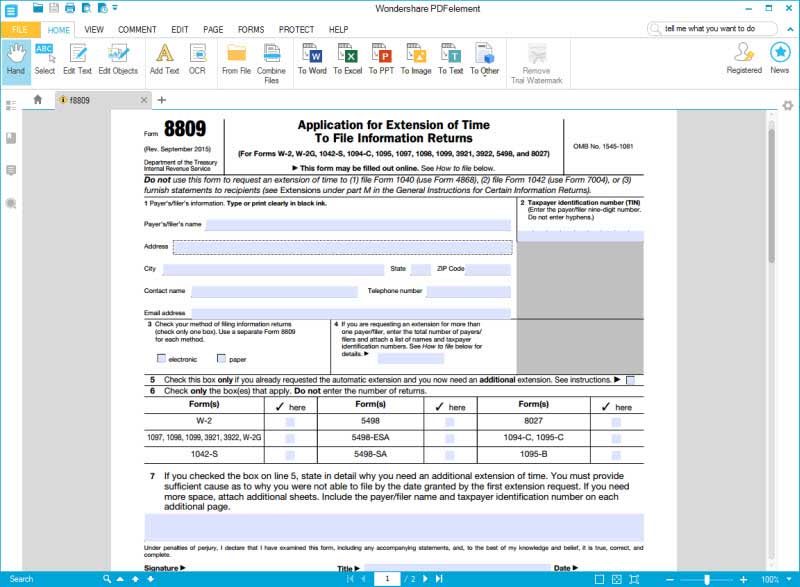

Form 8809 Instructions

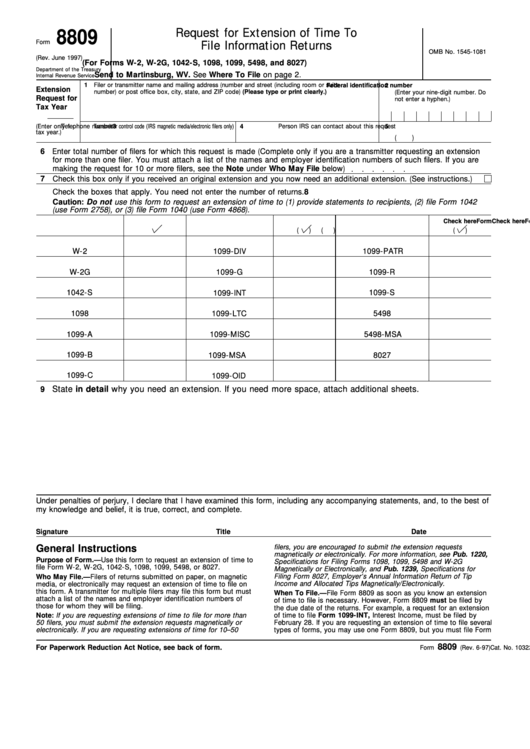

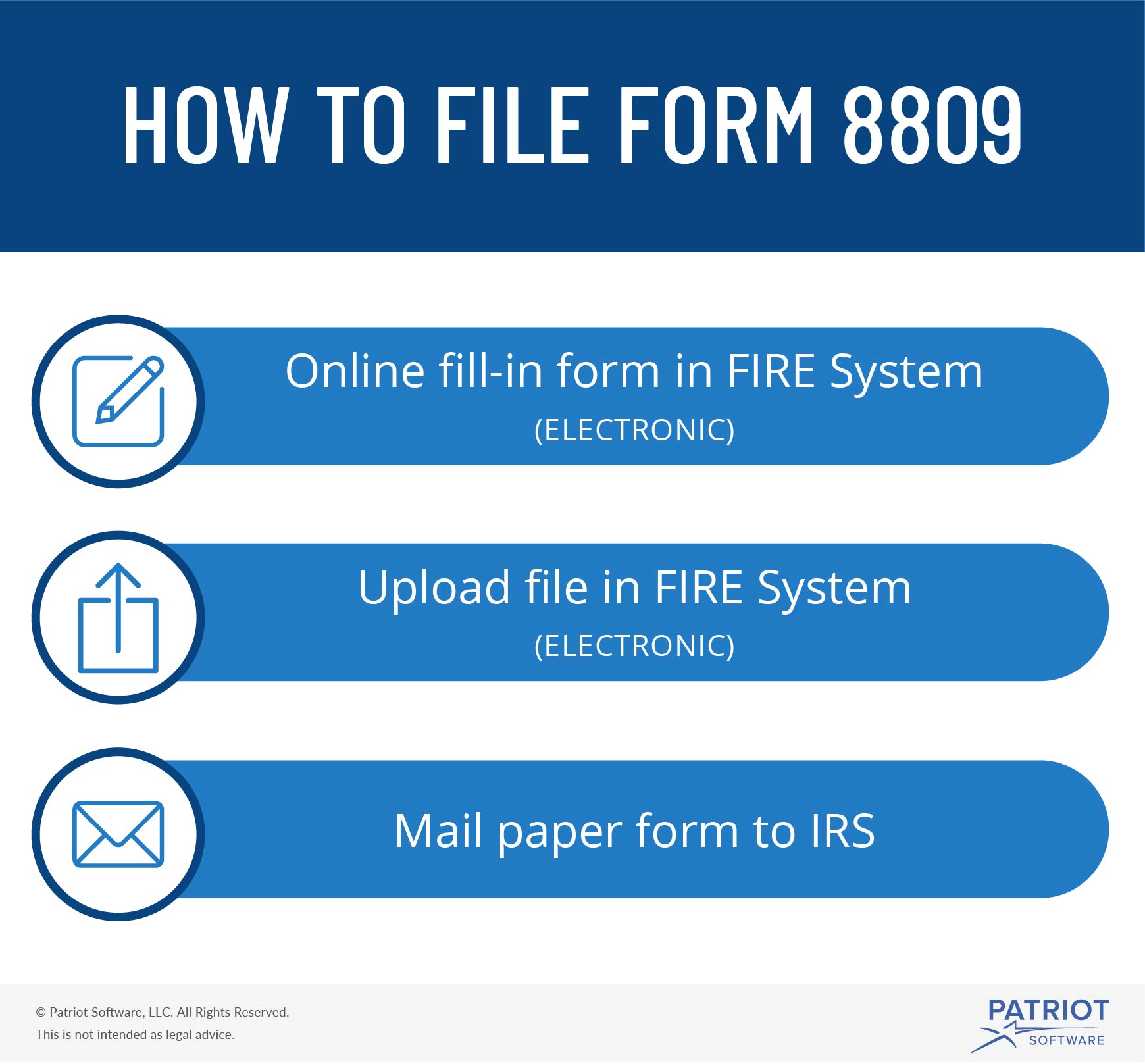

Form 8809 Instructions - Use form 8809 to request an initial or additional extension of time to file only the forms. Web what is form 8809? Application for extension of time to file information returns (for forms. Web information on this form to carry out the internal revenue laws of the united states. Web when you need to file 8809. September 2017) department of the treasury internal revenue service. For example, if you are requesting an extension of time to file both 1099 series and. Get ready for tax season deadlines by completing any required tax forms today. Do not use this form to. Do not use this form to request.

Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to. Web when you need to file 8809. Web information on this form to carry out the internal revenue laws of the united states. For example, if you are requesting an extension of time to file both 1099 series and. How to file 8809 instructions & due. September 2017) department of the treasury internal revenue service. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809. Web form 8809, application for extension of time to file information returns. Web form 8809 is a federal corporate income tax form.

