Form 8883 Instructions

Form 8883 Instructions - Web instructions for opening a form. Upload, modify or create forms. Information about transactions involving new target. Sign it in a few clicks. This includes information previously reported on. Complete, edit or print tax forms instantly. Web 8883 asset allocation statement form (october 2002) under section 338 department of the treasury internal revenue service attach to your income tax return. It is a straightforward form with simple instructions outlined below. Web the irs recently launched a program to match the filing of form 8023, elections under section 338 for corporations making qualified stock purchases, by a foreign purchasing. This includes information previously reported on.

This includes information previously reported on. Web 8883 asset allocation statement form (october 2002) under section 338 department of the treasury internal revenue service attach to your income tax return. Complete, edit or print tax forms instantly. Sign it in a few clicks. Information about transactions involving new target. Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate. Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Web we last updated the asset allocation statement under section 338 in february 2023, so this is the latest version of form 8883, fully updated for tax year 2022. Web edit your filled supplemental form 8883 sample online. Web for instructions and the latest information.

Complete, edit or print tax forms instantly. Web 8883 asset allocation statement form (october 2002) under section 338 department of the treasury internal revenue service attach to your income tax return. Web we last updated the asset allocation statement under section 338 in february 2023, so this is the latest version of form 8883, fully updated for tax year 2022. Web information about form 8883, asset allocation statement under section 338, including recent updates, related forms and instructions on how to file. Sign it in a few clicks. Try it for free now! Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Complete, edit or print tax forms instantly. Web use form 8883, asset allocation on which a qsp has occurred. This includes information previously reported on.

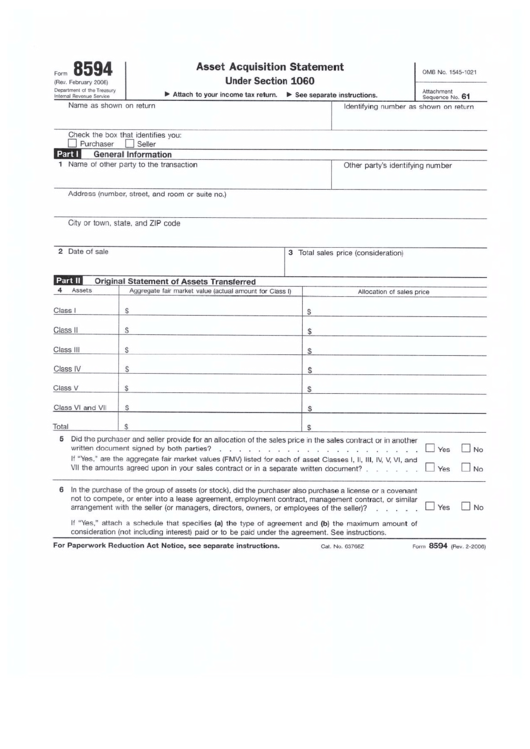

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate. Name(s) shown on your income tax return. Try it for free now! This includes information previously reported on. Type text, add images, blackout confidential details, add comments, highlights and more.

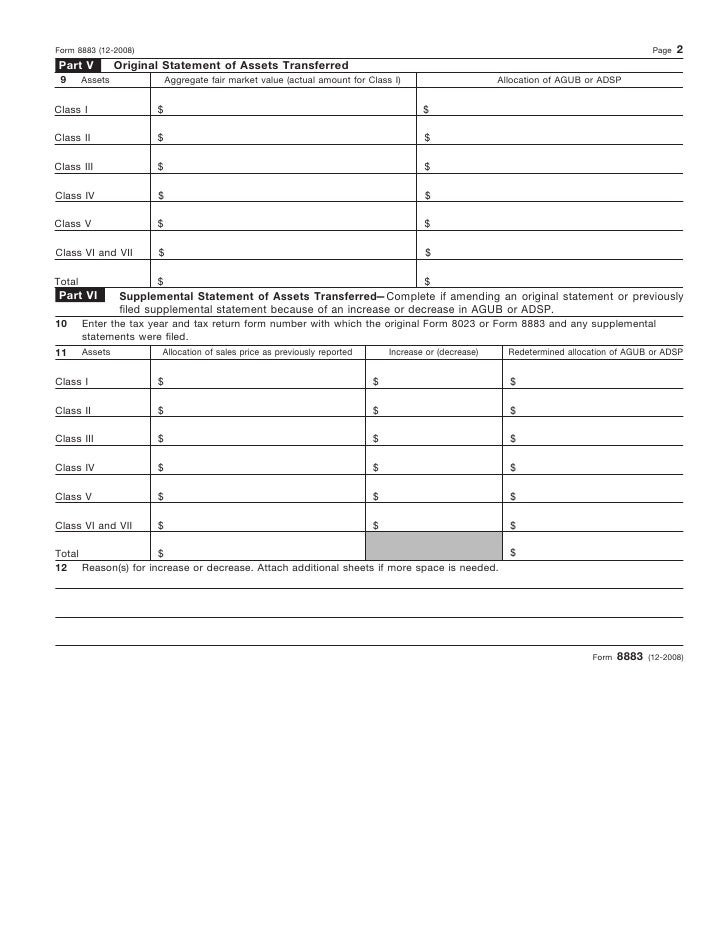

Form 8883 Asset Allocation Statement under Section 338 (2008) Free

Some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system. Try it for free now! Upload, modify or create forms. Statement under section 338, to report details. Web if you did not receive any taxable income last year, you can file the 8843 form by hand.

