Form 8962 For A Binary Attachment

Form 8962 For A Binary Attachment - Web form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re. Web i receive efiling message: Web use form 8962 to: Name shown on your return. Ad access irs tax forms. Web this is the first year 2022 that we are seeing this reject. Get ready for this year's tax season quickly and safely with pdffiller! Get ready for tax season deadlines by completing any required tax forms today. Web updated 3 days ago. Figure the amount of your premium tax credit (ptc).

Web this is the first year 2022 that we are seeing this reject. Figure the amount of your premium tax credit (ptc). Web use form 8962 to: If you, or your spouse (if filing a. Complete, edit or print tax forms instantly. Go to www.irs.gov/form8962 for instructions. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web i receive efiling message:

Web form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re. Figure the amount of your premium tax credit (ptc). Web form 8962 department of the treasury. Web use form 8962 to: Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Reconcile it with any advance payments of the premium tax credit (aptc). Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a. Name shown on your return. Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of your return or refund, or cause you to receive correspondence from the irs. If you, or your spouse (if filing a.

How To Fill Out Tax Form 8962 amulette

Go to www.irs.gov/form8962 for instructions. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Web form 8962 department of the treasury. Web up to.

How To Fill Out Tax Form 8962 amulette

Get ready for tax season deadlines by completing any required tax forms today. Web i receive efiling message: Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to.

What Individuals Need to Know About the Affordable Care Act for 2016

Get ready for this year's tax season quickly and safely with pdffiller! Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a. Reconcile it with any advance payments of the premium tax credit (aptc). Web mistakes in completing form 8962 can cause you to pay.

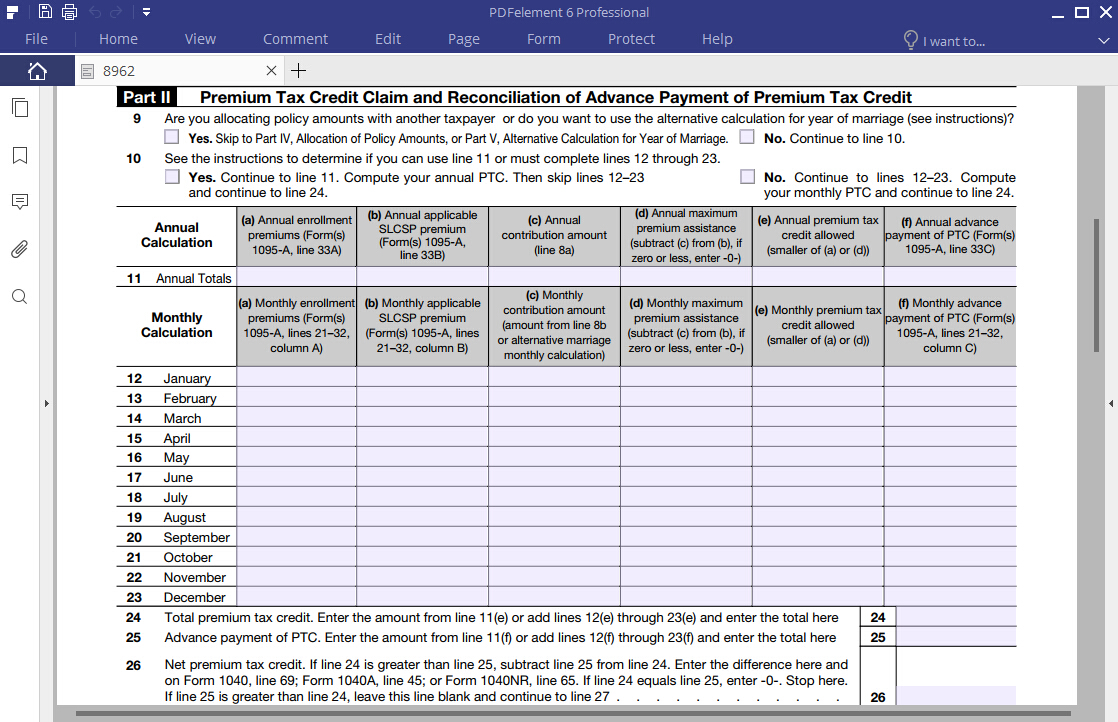

Fill Free fillable Premium Tax Credit (PTC) Form 8962 PDF form

Web form 8962 department of the treasury. Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a. Get ready for this year's tax season quickly and safely with pdffiller! Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web.

