Form 8938 Threshold 2022

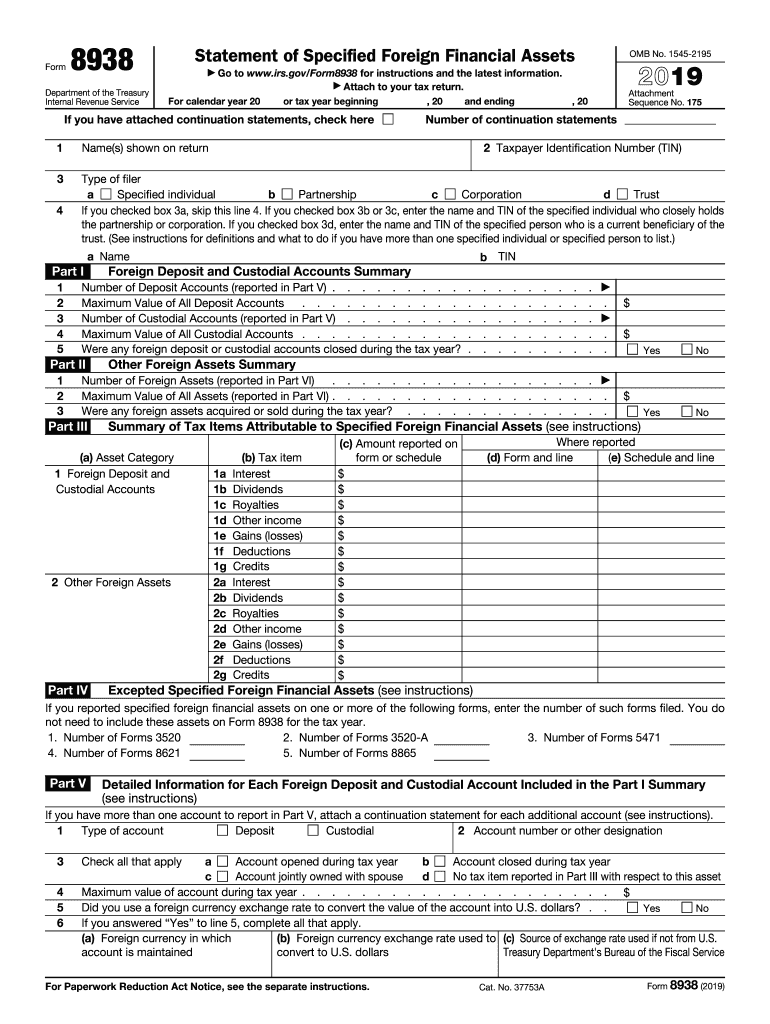

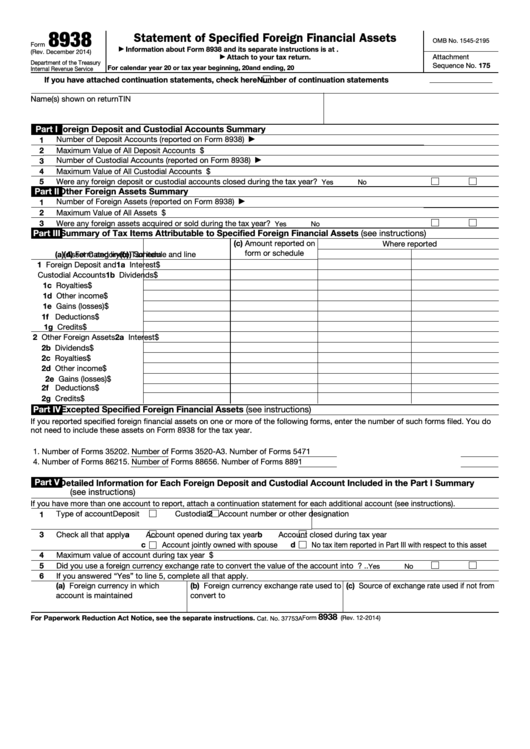

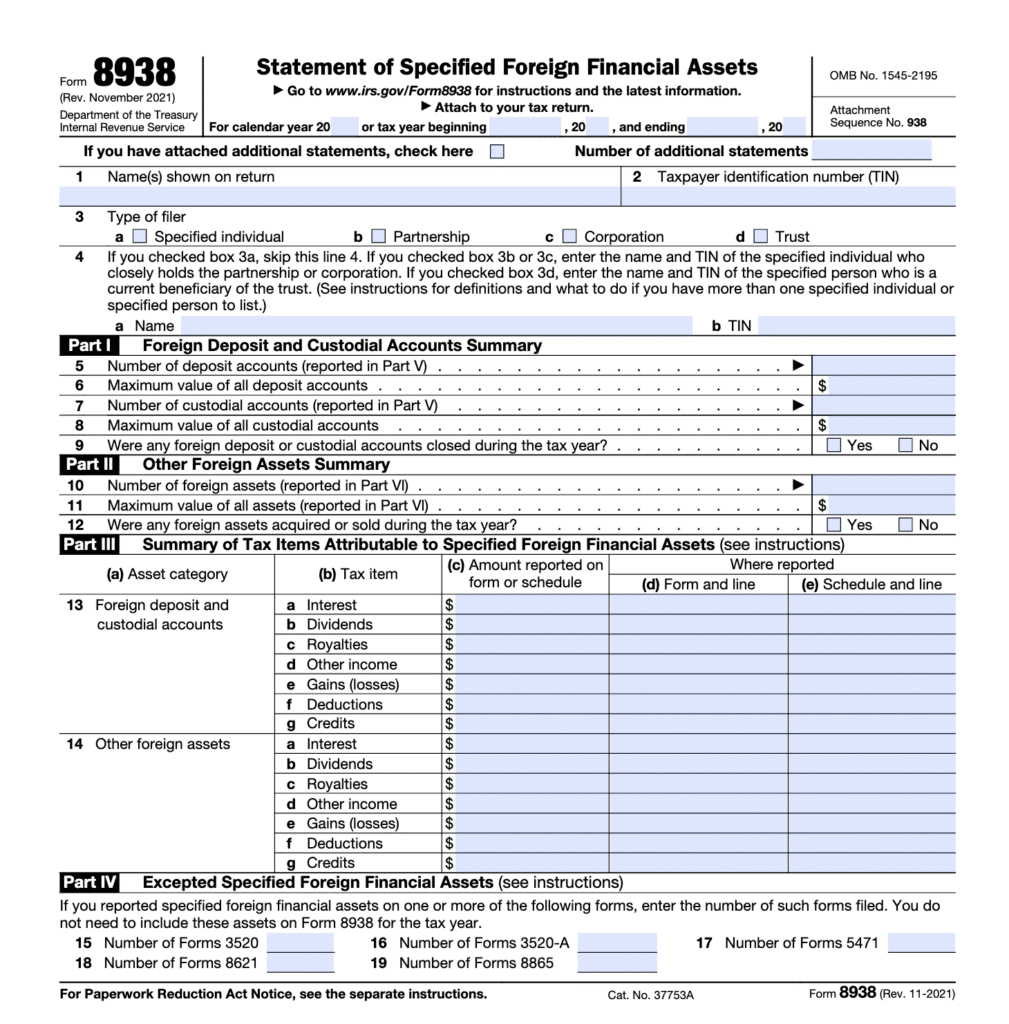

Form 8938 Threshold 2022 - Taxpayers who own foreign financial assets to determine if they need to file irs form 8938, a. Who has to file form 8938? Web the following tips can help you complete irs 8938 easily and quickly: Single, head of household, married filing separately. You do not satisfy the reporting threshold of more than $400,000 on the last day of the tax year or more than $600,000 at. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. For example, if a married couple filing jointly. You can download or print. Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Web form 8938 reporting & filing requirements:

