Form 941 Erc

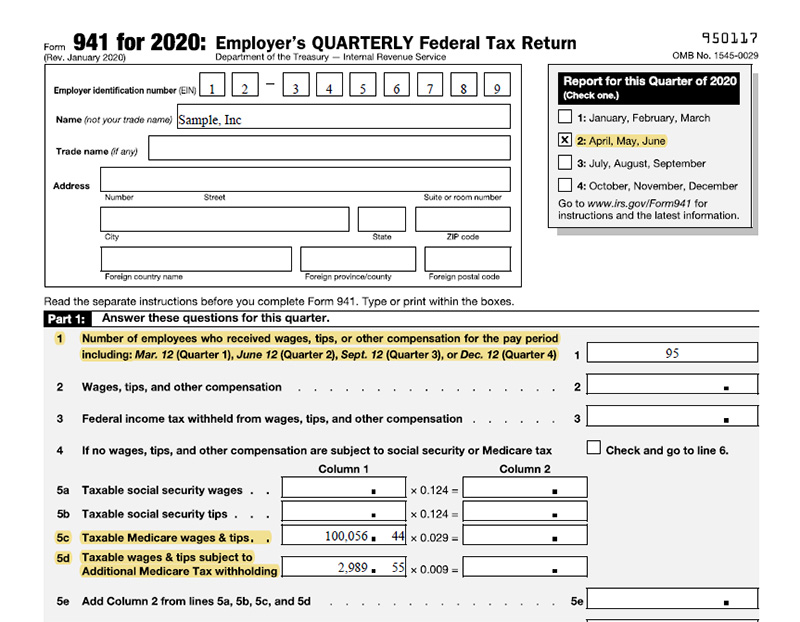

Form 941 Erc - Claim the employee retention credit to get up to $26k per employee. Web 2 days agomany accountants and experts initially advised their clients the erc deadlines would be a series of staggered, quarterly deadlines that corresponded to three years. Web all advances requested via the irs form 7200 must be reconciled with the erc and any other credits for which the employer is eligible on the irs form 941,. A credit for family leave. Thus, any employer who files the quarterly. Talk to our skilled erc team about the employee retention credit. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. We wanted to remind you about the erc (employee retention credit), a very helpful. Section 2301 (b) (1) of the cares act limits the. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of.

Web about form 941, employer's quarterly federal tax return. A credit for family leave. Talk to our skilled erc team about the employee retention credit. Claim the employee retention credit to get up to $26k per employee. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Employers use form 941 to: Web 2 days agomany accountants and experts initially advised their clients the erc deadlines would be a series of staggered, quarterly deadlines that corresponded to three years. Section 2301 (b) (1) of the cares act limits the. A credit for sick leave, and. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability.

We wanted to remind you about the erc (employee retention credit), a very helpful. Employers use form 941 to: Reminders don't use an earlier revision of. A credit for family leave. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Claim the employee retention credit to get up to $26k per employee. Web apr 9th, 2021. There is no cost to you until you receive the funds from the irs. Section 2301 (b) (1) of the cares act limits the. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022.

ERC Calculator Tool ERTC Funding

Claim your ercs with confidence today. A credit for family leave. A credit for sick leave, and. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Web form 941 erc employee retention credit:

