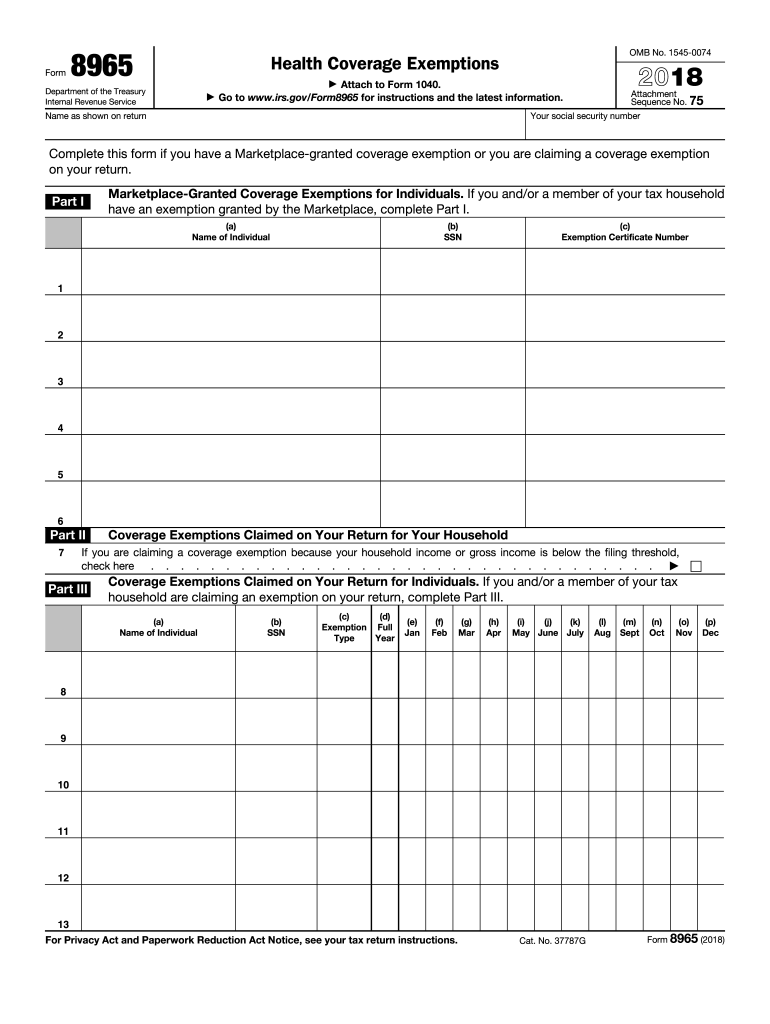

Form 8995 2018

Form 8995 2018 - Web how you can fill out the irs 8965 2018 on the internet: As with most tax issues, the. Web for the 2018 tax year, taxpayers must calculate the deduction amount on a worksheet, filed separately from the taxpayer’s return. Form 8995 is the simplified form and is used if all of the following are true: Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Go to www.irs.gov/form8995 for instructions and the latest information. Web great news for small business owners: Your 20% tax savings is just one form away. The individual has qualified business income. The taxpayer isn't a patron in a specified agricultural or.

