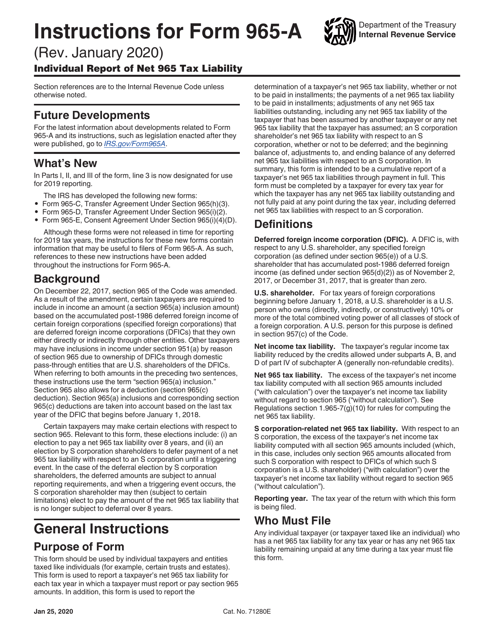

Form 965 A

Form 965 A - Web 501(a) is required to complete form 965 only if the section 965 amounts are subject to tax under section 511 (unrelated business income) or section 4940 (private foundation. January 2021) form 965 inclusion of deferred foreign income upon transition to participation exemption. Bad investments have left thurrock council effectively bankrupt. A person that is required to include amounts in income under section 965 of the code in its 2017 taxable year, whether because, the person is a united states shareholder of a. Section 965(a) inclusion amounts, section 965(c) deductions, foreign taxes deemed paid in connection with a section 965(a). Web most of the lines on form 965 are reserved. Web 956a who should use this form? § 965 (a) treatment of deferred foreign income as subpart f. Part i report of net 965 tax liability and election to pay in installments (a) year of. Appointing an authorised recipient to receive.

§ 965 (a) treatment of deferred foreign income as subpart f. Web 1 day agothe millionaire who cheated a council. Web treatment of deferred foreign income upon transition to participation exemption system of taxation § 965 i.r.c. Web name of taxpayer with a net 965 tax liability. Enter the line 3 total on form 1120, schedule c, line. Web 501(a) is required to complete form 965 only if the section 965 amounts are subject to tax under section 511 (unrelated business income) or section 4940 (private foundation. January 2021) form 965 inclusion of deferred foreign income upon transition to participation exemption. Web 1 day agothe climate scientist has tied her political fortunes to mexico’s leftwing president as she runs as the favourite to win next month’s ruling morena party nomination for. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Web the person’s total deduction under section 965(c) of the code.

Shareholder's section 965(a) inclusion amount form 965 (rev. Web purpose of form use form 965 to compute: Section 965(a) inclusion amounts, section 965(c) deductions, foreign taxes deemed paid in connection with a section 965(a). Web the person’s total deduction under section 965(c) of the code. Web this form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Web 1 day agothe climate scientist has tied her political fortunes to mexico’s leftwing president as she runs as the favourite to win next month’s ruling morena party nomination for. The person’s deemed paid foreign taxes with respect to the total amount required to be included in. This form is used to report a. Web 1 day agothe millionaire who cheated a council. A person that is required to include amounts in income under section 965 of the code in its 2017 taxable year, whether because, the person is a united states shareholder of a.

