Form 8915 E Turbotax

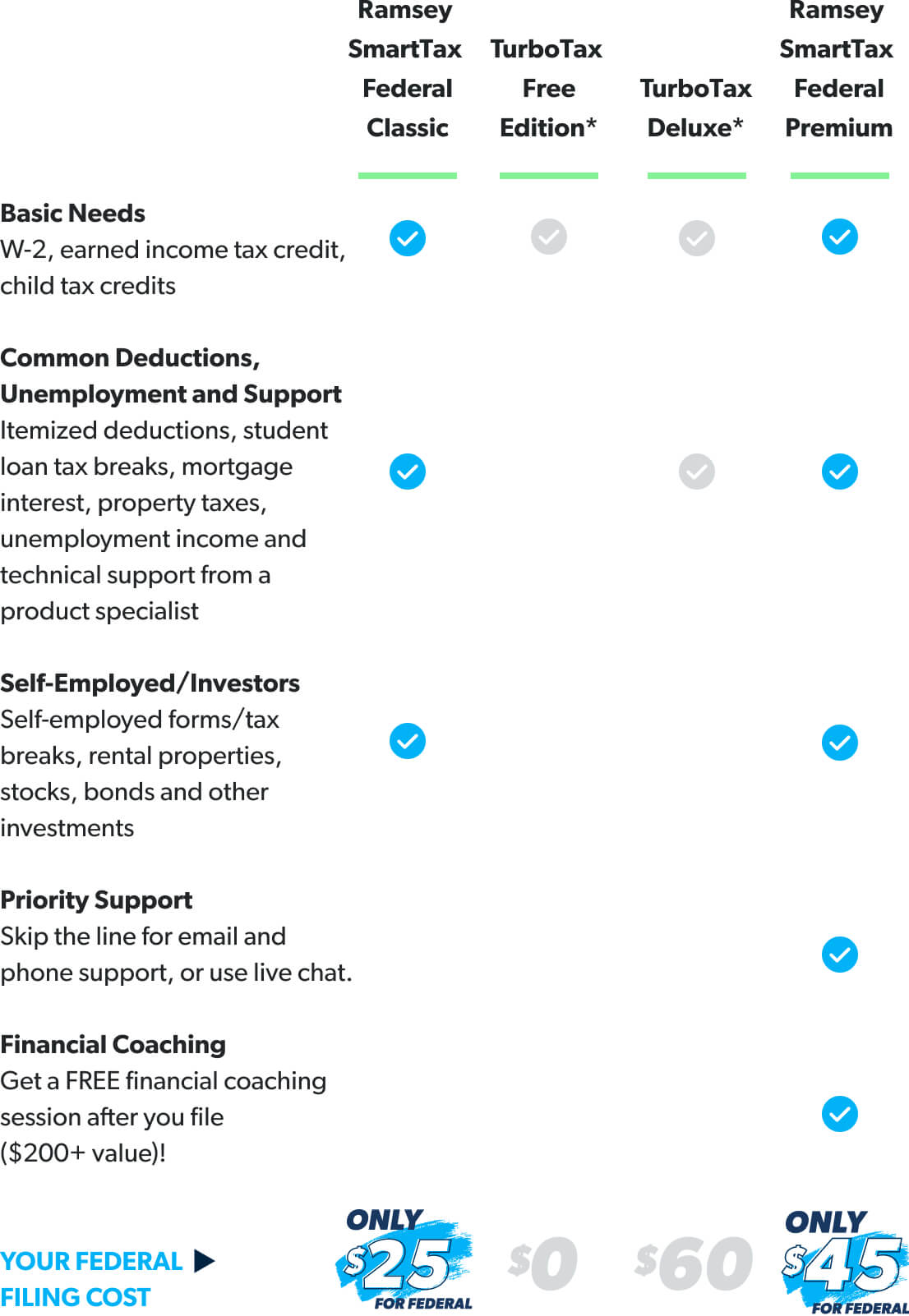

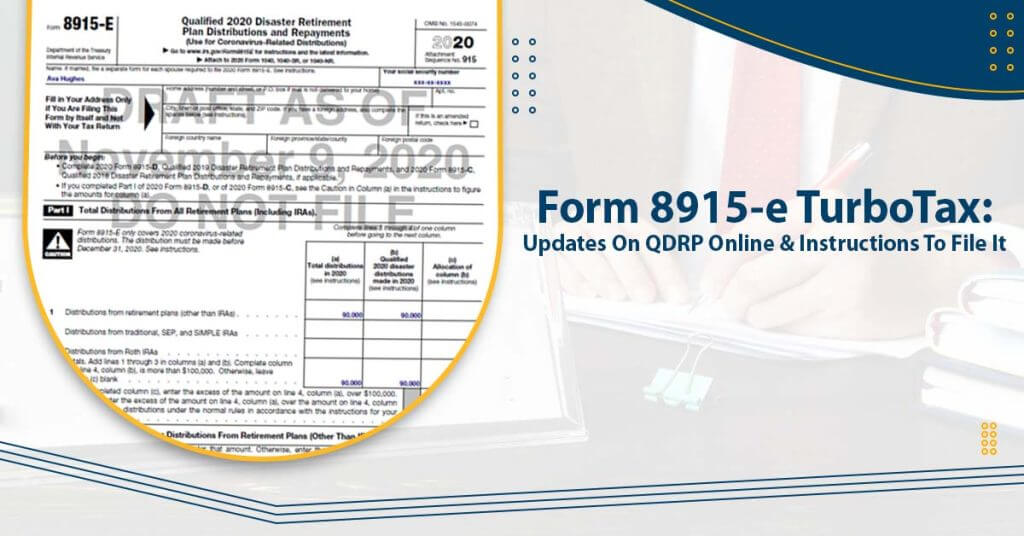

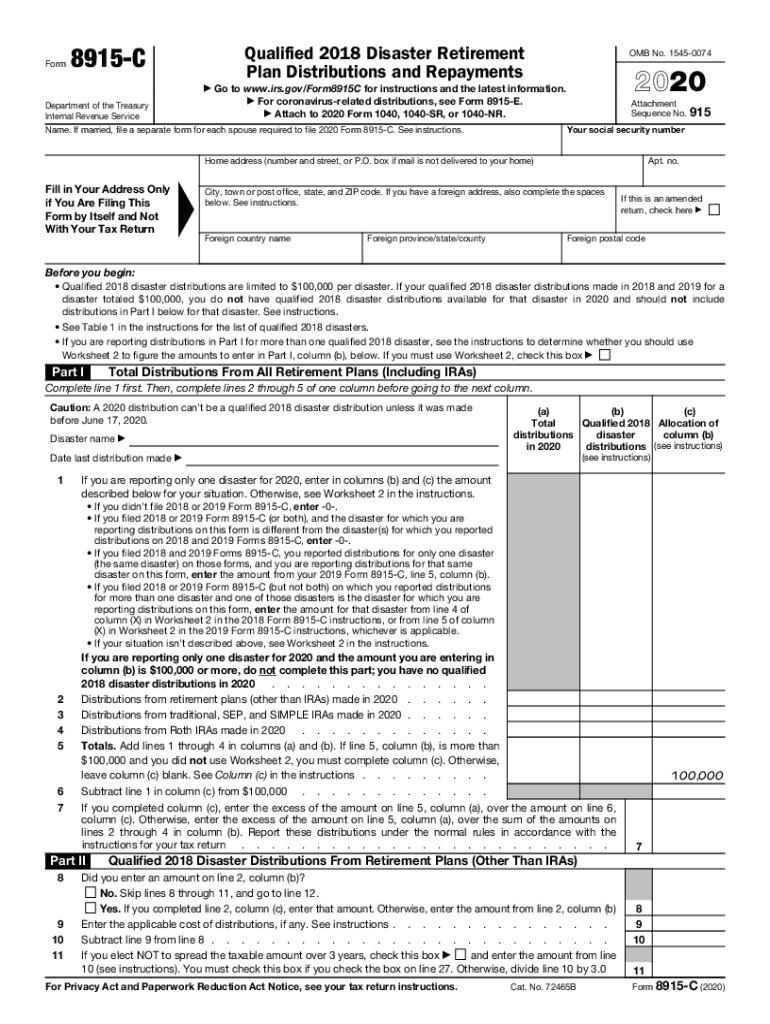

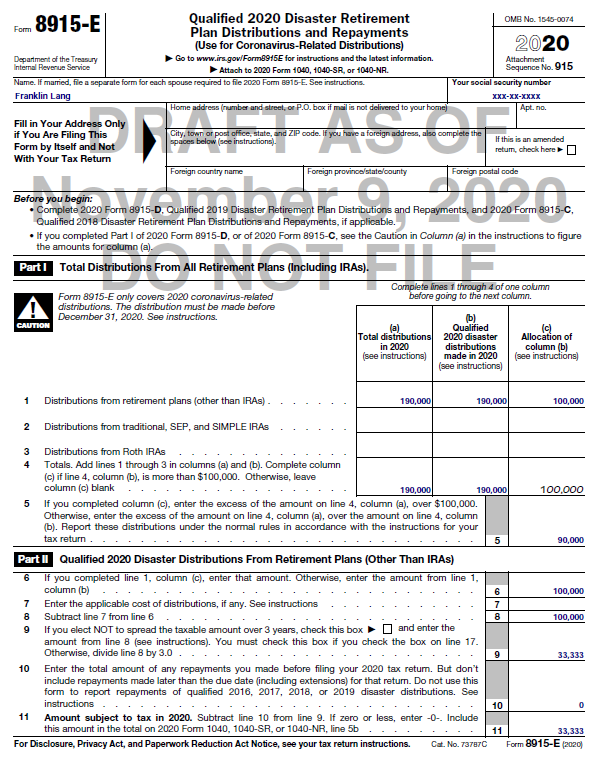

Form 8915 E Turbotax - This form has not been finalized by the irs for filing with a 2020 federal tax. The irs just finalized the form on feb 11. In prior tax years, form 8915. 24 (pending irs approval by then). You can also file and. Web this form is necessary to report covid related distributions from ira's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax. While in your return, click federal taxes > wages & income > i'll choose what i. Qualified 2020 disaster retirement plan distributions and repayments. You can add form 8815 in your turbotax by following these steps: Department of the treasury internal revenue service.

This form has not been finalized by the irs for filing with a 2020 federal tax. 24 (pending irs approval by then). Web this form is necessary to report covid related distributions from ira's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax. You can also file and. To find form 8615 please follow the steps below. Department of the treasury internal revenue service. The irs just finalized the form on feb 11. Your social security number before you begin (see instructions for details): Web updated january 13, 2023. Web form 8615 is tax for certain children who have unearned income.

Department of the treasury internal revenue service. This form has not been finalized by the irs for filing with a 2020 federal tax. You can add form 8815 in your turbotax by following these steps: In prior tax years, form 8915. Sign in to the community or sign in to turbotax and start working on your taxes 24 (pending irs approval by then). Yes, you are allowed to file for an extension by using the extension to file irs website. Your social security number before you begin (see instructions for details): I have also included additional information as it. Web updated january 13, 2023.

form 8915 e instructions turbotax Renita Wimberly

