Form 941 Due Dates For 2023

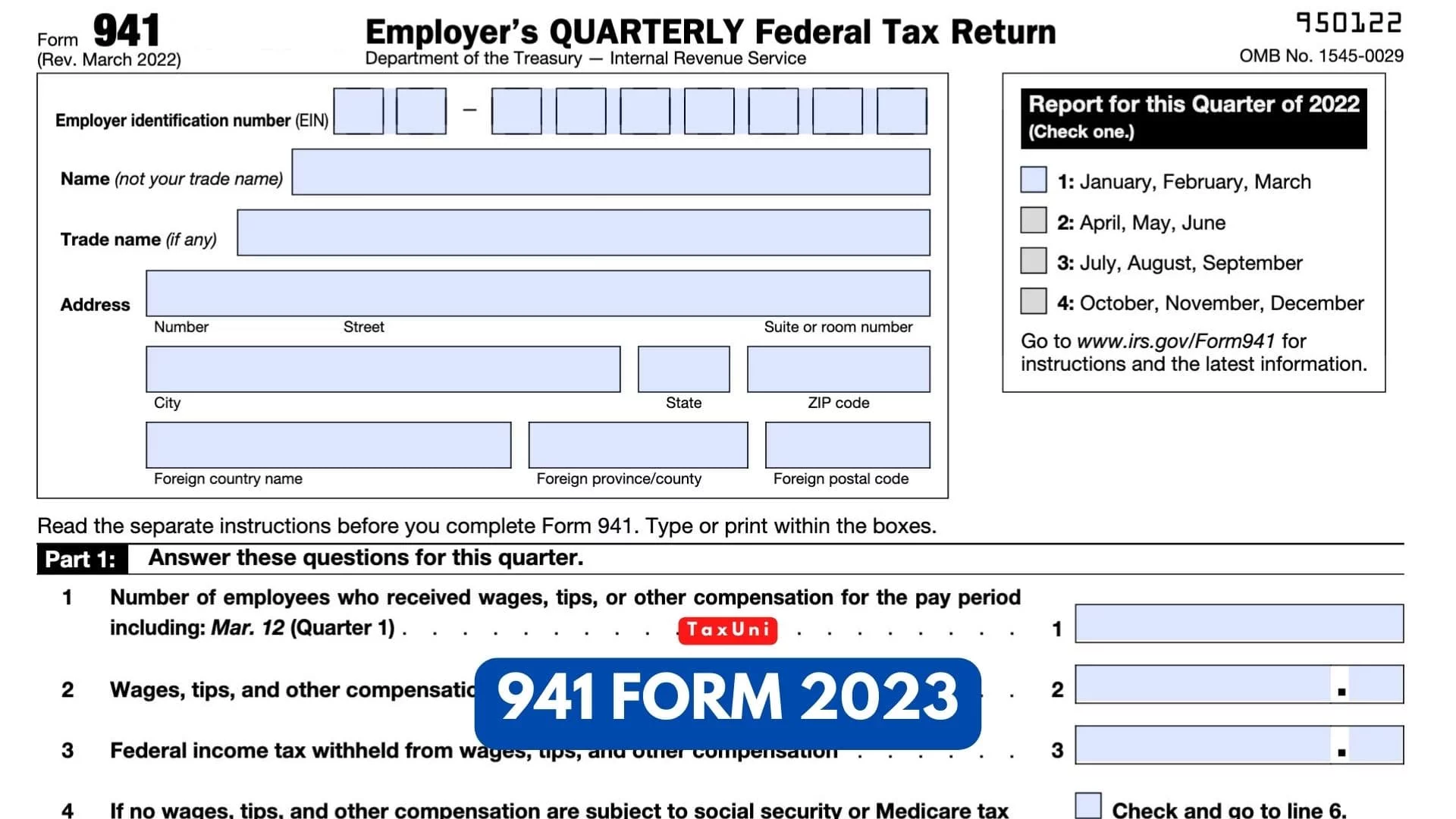

Form 941 Due Dates For 2023 - Deposit dates tips to balance. This is the final week the social security administration is sending out payments for july. For 2023, form 941 is payable the may 2, august 1, october 31, & Form 941 is an important document that all employers must complete and submit to the irs. The instructions now refer to the quarter of “2023” instead. Reporting income tax withholding and fica taxes for first quarter 2023 (form 941) and paying any tax due. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. There is also a small update to the instruction box for line 5. For 2023, form 941 is due by may 1, july 31, october 31,january 31. Web state zip code foreign country name foreign province/county foreign postal code 950122 omb no.

