Form 8886 Instructions 2021

Form 8886 Instructions 2021 - Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,. Mark an x in the box(es) that apply (see. The ftb may impose penalties if. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Who must file a utah return; 4 identify the type of new york reportable transactions. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web 2 enter the total number of irs form(s) 8886 that are attached to this form.

Web this information explains tax shelter disclosure requirements and penalties for taxpayers participating in tax shelters, tax shelter promoters, and material advisors. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web download this form print this form more about the federal form 8886 corporate income tax ty 2022 we last updated the reportable transaction disclosure statement in. However, you may report nonrecognition of gain, tax credits,. Mark an x in the box(es) that apply (see. Web the ftb may impose penalties if the corporation fails to file federal form 8886, form 8918, material advisor disclosure statement, or any other required information. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. The ftb may impose penalties if. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,.

Web download this form print this form more about the federal form 8886 corporate income tax ty 2022 we last updated the reportable transaction disclosure statement in. Web when and how to file. Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. The ftb may impose penalties if. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. However, you may report nonrecognition of gain, tax credits,. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Mark an x in the box(es) that apply (see. Web the ftb may impose penalties if the corporation fails to file federal form 8886, form 8918, material advisor disclosure statement, or any other required information. 4 identify the type of new york reportable transactions.

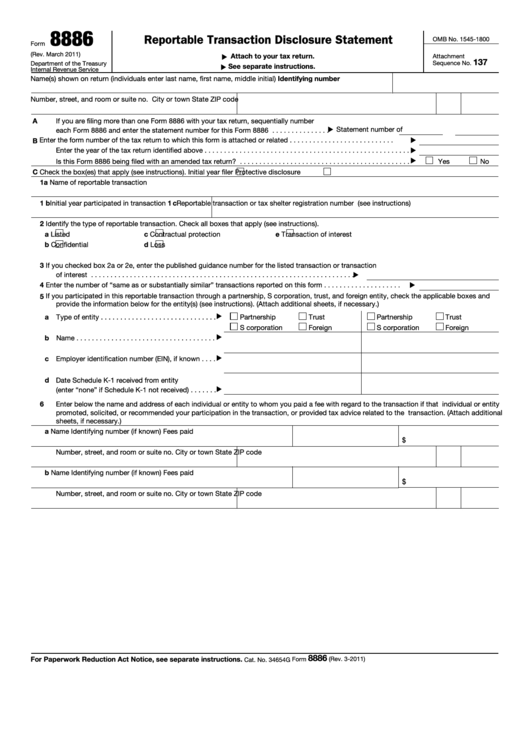

Fillable Form 8886 Reportable Transaction Disclosure Statement

Web this information explains tax shelter disclosure requirements and penalties for taxpayers participating in tax shelters, tax shelter promoters, and material advisors. You can view or download the. Mark an x in the box(es) that apply (see. However, you may report nonrecognition of gain, tax credits,. Web form 8886 for each reportable exclusions from gross income, updated in future issues.

8594 Instructions 2021 2022 IRS Forms Zrivo

Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Line by line instructions + general instructions. Web this information explains tax shelter disclosure requirements and penalties for taxpayers participating in tax shelters, tax shelter promoters, and material advisors. You can view or download the. Web if you are filing more than.

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

Web the instructions to form 8886 suggest a total estimated preparation time of over 21 hours per submission due to the lengthy requests for disclosure. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Web form 8886 for each reportable exclusions.

USCIS I864 Instructions 2021 Fill and Sign Printable Template Online

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Who must file a utah return; Web the instructions to form 8886 suggest a total estimated preparation time of over 21 hours per submission due to the lengthy requests for disclosure. Web.