Web this form is necessary to report covid related distributions from ira's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax. This form has not been finalized by the irs for filing with a 2020 federal tax. The irs just finalized the form on feb 11. To find form 8615 please.

8915e tax form instructions Somer Langley

Department of the treasury internal revenue service. This form has not been finalized by the irs for filing with a 2020 federal tax. Web 1 best answer. Sign in to the community or sign in to turbotax and start working on your taxes Your social security number before you begin (see instructions for details):

Re When will form 8915E 2020 be available in tur... Page 19

Web updated january 13, 2023. Yes, you are allowed to file for an extension by using the extension to file irs website. I have also included additional information as it. Web 1 best answer. 24 (pending irs approval by then).

Kandy Snell

This form has not been finalized by the irs for filing with a 2020 federal tax. Web form 8615 is tax for certain children who have unearned income. Web 1 best answer. You can also file and. I have also included additional information as it.

form 8915 e instructions turbotax Renita Wimberly

Web why sign in to the community? Department of the treasury internal revenue service. Web updated january 13, 2023. Web form 8615 is tax for certain children who have unearned income. In prior tax years, form 8915.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

Your social security number before you begin (see instructions for details): To find form 8615 please follow the steps below. While in your return, click federal taxes > wages & income > i'll choose what i. In prior tax years, form 8915. Department of the treasury internal revenue service.

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Sign in to the community or sign in to turbotax and start working on your taxes Web this form is necessary to report covid related distributions from ira's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax. 24 (pending irs approval by then). Web updated january 13, 2023. Department of the.

