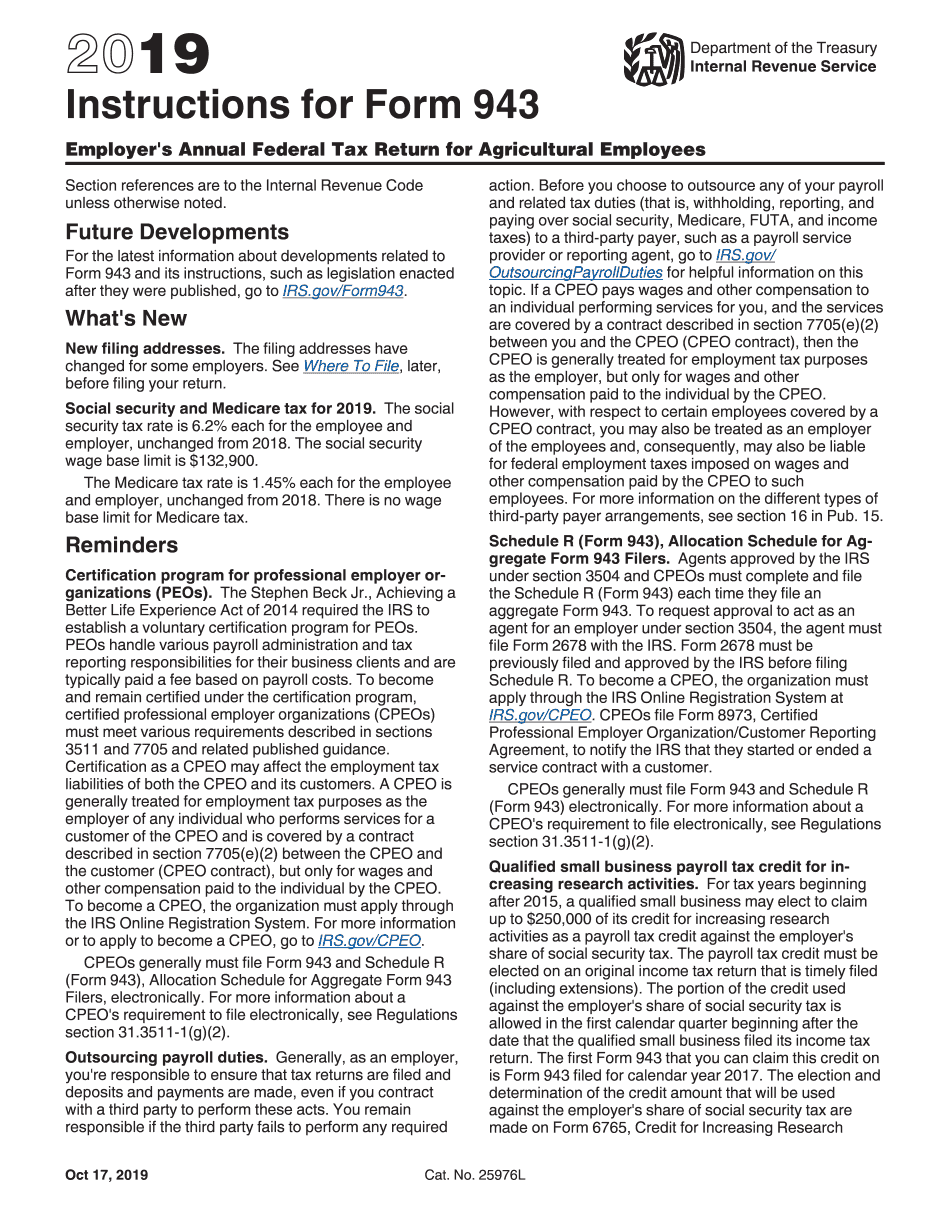

Form 943 Instructions

Form 943 Instructions - Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26, and 27, for the credit for qualified sick and family leave wages for leave taken after march 31,. How should you complete form 943? Web irs form 943: Web irs form 943 instructions. Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. Create a free taxbandits account or login if you have one already step 2: Web simply follow the steps below to file your form 943: We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. Department of the treasury internal revenue service. Form 943 (employer’s annual federal tax. Web irs form 943 instructions. Create a free taxbandits account or login if you have one already step 2: The instructions include five worksheets similar to those in form. Web irs form 943: Who must file form 943? Department use only number federal employer i.d. Missouri tax identification number, federal employer identification number, or charter number.

We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. How should you complete form 943? Create a free taxbandits account or login if you have one already step 2: The instructions include five worksheets similar to those in form. Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26, and 27, for the credit for qualified sick and family leave wages for leave taken after march 31,. This checklist provides guidance for preparing and reviewing form 943 (employer’s annual federal tax return for agricultural employees). Web simply follow the steps below to file your form 943: Department use only number federal employer i.d. To determine if you're a semiweekly schedule.