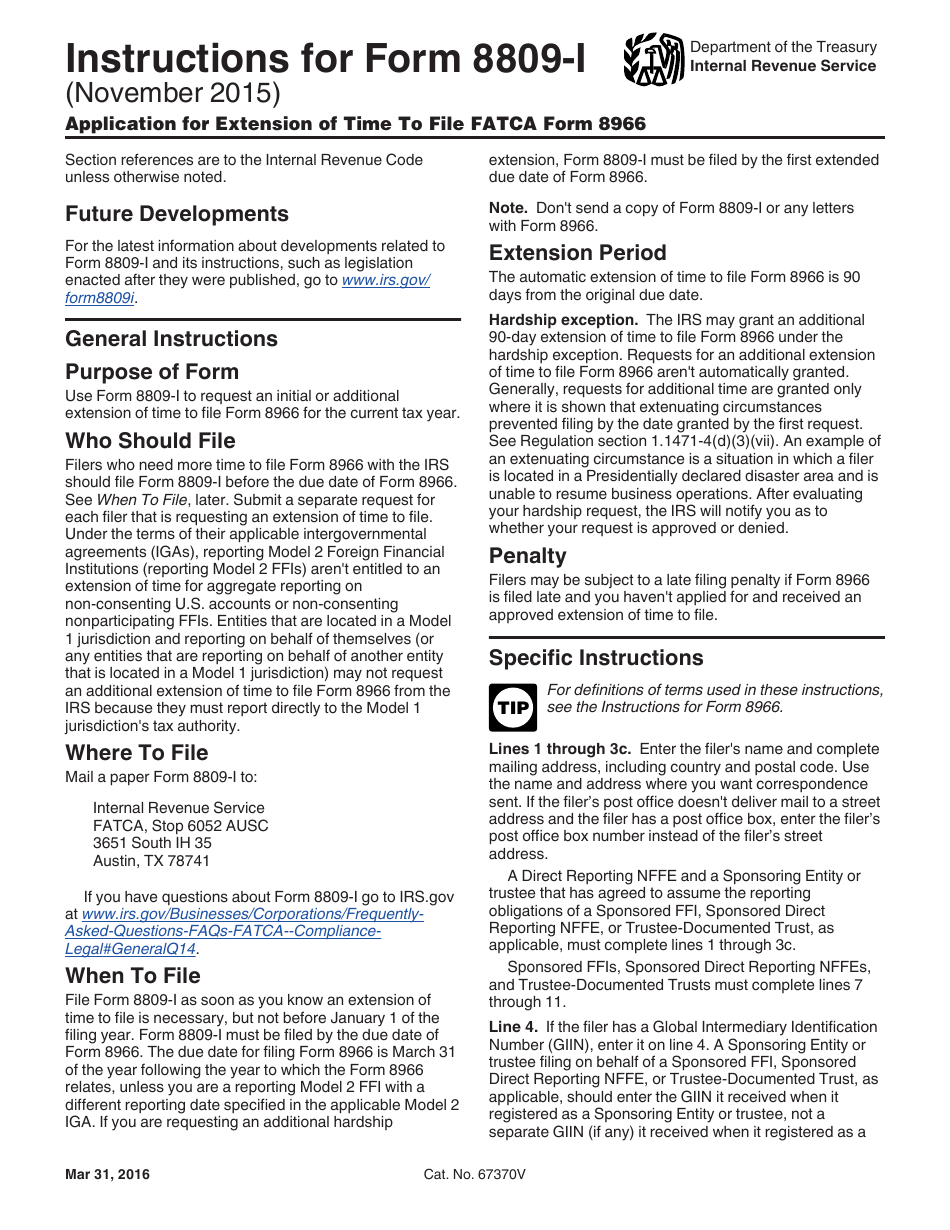

Web form 8809, application for extension of time to file information returns. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809. For example, if you are requesting an extension of time to file both 1099 series and. Form 8809 is provided by the irs to request an extension of time to file. Web what is form 8809? The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. Do not use this form to. You must file form 8809. Application for extension of time to file information returns (for forms. Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to.

Tax Extension Form Extend Tax Due Date if You Need

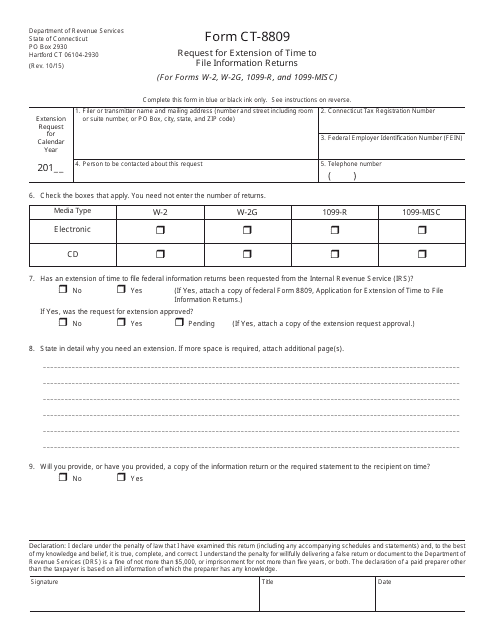

Web complete this form in blue or black ink only. Ad access irs tax forms. However, form 8809 must be filed by the due date of the returns. Web when you need to file 8809. Web form 8809, application for extension of time to file information returns.