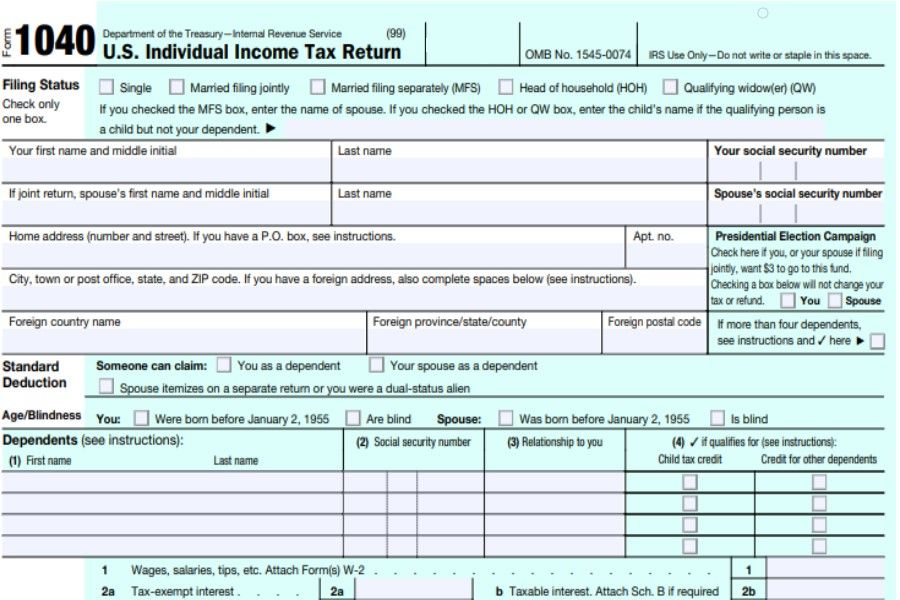

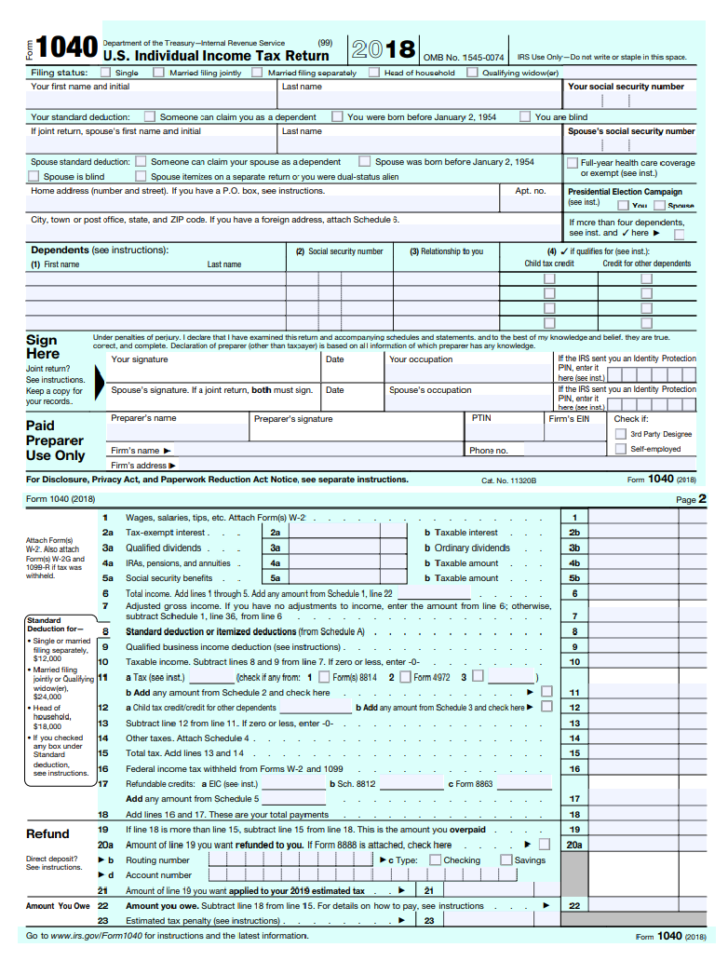

2021 Federal Tax Forms Printable 2022 W4 Form

Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,. Web when and how to file. You can view or download the. However, you may report nonrecognition of gain, tax credits,. Who must file a utah return;

Fill Free fillable Form 8886 Reportable Transaction Disclosure

Web download this form print this form more about the federal form 8886 corporate income tax ty 2022 we last updated the reportable transaction disclosure statement in. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. You can view or download.

Form1040allpages PriorTax Blog 2021 Tax Forms 1040 Printable

Line by line instructions + general instructions. The ftb may impose penalties if. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web when and how to file. You can view or download the.