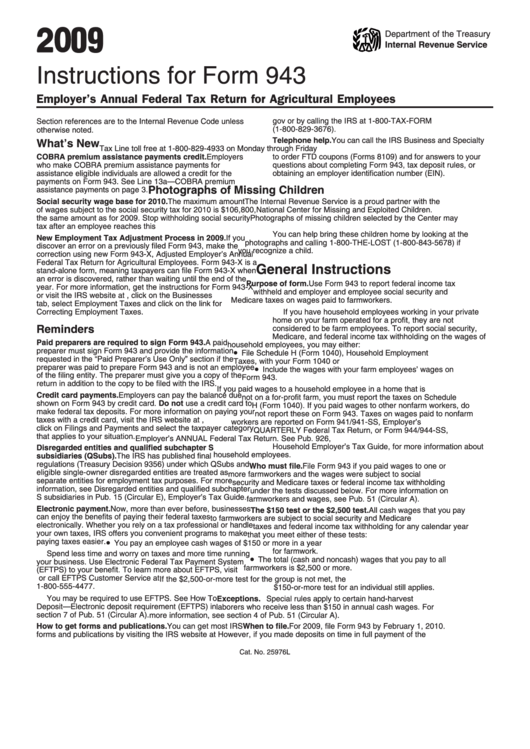

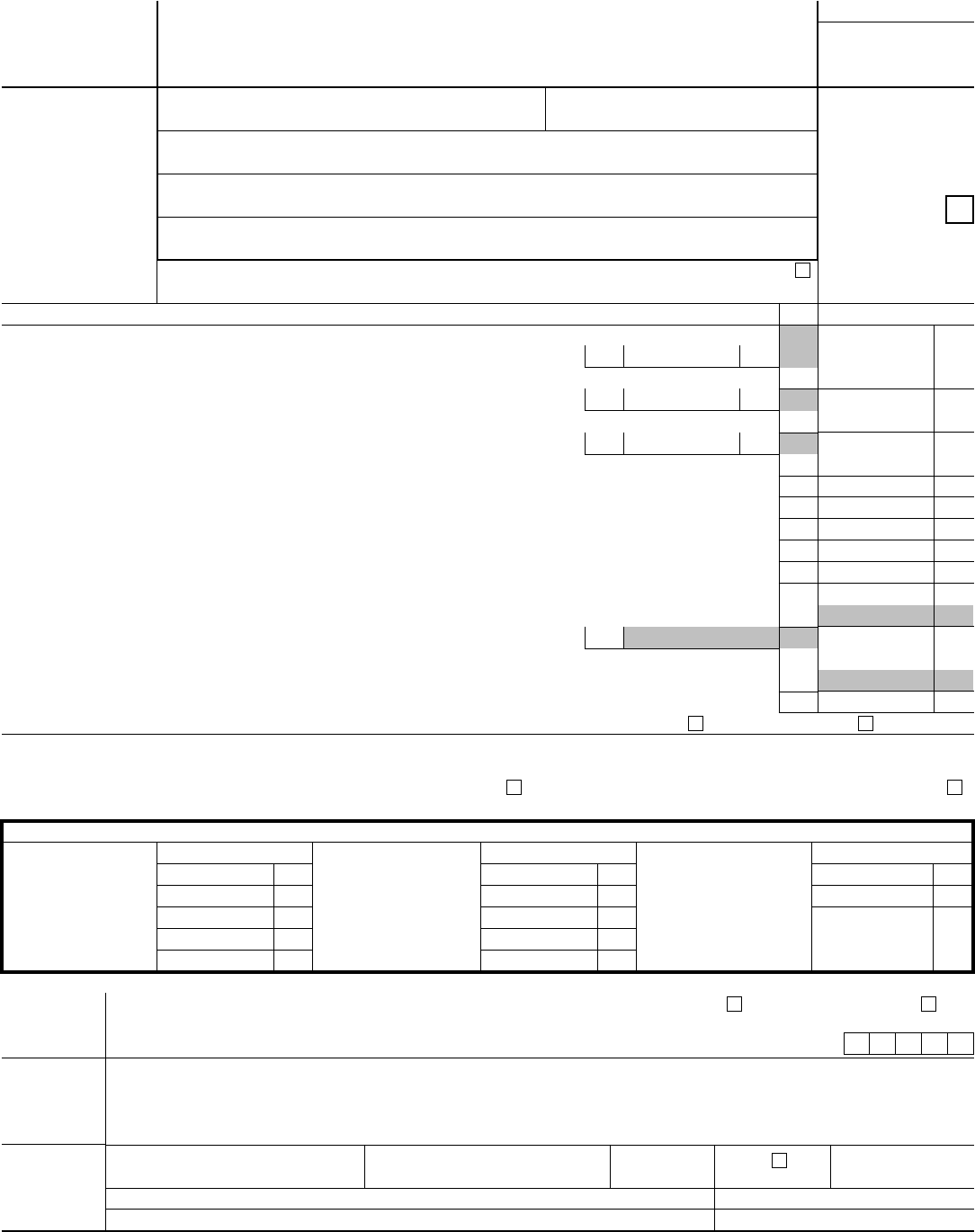

Instructions For Form 943 2009 printable pdf download

Missouri tax identification number, federal employer identification number, or charter number. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26, and 27, for the credit for qualified sick and.