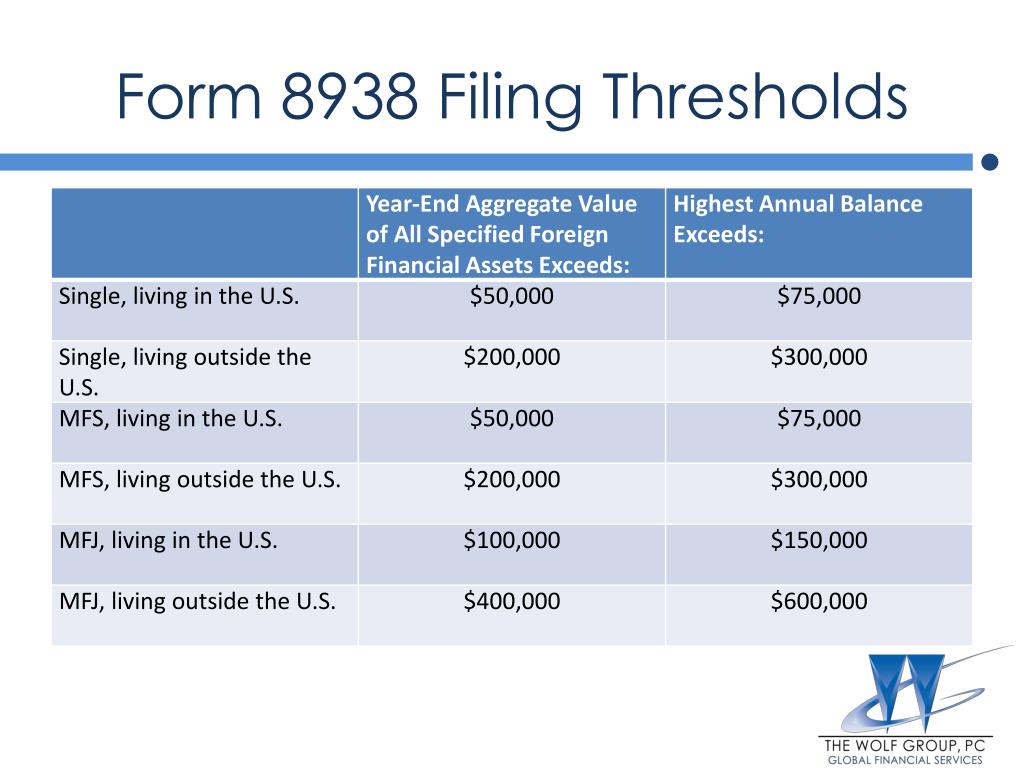

Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Web form 8938 reporting & filing requirements: Fill out the required boxes which. Taxpayers who own foreign financial assets to determine if they need to file irs form 8938, a. You can download or print. Sole proprietors & rental income recipients may have more filing requirements in 2023? Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Web form 8938 thresholds for 20232. Use form 8938 to report your.

Web as october 15, 2022, is fast approaching, now is the time for u.s. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Form 8938 threshold & requirements. $200,000 on the last day of the tax year or more than. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Single, head of household, married filing separately. Web the following tips can help you complete irs 8938 easily and quickly: Who has to file form 8938? Web you and your spouse do not have to file form 8938. Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

You can download or print. $200,000 on the last day of the tax year or more than. You do not satisfy the reporting threshold of more than $400,000 on the last day of the tax year or more than $600,000 at. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Web.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web the following tips can help you complete irs 8938 easily and quickly: Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Single, head of household, married filing separately. Use form 8938 to report your. Web for an unmarried us resident, taxpayers file.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about. Sole proprietors & rental income recipients may have more filing requirements in 2023? Web filing form 8938 is only available to those using turbotax deluxe or higher. Web form 8938 thresholds for 20232. Taxpayers who meet the.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web fatca requires certain u.s. Web form 8938 reporting & filing requirements: Web as october 15, 2022, is fast approaching, now is the time for u.s. You do not satisfy the reporting threshold of more than $400,000 on the last day of the tax year or more than $600,000 at. Web filing form 8938 is only available to those using.

