Form 8812 2021

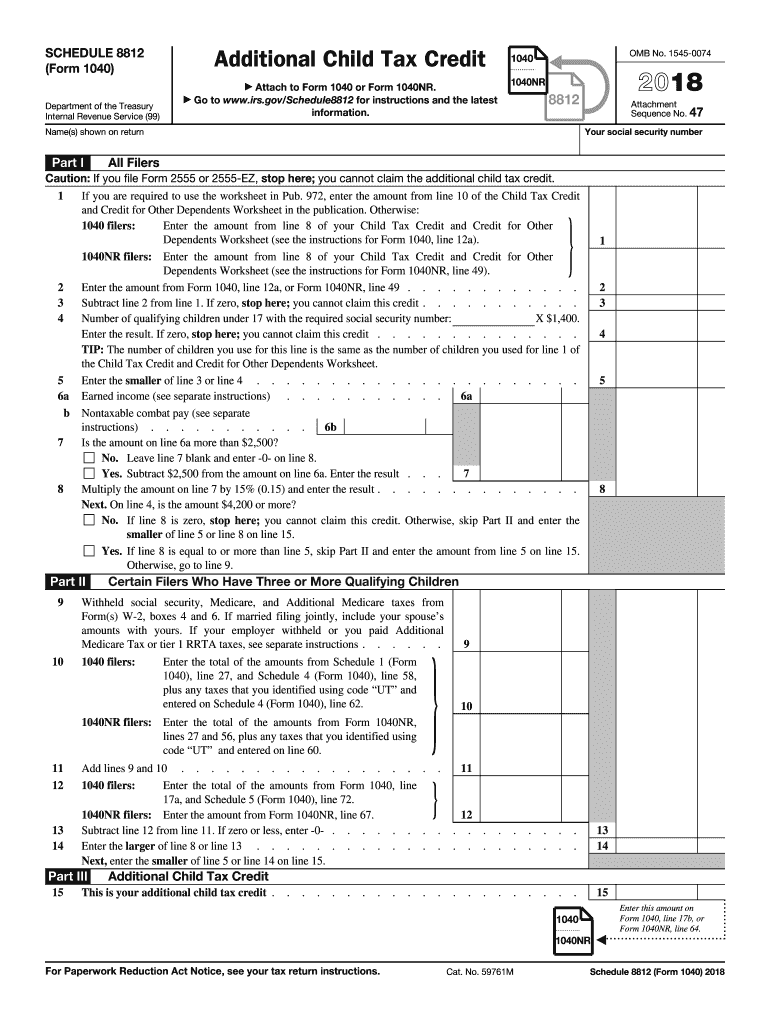

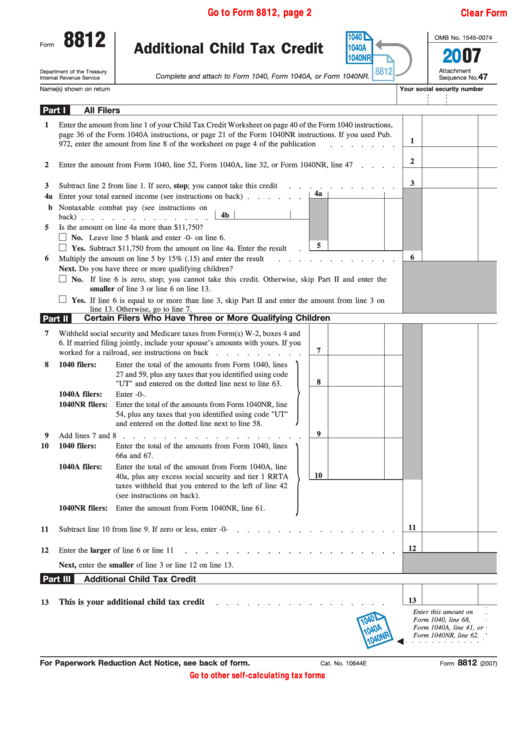

Form 8812 2021 - Ad upload, modify or create forms. Go to www.irs.gov/schedule8812 for instructions and the latest information. The ctc and odc are nonrefundable credits. The actc is a refundable credit. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Signnow allows users to edit, sign, fill & share all type of documents online. Should be completed by all filers to claim the basic child tax credit. Web 2020 instructions for schedule 8812 (rev. The actc may give you a refund even if you do not owe any tax. Last year, many of the federal income tax forms were published late in december, with instructions booklet following in early january due to last minute.

