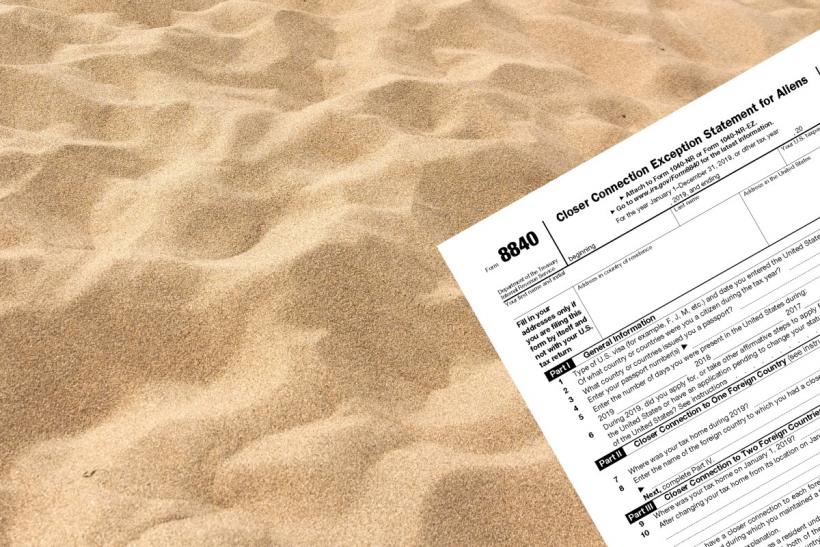

Form 8840 Instructions

Form 8840 Instructions - For more details on the substantial presence test and the closer connection exception, see pub. Nonresident alien income tax return in order to access form 8840. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. You were present in the united states for fewer than 183 days during 2018; In case you are filing the form alone, you'll be required to enter your physical addresses in your residence country and the u.s. As provided by the irs: 8840 (2021) form 8840 (2021) page. Federal income tax return, please attach form 8840 to the income tax return. Each alien individual must file a separate form 8840 to claim the closer connection exception. Web for paperwork reduction act notice, see instructions.