1098 Form 2021 IRS Forms Zrivo

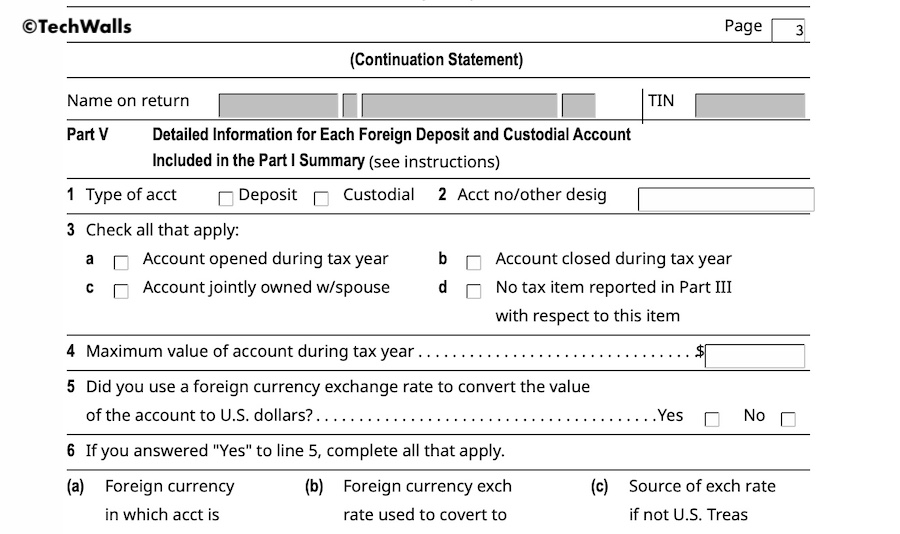

Taxpayers who meet the form 8938. Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. To get to the 8938 section in turbotax, refer to the following instructions: Web form 8938 reporting & filing requirements: Sole proprietors & rental income.

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Use form 8938 to report your. Web the filing thresholds for.

PPT 1818 Society Form 8938 and Other I mportant R eporting I ssues

Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. $200,000 on the last day of the tax year or more than. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Single, head.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

You can download or print. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Fill out the required boxes which. To get to the 8938 section in turbotax, refer to the following instructions: You do not satisfy.

Form 8938 IRS RJS LAW International Tax Tax Attorney San Diego

Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about. $200,000 on the last day of the tax year or more than. Web fatca requires certain u.s. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Sole proprietors & rental income recipients may have more filing requirements in 2023? Use form 8938 to report your. Web you and your spouse do not have to file form 8938. Single, head of household, married filing separately. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets.

Fill Out The Required Boxes Which.

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Who has to file form 8938? Single, head of household, married filing separately. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022.

Taxpayers Who Hold Foreign Financial Assets With An Aggregate Value Of More Than The Reporting Threshold (At Least $50,000) To Report Information About.

Web as october 15, 2022, is fast approaching, now is the time for u.s. Taxpayers who own foreign financial assets to determine if they need to file irs form 8938, a. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Taxpayers who meet the form 8938.

Web The Filing Thresholds For Form 8938 Depend On The Taxpayer's Filing Status And Whether They Live In The U.s.

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Form 8938 threshold & requirements. You can download or print. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —.

Web Home Comparison Of Form 8938 And Fbar Requirements The Form 8938 Filing Requirement Does Not Replace Or Otherwise Affect A Taxpayer’s Obligation To File Fincen.

Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Even if a person meets the threshold. For example, if a married couple filing jointly. Web filing form 8938 is only available to those using turbotax deluxe or higher.