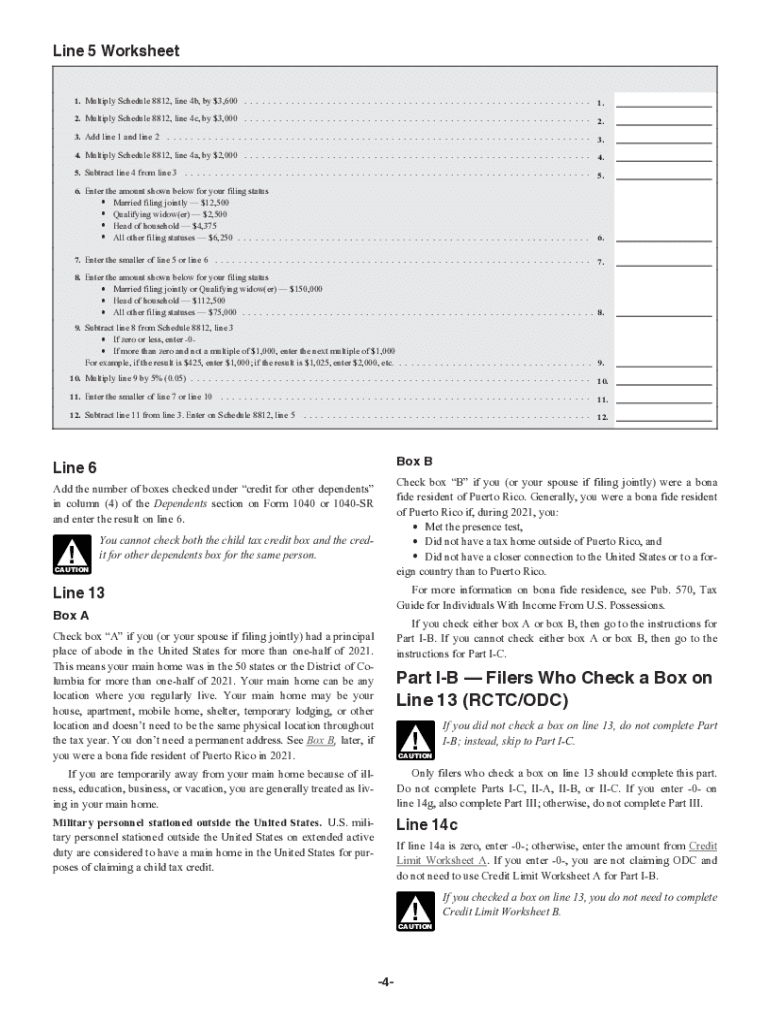

Web the irs schedule 8812 form and instructions booklet are generally published late in december of each year. Try it for free now! Go to www.irs.gov/schedule8812 for instructions and the latest information. 47 name(s) shown on return The actc is a refundable credit. Go to www.irs.gov/schedule8812 for instructions and the latest information. Should be completed by all filers to claim the basic child tax credit. The actc is a refundable credit. Web you'll use form 8812 to calculate your additional child tax credit. The maximum amount of the 2021 child credit was increased from $2,000 to $3,000 for children under age 18, or $3,600 for children under age six.

Current revision schedule 8812 (form 1040) pdf The ctc and odc are nonrefundable credits. The actc is a refundable credit. The ctc and odc are nonrefundable credits. The maximum amount of the 2021 child credit was increased from $2,000 to $3,000 for children under age 18, or $3,600 for children under age six. Section references are to the internal revenue code unless otherwise noted. January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Try it for free now! Last year, many of the federal income tax forms were published late in december, with instructions booklet following in early january due to last minute. Complete to claim the additional child tax credit.

