Form 8880 Instructions

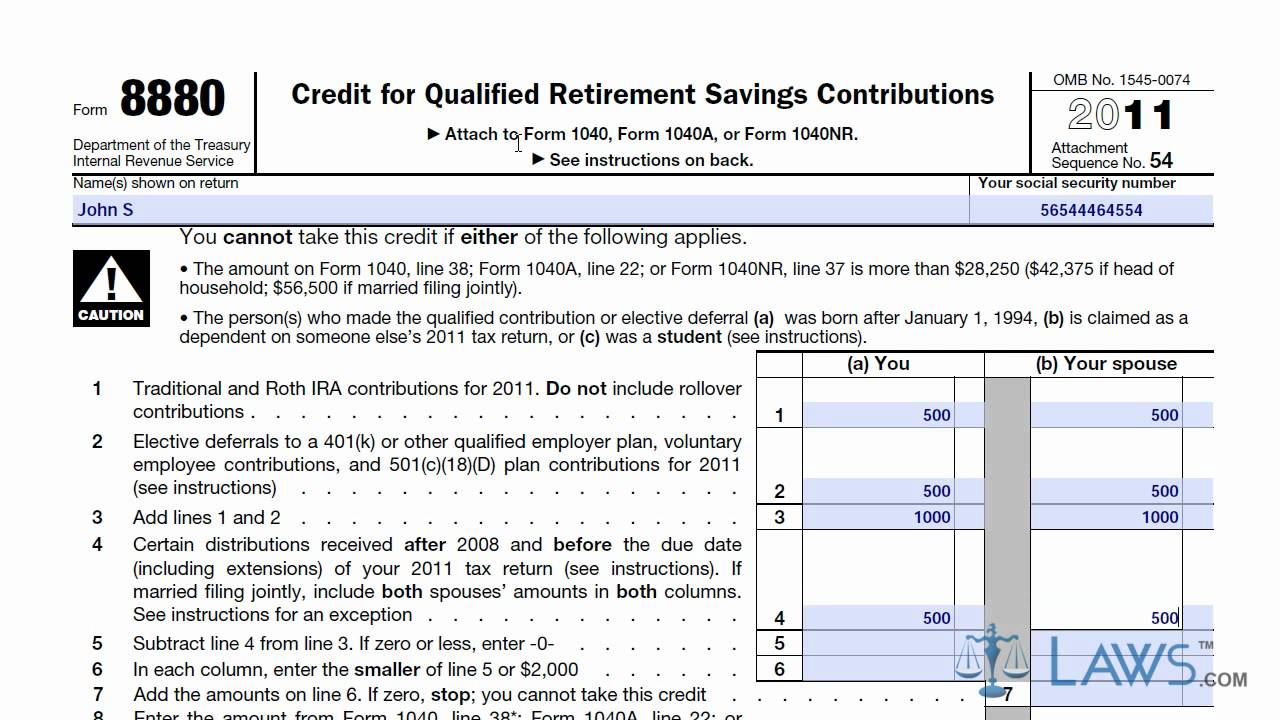

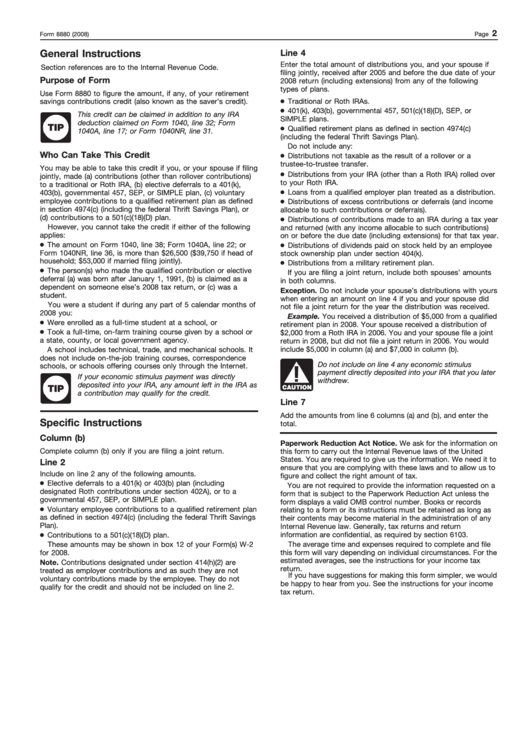

Form 8880 Instructions - Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Who can take this credit This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; However, to complete the form successfully, the following step by step guide will be helpful. Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. This credit can be claimed in addition to any ira deduction. Contributions you make to a traditional or roth ira, This form determines whether you qualify for the retirement saver's credit and how much money you can claim. Web see form 8880, credit for qualified retirement savings contributions, for more information. Or form 1040nr, line 32.

