Form 941 For 1St Quarter 2022

Form 941 For 1St Quarter 2022 - Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Please note that some of these deadlines land over a weekend or on a federal holiday, therefore the next. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web 1 day agointroduction the u.s. Web you were a semiweekly schedule depositor for any part of this quarter. Web diluted earnings of $0.58 per share, an increase of $0.20 compared to $0.38 in the same quarter last year. Web employers who have seasonal employees only fill out form 941 for those quarters in which they had paid wages. Try it for free now! Ad upload, modify or create forms. Economy continued to show resilience and strength in the second quarter of 2023.

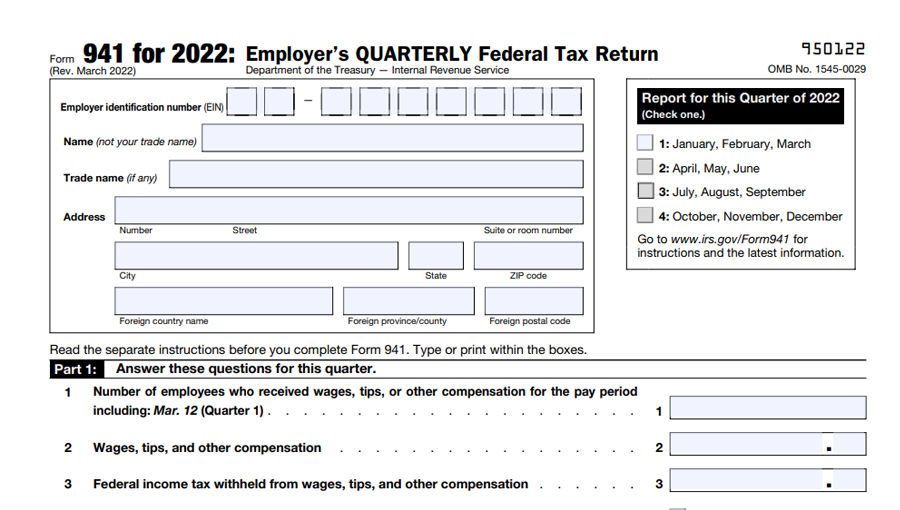

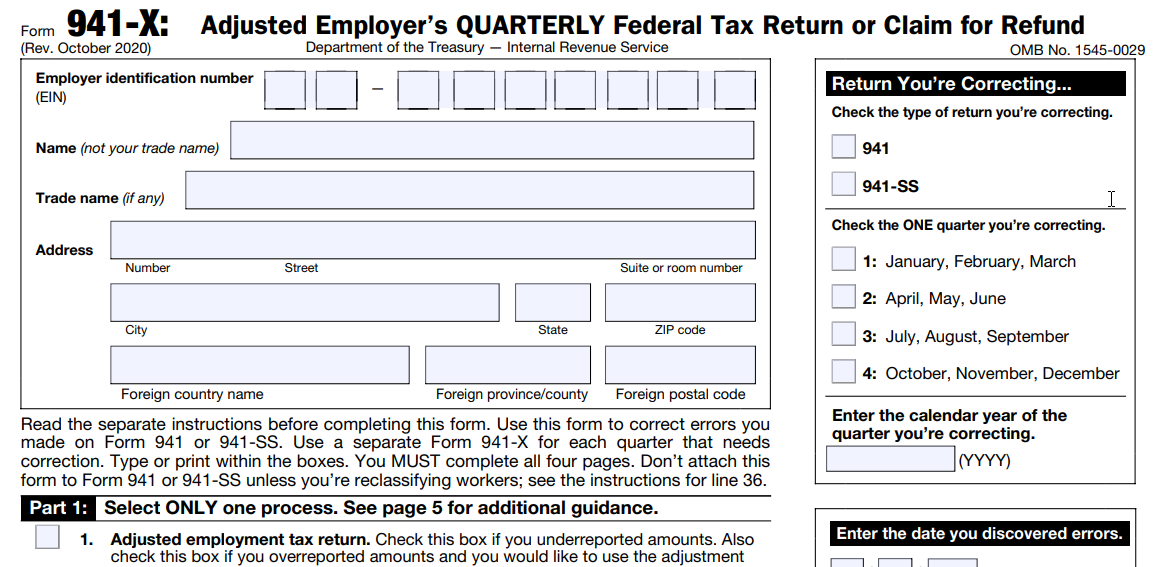

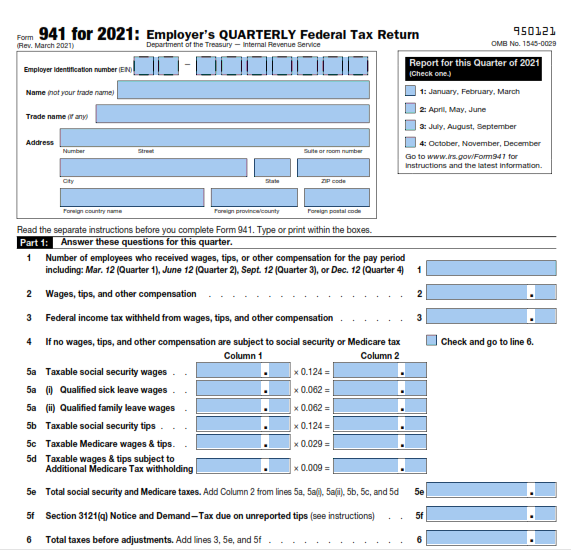

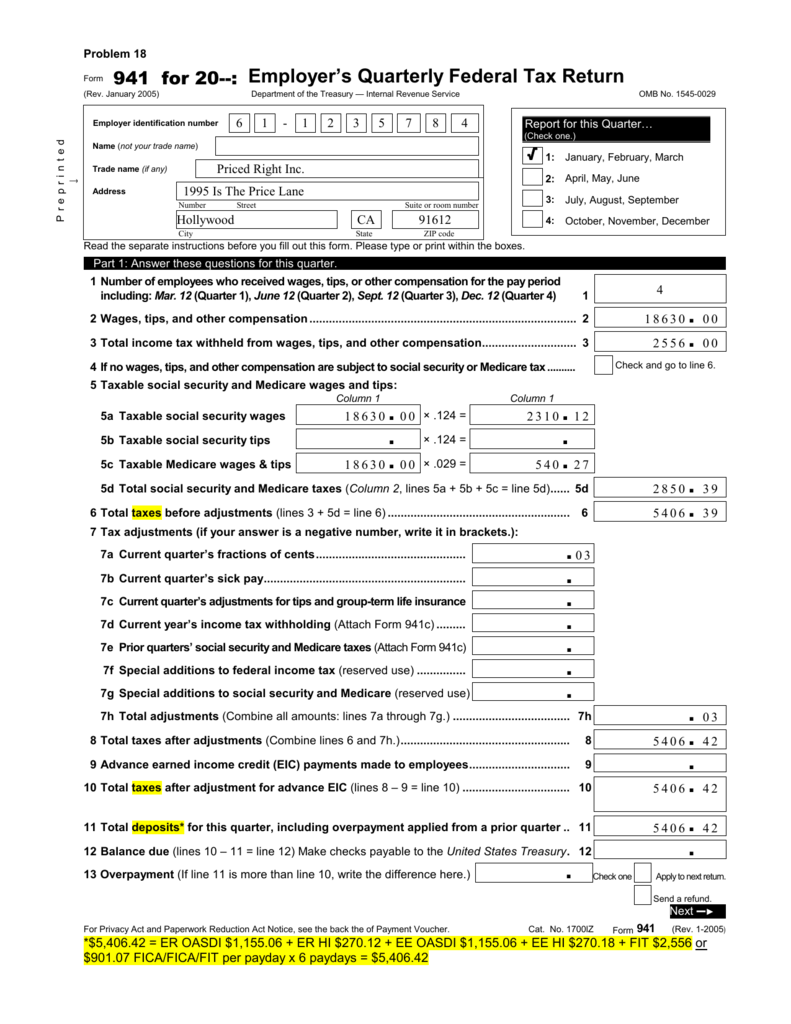

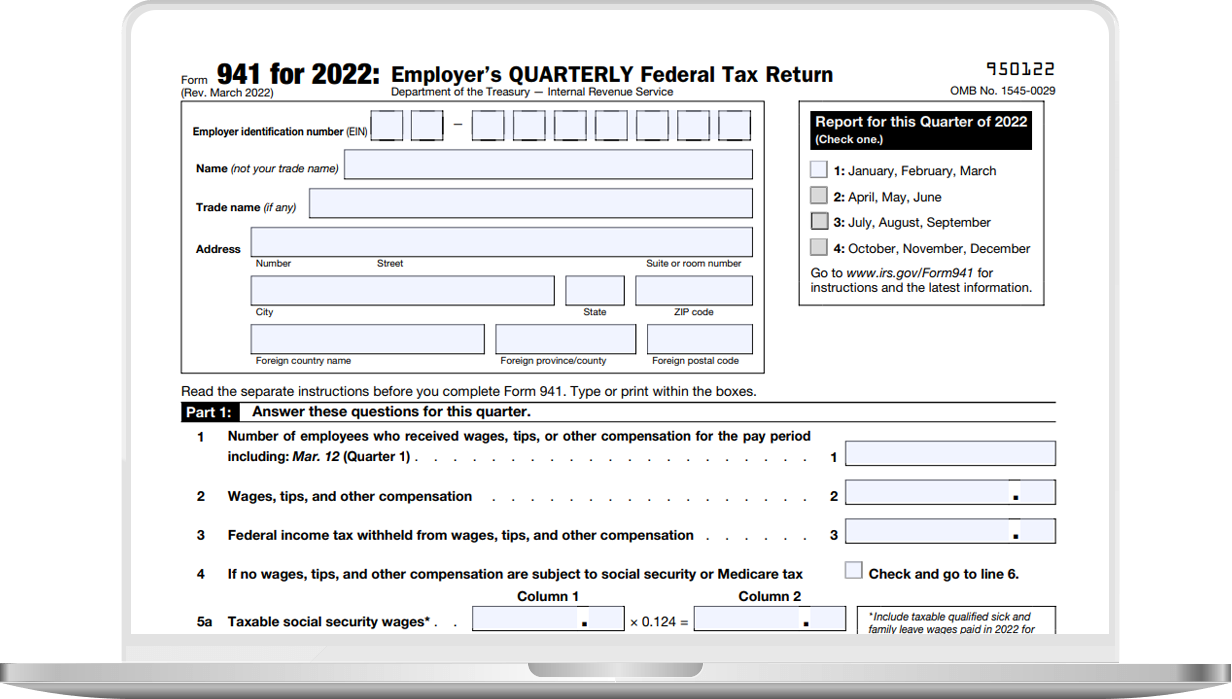

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Ad upload, modify or create forms. $115.7 million investment in infrastructure projects in the. Web dallas, july 26, 2023 — at&t inc. The last time form 941 was. Web the irs recently released a revised form 941 for the first quarter of 2022, complete with proposed changes. Web employers who have seasonal employees only fill out form 941 for those quarters in which they had paid wages. Use this form to correct. Your irs payroll tax penalty and interest solution.