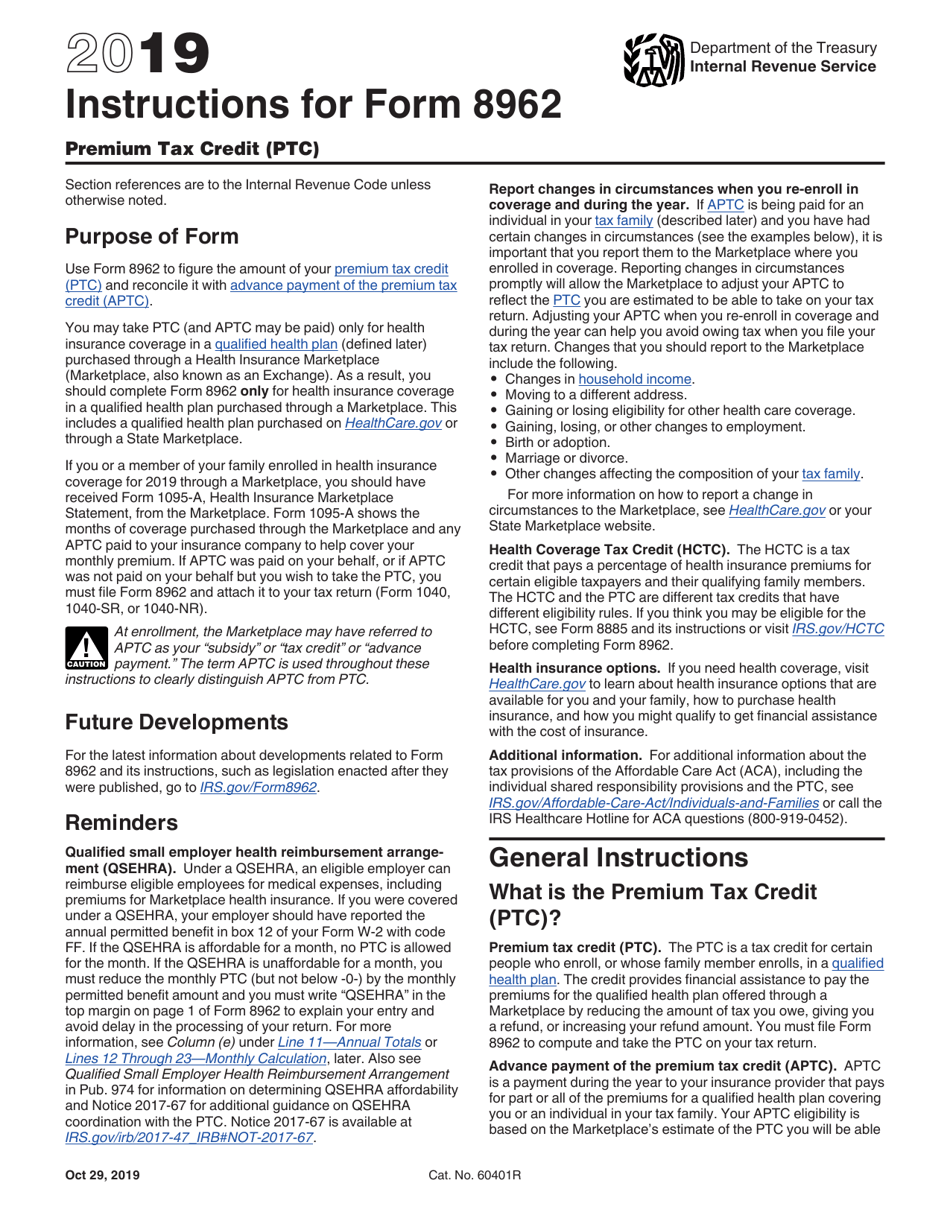

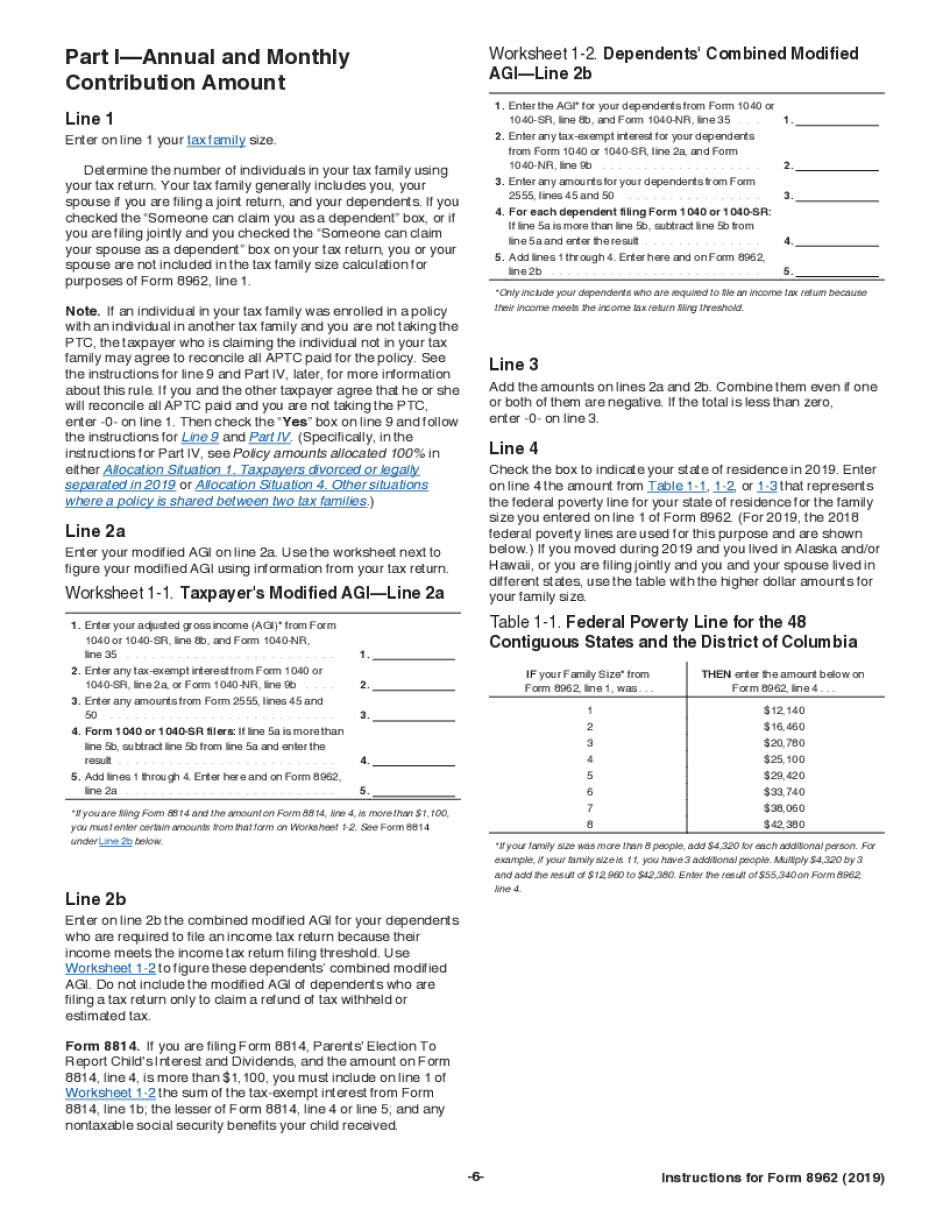

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

Web form 8962 department of the treasury. If you, or your spouse (if filing a. Get ready for tax season deadlines by completing any required tax forms today. Reconcile it with any advance payments of the premium tax credit (aptc). Web use form 8962 to:

