Form 8867 Instructions

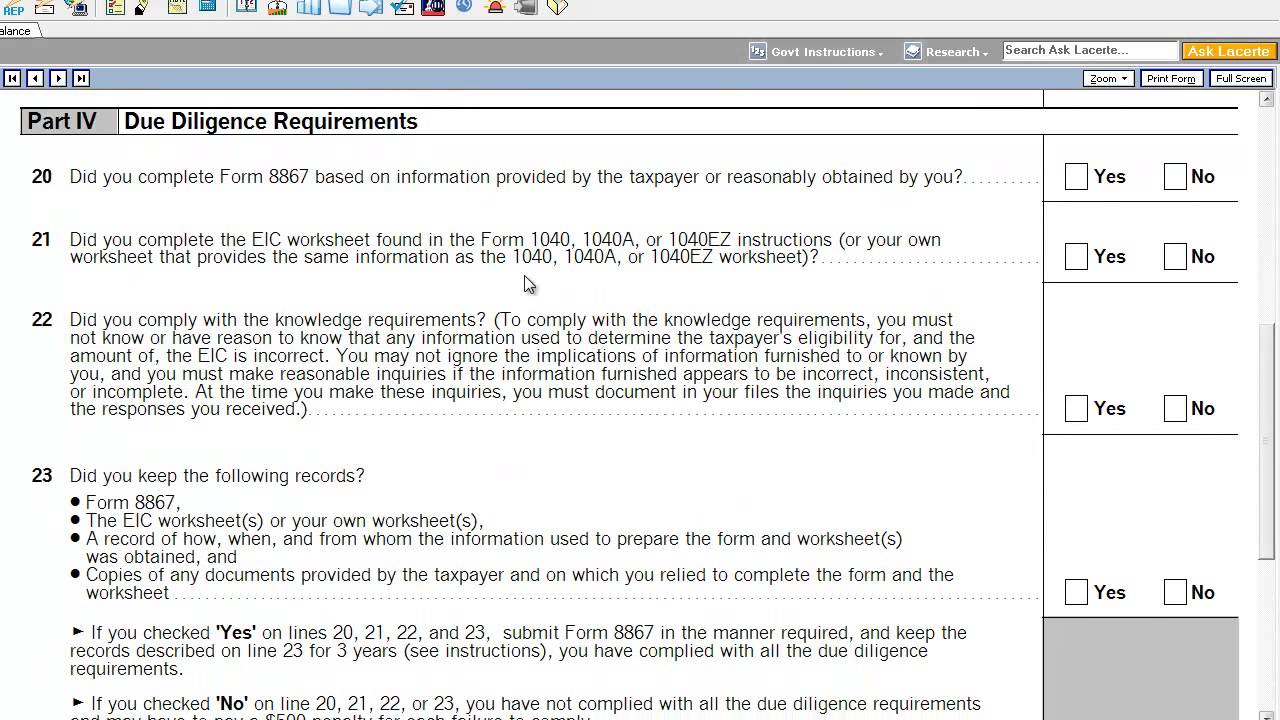

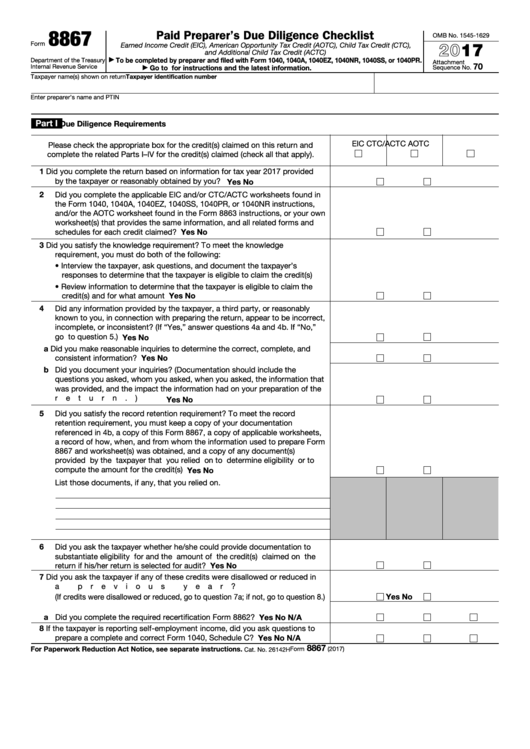

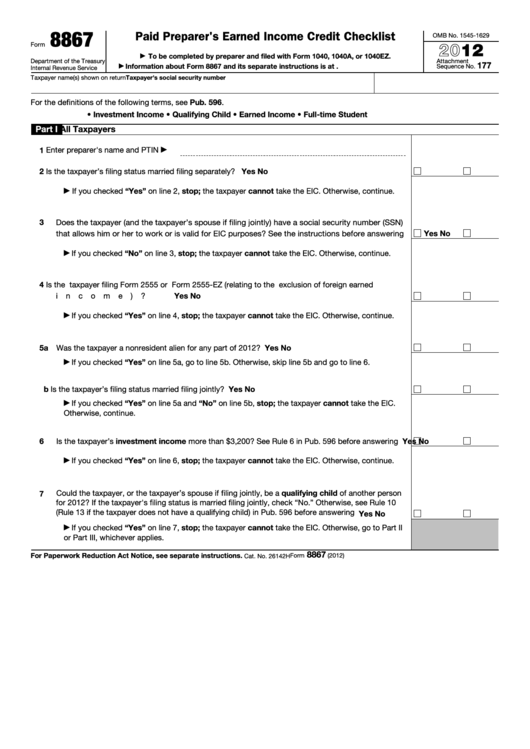

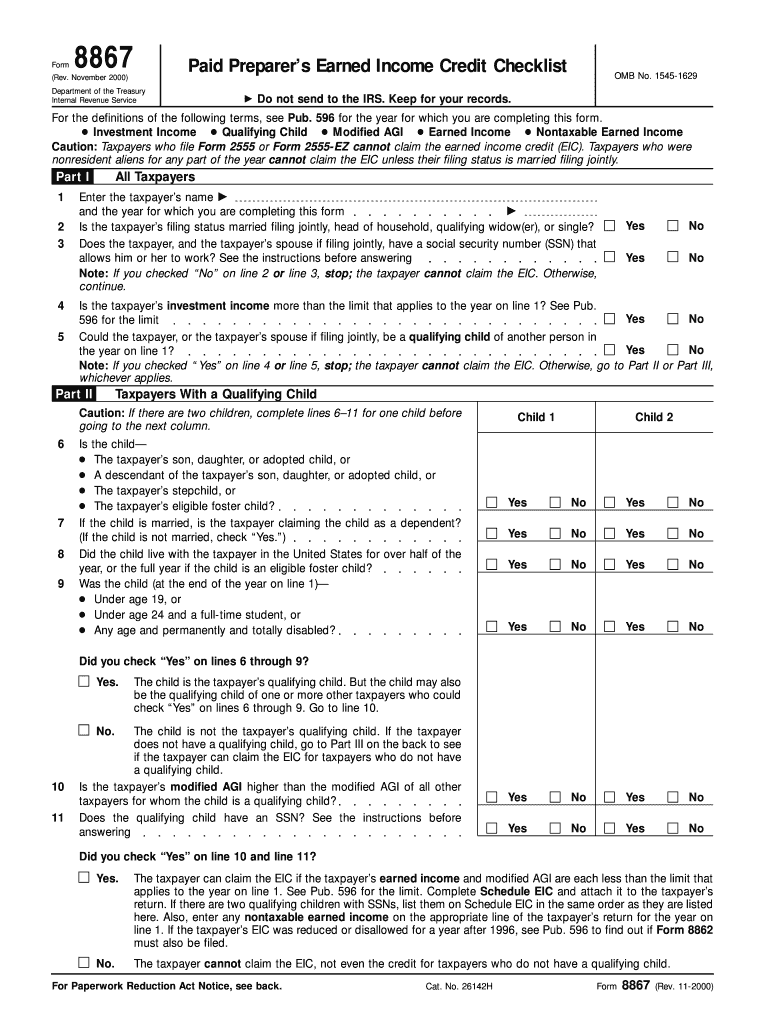

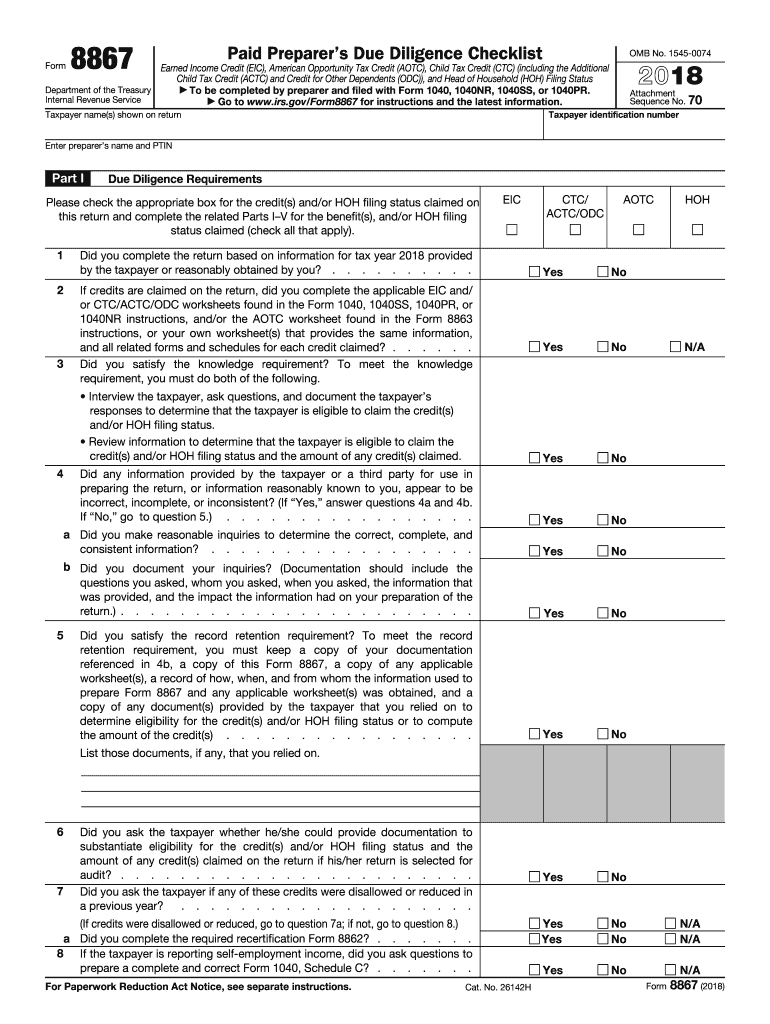

Form 8867 Instructions - Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Keep a copy of the five records listed above; Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. 26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) Meet the knowledge requirement by. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the earned income tax credit (eitc), child tax credit (ctc), additional child tax credit (actc), credit for other dependents (odc), american opportunity credit (aotc) and/or the h. November 2022) department of the treasury internal revenue service. Keep all five of the following records for 3 years from the latest of the dates specified later in document retention.

Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. For any information that appeared incorrect, inconsistent or incomplete,. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. November 2022) department of the treasury internal revenue service. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Keep a copy of the five records listed above; Meet the knowledge requirement by.

Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Submit form 8867 in the manner required. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the earned income tax credit (eitc), child tax credit (ctc), additional child tax credit (actc), credit for other dependents (odc), american opportunity credit (aotc) and/or the h. Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. November 2022) department of the treasury internal revenue service.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