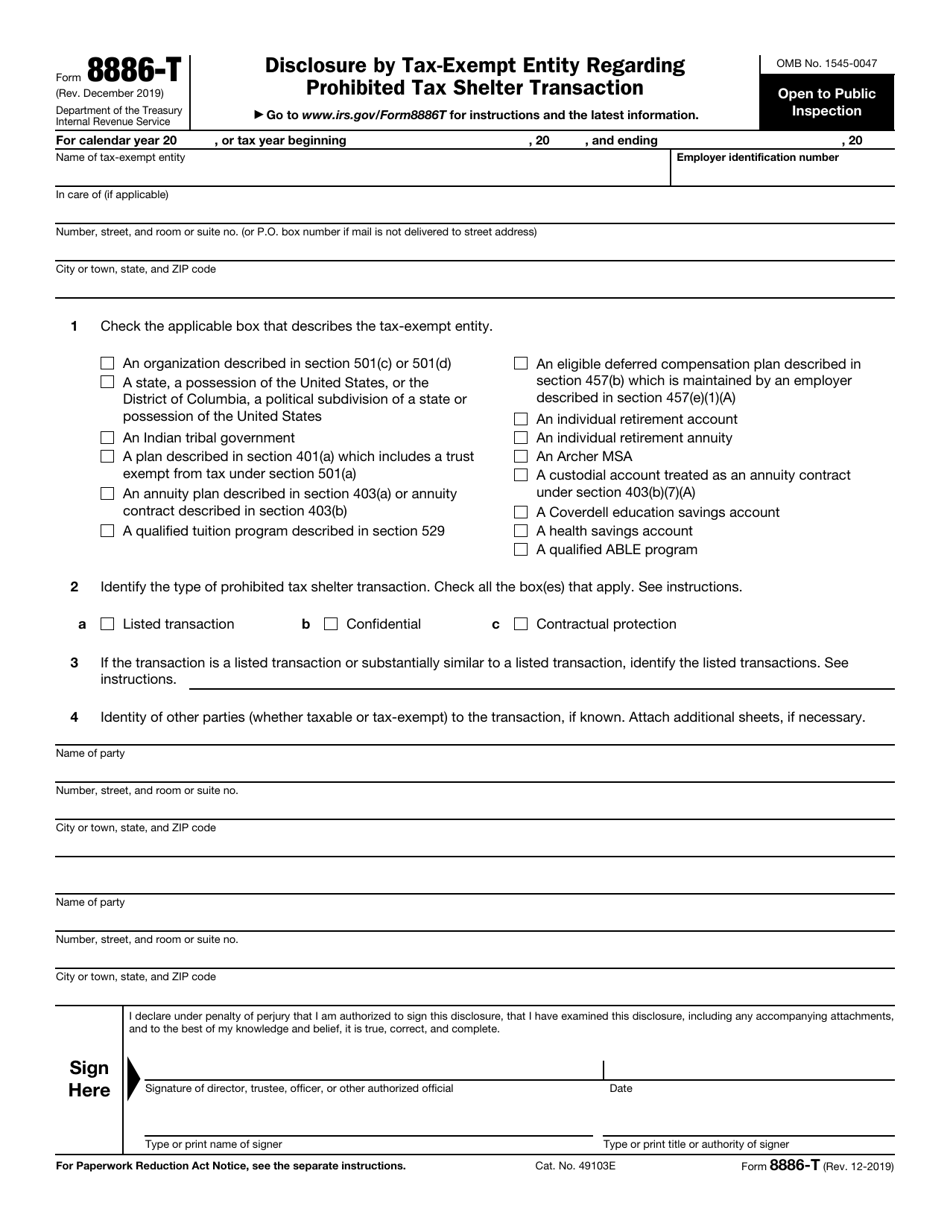

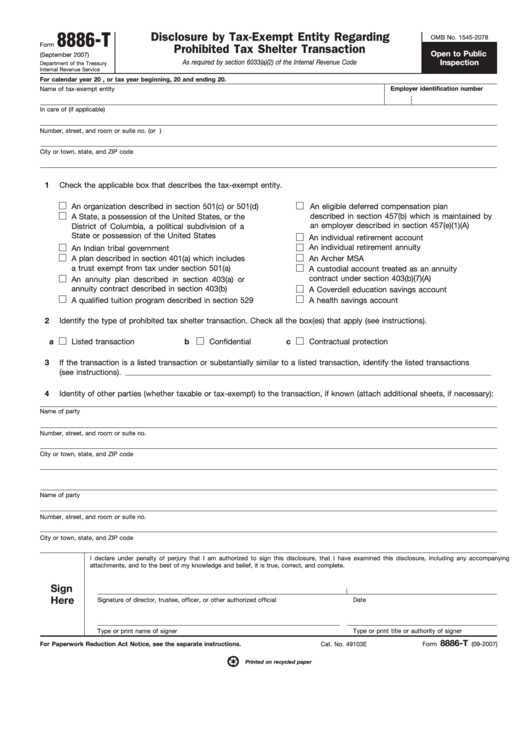

IRS Form 8886T Download Fillable PDF or Fill Online Disclosure by Tax

You can view or download the. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. Web download this form print this form more about the federal form 8886 corporate income tax ty 2022 we last updated.

