Form 8962 Pdf

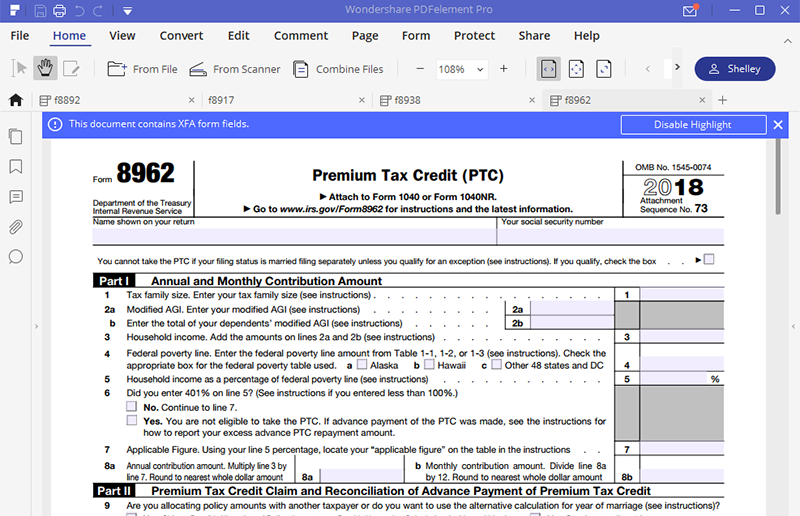

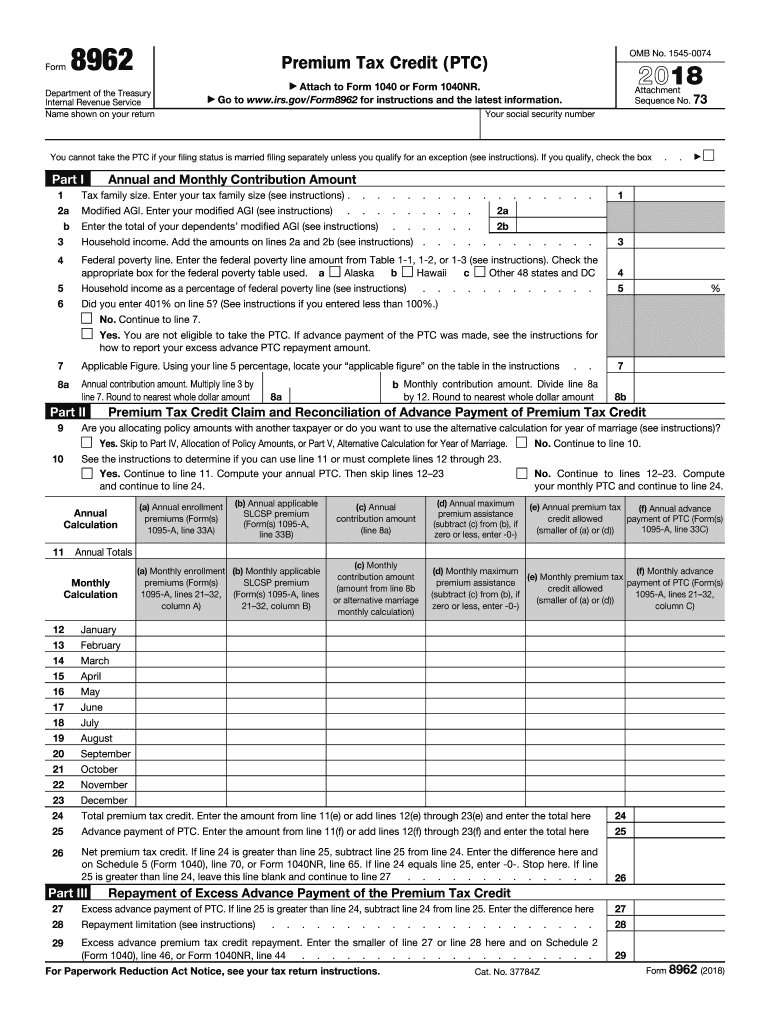

Form 8962 Pdf - You have to include form 8962 with your tax return if: You or someone on your tax return received advance payments of the premium tax credit. Part ii is where you balance the amount of your advanced premium tax credit with the amount of your monthly premiums. Part i is where you enter the annual and monthly payment amounts based on the size of your family, modified adjusted gross income, and household income. • aptc was paid for an individual you told the marketplace You need to complete form 8962 if you. Calculate net premium tax credit. Calculate the annual and monthly contribution amount in part 1. Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). The request for mail order forms may be used to order one copy or several copies of forms.