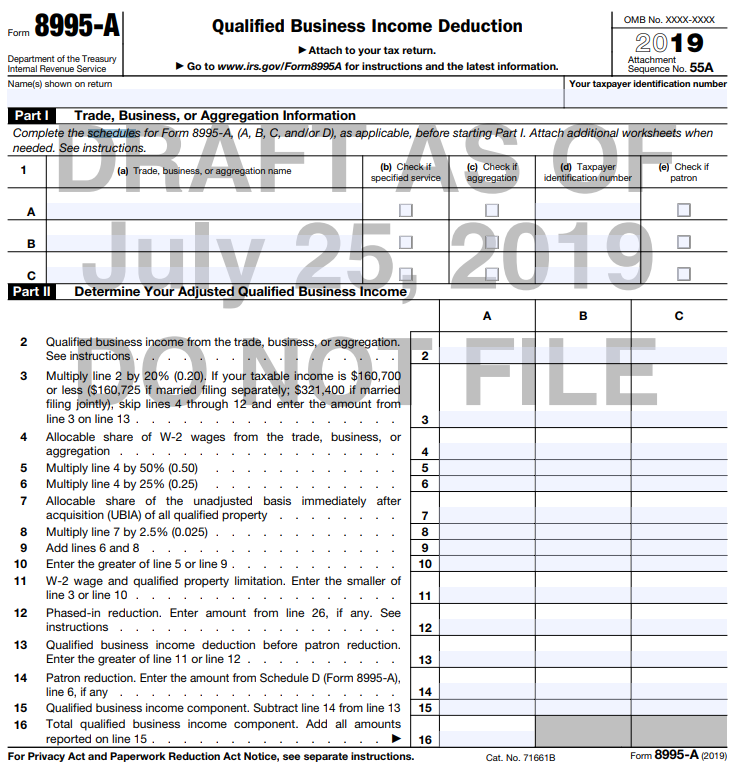

Web a taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Taxable income thresholds that potentially affect the. Table of contents the qualified business. To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Your 20% tax savings is just one form away. Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. Web how you can fill out the irs 8965 2018 on the internet: Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. The advanced tools of the.

Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. On april 15, 2019, the irs. By completing irs tax form 8995, eligible small business owners can claim. Taxable income thresholds that potentially affect the. Web attach to your tax return. As with most tax issues, the. Go to www.irs.gov/form8995 for instructions and the latest information. To begin the form, utilize the fill & sign online button or tick the preview image of the blank. And your 2019 taxable income. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995.

8995 Instructions 2022 2023 IRS Forms Zrivo

The advanced tools of the. And your 2019 taxable income. Web great news for small business owners: Table of contents the qualified business. As with most tax issues, the.

