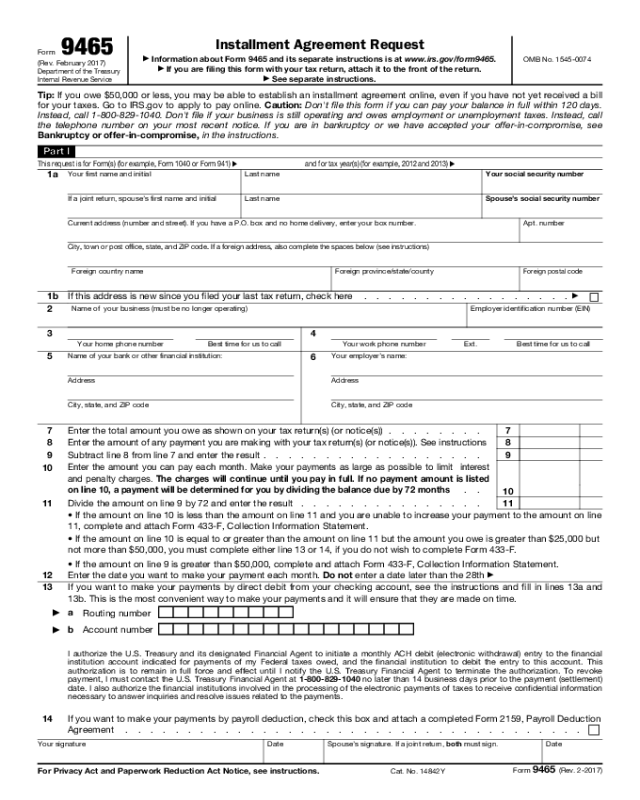

Form 9465 Online Payment Agreement

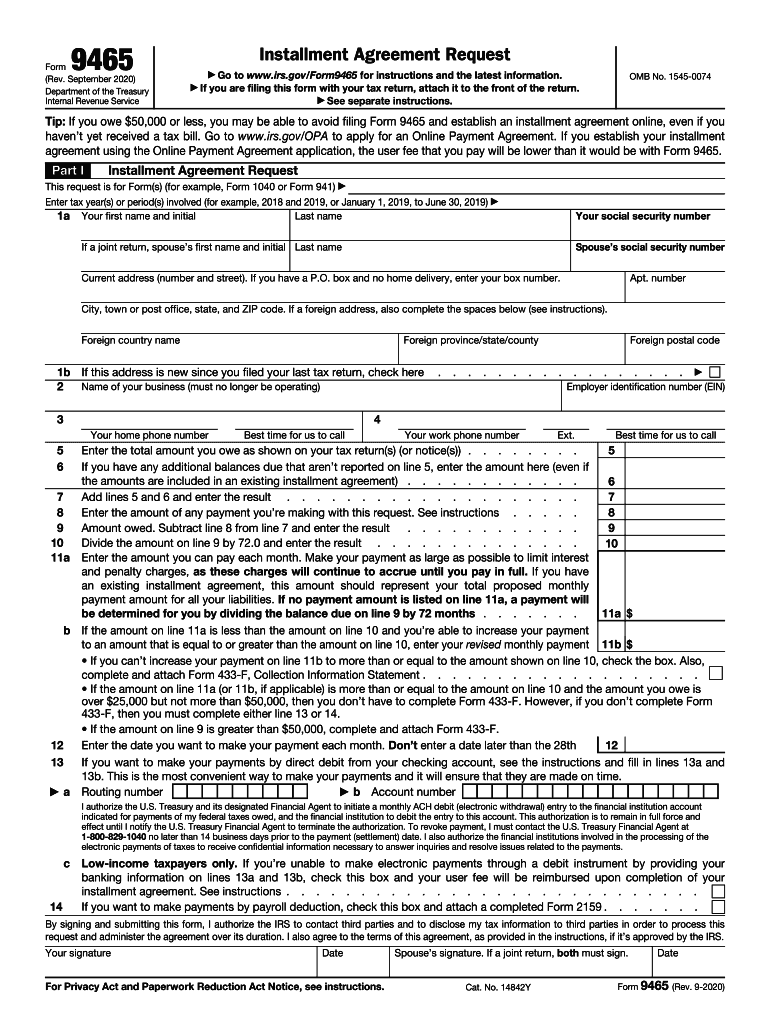

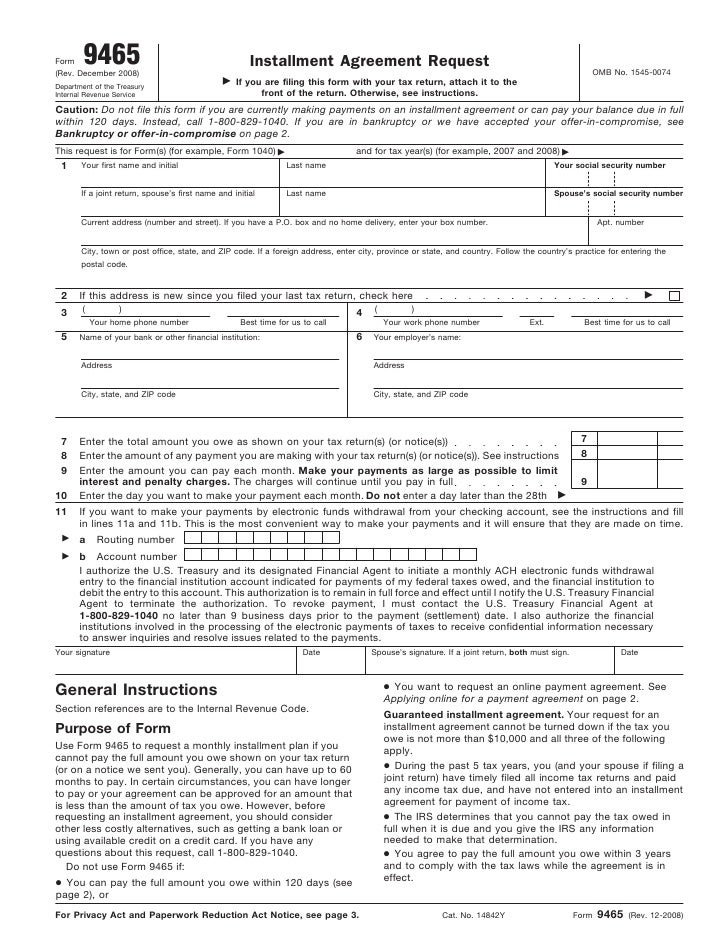

Form 9465 Online Payment Agreement - Web go to www.irs.gov/opa to apply for an online payment agreement. Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465 (installment agreement request) to request a payment plan. Web below is the setup fee for online, mail or phone filing options: Complete this form to request an installment payment agreement with the irs for unpaid taxes. If you can’t or choose not to use. Web 9465 installment agreement request (rev. Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. Web the irs offers these taxpayers the option to pay current tax credits with monthly payment arrangements through the irs`s online payment agreement program. If you establish your installment agreement using the online payment agreement application, the user fee. December 2011) if you are filing this form with your tax return, attach it to the front of the return.

No setup fee if you apply online, by mail, phone or at a physical location;. The irs encourages you to pay a portion of the. Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465 (installment agreement request) to request a payment plan. Web the irs offers these taxpayers the option to pay current tax credits with monthly payment arrangements through the irs`s online payment agreement program. Web below is the setup fee for online, mail or phone filing options: Complete this form to request an installment payment agreement with the irs for unpaid taxes. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web more about the federal form 9465 individual income tax ty 2022. Get ready for tax season deadlines by completing any required tax forms today. Web 9465 installment agreement request (rev.