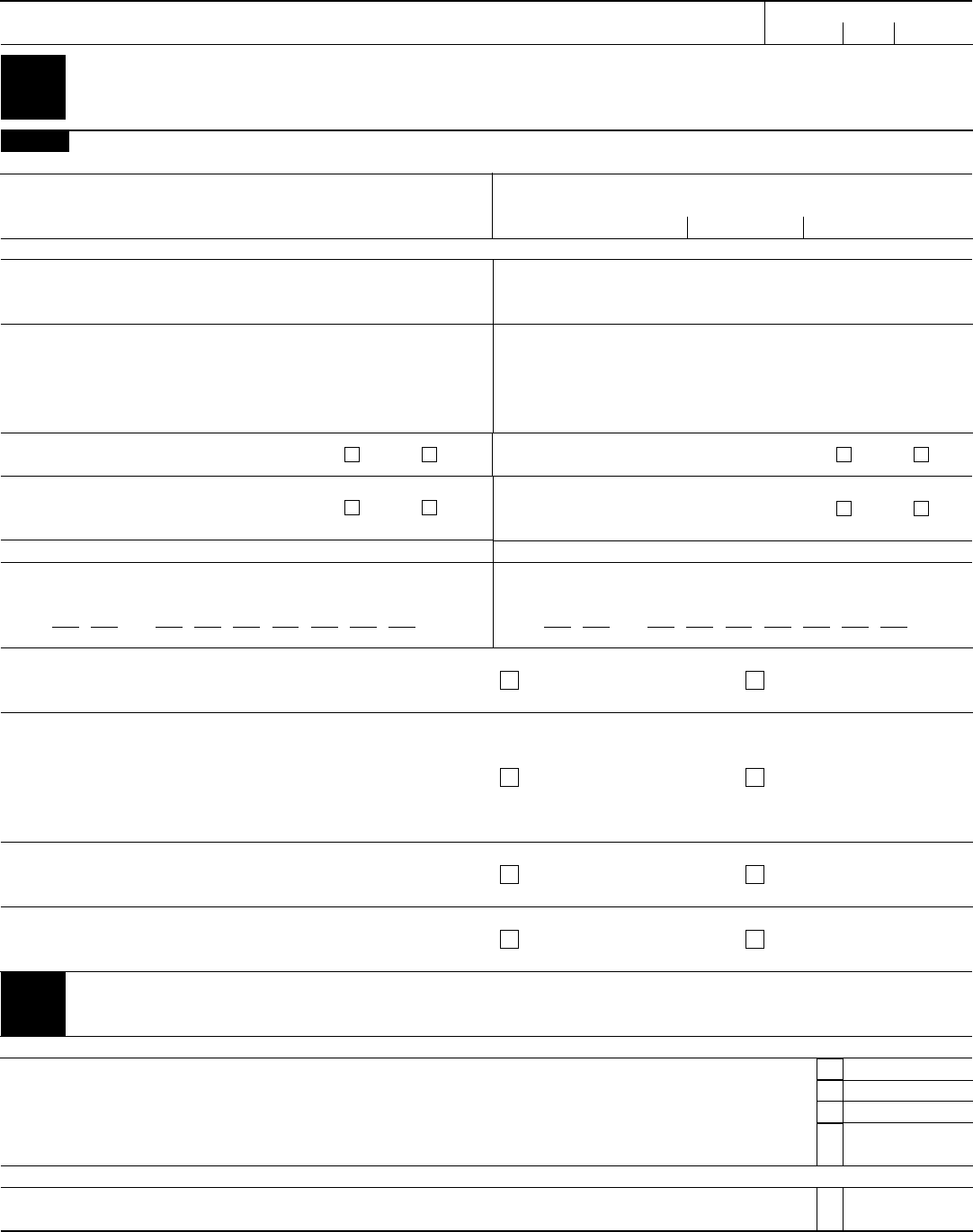

26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) For any information that appeared incorrect, inconsistent or incomplete,. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your..

Form 8863 Edit, Fill, Sign Online Handypdf

Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to.

Form 8863 Instructions & Information on the Education Credit Form

Keep a copy of the five records listed above; Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Submit form 8867 in the manner required. As part of exercising due diligence, the preparer must.

Form 8867, Paid Preparer's Earned Credit Checklist YouTube

Submit form 8867 in the manner required. November 2022) department of the treasury internal revenue service. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your. Keep a copy of the five records listed above; Keep all five of the following records for 3 years from the latest of the.

Form 8867 Fill out & sign online DocHub

Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. November 2022) department of the treasury internal revenue service. Keep a copy of the five records listed above; Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the.