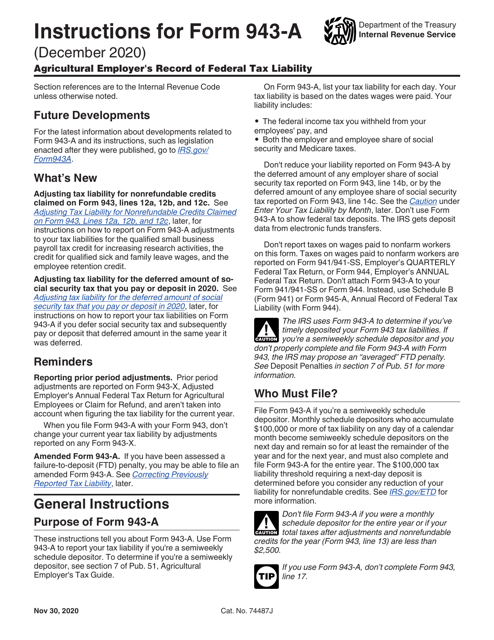

Download Instructions for IRS Form 943A Agricultural Employer's Record

Making payment with form 943 to avoid. Employer’s annual federal tax return for agricultural employees. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Missouri tax identification number, federal employer identification number, or charter number. We will use.

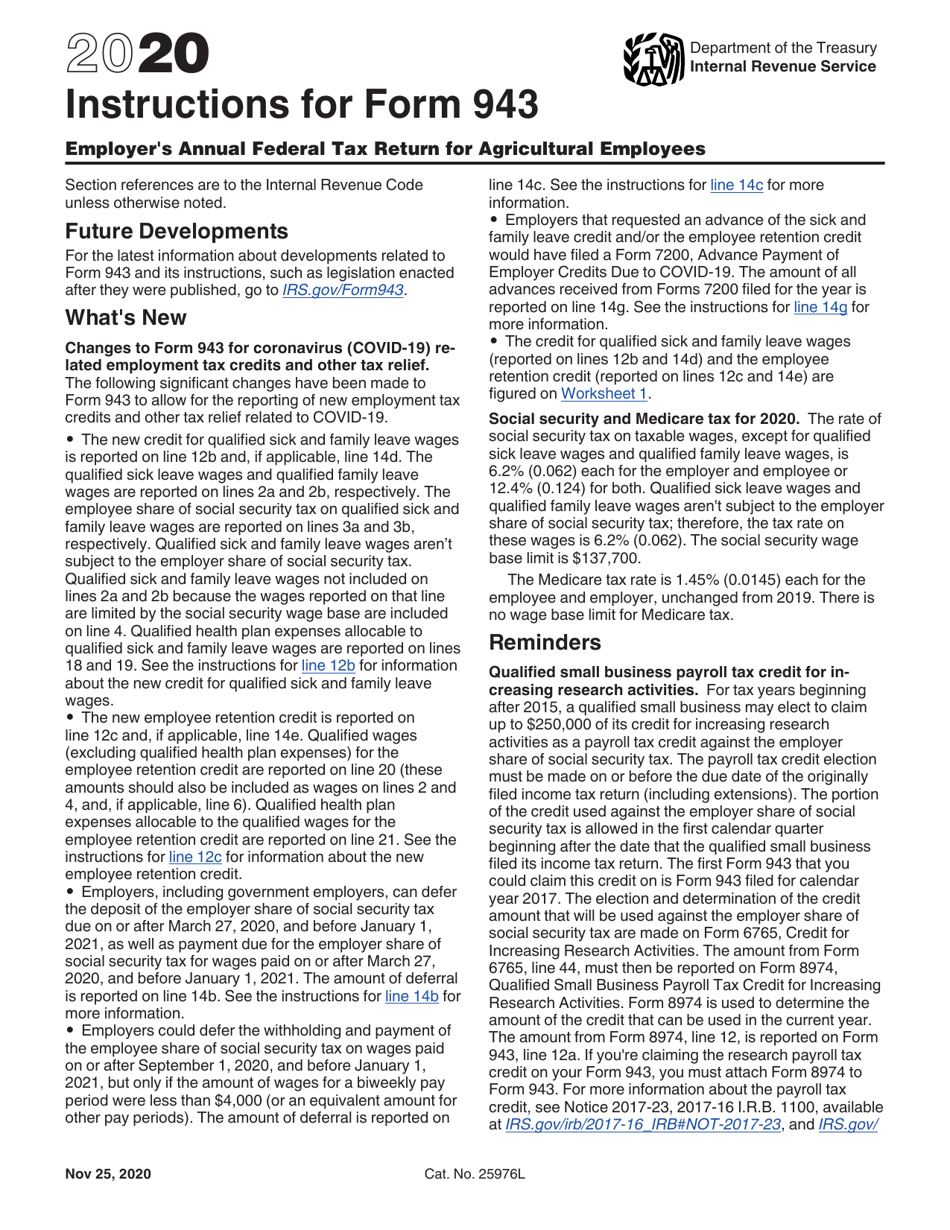

Download Instructions for IRS Form 943 Employer's Annual Federal Tax

Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26,.

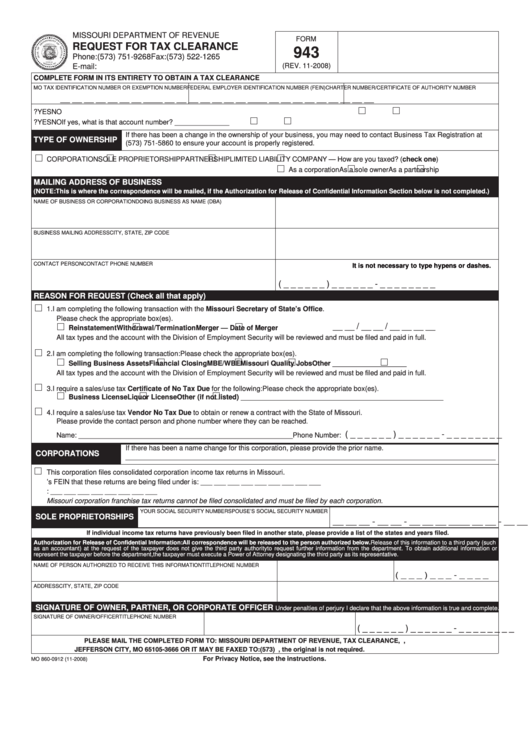

Fillable Form 943 Request For Tax Clearance 2008 printable pdf download

Missouri tax identification number, federal employer identification number, or charter number. Select form 943 and enter. Line by line instruction for 2022. This checklist provides guidance for preparing and reviewing form 943 (employer’s annual federal tax return for agricultural employees). Making payment with form 943 to avoid.

Form 943 Edit, Fill, Sign Online Handypdf

Making payment with form 943 to avoid. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. Missouri tax identification number, federal employer identification number, or charter number. Web irs form 943: Employer’s annual federal tax return for agricultural employees.

2019 form 943 Fill Online, Printable, Fillable Blank form943

To determine if you're a semiweekly schedule. Web form 943 missouri department of revenue request for tax clearance missouri tax i.d. Select form 943 and enter. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web generally, you must file your form 943 by january.

Form 943 What You Need to Know About Agricultural Withholding

Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. The instructions include five worksheets similar to those in form. Department of the treasury internal revenue service. Web generally, you must file your form 943 by january 31 of.

IRS Form 943 Complete PDF Tenplate Online in PDF

Department of the treasury internal revenue service. Who must file form 943? Employer’s annual federal tax return for agricultural employees. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. We will use the completed voucher to credit your.