Web go to www.irs.gov/form8962 for instructions and the latest information. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Calculate net premium tax credit. If you qualify, check the box part i Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Tax forms and and guides: Download & print with other fillable us tax forms in pdf. Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). • you are taking the ptc. Web what is form 8962?

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc) on form 8962, premium tax credit (ptc), but does not attach the form to the tax return. Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. You have to include form 8962 with your tax return if: Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Part ii is where you balance the amount of your advanced premium tax credit with the amount of your monthly premiums. The american rescue plan, signed into law on march 11, 2021, includes a provision that eliminates the requirement to repay excess advance premium tax credits for. Report annual and monthly calculations. Web easily complete a printable irs 8962 form 2022 online. Tax forms and and guides:

Fill Free fillable Premium Tax Credit (PTC) Form 8962 PDF form

Report annual and monthly calculations. Web what is form 8962? Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. To open the printable form 8962 click the fill out form button.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

If you qualify, check the box part i • you are taking the ptc. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You qualified for the premium tax credit in 2022. Web form 8962 is a form you must file with.

Form 8962 Edit, Fill, Sign Online Handypdf

Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Create a blank & editable 8962 form, fill it out and send it instantly to the irs. Web easily complete a printable irs 8962 form 2022 online. Enrollment premiums second lowest cost.

How To Fill Out Tax Form 8962 amulette

• you are taking the ptc. You'll find out if you qualify for a premium tax credit based on your final 2021 income. Part ii is where you balance the amount of your advanced premium tax credit with the amount of your monthly premiums. Download & print with other fillable us tax forms in pdf. You may take the ptc.

IRS Form 8962 Instruction for How to Fill it Right

• aptc was paid for an individual you told the marketplace Select the information you need to get details: Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Select the information you need to get details: A member of your family received advance. Tax forms and and guides: Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are.

form 8962 2015 Irs forms, Form, Tax credits

• aptc was paid for an individual you told the marketplace Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Select the information you need to get details: Web form 8962 is used to estimate the amount of premium tax credit for.

Fill Free fillable Form 8962 Premium Tax Credit PDF form

Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Enter personal information shown on your tax return. • you are taking the ptc. You'll find.

Form 8962 Premium Tax Credit (PTC) for Shared Policy Allocation DocHub

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). You or someone on your tax return received advance payments of the premium tax credit. You cannot take the ptc if your filing status is married filing separately unless you qualify for an exception. Name shown on your return. Web form 8962 is a.

Form 8962 Fill Out and Sign Printable PDF Template signNow

• you are taking the ptc. Go to www.irs.gov/form8962 for instructions and the latest information. Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). The purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount with their federal return. • aptc was paid for an individual you told the marketplace

You Have To Include Form 8962 With Your Tax Return If:

Part i is where you enter the annual and monthly payment amounts based on the size of your family, modified adjusted gross income, and household income. Web you’ll need it to complete form 8962, premium tax credit. Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. You may take the ptc (and aptc may be paid) only for health insurance coverage in a qualified health plan (defined later) purchased through a health insurance marketplace (marketplace, also known as an.

The American Rescue Plan, Signed Into Law On March 11, 2021, Includes A Provision That Eliminates The Requirement To Repay Excess Advance Premium Tax Credits For.

If you qualify, your credit will either increase your 2021 refund or reduce your tax owed. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. You can print other federal tax. Tax forms and and guides:

You Cannot Take The Ptc If Your Filing Status Is Married Filing Separately Unless You Qualify For An Exception.

Web use this slcsp figure to fill out form 8962, premium tax credit (pdf, 110 kb). Calculate net premium tax credit. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. You need to complete form 8962 if you.

To Open The Printable Form 8962 Click The Fill Out Form Button.

The purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount with their federal return. You'll find out if you qualify for a premium tax credit based on your final 2021 income. Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.