National Association of Tax Professionals Blog

Web why sign in to the community? 24 (pending irs approval by then). The irs just finalized the form on feb 11. To find form 8615 please follow the steps below. Yes, you are allowed to file for an extension by using the extension to file irs website.

PPT Form 8915e TurboTax Updates On QDRP Online & Instructions To

24 (pending irs approval by then). I have also included additional information as it. Sign in to the community or sign in to turbotax and start working on your taxes Web why sign in to the community? You can add form 8815 in your turbotax by following these steps:

PPT Form 8915e TurboTax Updates On QDRP Online & Instructions To

This form has not been finalized by the irs for filing with a 2020 federal tax. While in your return, click federal taxes > wages & income > i'll choose what i. You can also file and. Web form 8615 is tax for certain children who have unearned income. Web 1 best answer.

Web Form 8615 Is Tax For Certain Children Who Have Unearned Income.

The irs just finalized the form on feb 11. You can also file and. 24 (pending irs approval by then). While in your return, click federal taxes > wages & income > i'll choose what i.

In Prior Tax Years, Form 8915.

Your social security number before you begin (see instructions for details): Web updated january 13, 2023. Web this form is necessary to report covid related distributions from ira's and other retirement plans to report the distribution, pay it back over 3 years or spread the tax. I have also included additional information as it.

This Form Has Not Been Finalized By The Irs For Filing With A 2020 Federal Tax.

Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. Web 1 best answer. You can add form 8815 in your turbotax by following these steps:

Web Why Sign In To The Community?

To find form 8615 please follow the steps below. Yes, you are allowed to file for an extension by using the extension to file irs website. Sign in to the community or sign in to turbotax and start working on your taxes