Complete this form to request an installment payment agreement with the irs for unpaid taxes. Ad register and subscribe now to work on your irs 9465 instructions & more fillable forms. Web this summary does not include information you would need to provide when requesting a payment agreement online. Web go to www.irs.gov/opa to apply for an online payment agreement. Web the irs offers these taxpayers the option to pay current tax credits with monthly payment arrangements through the irs`s online payment agreement program. Web more about the federal form 9465 individual income tax ty 2022. If you can’t or choose not to use. Web if you don’t qualify for the online payment agreement program, opa will provide instructions on available alternatives. The irs encourages you to pay a portion of the. Get ready for tax season deadlines by completing any required tax forms today.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

The irs encourages you to pay a portion of the. Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465 (installment agreement request) to request a payment plan. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Complete this.

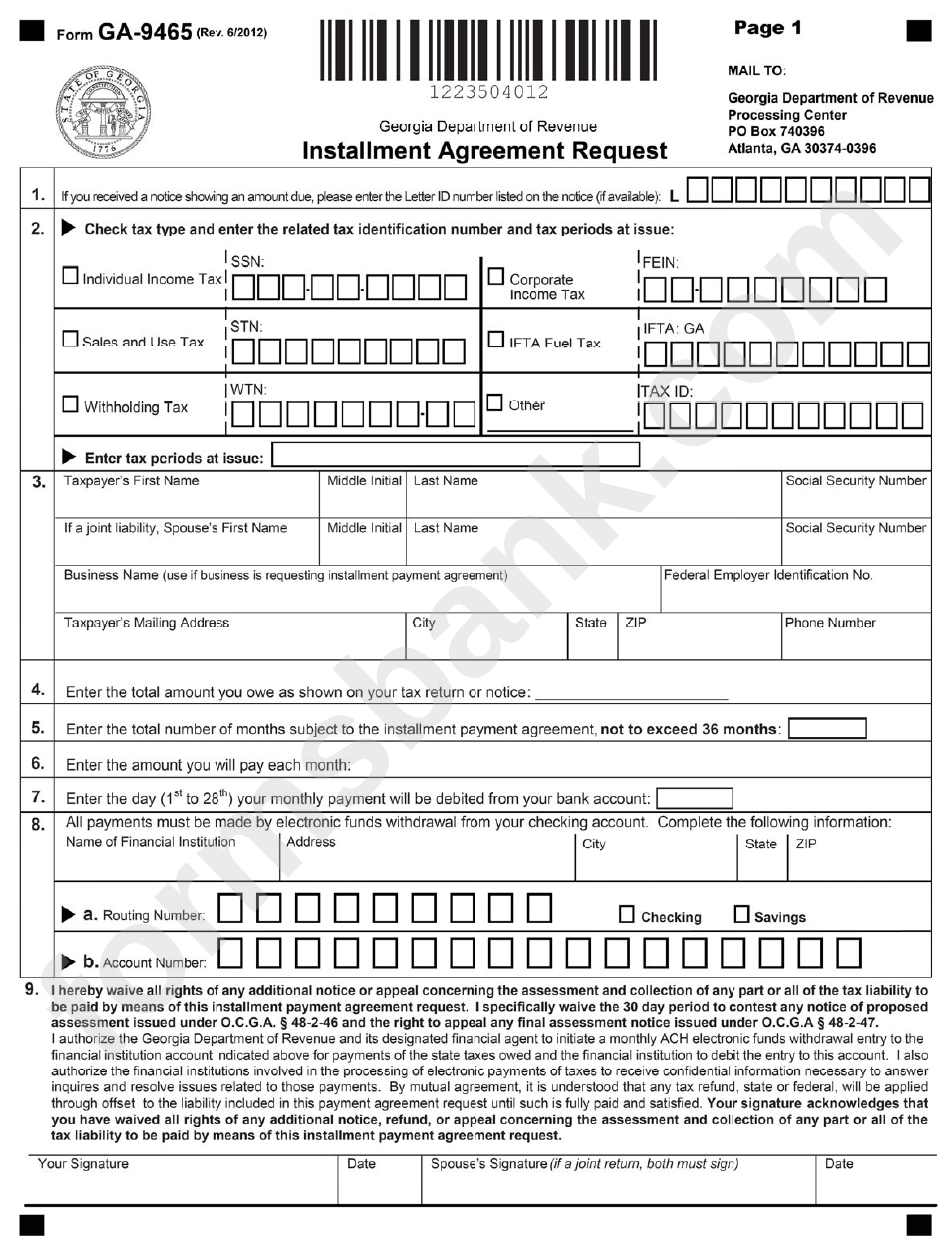

Form Ga9465 Installment Agreement Request printable pdf download

Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web below is the setup fee for online, mail or phone filing options: Web if you cannot use the irs’s online payment agreement or you don’t want.

