Form 8839 Instructions 2021

Form 8839 Instructions 2021 - Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Information about your eligible child (or children) part ii: Use this form to figure the amount of your. The credit will begin to phase out for families with modified. You may be able to take this credit in 2022 if any of the. Web you have a carryforward of an adoption credit from 2021. Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. The adopted child must be under age 18 or.

Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Qualified adoption expenses are reasonable. The adopted child must be under age 18 or. Please see the turbotax faq here for dates. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. The credit will begin to phase out for families with modified. Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web for 2021 adoptions (claimed in early 2022), the maximum adoption credit and exclusion is $14,440 per child.

Web for 2021 adoptions (claimed in early 2022), the maximum adoption credit and exclusion is $14,440 per child. Qualified adoption expenses are reasonable. Please see the turbotax faq here for dates. Web you have a carryforward of an adoption credit from 2021. Must be removed before printing. Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Web table of contents how do i complete irs form 8839? You may be able to take this credit in 2022 if any of the. The credit will begin to phase out for families with modified.

Form 8839 Qualified Adoption Expenses (2015) Free Download

Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Information about your eligible child (or children) part ii: Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply:.

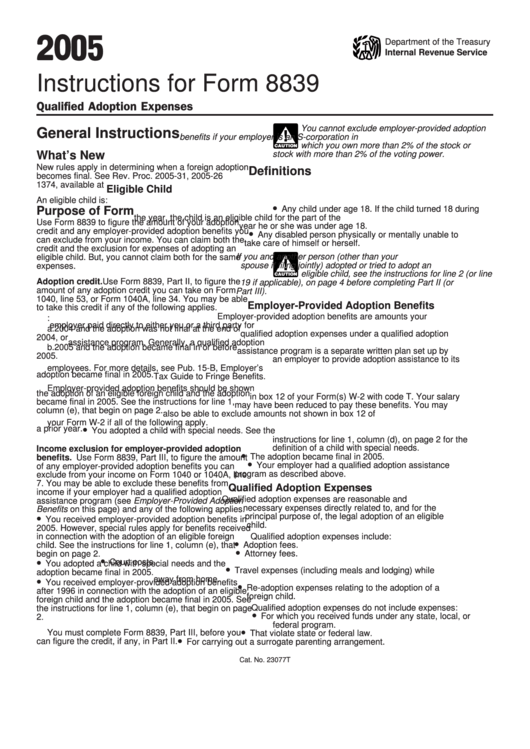

Instructions For Form 8839 2005 printable pdf download

You may be able to take this credit in 2022 if any of the. Web future developments for the latest information about developments related to form 8839 and its instructions, such as legislation enacted after theyare published, go to. Information about your eligible child (or children) part ii: Web you have a carryforward of an adoption credit from 2021. Please.

Form 8839Qualified Adoption Expenses

Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. The adopted child must be under age 18 or. Web table of contents how do i complete irs form 8839?.

How to Take Adoption Tax Credit for Failed Adoption Pocket Sense

Must be removed before printing. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. The credit will begin to phase out for families with modified. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Please see the.

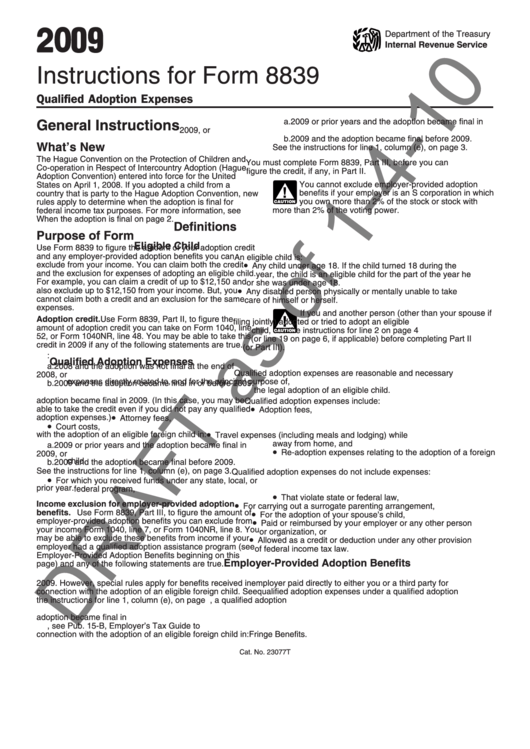

Instructions For Form 8839 Draft 2009 printable pdf download

Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. Information about your eligible child (or children) part ii: Web table of contents how do i complete irs form 8839? Use this form to figure the amount of your. Web future developments for the latest information about developments related to.

LEGO 8839 Supply Ship Set Parts Inventory and Instructions LEGO

Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. The credit will begin to phase out for families with modified. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these.

LEGO instructions Technic 8839 Supply Ship YouTube

Web table of contents how do i complete irs form 8839? Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Must be removed before printing. Please see the turbotax faq here for dates. Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service.