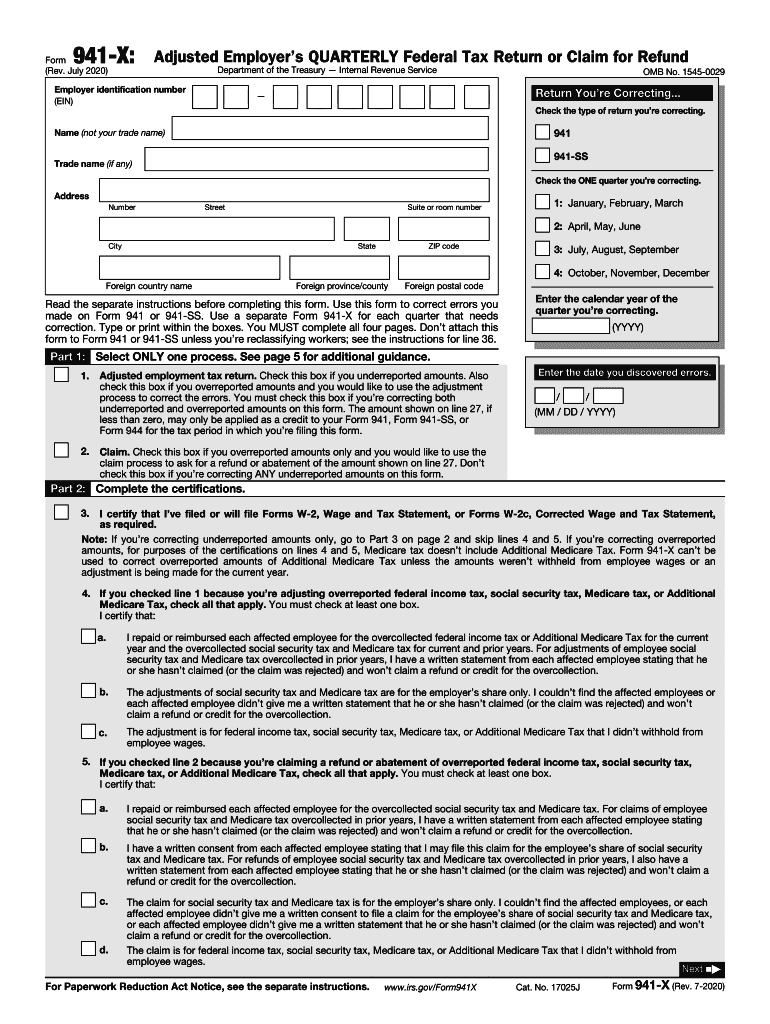

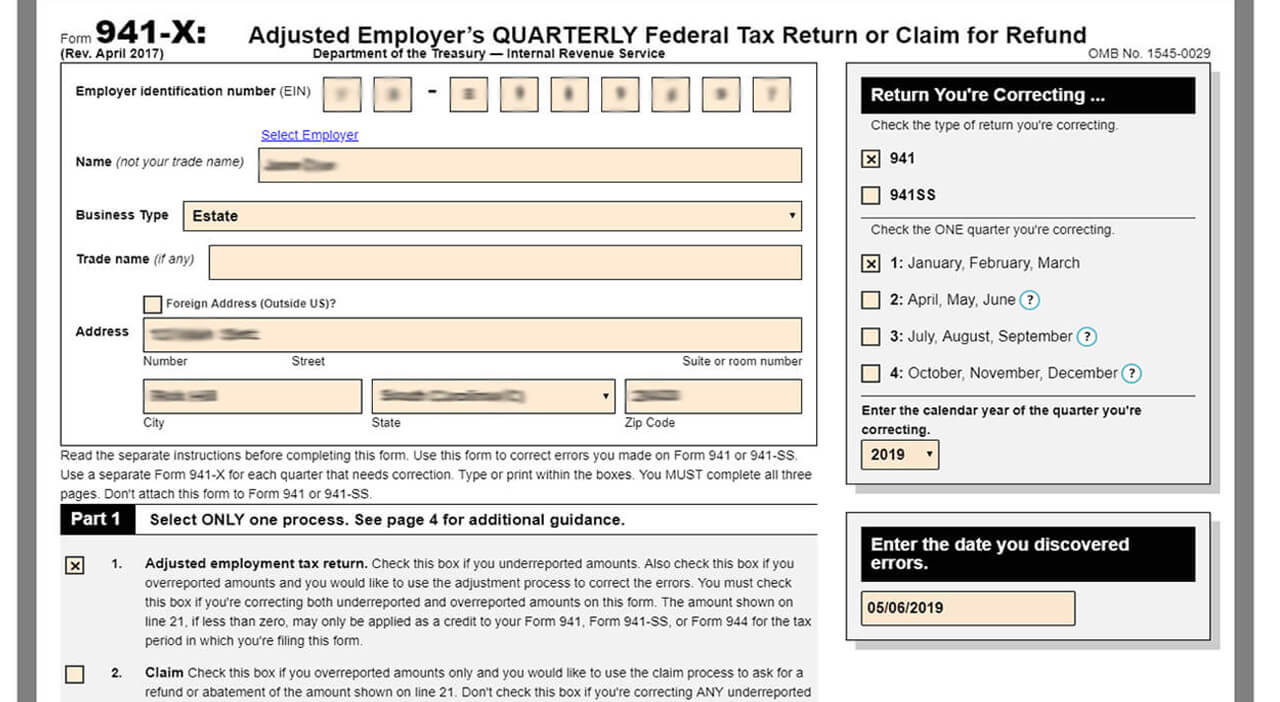

For Retro ERC, Use Form 941X Crippen

Thus, any employer who files the quarterly. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Claim the employee retention credit to get up to $26k per employee. Section 2301 (b) (1) of the cares act limits the. Claim.

941 Erc Worksheet

Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. We wanted to remind you about the erc (employee retention credit), a very helpful. Thus, any employer who files the quarterly. Report income taxes, social security tax, or medicare tax.

Employee Retention Credit (ERC) Form 941X Everything You Need to Know

Section 2301 (b) (1) of the cares act limits the. Claim the employee retention credit to get up to $26k per employee. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. A credit for sick leave, and. Hold off.

How to File IRS Form 941X Instructions & ERC Guidelines

Ad stentam is the nations leading tax technology firm. Claim your ercs with confidence today. Web form 941 erc employee retention credit: Web understanding tax credits and their impact on form 941. Talk to our skilled erc team about the employee retention credit.

How to Claim ERTC Retroactive Employee Retention Tax Credit [Form 941

A credit for family leave. Claim the employee retention credit to get up to $26k per employee. Claim your ercs with confidence today. Thus, any employer who files the quarterly. Web the erc, as originally enacted, is a fully refundable tax credit for employers equal to 50 percent of qualified wages.

941 Erc Worksheet

Web form 941 erc employee retention credit: Report income taxes, social security tax, or medicare tax withheld from employee's. Talk to our skilled erc team about the employee retention credit. Web apr 9th, 2021. There is no cost to you until you receive the funds from the irs.

How to Complete & Download Form 941X (Amended Form 941)?

Thus, any employer who files the quarterly. Web understanding tax credits and their impact on form 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web form 941 worksheet 1 is designed to.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