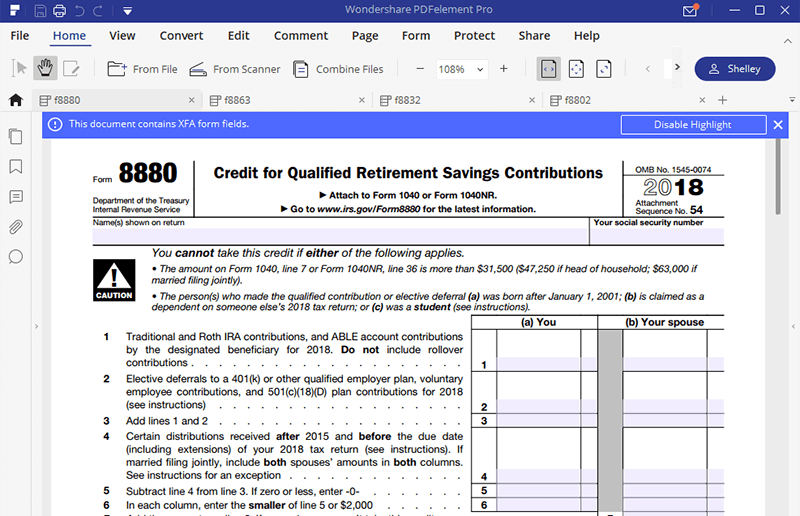

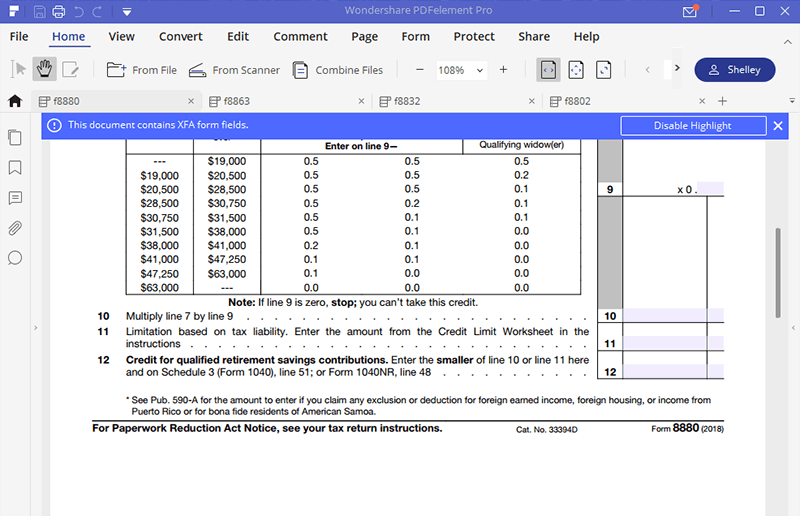

The irs form 8880 is a simple form which can be completed in just few minutes. Web see form 8880, credit for qualified retirement savings contributions, for more information. This credit can be claimed in addition to any ira deduction. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; Contributions you make to a traditional or roth ira, Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file.

The irs form 8880 is a simple form which can be completed in just few minutes. This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; Who can take this credit All you need to do is just to open it on pdfelement and fill the form accordingly. This form determines whether you qualify for the retirement saver's credit and how much money you can claim. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web irs form 8880 reports contributions made to qualified retirement savings accounts. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Web see form 8880, credit for qualified retirement savings contributions, for more information.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

The irs form 8880 is a simple form which can be completed in just few minutes. If you contribute to a retirement account, you might qualify for a tax credit. Web irs form 8880 reports contributions made to qualified retirement savings accounts. This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; Web.

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

The irs form 8880 is a simple form which can be completed in just few minutes. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web •.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

This credit can be claimed in addition to any ira deduction. The irs form 8880 is a simple form which can be completed in just few minutes. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: This form determines whether you qualify for the retirement.

Form 8880 Instructions Wallpaper Free Best Hd Wallpapers

Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Web instructions for how to fill out irs form 8880. Web to claim the credit, you must complete irs form 8880 and include it with your tax.

IRS Form 8880 Get it Filled the Right Way

Web instructions for how to fill out irs form 8880. If you contribute to a retirement account, you might qualify for a tax credit. Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: This credit can be claimed in addition to any ira deduction claimed.

4974 c retirement plan Early Retirement

If you contribute to a retirement account, you might qualify for a tax credit. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web for the latest.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; If you contribute to a retirement account, you might qualify for a tax credit. Form 8880 is used by individuals to.

IRS Form 8880 Get it Filled the Right Way

Who can take this credit Web to claim the credit, you must complete irs form 8880 and include it with your tax return. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Web for the.

IRS Form 8880 Instructions

Web for the latest information about developments related to form 8880 and its instructions, such as legislation enacted after they were published,. Contributions you make to a traditional or roth ira, Web see form 8880, credit for qualified retirement savings contributions, for more information. Web irs form 8880 reports contributions made to qualified retirement savings accounts. Depending on your adjusted.

Form 8880 Edit, Fill, Sign Online Handypdf

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Form.

Web For The Latest Information About Developments Related To Form 8880 And Its Instructions, Such As Legislation Enacted After They Were Published,.

Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). If you contribute to a retirement account, you might qualify for a tax credit. Contributions you make to a traditional or roth ira, Web to claim the credit, you must complete irs form 8880 and include it with your tax return.

The Irs Form 8880 Is A Simple Form Which Can Be Completed In Just Few Minutes.

Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. All you need to do is just to open it on pdfelement and fill the form accordingly. This credit can be claimed in addition to any ira deduction claimed on form 1040, line 32; This form determines whether you qualify for the retirement saver's credit and how much money you can claim.

However, To Complete The Form Successfully, The Following Step By Step Guide Will Be Helpful.

Web see form 8880, credit for qualified retirement savings contributions, for more information. Two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total retirement account contributions for the year. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web instructions for how to fill out irs form 8880.

Web Irs Form 8880 Reports Contributions Made To Qualified Retirement Savings Accounts.

Or form 1040nr, line 32. Who can take this credit Depending on your adjusted gross income reported on your form 1040 series return, the amount of the credit is 50%, 20% or 10% of: This credit can be claimed in addition to any ira deduction.