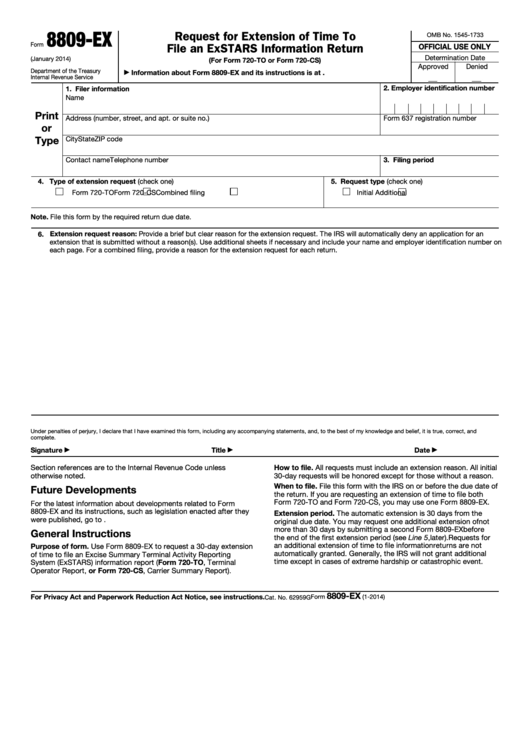

Fillable Form 8809Ex Request For Extension Of Time To File An

Complete, edit or print tax forms instantly. Form 8809 is provided by the irs to request an extension of time to file. Web when you need to file 8809. September 2017) department of the treasury internal revenue service. Filers and transmitters of form.

Form 8809 Edit, Fill, Sign Online Handypdf

The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. However, form 8809 must be filed by the due date of the returns. You must file form 8809. However, any approved extension of time to file will only extend the due date for filing the. Web form 8809 is.

Download Instructions for IRS Form 8809I Application for Extension of

Ad access irs tax forms. You must file form 8809. Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to. Get ready for tax season deadlines.

SSA POMS RM 01105.037 Exhibit 3 Form 8809 (Request for

Use form 8809 to request an initial or additional extension of time to file only the forms. Web complete this form in blue or black ink only. You must file form 8809. Filers and transmitters of form. Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals.

Form 8809 Application for Extension of Time to File Information

Ad access irs tax forms. Filers and transmitters of form. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. Web form 8809 is a federal corporate income tax form. Web form 8809, application for extension of time to file information returns.

Form 8809 2022 Printable and Fillable PDF Application

Ad access irs tax forms. Do not use this form to request. Application for extension of time to file information returns (for forms. Use form 8809 to request an initial or additional extension of time to file only the forms. You must file form 8809.

Form 8809 Request For Extension Of Time To File Information Returns

Do not use this form to. Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to. Filers and transmitters of form. Application for extension of time to file information returns (for forms. However, form 8809 must be filed by the due date of the returns.

Form CT8809 Download Printable PDF or Fill Online Request for

You must file form 8809. Web what is form 8809? Web when you need to file 8809. However, any approved extension of time to file will only extend the due date for filing the. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809.

Need a Filing Extension for W2s and 1099s? File Form 8809

Web form 8809 is a federal corporate income tax form. Web form 8809, application for extension of time to file information returns. Use form 8809 to request an initial or additional extension of time to file only the forms. Application for extension of time to file information returns (for forms. Web information on this form to carry out the internal.

Do Not Use This Form To Request.

The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. However, form 8809 must be filed by the due date of the returns. Web form 8809 is a federal corporate income tax form. Complete, edit or print tax forms instantly.

Application For Extension Of Time To File Information Returns (For Forms.

Filers and transmitters of form. Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. For example, if you are requesting an extension of time to file both 1099 series and. Web complete this form in blue or black ink only.

Web Information On This Form To Carry Out The Internal Revenue Laws Of The United States.

Do not use this form to. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809. Web when you need to file 8809. Get ready for tax season deadlines by completing any required tax forms today.

Web Complete This Form In Blue Or Black Ink Only.

Use form 8809 to request an initial or additional extension of time to file only the forms. Ad access irs tax forms. September 2017) department of the treasury internal revenue service. You must file form 8809.