Web payroll tax returns. The total tax reported on forms 941 during the “lookback period” is. Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well. Web form 941 is generally due by the last day of the month following the end of the quarter. Quarter one (january, february, march): Form 941 is used to report the social security, medicare, and income taxes withheld from employee. Web your form 941 is due by the last day of the month that follows the end of the quarter. Those returns are processed in.

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. There is also a small update to the instruction box for line 5. Form 941 is due on april 30. Quarter one (january, february, march): For 2023, form 941 is payable the may 2, august 1, october 31, & Those returns are processed in. Form 941 is used to report the social security, medicare, and income taxes withheld from employee. Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. Web which deadline to file 941 will be the last date of the month later the end of the quarter. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well.

EFile Form 941 for 2022 File 941 Electronically at 4.95

Form 941 is an important document that all employers must complete and submit to the irs. Web line by line review of the 2023 form 941 third quarter pending changes to the third quarter tips for completing the schedule b—liability dates vs. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31,.

2021 IRS Form 941 Deposit Rules and Schedule

Web the deadline to file 941 will be the last day of the month following the end of the quarter. Quarter one (january, february, march): Web the irs has introduced a second worksheet for form 941. We provide this information to ensure. Web for 2023, the “lookback period” is july 1, 2021, through june 30, 2022.

New Form 941 for Q2 2022 Revised IRS Form 941 For 2nd Quarter

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. Form 941 is due on april 30. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well. As of july 13,.

2020 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

For 2023, form 941 is due by may 1, july 31, october 31,january 31. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return,.

2020 Form 941 Employee Retention Credit for Employers subject to

July 22, 2023 5:00 a.m. Those returns are processed in. Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return, is july 31, 2023. Form 941 is due on april 30. Web april 30 july 31 october 31 what is the penalty for failing to file form 941?

Form 941 Employer's Quarterly Federal Tax Return Definition

For 2023, form 941 is due by may 1, july 31, october 31,january 31. Web the irs has introduced a second worksheet for form 941. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web april 30 july.

How to fill out IRS Form 941 2019 PDF Expert

For 2023, form 941 is due by may 1, july 31, october 31,january 31. Deposit dates tips to balance. Those returns are processed in. Web the irs has introduced a second worksheet for form 941. There is also a small update to the instruction box for line 5.

Irs 941 Instructions Publication 15 All Are Here

Web form 941 for q1, 2023 is due in a week, meet the irs deadline with taxbandits taxbandits april 24, 2023 at 12:30 pm · 3 min read rock hill, sc /. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Deposit dates tips to balance. Form 941 is used to report the social security, medicare, and.

2023 Payroll Tax & Form 941 Due Dates Paylocity

Web 2023 irs form 941 deposit rules and schedule oct 18, 2022 released september 30, 2022 notice 931 sets the deposit rules and schedule for form 941 this. Web the deadline to file 941 will be the last day of the month following the end of the quarter. Form 941 is an important document that all employers must complete and.

941 Form 2023

However, in general, they are relatively the same as the previous year. Those returns are processed in. Since april 15 falls on a saturday, and emancipation day. Quarter one (january, february, march): Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well.

Web For 2023, The “Lookback Period” Is July 1, 2021, Through June 30, 2022.

However, in general, they are relatively the same as the previous year. Quarter one (january, february, march): For 2023, form 941 is due by may 1, july 31, october 31,january 31. Deposit dates tips to balance.

Web Line By Line Review Of The 2023 Form 941 Third Quarter Pending Changes To The Third Quarter Tips For Completing The Schedule B—Liability Dates Vs.

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with. Web the irs has introduced a second worksheet for form 941. There is also a small update to the instruction box for line 5. July 22, 2023 5:00 a.m.