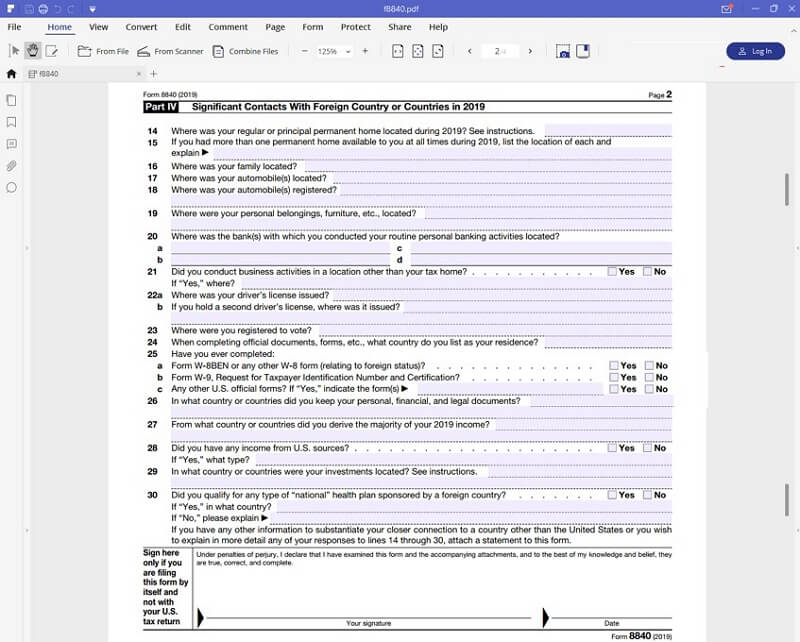

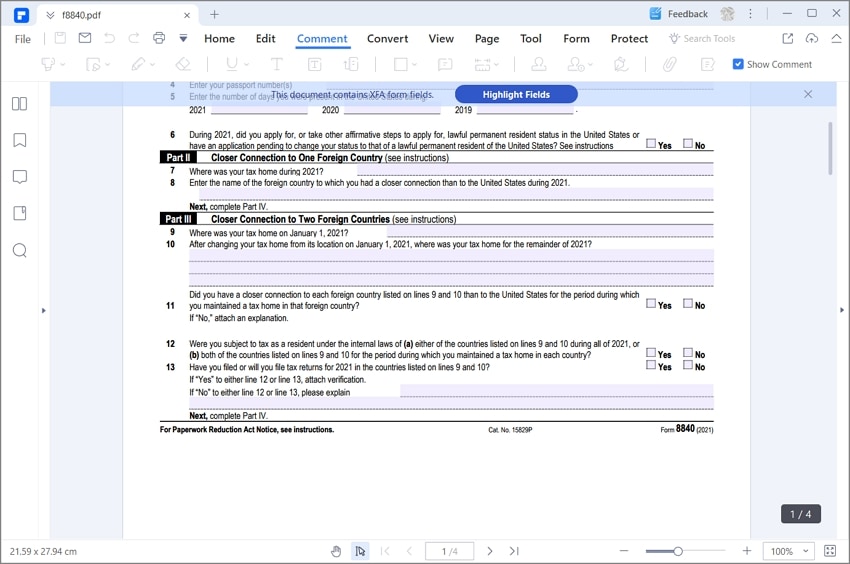

Launch pdfelement and click open file to add form 8840 from your computer. Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. The reason the foreign person files a 1040 nr and not a 1040, is because they are a nonresident, and nr stands for nonresident. 8840 (2021) form 8840 (2021) page. Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. 2 part iv significant contacts with foreign country or countries in 2021 14. Nonresident alien income tax return in order to access form 8840. Web form 8840 closer connection exception statement for aliens is used to claim the closer connection to a foreign country (ies) exception to the substantial presence test. If you are filing a u.s. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file.

Web for paperwork reduction act notice, see instructions. Launch pdfelement and click open file to add form 8840 from your computer. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. Federal income tax return, please attach form 8840 to the income tax return. Nonresident alien income tax return in order to access form 8840. If you are filing a u.s. You establish that during 2018, you had a tax home in a foreign country; Web general instructions purpose of form use form 8840 to claim the closer connection to a foreign country(ies) exception to the substantial presence test. As provided by the irs: Web form 8840, closer connection exception statement for aliens.

FTI Tax Forms. L1098TFED

Web file form 8840 with the irs to establish your claim that you are a nonresident of the united states by reason of that exception. Web form 8840, closer connection exception statement for aliens. Launch pdfelement and click open file to add form 8840 from your computer. Web form 8840 closer connection exception statement for aliens is used to claim.

Technic Safari Racer [Lego 8840] in 2020 Lego technic sets, Safari

Web irs form 8840 instructions. Web form 8840, closer connection exception statement for aliens. If you are filing a u.s. Web form 8840 closer connection exception statement for aliens is used to claim the closer connection to a foreign country (ies) exception to the substantial presence test. Even though you would otherwise meet the substantial presence test, you will not.

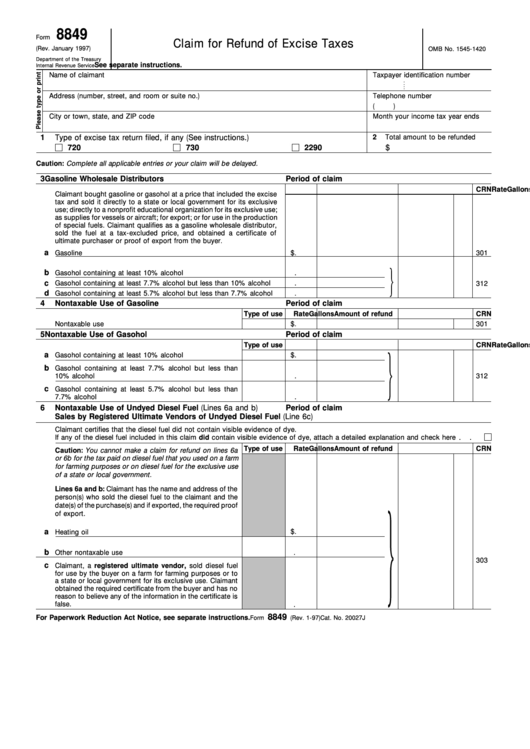

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

Web for paperwork reduction act notice, see instructions. Web irs form 8840 instructions. You establish that during 2018, you had a tax home in a foreign country; 8840 (2021) form 8840 (2021) page. You are not eligible for the closer connection exception if any of the following apply.

Gallery of Form 8849 Schedule 1 Elegant 20 Simple Work Release forms

8840 (2021) form 8840 (2021) page. The reason the foreign person files a 1040 nr and not a 1040, is because they are a nonresident, and nr stands for nonresident. As provided by the irs: You are not eligible for the closer connection exception if any of the following apply. Web form 8840 closer connection exception statement for aliens is.

Form 8840 IRS Closer Connection Exception Statement

Fill the tax period, your identification names and the u.s. The reason the foreign person files a 1040 nr and not a 1040, is because they are a nonresident, and nr stands for nonresident. Web for paperwork reduction act notice, see instructions. It is filed at the same time a person files their u.s. Federal income tax return, please attach.

IRS Form 8840 How to Fill it Right and Easily

Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. You are not eligible for the closer connection exception if any of the following apply. You were present in the united states for fewer than 183 days during 2018; Use form 8840 to claim the closer connection to a foreign country(ies) exception.

