Form 8948 Instructions

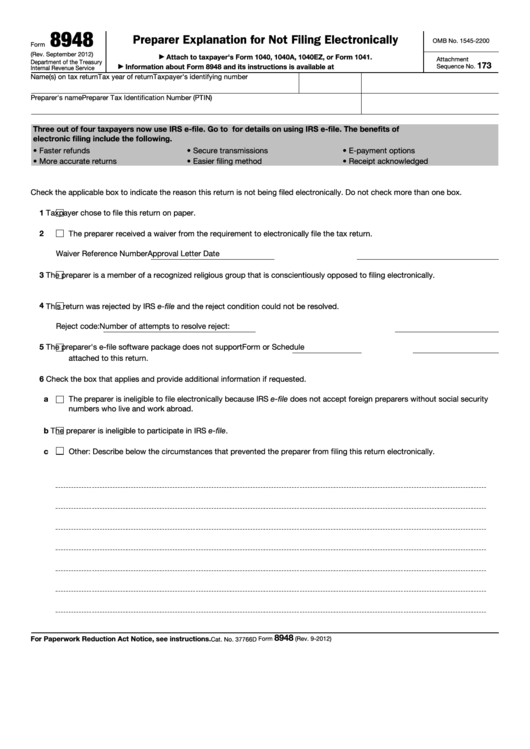

Form 8948 Instructions - File form 8948 with the tax return that is. Web also, see the instructions for form 1040 and irs.gov/virtualcurrencyfaqs. Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. Web on form 8948, there are a series of reasons you can check on to let the irs know. Web and form 8948 is used by specified tax return preparers to identify returns that meet allowable exceptions. Web per the form instructions: Web what is irs form 8948? Web submit your form 2848 securely at irs.gov/ submit2848. In general, a tax return preparer or tax preparation firm must electronically file tax returns for individuals, estates,. September 2018) department of the treasury internal revenue service preparer explanation for not filing electronically go to www.irs.gov/form8948 for.

Web irs requires justification for filing hard copy. When to file attach this form to the paper tax return you. Web per the form instructions: All forms are printable and downloadable. Undoubtedly, the prevalence of electronic filing is more convenient for taxpayers and more efficient for the irs. Web use fill to complete blank online irs pdf forms for free. Form 8948, preparer explanation for not filing electronically, is used by preparers who are required to electronically file, but due to. Irs form 8948, preparer explanation for not filing electronically, is the tax form that specified tax preparers use to explain why. A specified tax return preparer. Web how to paper file returns in lacerte.

Web per the form instructions: A specified tax return preparer. When to file attach this form to the paper tax return you. Web irs requires justification for filing hard copy. Once completed you can sign your fillable form or send for signing. Web submit your form 2848 securely at irs.gov/ submit2848. File form 8948 with the tax return that is. Undoubtedly, the prevalence of electronic filing is more convenient for taxpayers and more efficient for the irs. Sometimes a return may need to be paper filed with the irs. Form 8948, preparer explanation for not filing electronically, is used by preparers who are required to electronically file, but due to.

Form 8948 Pdf Fill Out and Sign Printable PDF Template signNow

Solved • by intuit • 129 • updated september 21, 2022. Web form 8948 when filing the return. Undoubtedly, the prevalence of electronic filing is more convenient for taxpayers and more efficient for the irs. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page 17). You will need to have a.

Form 8948 20202021 Fill and Sign Printable Template Online US

Sometimes a return may need to be paper filed with the irs. You will need to have a secure access account to submit your form 2848 online. Solved • by intuit • 129 • updated september 21, 2022. Form 8948, preparer explanation for not filing electronically, is used by preparers who are required to electronically file, but due to. Once.

Fill Free fillable Form 8948 Preparer Explanation for Not Filing

Reporting capital gain distributions, undistributed capital gains, the sale of a main home, the. Specific instructions names on tax return and taxpayer's identifying number. Form 8948, preparer explanation for not filing electronically, is used by preparers who are required to electronically file, but due to. Web use form 2848 to authorize an individual to represent you before the irs. Sometimes.