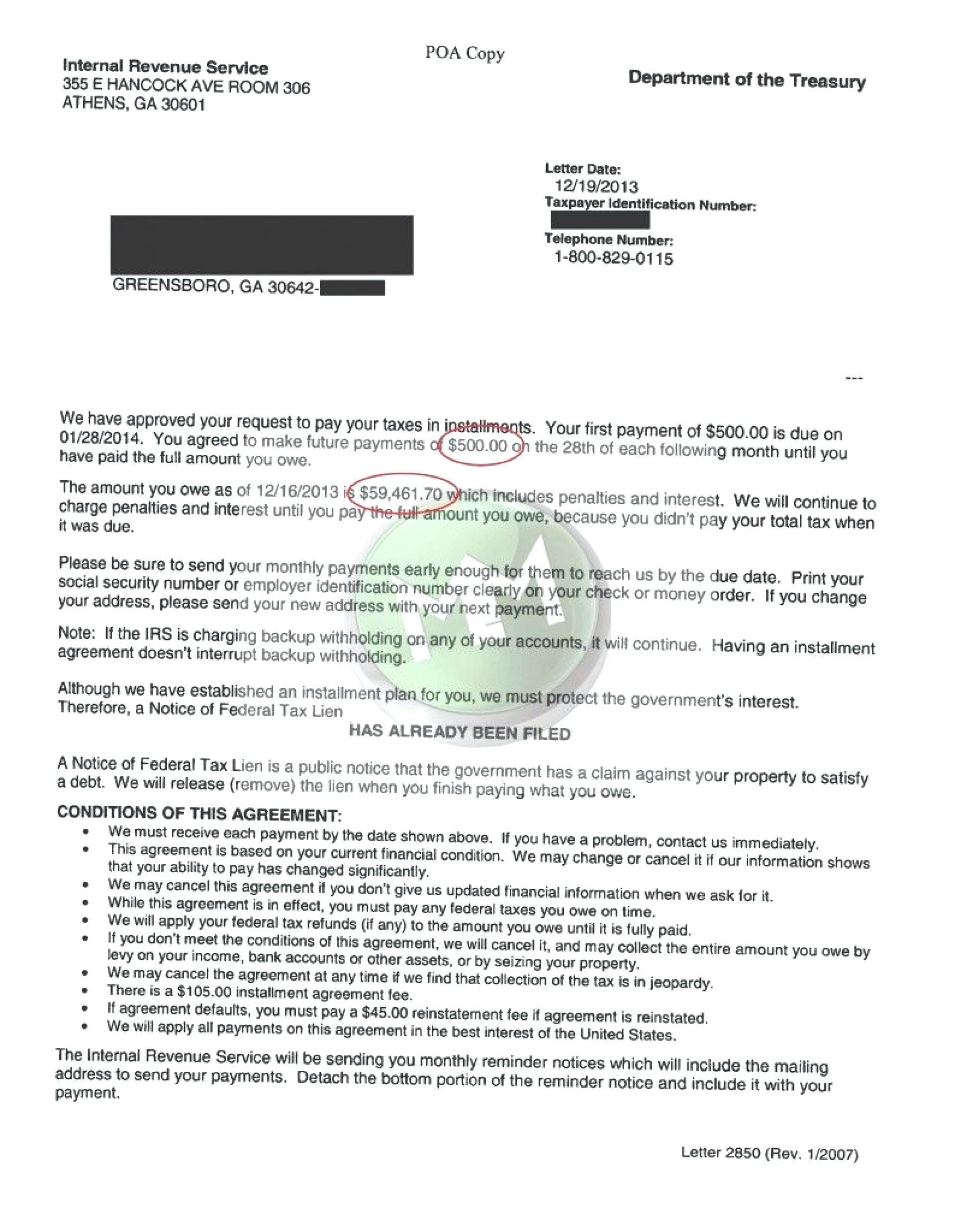

How Do I Set Up an Installment Agreement; IRS Just Sent Me Form 9465

Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. Web this summary does not include information you would need to provide when requesting a payment agreement online. Web below is the setup fee for online, mail or phone filing options:.

Irs form 9465 Fillable How to Plete Irs form 9465 Installment Agreement

Get ready for tax season deadlines by completing any required tax forms today. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. If you can’t or choose not to use. No setup fee if you apply online, by mail, phone or at a physical location;. Web 9465 installment agreement request form (rev.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

If you establish your installment agreement using the online payment agreement application, the user fee. Web 9465 installment agreement request form (rev. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web more about the federal form 9465 individual income tax ty 2022. Web irs form.

20202023 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

No setup fee if you apply online, by mail, phone or at a physical location;. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107.

IRS Form 9465 Installment Agreement Request

Web 9465 installment agreement request form (rev. Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465 (installment agreement request) to request a payment plan. Web this summary does not include information you would need to provide when requesting a payment agreement online. Web use form 9465.

How to Use Form 9465 Instructions for Your IRS Payment Plan Tax

Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Complete this form to request an installment payment agreement with the irs for unpaid taxes. Web 9465 installment agreement request.

Form 9465Installment Agreement Request

Complete this form to request an installment payment agreement with the irs for unpaid taxes. Web if you don’t qualify for the online payment agreement program, opa will provide instructions on available alternatives. Web 9465 installment agreement request (rev. Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use.