Irs Schedule A Printable Form Printable Form 2021

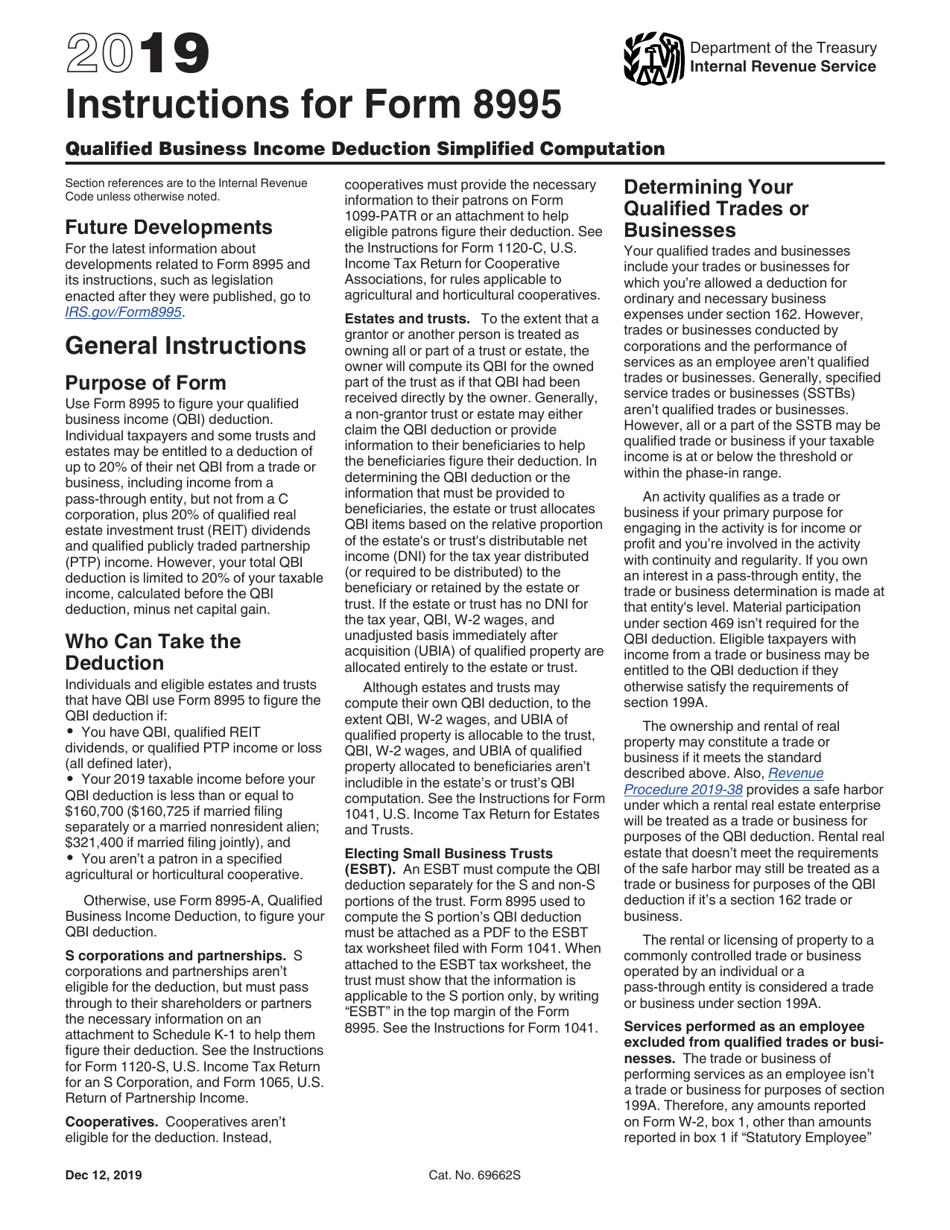

Web how you can fill out the irs 8965 2018 on the internet: The taxpayer isn't a patron in a specified agricultural or. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. Your 20% tax savings is just one form away. The advanced tools of the.

Mason + Rich Blog NH’s CPA Blog

As with most tax issues, the. Go to www.irs.gov/form8995 for instructions and the latest information. Web attach to your tax return. Web a taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to.

