Form 944 Tax Return

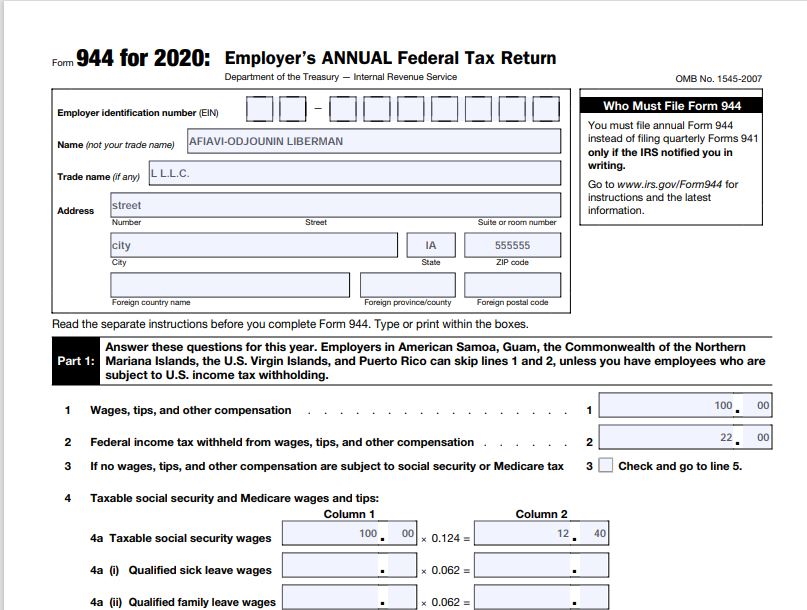

Form 944 Tax Return - Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web for updated information on form 944, visit about form 944, employer’s annual federal tax return. Web finalized versions of the 2020 form 944 and its instructions are available. Ad access irs tax forms. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Complete, edit or print tax forms instantly. Web form 944, employer’s annual federal tax return irs form 944 is designed to assist small business owners who are eligible to file their employment taxes (social security,. Every employer in the united states is familiar with form 941, formally titled the employer's quarterly federal tax return, which is required to be filed with the internal.

Web finalized versions of the 2020 form 944 and its instructions are available. As an employer, you must withhold certain taxes from your. When you file irs form 944,. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Complete irs tax forms online or print government tax documents. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web more from h&r block. Ad access irs tax forms.

Why the irs requires employers to file it; Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. Web form 944, employer’s annual federal tax return irs form 944 is designed to assist small business owners who are eligible to file their employment taxes (social security,. Web in this guide, we’re talking about irs form 944, the employer’s annual federal tax return, including: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Web annual employment tax return. Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. The deadline for filing the form is feb.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Complete, edit or print tax forms instantly. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. Data may be imported from the 941 payroll. Web show sources > about the corporate income tax the irs and most states require corporations to.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

The finalized versions of the 2020 form. Form 944 (employer’s annual federal tax return) is used by employers with an annual employment tax liability of $1,000 or less. When you file irs form 944,. Web in this guide, we’re talking about irs form 944, the employer’s annual federal tax return, including: The deadline for filing the form is feb.

Form 944 Employer's Annual Federal Tax Return Workful

When you file irs form 944,. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web more from h&r block. The finalized versions of the 2020 form.

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

Form 944 (employer’s annual federal tax return) is used by employers with an annual employment tax liability of $1,000 or less. The deadline for filing the form is feb. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. Get ready for.

IRS Form 944 Employer's Annual Federal Tax Return

As a small business owner, one of your many responsibilities is to ensure. Web finalized versions of the 2020 form 944 and its instructions are available. Why the irs requires employers to file it; As an employer, you must withhold certain taxes from your. Ad access irs tax forms.

IRS Form 944 Download Printable PDF 2019, Employer's ANNUAL Federal Tax

Why the irs requires employers to file it; Complete, edit or print tax forms instantly. As a small business owner, one of your many responsibilities is to ensure. Form 944 (employer’s annual federal tax return) is used by employers with an annual employment tax liability of $1,000 or less. The deadline for filing the form is feb.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

As a small business owner, one of your many responsibilities is to ensure. The deadline for filing the form is feb. Why the irs requires employers to file it; Employers are required to report the amounts they withhold from an employee’s pay check and the employer portion of social security/medicare on the. Form 944 (employer’s annual federal tax return) is.

Form 944 YouTube

Ad access irs tax forms. Web form 944, employer’s annual federal tax return irs form 944 is designed to assist small business owners who are eligible to file their employment taxes (social security,. Federal tax return for small businesses download form 944 introduction. When you file irs form 944,. Web form 944 is an irs tax form that reports the.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

As a small business owner, one of your many responsibilities is to ensure. Why the irs requires employers to file it; Web in this guide, we’re talking about irs form 944, the employer’s annual federal tax return, including: Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly.

How to Complete Form 944 Employer's Annual Federal Tax return YouTube

The finalized versions of the 2020 form. When you file irs form 944,. Data may be imported from the 941 payroll. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

When You File Irs Form 944,.

Ad access irs tax forms. As a small business owner, one of your many responsibilities is to ensure. Complete, edit or print tax forms instantly. Employers are required to report the amounts they withhold from an employee’s pay check and the employer portion of social security/medicare on the.

Federal Tax Return For Small Businesses Download Form 944 Introduction.

Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Why the irs requires employers to file it; Web form 944, employer’s annual federal tax return irs form 944 is designed to assist small business owners who are eligible to file their employment taxes (social security,. The deadline for filing the form is feb.

Web For Updated Information On Form 944, Visit About Form 944, Employer’s Annual Federal Tax Return.

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Complete, edit or print tax forms instantly. Web in this guide, we’re talking about irs form 944, the employer’s annual federal tax return, including: Every employer in the united states is familiar with form 941, formally titled the employer's quarterly federal tax return, which is required to be filed with the internal.

Web Show Sources > About The Corporate Income Tax The Irs And Most States Require Corporations To File An Income Tax Return, With The Exact Filing Requirements Depending On.

As an employer, you must withhold certain taxes from your. The finalized versions of the 2020 form. Form 944 (employer’s annual federal tax return) is used by employers with an annual employment tax liability of $1,000 or less. Web more from h&r block.

/GettyImages-182660354-577bfcf95f9b585875bcac41.jpg)