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Try it for free now! Use this form to correct. Web assistance credit after the first quarter of 2022. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Finding a authorized specialist, making a scheduled appointment and going to the office for a private meeting makes doing a irs 941 from. Ad upload, modify or create forms. Web dallas, july 26, 2023 — at&t inc. The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

EFile Form 941 for 2022 File 941 Electronically at 4.95

The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows: Form 941 is used by employers. Web form 941 is a tax report due on a quarterly basis. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th.

Top10 US Tax Forms in 2022 Explained PDF.co

Web employers who have seasonal employees only fill out form 941 for those quarters in which they had paid wages. All employers that are required to report the federal. Try it for free now! Web follow the simple instructions below: Mandatory filing deadlines for 2022 form 941.

1040 Tax Form Instructions 2021 2022 1040 Forms

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web the irs recently released a revised form 941 for the first quarter of 2022, complete with proposed changes. Real gdp grew for the fourth consecutive quarter, picking up. Go to the.

Update Form 941 Changes Regulatory Compliance

Your irs payroll tax penalty and interest solution. All employers that are required to report the federal. Go to the employee menu. Web form 941 is a tax report due on a quarterly basis. Ad upload, modify or create forms.

January 2021

Web for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and. Finding a authorized specialist, making.

Printable 941 Form For 2020 Printable World Holiday

Download or email irs 941 & more fillable forms, register and subscribe now! Please note that some of these deadlines land over a weekend or on a federal holiday, therefore the next. Download or email irs 941 & more fillable forms, register and subscribe now! Web follow the simple instructions below: Ad take control of irs payroll tax penalties and.

EFile Form 941 for 2023 File 941 Electronically at 5.95

Web follow the simple instructions below: Try it for free now! Use this form to correct. Web diluted earnings of $0.58 per share, an increase of $0.20 compared to $0.38 in the same quarter last year. $115.7 million investment in infrastructure projects in the.