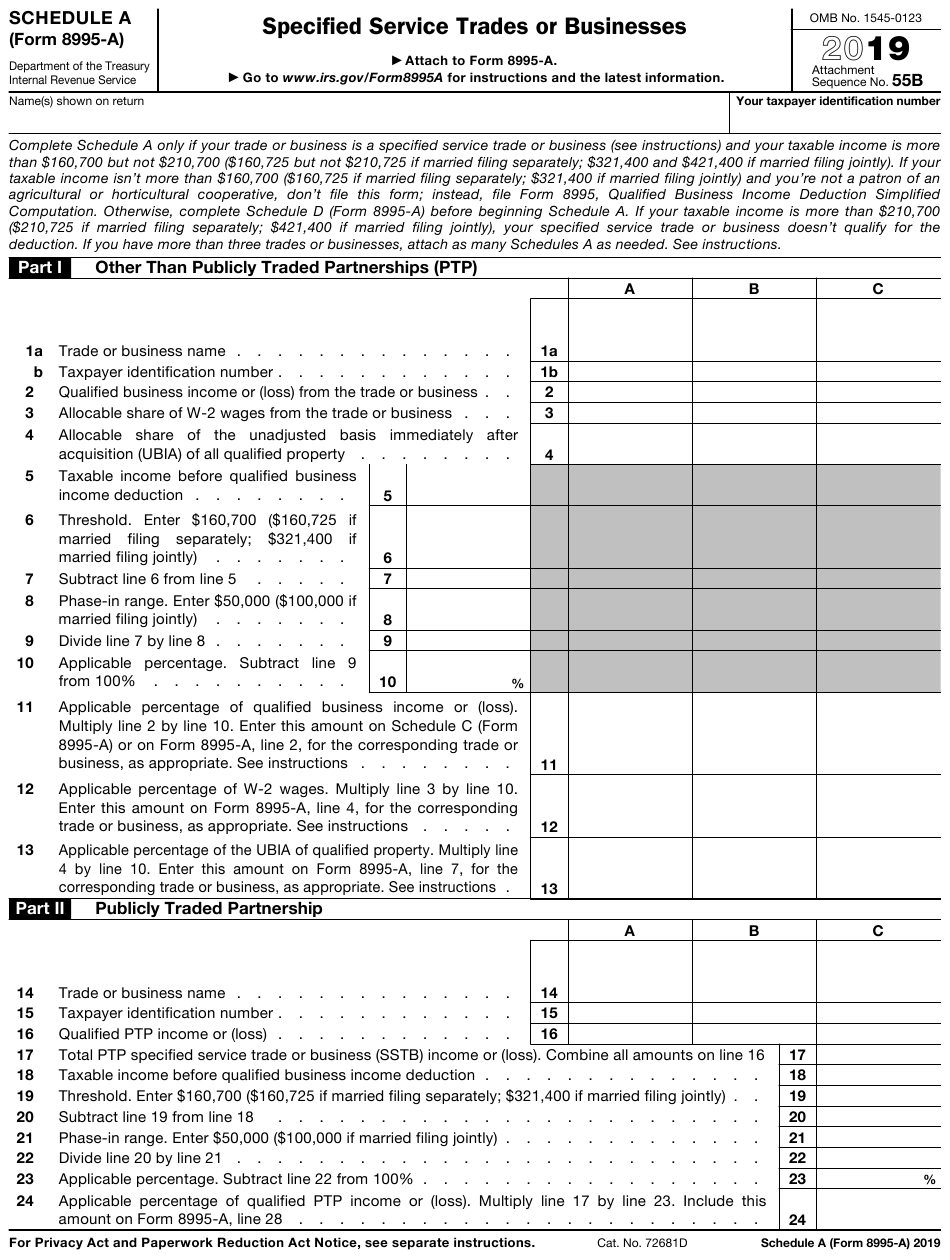

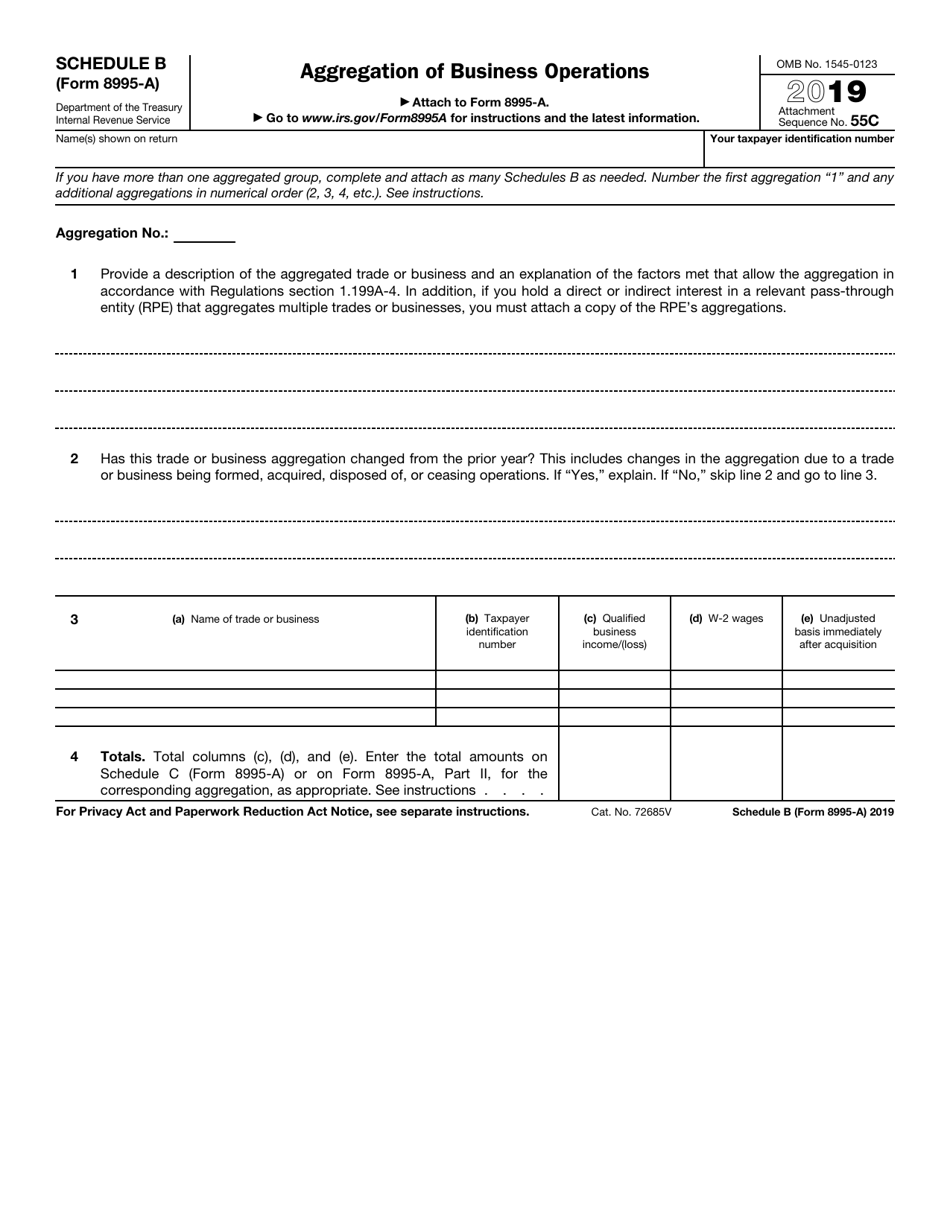

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

As with most tax issues, the. The taxpayer isn't a patron in a specified agricultural or. By completing irs tax form 8995, eligible small business owners can claim. The individual has qualified business income. Taxable income thresholds that potentially affect the.

Download Instructions for IRS Form 8995 Qualified Business

Taxable income thresholds that potentially affect the. The advanced tools of the. Go to www.irs.gov/form8995 for instructions and the latest information. Form 8995 is the simplified form and is used if all of the following are true: On april 15, 2019, the irs.

Instructions for Form 8995 (2019) Internal Revenue Service Small

Taxable income thresholds that potentially affect the. Web attach to your tax return. You have qbi, qualified reit dividends, or qualified ptp income or loss; Web a taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: By completing irs tax form 8995, eligible small business owners can claim.

20182023 Form IRS 8965 Fill Online, Printable, Fillable, Blank pdfFiller

Taxable income thresholds that potentially affect the. Web great news for small business owners: As with most tax issues, the. By completing irs tax form 8995, eligible small business owners can claim. Form 8995 is the simplified form and is used if all of the following are true:

