Form 8971 Instructions

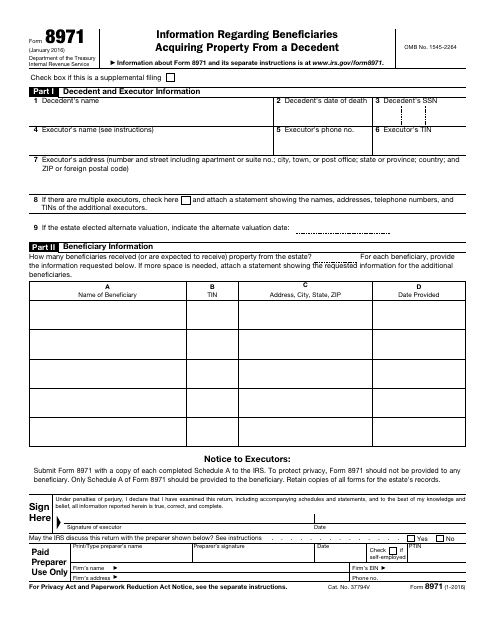

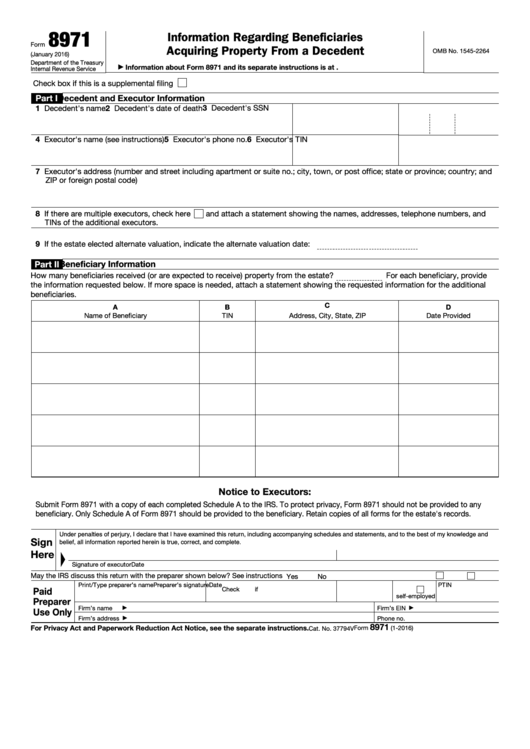

Form 8971 Instructions - Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Web the form 8971 and schedule(s) a are due 30 days after the filing date. One schedule a is provided to each beneficiary receiving property from an estate. Web instructions include rate schedules. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? City, town, or post office; The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. The executor must complete a schedule a for each beneficiary who can receive property from the estate. Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.;

Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. City, town, or post office; Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.; One schedule a is provided to each beneficiary receiving property from an estate. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web the form 8971 and schedule(s) a are due 30 days after the filing date. Web form 8971 and all schedules a must be signed by the executor and filed with the irs. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web the irs released form 8971 and instructions to form 8971 on january 29, 2016.

Web instructions include rate schedules. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. The form includes a schedule a that will be sent to each beneficiary receiving property included on the estate tax return. Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971. One schedule a is provided to each beneficiary receiving property from an estate. Each schedule a should include every item of property that could potentially pass to the recipient. Form 8971 and attached schedule(s) a must be filed with the irs, separate from any and all other tax returns filed by the estate. Web this form, along with a copy of every schedule a, is used to report values to the irs. City, town, or post office; And zip or foreign postal code)

Instructions For Form 8971 And Schedule A 2016 printable pdf download

Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Form 8971 and attached schedule(s) a must be.

Fill Free fillable Form 8971 Acquiring Property From a Decedent 2016

This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Do you have to file form 8971 for an estate that files its original 706 prior to july, 2015, but files a supplemental 706 after july, 2015? Form 8971 and attached schedule(s) a must be filed.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971. Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. This information return reports the values from the decedent’s gross estate to.

IRS Form 8971 Download Fillable PDF or Fill Online Information

Web the form 8971 and schedule(s) a are due 30 days after the filing date. One schedule a is provided to each beneficiary receiving property from an estate. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Web department of the treasury internal revenue service information about form 8971 and its separate instructions is.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web the irs released form 8971 and instructions to form 8971 on january 29, 2016. The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. The executor must complete a schedule a for each beneficiary who can receive property from the estate. One schedule a is provided to each beneficiary.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web instructions include rate schedules. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Web form 8971 and all schedules a must be signed by the executor and filed with the irs. Form 8971 and attached schedule(s) a must be filed with the irs, separate.

IRS Form 8971 Instructions Reporting a Decedent's Property

And zip or foreign postal code) Web instructions include rate schedules. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Web the irs released form 8971 and instructions to form 8971.

IRS Form 8978 Instructions Reporting Partner's Additional Taxes

Form 8971 and attached schedule(s) a must be filed with the irs, separate from any and all other tax returns filed by the estate. Web this form, along with a copy of every schedule a, is used to report values to the irs. This information return reports the values from the decedent’s gross estate to both the irs and to.

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

The executor must complete a schedule a for each beneficiary who can receive property from the estate. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Web irs form 8971 is the tax form that the executor of an estate must use to report the.

IRS Form 1310 Instructions Tax Refund on A Decedent's Behalf

Form 8971 and attached schedule(s) a must be filed with the irs, separate from. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax.

Web The Irs Released Form 8971 And Instructions To Form 8971 On January 29, 2016.

Check box if this is a supplemental filing 7 executor's address (number and street including apartment or suite no.; Web instructions include rate schedules. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service

And Zip Or Foreign Postal Code)

Web department of the treasury internal revenue service information about form 8971 and its separate instructions is at www.irs.gov/form8971. One schedule a is provided to each beneficiary receiving property from an estate. Web the form 8971 and schedule(s) a are due 30 days after the filing date. City, town, or post office;

It Is Not Clear That Form 8971 Is Required Under These Circumstances.

The form includes a schedule a that will be sent to each beneficiary receiving property included on the estate tax return. Web form 8971 is required for any estate that files a 706 after july, 2015, regardless of the decedent’s date of death. Web form 8971 and all schedules a must be signed by the executor and filed with the irs. The executor must complete a schedule a for each beneficiary who can receive property from the estate.

Web This Form, Along With A Copy Of Every Schedule A, Is Used To Report Values To The Irs.

The initial reports under the new statutory requirement are due four weeks from that release date, by february 29, 2016. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Form 8971 and attached schedule(s) a must be filed with the irs, separate from any and all other tax returns filed by the estate. Form 8971 and attached schedule(s) a must be filed with the irs, separate from.