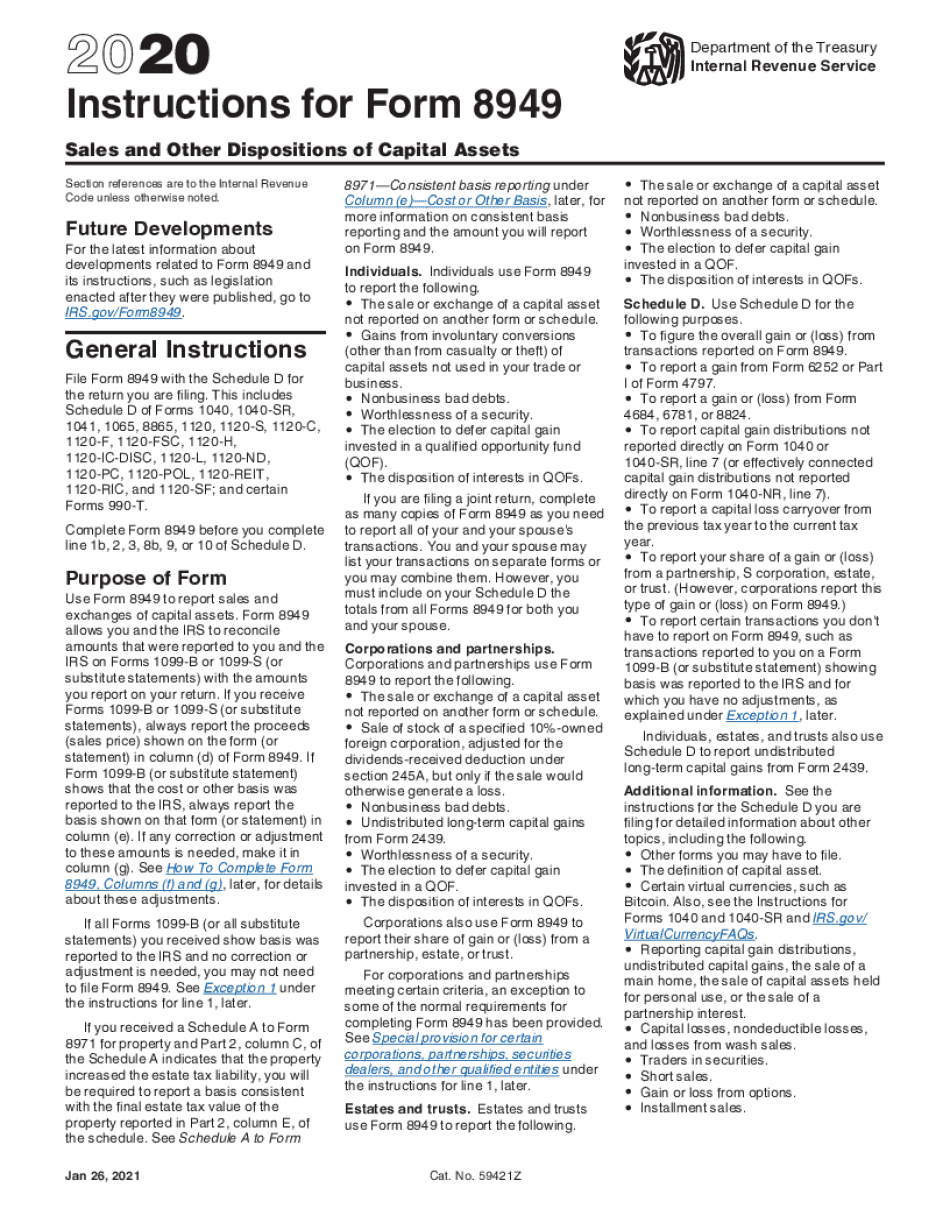

Form 8949 Instructions 2020 2021 Fillable and Editable PDF Template

Web the ftb may impose penalties if the corporation fails to file federal form 8886, form 8918, material advisor disclosure statement, or any other required information. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Web 2 enter the total number.

Fillable Form 8886T Disclosure By Tax Exempt Entity Regarding

Web this information explains tax shelter disclosure requirements and penalties for taxpayers participating in tax shelters, tax shelter promoters, and material advisors. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,. Web download this form print this form more about the.

The Ftb May Impose Penalties If.

4 identify the type of new york reportable transactions. Web download this form print this form more about the federal form 8886 corporate income tax ty 2022 we last updated the reportable transaction disclosure statement in. Who must file a utah return; Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the llc has claimed or reported income from, or a deduction, loss,.

Web If You Are Filing More Than One Form 8886 With Your Tax Return, Sequentially Number Each Form 8886 And Enter The Statement Number For This Form 8886.

You can view or download the. Mark an x in the box(es) that apply (see. Web this information explains tax shelter disclosure requirements and penalties for taxpayers participating in tax shelters, tax shelter promoters, and material advisors. Line by line instructions + general instructions.

Web 2 Enter The Total Number Of Irs Form(S) 8886 That Are Attached To This Form.

Web the instructions to form 8886 suggest a total estimated preparation time of over 21 hours per submission due to the lengthy requests for disclosure. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a. However, you may report nonrecognition of gain, tax credits,.

Web The Ftb May Impose Penalties If The Corporation Fails To File Federal Form 8886, Form 8918, Material Advisor Disclosure Statement, Or Any Other Required Information.

Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Attach form 8886 to your income tax return or information return (including a partnership, s corporation, or trust return), including amended. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Web when and how to file.