How to fill out IRS Form 941 2019 PDF Expert

Try it for free now! Web rock hill, sc / accesswire / april 27, 2022 / the deadline to file the quarterly payroll form 941 for the first quarter is approaching on may 2, 2022. Web for the latest information about developments related to form 941 and its instructions, such as legislation enacted after they were published, go to. Download.

Form 941 Employer's Quarterly Federal Tax Return Definition

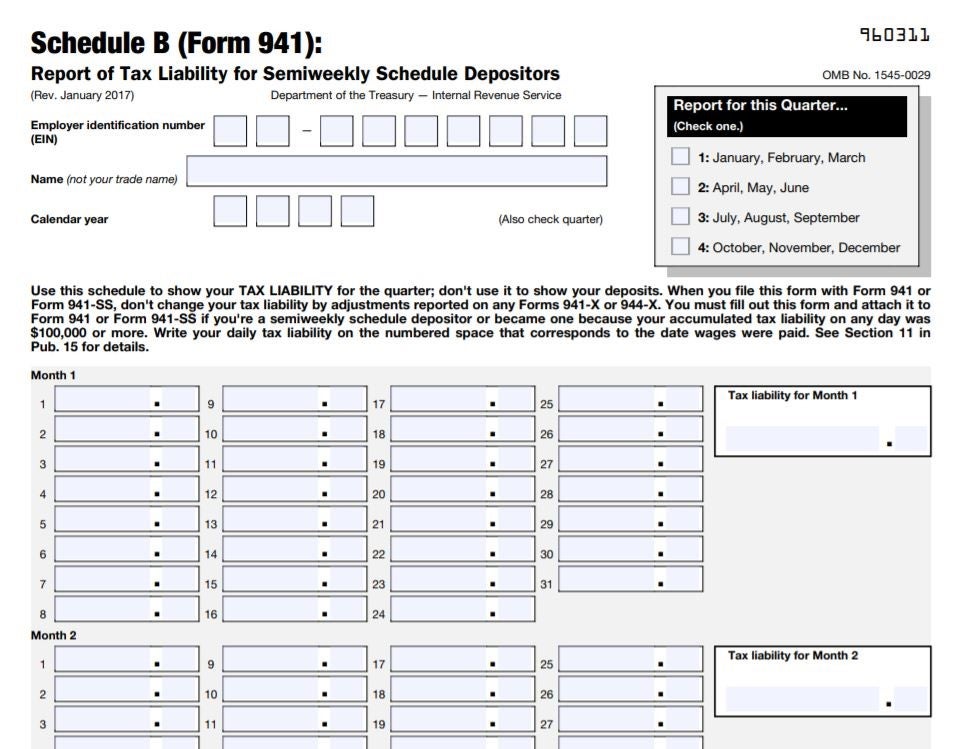

Web 1 day agointroduction the u.s. Web you were a semiweekly schedule depositor for any part of this quarter. Web assistance credit after the first quarter of 2022. Go to the employee menu. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order.

File Form 941 Online for 2023 Efile 941 at Just 5.95

Use this form to correct. All employers that are required to report the federal. April, may, june read the separate instructions before completing this form. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Download or email irs 941 & more fillable.

Web Once The Payroll Tax Forms Are Available For The First Quarter Of 2022, They Will Be Included In The Payroll News And Updates.

Web form 941 for 2023: Ad upload, modify or create forms. Web diluted earnings of $0.58 per share, an increase of $0.20 compared to $0.38 in the same quarter last year. Use this form to correct.

Go To The Employee Menu.

Web employers who have seasonal employees only fill out form 941 for those quarters in which they had paid wages. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Please note that some of these deadlines land over a weekend or on a federal holiday, therefore the next. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Try it for free now! Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after march 31, 2021, and. April, may, june read the separate instructions before completing this form. The typical quarterly due date for the form is 30 days following the end of each calendar quarter as follows:

Web Ein, “Form 941,” And The Tax Period (“1St Quarter 2023,” “2Nd Quarter 2023,” “3Rd Quarter 2023,” Or “4Th Quarter 2023”) On Your Check Or Money Order.

Web dallas, july 26, 2023 — at&t inc. Web rock hill, sc / accesswire / april 27, 2022 / the deadline to file the quarterly payroll form 941 for the first quarter is approaching on may 2, 2022. All employers that are required to report the federal. Web follow the simple instructions below:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)