Form 8812, Additional Child Tax Credit printable pdf download

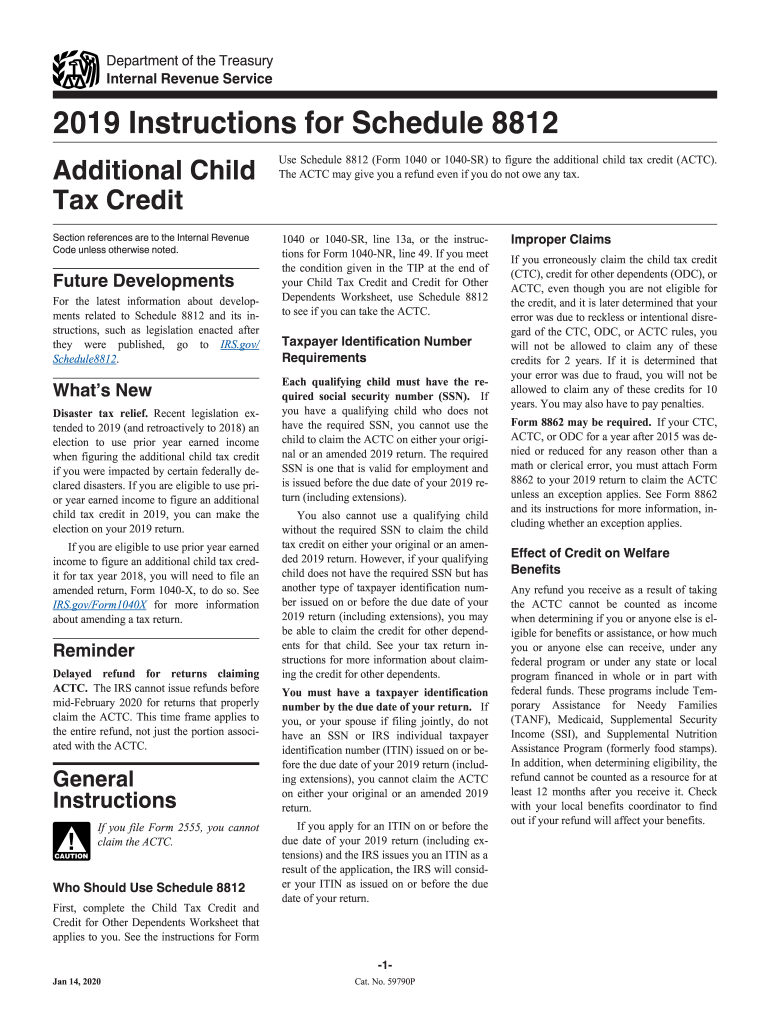

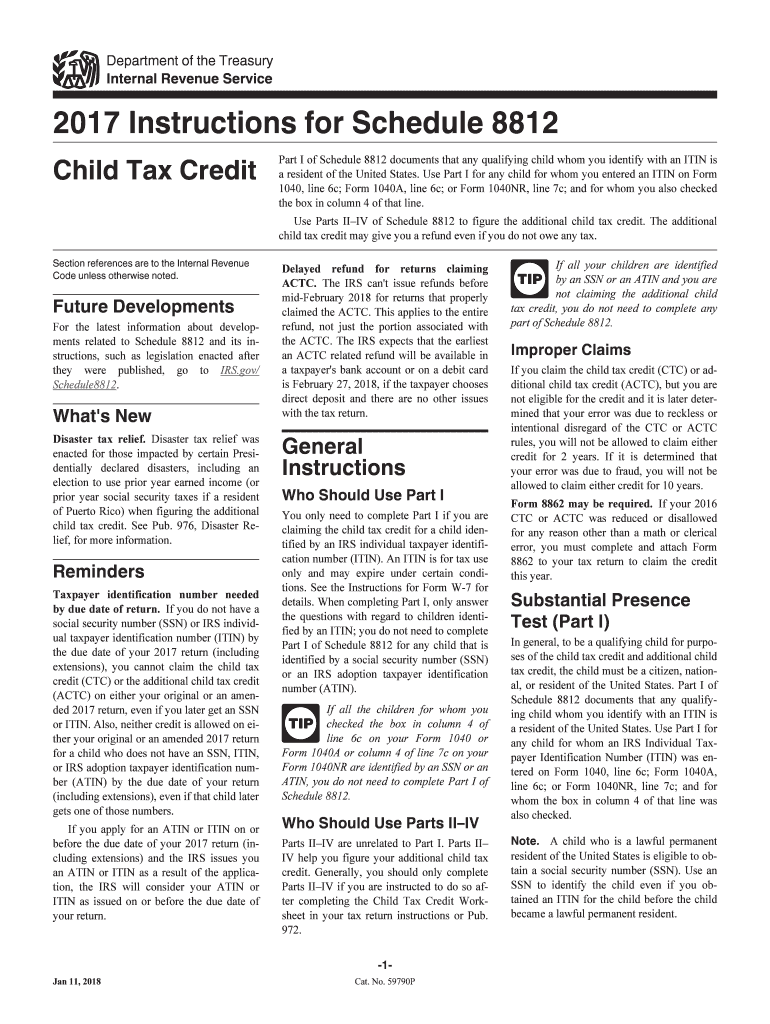

Section references are to the internal revenue code unless otherwise noted. Filers must deal with substantive changes to the credit, as well as substantially revamped tax forms and instructions. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

January 2021)additional child tax credit use schedule 8812 (form 1040) to figure the additional child tax credit (actc). Should be completed by all filers to claim the basic child tax credit. Get ready for tax season deadlines by completing any required tax forms today. The actc is a refundable credit. Web use schedule 8812 (form 1040) to figure your child.

2015 form 8812 pdf Fill out & sign online DocHub

Should be completed by all filers to claim the basic child tax credit. Web 2020 instructions for schedule 8812 (rev. Section references are to the internal revenue code unless otherwise noted. Ad upload, modify or create forms. If published, the 2022 tax year pdf file will display, the prior tax year 2021 if not.

Top 8 Form 8812 Templates free to download in PDF format

Signnow allows users to edit, sign, fill & share all type of documents online. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web major changes in the 2021 child tax credit may complicate 2021 tax.

Credit Limit Worksheets A Form

Try it for free now! The actc is a refundable credit. The actc may give you a refund even if you do not owe any tax. The ctc and odc are nonrefundable credits. Should be completed by all filers to claim the basic child tax credit.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Web the irs schedule 8812 form and instructions booklet are generally published late in december of each year. 47 name(s) shown on return Complete to claim the additional child tax credit. The ctc and odc are nonrefundable credits. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in.

What Is The Credit Limit Worksheet A For Form 8812