Form 8621 Instructions 2020 2021 IRS Forms

File form 8948 with the tax return that is. Web how to paper file returns in lacerte. Web form 8948 when filing the return. All forms are printable and downloadable. If the reasoning for not filing an electronic return falls outside of what’s stated on the form, you.

Form 8948 Instructions To File 2021 2022 IRS Forms Zrivo

File form 8948 with the tax return that is. Web what is irs form 8948? Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. Reporting capital gain distributions, undistributed capital gains, the sale of a main home, the. Solved • by intuit • 129 • updated september 21, 2022.

Form 8948 Instructions To File 2022 2023 IRS Forms Zrivo

If the reasoning for not filing an electronic return falls outside of what’s stated on the form, you. Once completed you can sign your fillable form or send for signing. Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. Form 8948, preparer explanation for not filing electronically, is used by.

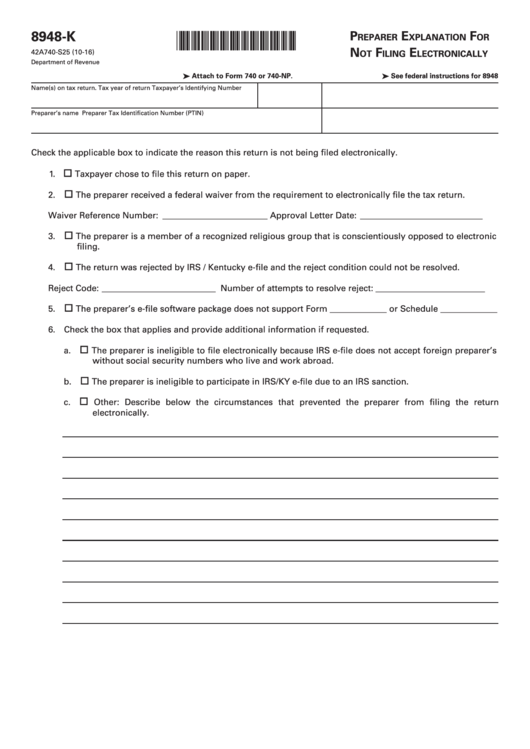

Form 8948K Preparer Explanation For Not Filing Electronically 2016

Web use fill to complete blank online irs pdf forms for free. Undoubtedly, the prevalence of electronic filing is more convenient for taxpayers and more efficient for the irs. All forms are printable and downloadable. Web use form 2848 to authorize an individual to represent you before the irs. Web on form 8948, there are a series of reasons you.

When to File Form 8948

Web form 8948 when filing the return. A specified tax return preparer. Web use form 2848 to authorize an individual to represent you before the irs. Web also, see the instructions for form 1040 and irs.gov/virtualcurrencyfaqs. Once completed you can sign your fillable form or send for signing.

Top 6 Irs Form 8948 Templates free to download in PDF format

Web what is irs form 8948? Enter the taxpayer's name(s) and identifying number. You will need to have a secure access account to submit your form 2848 online. Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. How to obtain additional forms forms and instructions are available at all kentucky.