943 Fillable and Editable PDF Template

How should you complete form 943? Making payment with form 943 to avoid. To determine if you're a semiweekly schedule. Department of the treasury internal revenue service. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

2022 irs form 943 instructions Fill Online, Printable, Fillable Blank

Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document. Create a free taxbandits account or login if you have one already step 2: Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages. Web simply.

Select Form 943 And Enter.

Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web generally, you must file your form 943 by january 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your. Web corrections to amounts reported on form 943, lines 12d, 14f, 22, 23, 24, 25, 26, and 27, for the credit for qualified sick and family leave wages for leave taken after march 31,. Web form 943, employer's annual federal tax return for agricultural employees, is a form agricultural employers use to report taxes withheld from employees' wages.

Web Simply Follow The Steps Below To File Your Form 943:

This checklist provides guidance for preparing and reviewing form 943 (employer’s annual federal tax return for agricultural employees). Web form 943 missouri department of revenue request for tax clearance missouri tax i.d. Form 943 (employer’s annual federal tax. Employer’s annual federal tax return for agricultural employees.

Create A Free Taxbandits Account Or Login If You Have One Already Step 2:

Web irs form 943 instructions. Missouri tax identification number, federal employer identification number, or charter number. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Department of the treasury internal revenue service.

Who Must File Form 943?

The instructions include five worksheets similar to those in form. How should you complete form 943? Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Like many tax forms, form 943 requires you to include various information and calculations on different lines within the document.