For Example, You're Required To File Form 941 By April 30 For Wages You Pay.

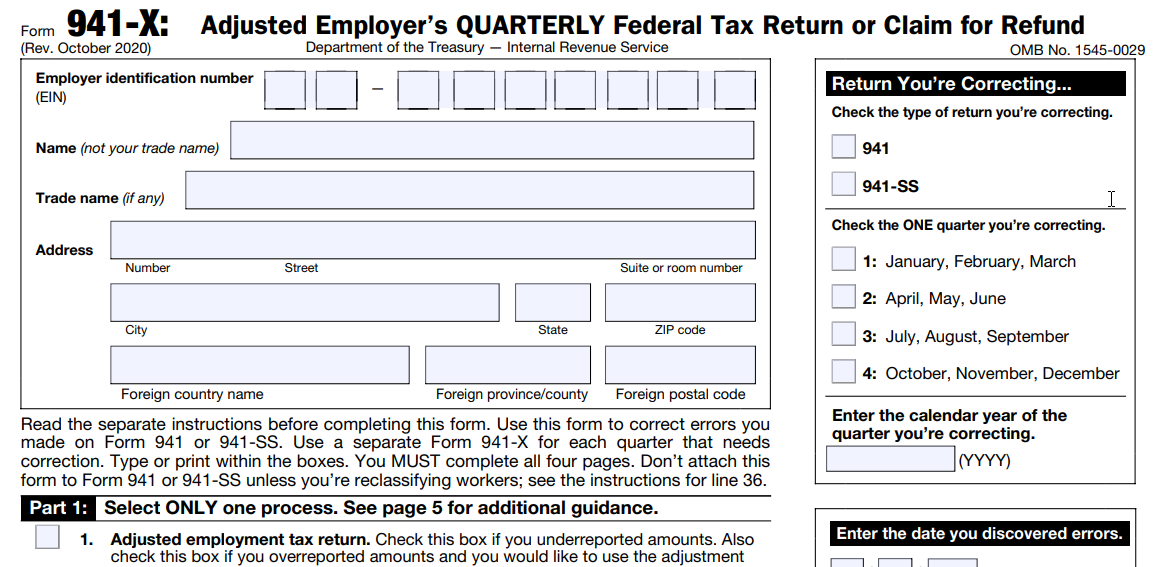

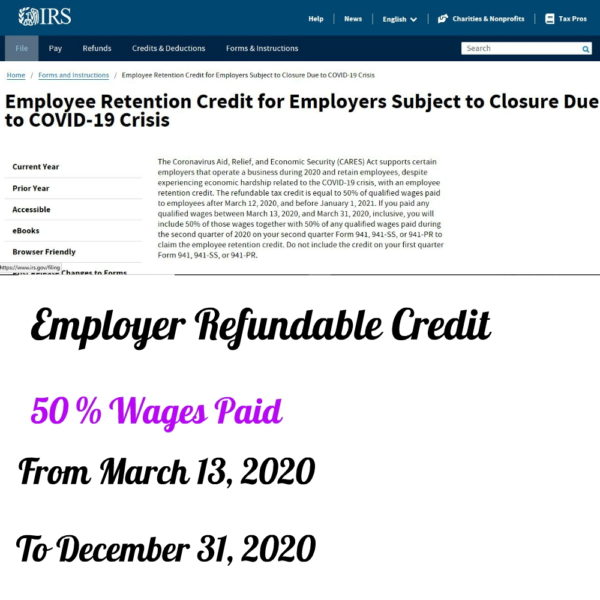

Web if the employer deferred paying the employer share of social security tax or the railroad retirement tax equivalent in 2020, 50% of the deferred amount of the employer share of. Web the deadline to file 941 will be the last day of the month following the end of the quarter. Since april 15 falls on a saturday, and emancipation day. Form 941 is an important document that all employers must complete and submit to the irs.

Web Payroll Tax Returns.

Those returns are processed in. Web the 2nd quarter filing deadline for 2023 form 941, employer’s quarterly federal tax return, is july 31, 2023. Form 941 is due on april 30. Web april 30 july 31 october 31 in addition to this, the due date for paying taxes may vary as well.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)