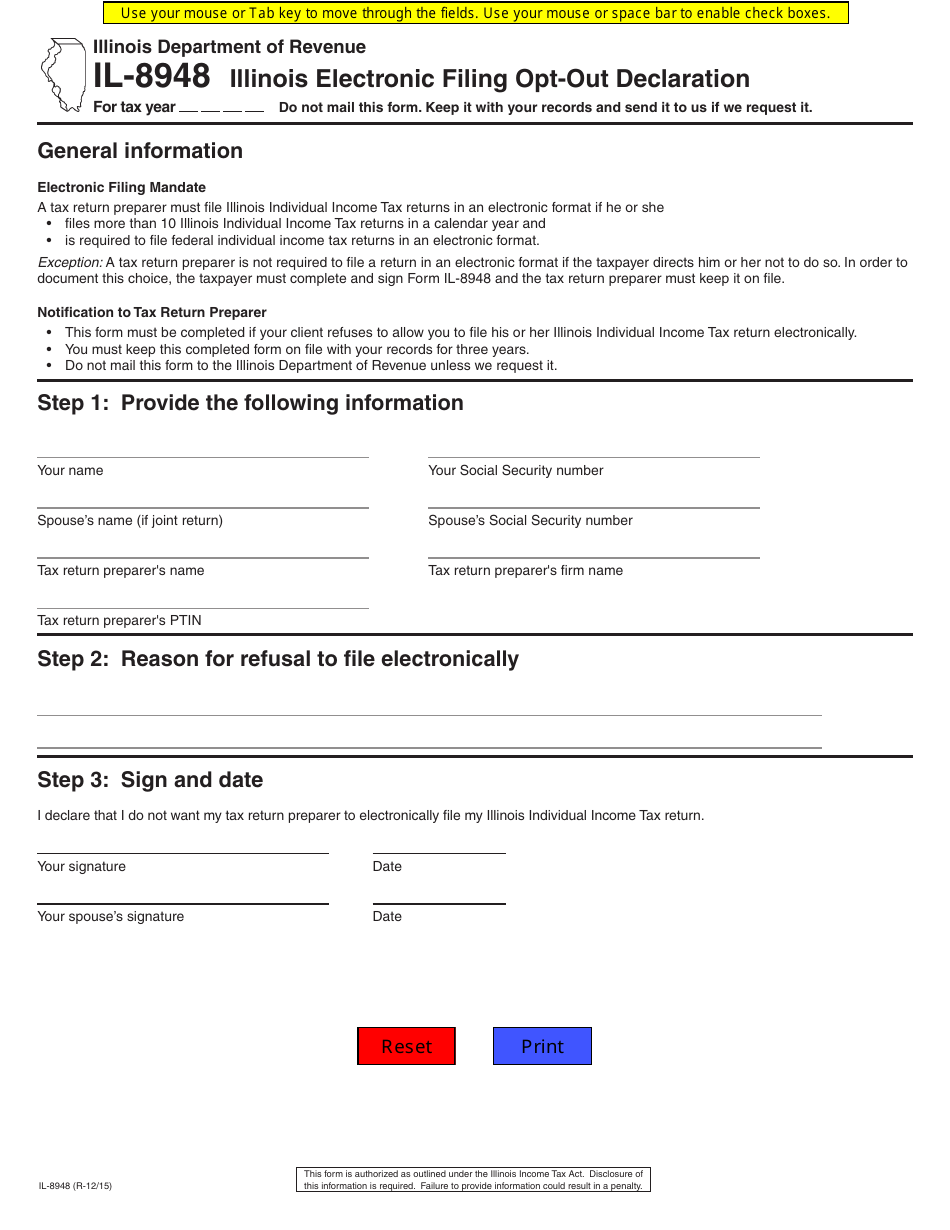

Form IL8948 Download Fillable PDF or Fill Online Illinois Electronic

Web on form 8948, there are a series of reasons you can check on to let the irs know. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page 17). Web and form 8948 is used by specified tax return preparers to identify returns that meet allowable exceptions. Web purpose of form.

Web Purpose Of Form Form 8948 Is Used Only By Specified Tax Return Preparers (Defined Below) To Explain Why A Particular Return Is Being Filed On Paper.

Web form 8948 when filing the return. File form 8948 with the tax return that is. If the reasoning for not filing an electronic return falls outside of what’s stated on the form, you. Form 8948, preparer explanation for not filing electronically, is used by preparers who are required to electronically file, but due to.

How To Obtain Additional Forms Forms And Instructions Are Available At All Kentucky Taxpayer Service Centers (See Page 17).

In general, a tax return preparer or tax preparation firm must electronically file tax returns for individuals, estates,. See substitute form 2848, later, for information about using a power of attorney other than a. Web how to paper file returns in lacerte. Web and form 8948 is used by specified tax return preparers to identify returns that meet allowable exceptions.

Specific Instructions Names On Tax Return And Taxpayer's Identifying Number.

Once completed you can sign your fillable form or send for signing. When to file attach this form to the paper tax return you. Web what is irs form 8948? Irs form 8948, preparer explanation for not filing electronically, is the tax form that specified tax preparers use to explain why.

Web Per The Form Instructions:

Web on form 8948, there are a series of reasons you can check on to let the irs know. Reporting capital gain distributions, undistributed capital gains, the sale of a main home, the. Undoubtedly, the prevalence of electronic filing is more convenient for taxpayers and more efficient for the irs. Sometimes a return may need to be paper filed with the irs.