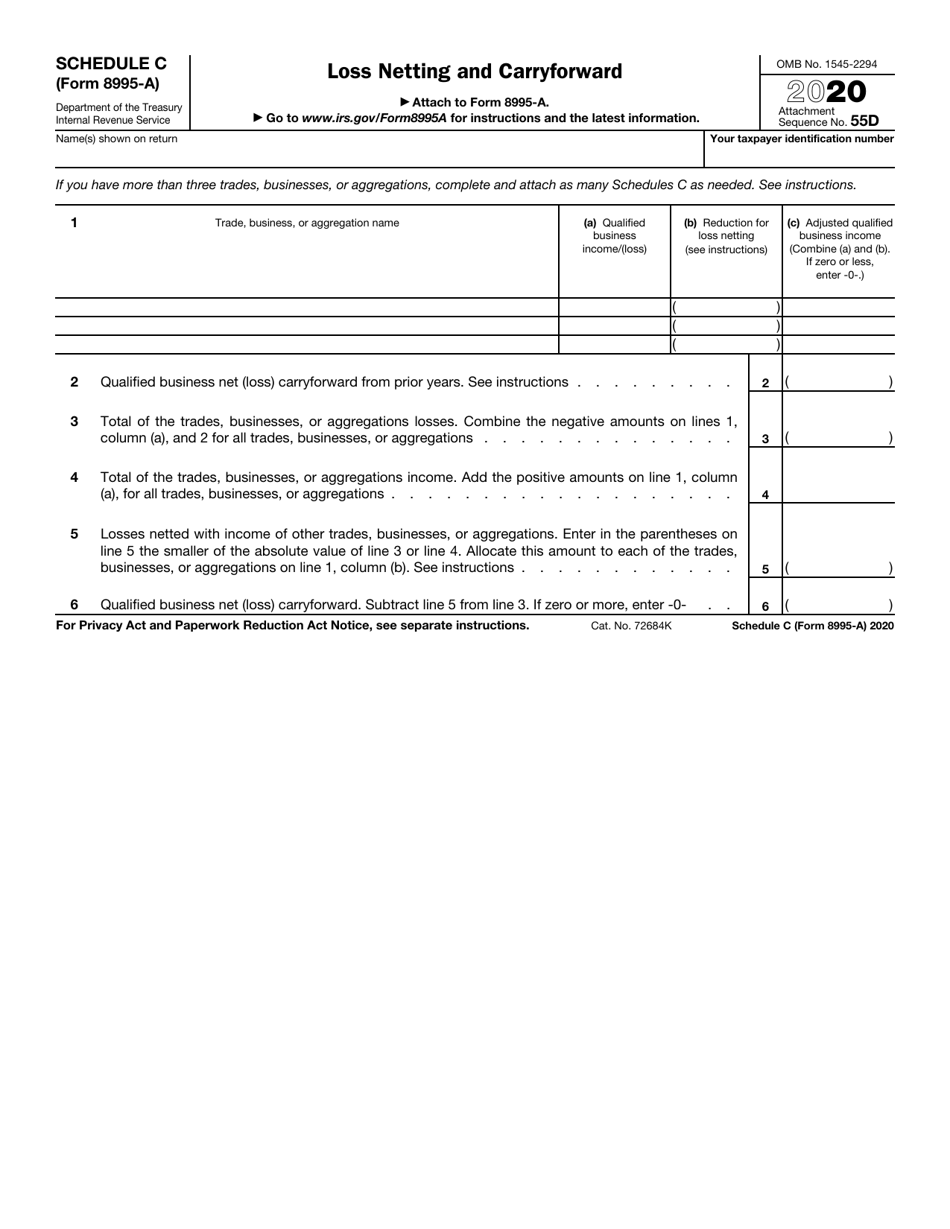

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

Taxable income thresholds that potentially affect the. The taxpayer isn't a patron in a specified agricultural or. Web attach to your tax return. By completing irs tax form 8995, eligible small business owners can claim. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995.

QBI Deduction Frequently Asked Questions (K1, QBI, ScheduleC

Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise noted. As with most tax issues, the. You have qbi, qualified reit dividends, or qualified ptp income or loss; Go to www.irs.gov/form8995 for instructions and the latest information. Web overview if your work qualifies you for certain business deductions.