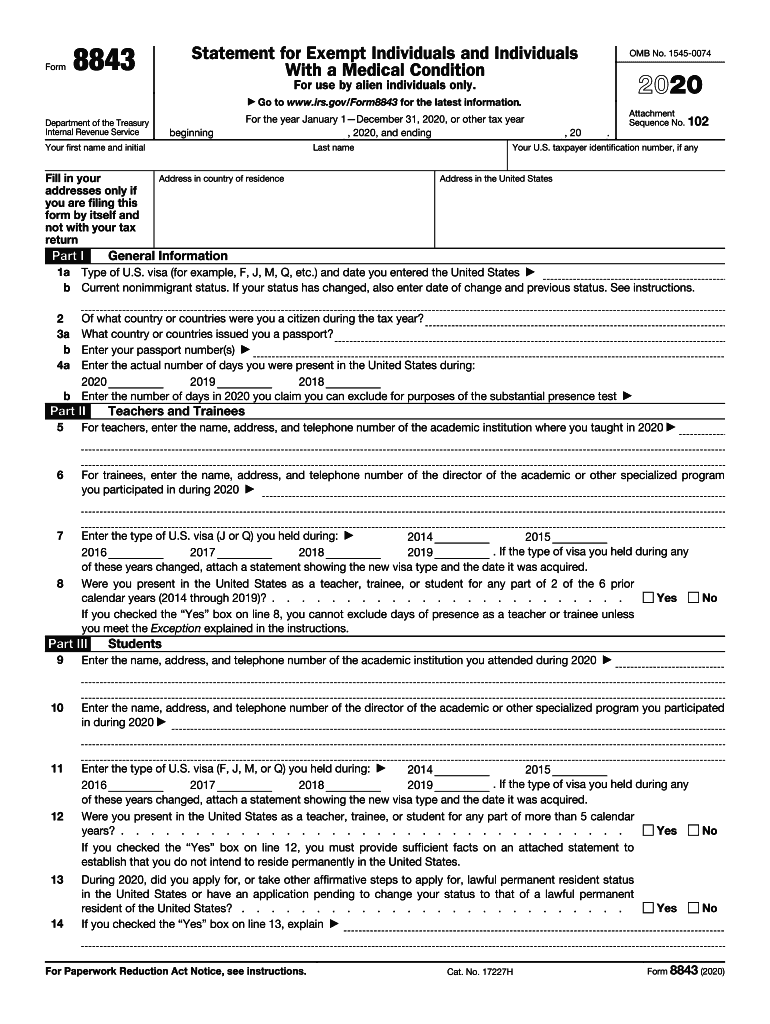

Form 8843 Fill Out and Sign Printable PDF Template signNow

Even though you would otherwise meet the substantial presence test, you will not be treated as a u.s. For more details on the substantial presence test and the closer connection exception, see pub. In case you are filing the form alone, you'll be required to enter your physical addresses in your residence country and the u.s. 8840 (2021) form 8840.

IRS Form 8840 How to Fill it Right and Easily

It is filed at the same time a person files their u.s. Fill the tax period, your identification names and the u.s. Nonresident alien income tax return in order to access form 8840. Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. As provided by the irs:

Why Is IRS Tax Form 8840 Important for Canadian Snowbirds?

Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. You establish that during 2018, you had a tax home in a foreign country; Web the form 8840 is the closer connection exception statement for aliens. Even though you would otherwise meet the substantial presence test, you will not be treated as.

Form 8840 instructions Fill online, Printable, Fillable Blank

Web irs form 8840 instructions. Web the form 8840 is the closer connection exception statement for aliens. A nonresident alien who meets the substantial presence test, defined in form 8840's instructions, can be taxed as a u.s. It is filed at the same time a person files their u.s. Even though you would otherwise meet the substantial presence test, you.

A Nonresident Alien Who Meets The Substantial Presence Test, Defined In Form 8840'S Instructions, Can Be Taxed As A U.s.

You were present in the united states for fewer than 183 days during 2018; Nonresident alien income tax return in order to access form 8840. Federal income tax return, please attach form 8840 to the income tax return. Web general instructions purpose of form use form 8840 to claim the closer connection to a foreign country(ies) exception to the substantial presence test.

Web Form 8840, Closer Connection Exception Statement For Aliens.

Even though you would otherwise meet the substantial presence test, you will not be treated as a u.s. It is filed at the same time a person files their u.s. You establish that during 2018, you had a tax home in a foreign country; Web the form 8840 is the closer connection exception statement for aliens.

Each Alien Individual Must File A Separate Form 8840 To Claim The Closer Connection Exception.

Fill the tax period, your identification names and the u.s. Web you must file form 8840, closer connection exception statement for aliens, to claim the closer connection exception. Web for paperwork reduction act notice, see instructions. For more details on the substantial presence test and the closer connection exception, see pub.

2 Part Iv Significant Contacts With Foreign Country Or Countries In 2021 14.

The reason the foreign person files a 1040 nr and not a 1040, is because they are a nonresident, and nr stands for nonresident. Web irs form 8840 instructions. Launch pdfelement and click open file to add form 8840 from your computer. In case you are filing the form alone, you'll be required to enter your physical addresses in your residence country and the u.s.

![Technic Safari Racer [Lego 8840] in 2020 Lego technic sets, Safari](https://i.pinimg.com/originals/92/2e/88/922e8861ebd0c94bf64f89974087b3b2.jpg)