Web 2020 instructions for schedule 8812 (rev. Section references are to the internal revenue code unless otherwise noted. Last year, many of the federal income tax forms were published late in december, with instructions booklet following in early january due to last minute. The ctc and odc are nonrefundable credits. Complete to claim the additional child tax credit.

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Ad upload, modify or create forms. Should be completed by all filers to claim the basic child tax credit. The maximum amount of the 2021 child credit was increased from $2,000 to $3,000 for children under age 18, or $3,600 for children.

8812 Worksheet

Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. If published, the 2022 tax year pdf file will display, the prior tax year 2021 if not. For 2022, there are two parts to this form: The ctc and odc are nonrefundable credits. The actc is a refundable credit.

January 2021)Additional Child Tax Credit Use Schedule 8812 (Form 1040) To Figure The Additional Child Tax Credit (Actc).

Signnow allows users to edit, sign, fill & share all type of documents online. For 2022, there are two parts to this form: The ctc and odc are nonrefundable credits. Should be completed by all filers to claim the basic child tax credit.

47 Name(S) Shown On Return

Web major changes in the 2021 child tax credit may complicate 2021 tax returns. The ctc and odc are nonrefundable credits. Go to www.irs.gov/schedule8812 for instructions and the latest information. The actc may give you a refund even if you do not owe any tax.

The Actc Is A Refundable Credit.

If published, the 2022 tax year pdf file will display, the prior tax year 2021 if not. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The actc is a refundable credit. Last year, many of the federal income tax forms were published late in december, with instructions booklet following in early january due to last minute.

Current Revision Schedule 8812 (Form 1040) Pdf

Web 2020 instructions for schedule 8812 (rev. Ad upload, modify or create forms. In part i, you'll enter information from your form 1040 and calculate your credit amount. Filers must deal with substantive changes to the credit, as well as substantially revamped tax forms and instructions.