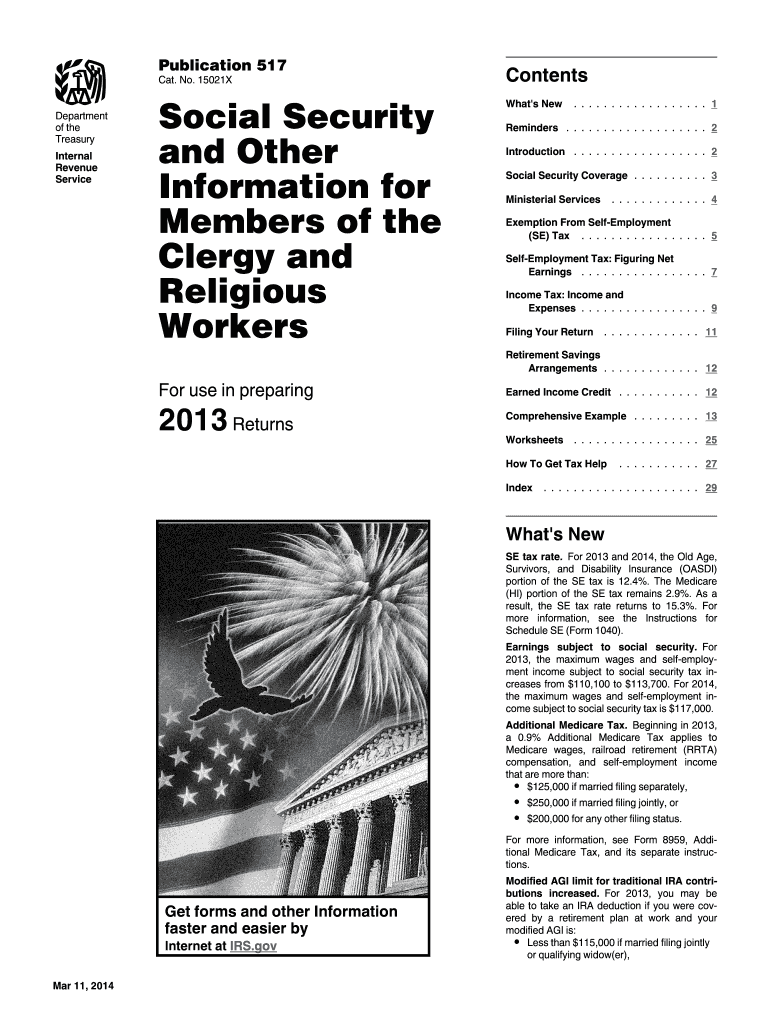

2013 Form IRS Publication 517 Fill Online, Printable, Fillable, Blank

Your 20% tax savings is just one form away. By completing irs tax form 8995, eligible small business owners can claim. Taxable income thresholds that potentially affect the. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. To begin the form,.

Table Of Contents The Qualified Business.

Web the draft form 8995 is comprised of one section (17 lines) with a fairly straightforward computation of the qualified business income (taking into account any. Web how you can fill out the irs 8965 2018 on the internet: The advanced tools of the. Web great news for small business owners:

Your 20% Tax Savings Is Just One Form Away.

The taxpayer isn't a patron in a specified agricultural or. Go to www.irs.gov/form8995 for instructions and the latest information. As with most tax issues, the. The individual has qualified business income.

Web For The 2018 Tax Year, Taxpayers Must Calculate The Deduction Amount On A Worksheet, Filed Separately From The Taxpayer’s Return.

You have qbi, qualified reit dividends, or qualified ptp income or loss; Web a taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: On april 15, 2019, the irs. By completing irs tax form 8995, eligible small business owners can claim.

Web Overview If Your Work Qualifies You For Certain Business Deductions On Your Taxes, You May Need To Use Form 8995.

Form 8995 is the simplified form and is used if all of the following are true: To begin the form, utilize the fill & sign online button or tick the preview image of the blank. Web we last updated the qualified business income deduction simplified computation in january 2023, so this is the latest version of 8995, fully updated for tax year 2022. Taxable income thresholds that potentially affect the.