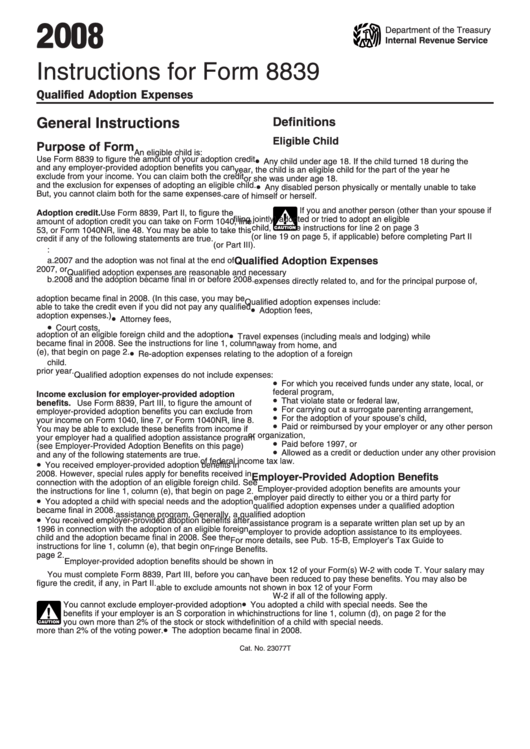

Instructions For Form 8839 2008 printable pdf download

Web table of contents how do i complete irs form 8839? Qualified adoption expenses are reasonable. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be.

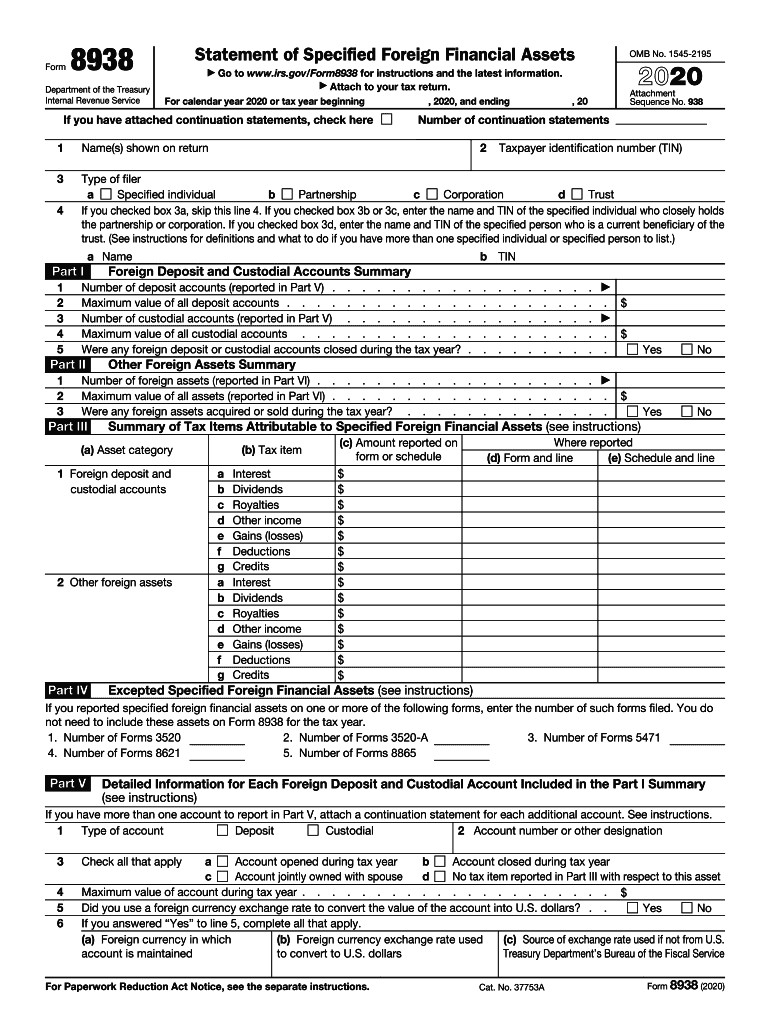

form 8938 Fill out & sign online DocHub

Web for 2021 adoptions (claimed in early 2022), the maximum adoption credit and exclusion is $14,440 per child. Use this form to figure the amount of your. The adopted child must be under age 18 or. Please see the turbotax faq here for dates. Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and.

LEGO 8839 Supply Ship Set Parts Inventory and Instructions LEGO

Please see the turbotax faq here for dates. Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Use this form to figure the amount of your. Qualified adoption expenses are reasonable. Web future developments for the latest information about developments related to form 8839 and its instructions, such.

Web You Have A Carryforward Of An Adoption Credit From 2021.

Web form 8839, qualified adoption expenses for tax year 2021 is estimated to be finalized and available in turbotax soon. You may be able to take this credit in 2022 if any of the. Web key takeaways • if you paid qualified adoption expenses to adopt a child, you may be eligible for the adoption tax credit up to a maximum of $14,890 per. Must be removed before printing.

The Credit Will Begin To Phase Out For Families With Modified.

Web information about form 8839, qualified adoption expenses, including recent updates, related forms and instructions on how to file. Use form 8839, part ii, to figure the adoption credit you can take on schedule 3 (form 1040), line 6c. Use this form to figure the amount of your. Qualified adoption expenses are reasonable.

Web Future Developments For The Latest Information About Developments Related To Form 8839 And Its Instructions, Such As Legislation Enacted After Theyare Published, Go To.

Web table of contents how do i complete irs form 8839? The adopted child must be under age 18 or. Please see the turbotax faq here for dates. Information about your eligible child (or children) part ii:

Web For 2021 Adoptions (Claimed In Early 2022), The Maximum Adoption Credit And Exclusion Is $14,440 Per Child.

Web travel expenses other adoption costs for your expenses to qualify for the credit or exclusion, both of these must apply: Web instructions for form 8839 qualified adoption expenses department of the treasury internal revenue service section references are to the internal revenue code unless otherwise.