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Reconcile it with any advance payments of the premium tax credit (aptc). Get ready for tax season deadlines by completing any required tax forms today. Web form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re. Go to www.irs.gov/form8962 for instructions. If you, or.

how to fill out form 8962 step by step Fill Online, Printable

Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of your return or refund, or cause you to receive correspondence from the irs. Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a. Go to www.irs.gov/form8962 for.

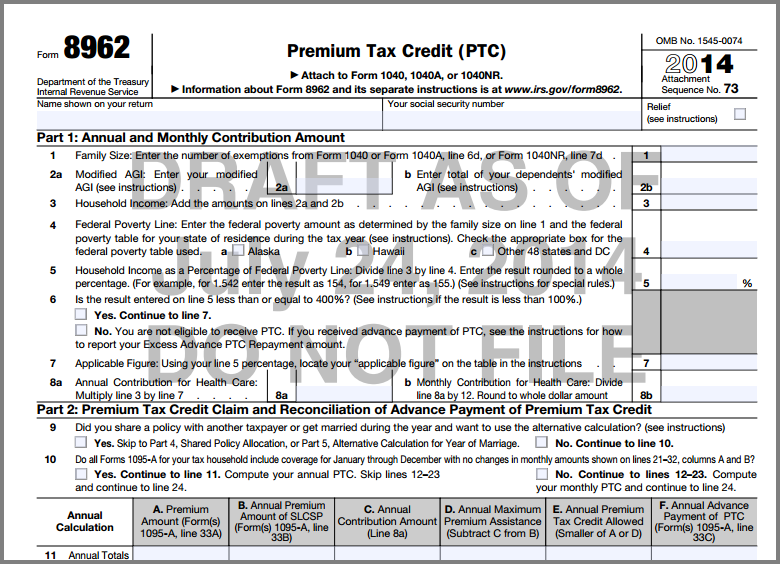

2014 federal form 8962 instructions

Reconcile it with any advance payments of the premium tax credit (aptc). Web form 8962 department of the treasury. Go to www.irs.gov/form8962 for instructions. Ad access irs tax forms. Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re. Web updated 3 days ago. Reconcile it with any advance payments of the premium tax credit (aptc). Web i receive efiling message: Name shown on your return.

IRS Form 8962 Instruction for How to Fill it Right

Web updated 3 days ago. Web this is the first year 2022 that we are seeing this reject. Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Figure the amount of your premium tax credit (ptc). Go to www.irs.gov/form8962 for instructions.

Go To Www.irs.gov/Form8962 For Instructions.

Web up to $40 cash back easily complete a printable irs 8962 form 2022 online. Web this is the first year 2022 that we are seeing this reject. Web i receive efiling message: Name shown on your return.

Ad Access Irs Tax Forms.

Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Figure the amount of your premium tax credit (ptc). If you, or your spouse (if filing a. Web taxroundtable | main messages single #16408 binary attachment aca explanation terry reed 2/07/22 #16408 i am getting rejects that say form 8962 or a.

Web Use Form 8962 To:

Web updated 3 days ago. Reconcile it with any advance payments of the premium tax credit (aptc). Web form 8962 department of the treasury. Web form 8962 is used to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. Web mistakes in completing form 8962 can cause you to pay too much tax, delay the processing of your return or refund, or cause you to receive correspondence from the irs. Get ready for this year's tax season quickly and safely with pdffiller!