child's parents is still living; Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. The child is required to file a tax return for any reason; Form 8615 must be filed with the child’s tax return if any of the following apply: Form 8615 must be used for only one individual. The child is within certain age.

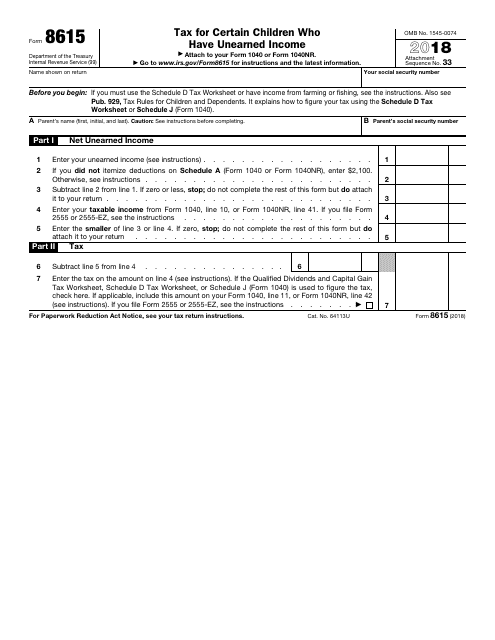

Go to www.irs.gov/form8615 for instructions and the latest information. For 2022, form 8615 needs to be filed if all of the following conditions apply: At least one of the child's parents is still living; The child does not file a joint tax return with a spouse; The child is required to file a tax return; The child is required to file a tax return for any reason; The child has more than $2,200 in unearned income for the year See who must file, later. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. The child has more than $2,300 in unearned income;

Child’s name shown on return The child is within certain age. Alternatively, taxpayers can attach an election statement to their 2019 tax return. Web who's required to file form 8615? The child is required to file a tax return; At least one of the child's parents is still living; Unearned income includes taxable interest, ordinary dividends, capital gains (including capital gain distributions), rents, royalties, etc. Web if the child, the parent, or any of the parent’s other children for whom form 8615 must be filed must use the schedule d tax worksheet or has income from farming or fishing, see. Tax for certain children who. Each billable service event must have a begin and end time.

Form 8615 Edit, Fill, Sign Online Handypdf

Each billable service event must have a begin and end time. Web the days of the week included on form 8615 and form 8616 may be altered if an individual receives individualized skills and socialization on a sunday or saturday. See your tax return instructions. For 2022, form 8615 needs to be filed if all of the following conditions apply:.

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Web the days of the week included on form 8615 and form 8616 may be altered if an individual receives individualized skills and socialization on a sunday or saturday. Child’s name shown on return Web when is form 8615 required? See who must file, later. The child has more than $2,300 in unearned income;

Form 8615 Office Depot

Form 8615 must be filed with the child’s tax return if any of the following apply: Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's.

Solved Comprehensive Problem 61 Richard And Christine Mc...

Form 8615 may be used for multiple billable service events. Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. The child's tax return is not a joint one; Go to www.irs.gov/form8615 for instructions and the latest information. Form 8615 must be used for only one individual.

Las instrucciones para el formulario 8615 del IRS Los Basicos 2022

Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. The child is required to file a tax return for any reason; Tax for certain children who. Web child's unearned income is more than $2,200, use form 8615 to figure the child's tax. Child’s name shown on return

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Web child's unearned income is more than $2,200, use form 8615 to figure the child's tax. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. Unearned income for form 8615, “unearned income” includes all taxable income other.

Solved Form 8615 election for children to be taxed at par... Intuit

Form 8615 is considered a medicaid document used for medicaid purposes. The child's tax return is not a joint one; Form 8615 may be used for multiple billable service events. Web who's required to file form 8615? The child has more than $2,300 in unearned income;

Form 8615 Instructions (2015) printable pdf download

Web who's required to file form 8615? For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is higher than the child's. Unearned income for form 8615, “unearned income” includes all taxable income other than earned income. Each billable service.

IRS Form 8615 Instructions

Go to www.irs.gov/form8615 for instructions and the latest information. The child is within certain age. The child has more than $2,200 in unearned income for the year Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. If.

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

Child’s name shown on return For 2022, form 8615 needs to be filed if all of the following conditions apply: The child's tax return is not a joint one; Unearned income includes taxable interest, ordinary dividends, capital gains (including capital gain distributions), rents, royalties, etc. The child has more than $2,200 in unearned income for the year

For Children Under Age 18 And Certain Older Children Described Below In Who Must File , Unearned Income Over $2,300 Is Taxed At The Parent's Rate If The Parent's Rate Is Higher Than The Child's.

The child's tax return is not a joint one; Web the days of the week included on form 8615 and form 8616 may be altered if an individual receives individualized skills and socialization on a sunday or saturday. Form 8615 is considered a medicaid document used for medicaid purposes. The child has more than $2,300 in unearned income;

At Least One Of The Child's Parents Is Still Living;

Go to www.irs.gov/form8615 for instructions and the latest information. If the child's unearned income is more than $2,300, use form 8615 to figure the child's tax. See your tax return instructions. The child is within certain age.

See Who Must File, Later.

For 2022, form 8615 needs to be filed if all of the following conditions apply: Form 8615 must be filed with the child’s tax return if any of the following apply: Unearned income includes taxable interest, ordinary dividends, capital gains (including capital gain distributions), rents, royalties, etc. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older.

Form 8615 Must Be Used For Only One Individual.

At least one of the child's parents is alive; The child is required to file a tax return for any reason; Web who's required to file form 8615? Alternatively, taxpayers can attach an election statement to their 2019 tax return.