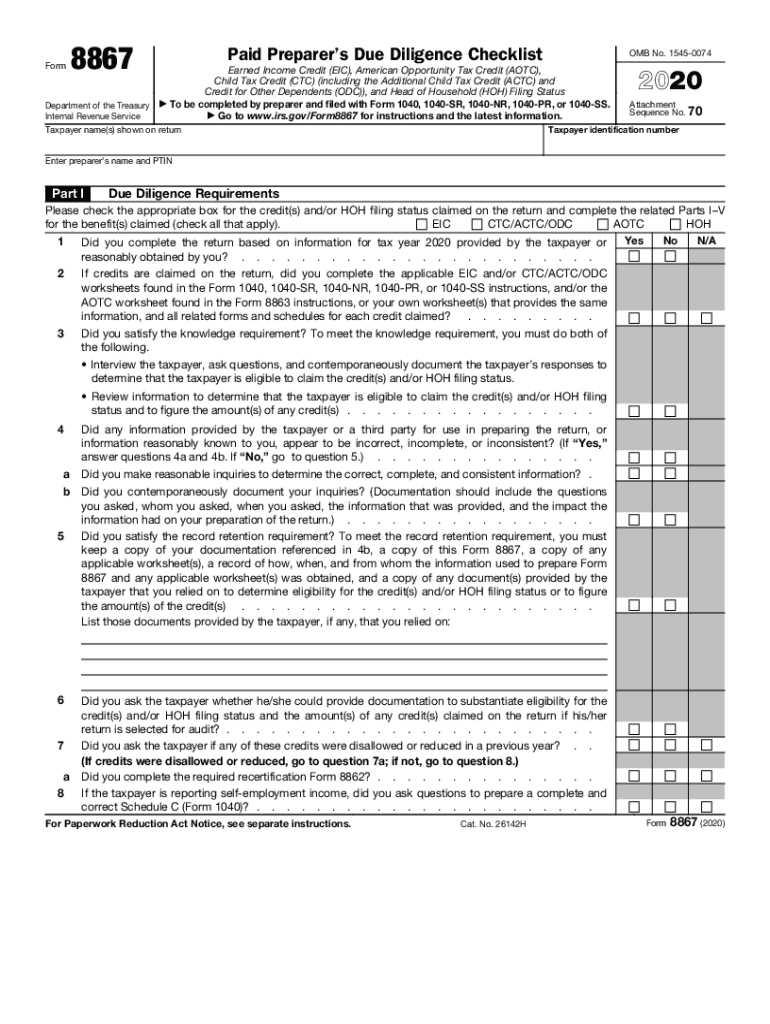

Form 8862Information to Claim Earned Credit for Disallowance

26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) Meet the knowledge requirement by. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go.

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. For any information that appeared incorrect, inconsistent or incomplete,. 26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc,.

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Complete form 8867 truthfully and accurately and complete the actions described on form 8867 for any applicable credit(s) claimed and hoh filing status, if claimed. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic,.

Form 8867 Fill Out and Sign Printable PDF Template signNow

November 2022) department of the treasury internal revenue service. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, Submit form 8867 in the manner required. Meet the knowledge requirement by. 26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc,.

Form 8867 Fill Out and Sign Printable PDF Template signNow

Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. As part of exercising.

Complete Form 8867 Truthfully And Accurately And Complete The Actions Described On Form 8867 For Any Applicable Credit(S) Claimed And Hoh Filing Status, If Claimed.

Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the earned income tax credit (eitc), child tax credit (ctc), additional child tax credit (actc), credit for other dependents (odc), american opportunity credit (aotc) and/or the h. November 2022) department of the treasury internal revenue service. Web enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions.

Keep A Copy Of The Five Records Listed Above;

Keep all five of the following records for 3 years from the latest of the dates specified later in document retention. As part of exercising due diligence, the preparer must interview the client, ask adequate questions, 26142hform 8867 (2018) form 8867 (2018) page 2 part iii due diligence questions for returns claiming ctc/actc/odc (if the return does not claim ctc, actc, or odc, go to part iv.) Submit form 8867 in the manner required.

For Any Information That Appeared Incorrect, Inconsistent Or Incomplete,.

Meet the knowledge requirement by. Future developments for the latest information about developments related to form 8867 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8867. Web parts of form 8867 compute the credits and complete all applicable credit worksheets, forms and schedules interview the client, make a record of your questions and the client’s responses, and review information to determine. Interviewing the taxpayer, asking adequate questions, contemporaneously documenting the questions and the taxpayer’s responses on the return or in your.