Fill Free fillable F8883 Form 8883 (Rev. October 2017) PDF form

, the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making. Web we last updated the asset allocation statement under section 338 in february 2023, so this is the latest version of form 8883, fully updated for tax year 2022. Try it for free now! Name(s) shown on your income.

Form 8883 Asset Allocation Statement Under Section 338

Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate. Web both old target and new target will be required to file form 8883, asset allocation statement under section 338 (or an appropriate successor form), with their. Try it for free now! Web use form 8883 to report information about.

LEGO Functions Power Functions MMotor 8883 Lego, Legos, Power

It is a straightforward form with simple instructions outlined below. Web for instructions and the latest information. This includes information previously reported on. Name(s) shown on your income tax return. Upload, modify or create forms.

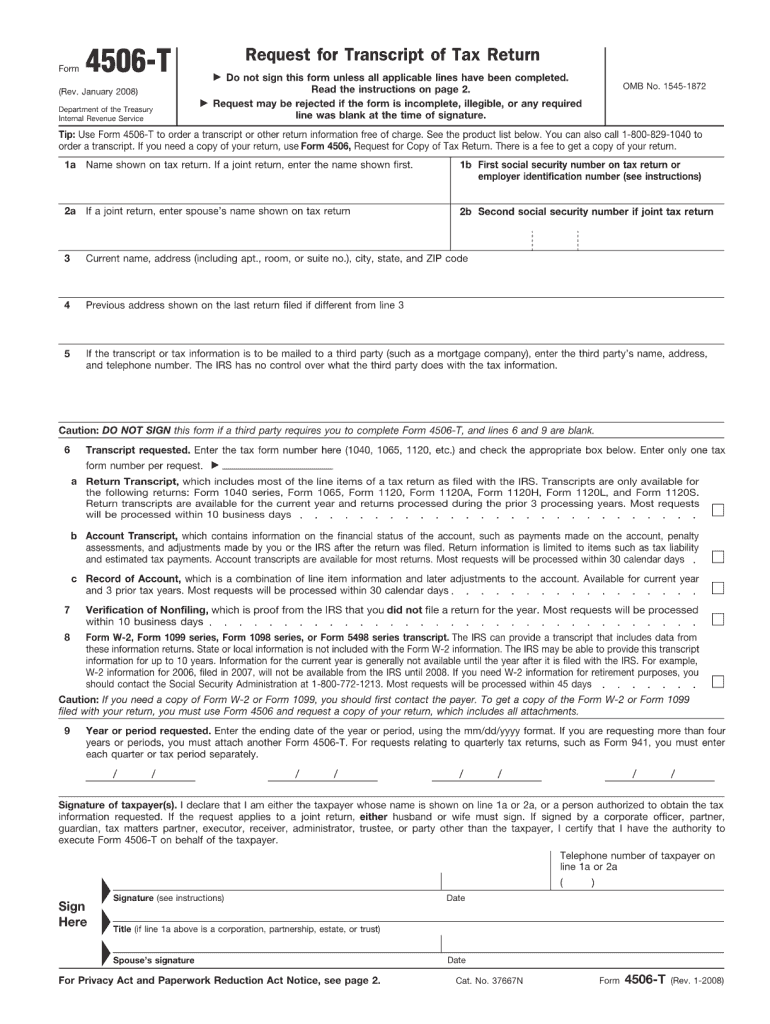

How To Fill Out Tax Forms

Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Web use form 8883, asset allocation on which a qsp has occurred. , the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making. Web for instructions and the latest information. Web.

Ct Sales And Use Tax Form Os 114 Instructions Form Resume Examples

Complete, edit or print tax forms instantly. This includes information previously reported on. Web if you did not receive any taxable income last year, you can file the 8843 form by hand. Try it for free now! Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338.

Form 8883 Fill Out and Sign Printable PDF Template signNow

Web if you did not receive any taxable income last year, you can file the 8843 form by hand. Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Try it for free now! This includes information previously reported on. Name(s) shown on your income tax return.

Form 8883 Asset Allocation Statement Under Section 338

Web the irs recently launched a program to match the filing of form 8023, elections under section 338 for corporations making qualified stock purchases, by a foreign purchasing. Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate. Web we last updated the asset allocation statement under section 338 in.

Instructions for filling online Application Form of Civil Services

Web both old target and new target will be required to file form 8883, asset allocation statement under section 338 (or an appropriate successor form), with their. Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Sign it in a few clicks. Web edit your filled supplemental form 8883 sample.

Web 8883 Asset Allocation Statement Form (October 2002) Under Section 338 Department Of The Treasury Internal Revenue Service Attach To Your Income Tax Return.

Web both old target and new target will be required to file form 8883, asset allocation statement under section 338 (or an appropriate successor form), with their. Name(s) shown on your income tax return. Web for instructions and the latest information. Complete, edit or print tax forms instantly.

Web Use Form 8883, Asset Allocation On Which A Qsp Has Occurred.

Statement under section 338, to report details. Web instructions for opening a form. Complete, edit or print tax forms instantly. , the irs is implementing the temporary procedure for fax transmission of form 8023, elections under section 338 for corporations making.

Web We Last Updated The Asset Allocation Statement Under Section 338 In February 2023, So This Is The Latest Version Of Form 8883, Fully Updated For Tax Year 2022.

This includes information previously reported on. It is a straightforward form with simple instructions outlined below. Sign it in a few clicks. Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338.

Upload, Modify Or Create Forms.

Web edit your filled supplemental form 8883 sample online. Web use form 8883 to report information about transactions involving the deemed sale of corporate assets under section 338. Try it for free now! Type text, add images, blackout confidential details, add comments, highlights and more.