Thus, any employer who files the quarterly. Ad stentam is the nations leading tax technology firm. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of. Web 2 days agomany accountants and experts initially advised their clients the erc deadlines would be a series of.

941 X Form Fill Out and Sign Printable PDF Template signNow

Claim your ercs with confidence today. A credit for family leave. We wanted to remind you about the erc (employee retention credit), a very helpful. Web apr 9th, 2021. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of.

Ad Unsure If You Qualify For Erc?

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Web up to 10% cash back the form 941 changes reflect two new credits against the employer’s share of employment taxes: There is no cost to you until you receive the funds from the irs. Ad stentam is the nations leading tax technology firm.

Web The Advance Payment On Form 941, Part 1, Line 13H, For The Fourth Quarter Of 2021 And Paying Any Balance Due By January 31, 2022.

Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. A credit for sick leave, and. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Report income taxes, social security tax, or medicare tax withheld from employee's.

Web Worksheet 1 (Included In The Instructions To The Form 941) Is Used To Calculate The Nonrefundable Portion And Refundable Portion Of The Erc.

Thus, any employer who files the quarterly. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web the tax deferral and credits are reportable on an employer’s form 941, employer’s quarterly federal tax return, starting with the second calendar quarter of. Web about form 941, employer's quarterly federal tax return.

Web 2 Days Agomany Accountants And Experts Initially Advised Their Clients The Erc Deadlines Would Be A Series Of Staggered, Quarterly Deadlines That Corresponded To Three Years.

Reminders don't use an earlier revision of. Claim the employee retention credit to get up to $26k per employee. Web the erc, as originally enacted, is a fully refundable tax credit for employers equal to 50 percent of qualified wages. Web corrections to amounts reported on form 941, lines 11d, 13e, 23, 24, 25, 26, 27, and 28, for the credit for qualified sick and family leave wages for leave taken after march 31, 2021,.

.jpg)