Form 9465 Edit, Fill, Sign Online Handypdf

Web below is the setup fee for online, mail or phone filing options: Web more about the federal form 9465 individual income tax ty 2022. December 2011) if you are filing this form with your tax return, attach it to the front of the return. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t.

Web More About The Federal Form 9465 Individual Income Tax Ty 2022.

If you can’t or choose not to use. Web 9465 installment agreement request form (rev. If you establish your installment agreement using the online payment agreement application, the user fee. Web the user fee for requesting an installment agreement using form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account.

Web Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice We Sent You).

Get ready for tax season deadlines by completing any required tax forms today. Web the irs offers these taxpayers the option to pay current tax credits with monthly payment arrangements through the irs`s online payment agreement program. Web this summary does not include information you would need to provide when requesting a payment agreement online. The irs encourages you to pay a portion of the.

Complete This Form To Request An Installment Payment Agreement With The Irs For Unpaid Taxes.

Web go to www.irs.gov/opa to apply for an online payment agreement. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Web below is the setup fee for online, mail or phone filing options:

Ad Register And Subscribe Now To Work On Your Irs 9465 Instructions & More Fillable Forms.

Web irs form 9465 installment agreement request is used to request a monthly installment plan if you cannot pay the full amount you owe shown on your federal tax return. Web 9465 installment agreement request (rev. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). Web if you cannot use the irs’s online payment agreement or you don’t want to call the irs, you can use form 9465 (installment agreement request) to request a payment plan.