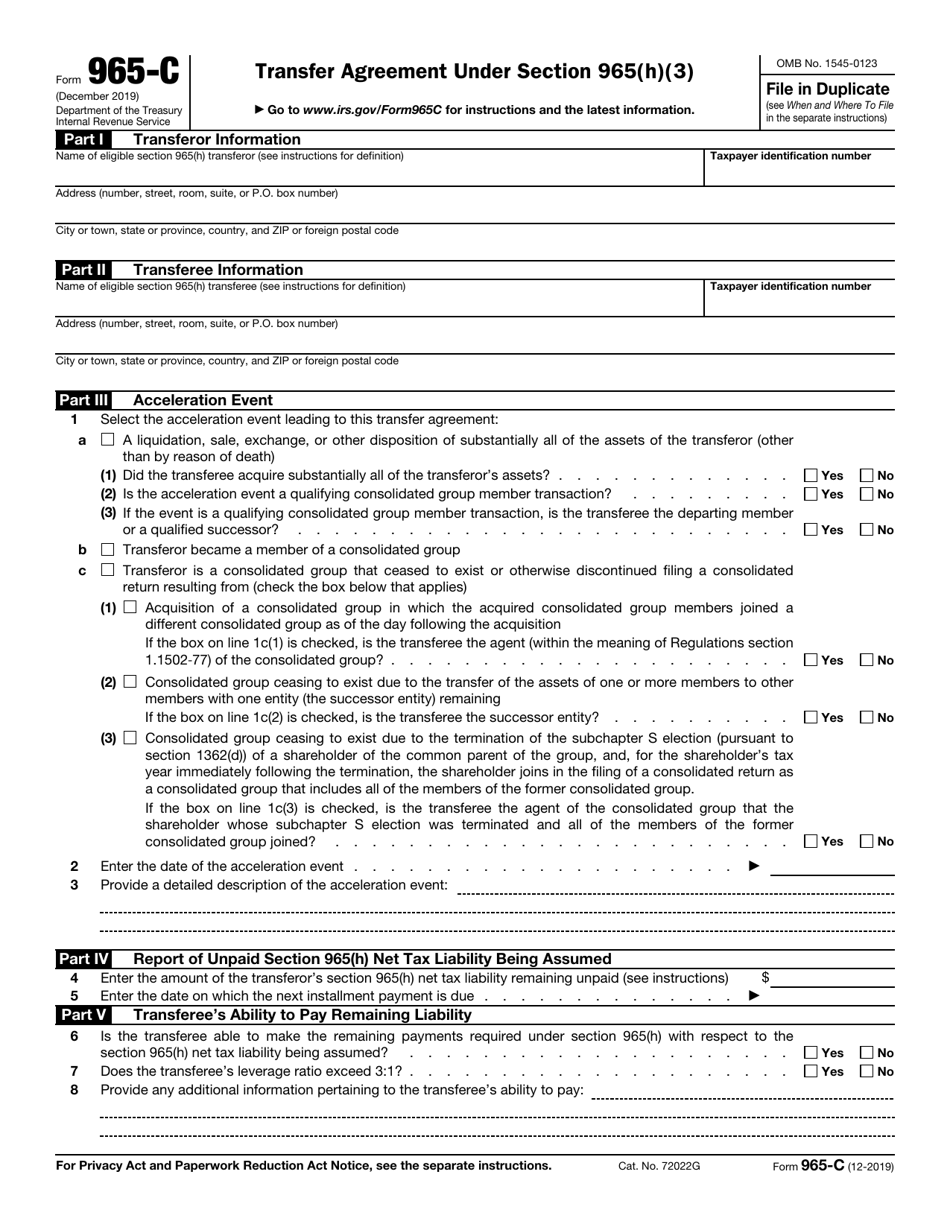

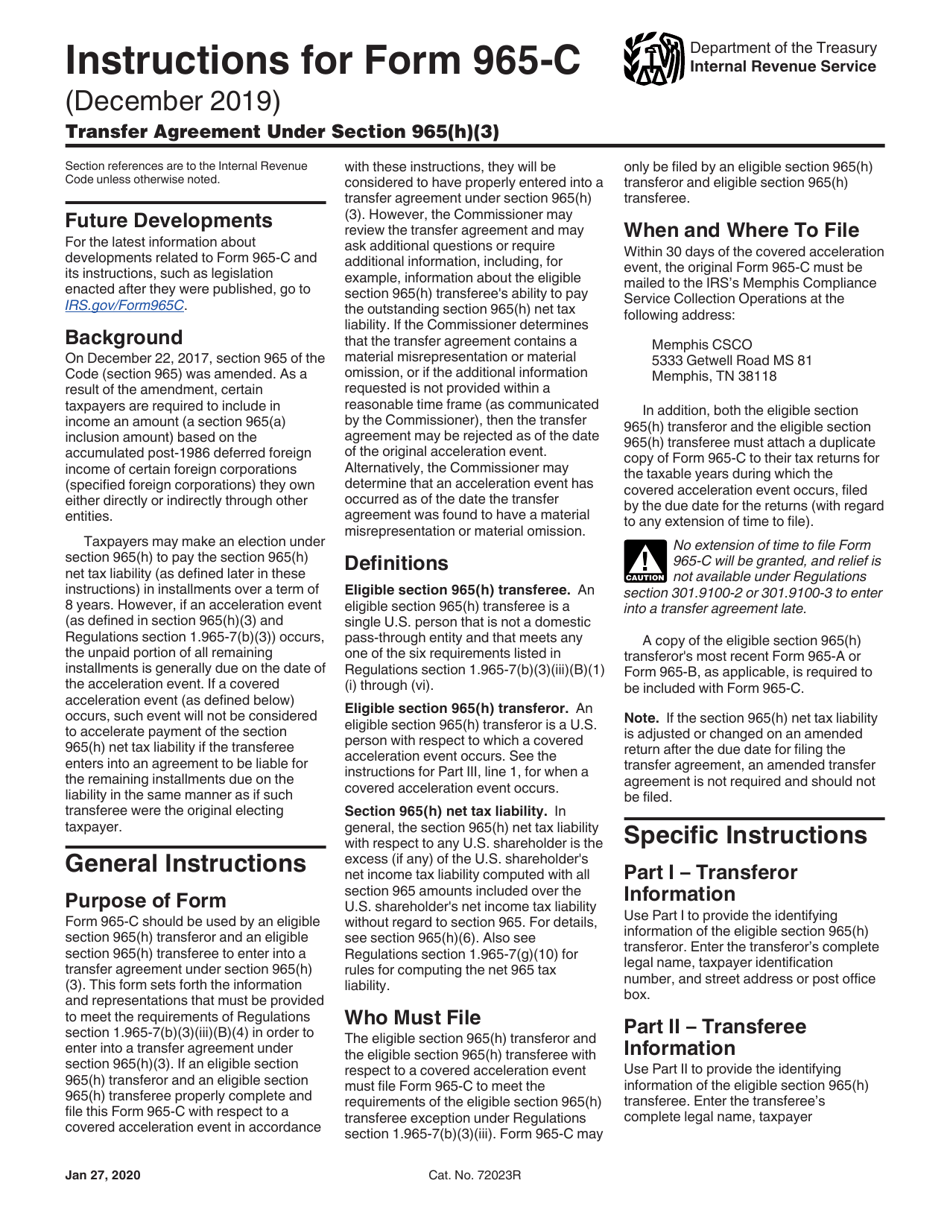

IRS Form 965C Download Fillable PDF or Fill Online Transfer Agreement

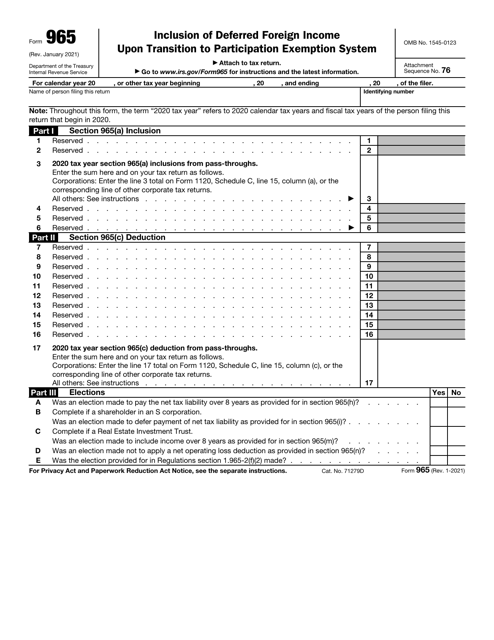

Web purpose of form use form 965 to compute: Appointing an authorised recipient to receive. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in pass. A person that is required to include amounts in income under section 965 of the code in its 2017 taxable year, whether because,.

IRS Form 965 Download Printable PDF, Instructions for IRS Form 965

This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). The person’s deemed paid foreign taxes with respect to the total amount required to be included in. Web purpose of form use form 965 to compute: Enter the sum here and on your tax return as follows. This form is used.

Download Instructions for IRS Form 965A Individual Report of Net 965

Enter the line 3 total on form 1120, schedule c, line. When and where to file. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). § 965 (a) treatment of deferred foreign income as subpart f. Enter the sum here and on your tax return as follows.

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

Shareholder's section 965(a) inclusion amount form 965 (rev. January 2021) form 965 inclusion of deferred foreign income upon transition to participation exemption. Part i report of net 965 tax liability and election to pay in installments (a) year of. This form is used to report a taxpayer’s net 965 tax. You can download or print.

IRS Form 965 Download Fillable PDF or Fill Online Inclusion of Deferred

This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Section 965(a) inclusion amounts, section 965(c) deductions, foreign taxes deemed paid in connection with a section 965(a). Part i report of net 965 tax liability and election to pay in installments (a) year of. This form is used to report a..

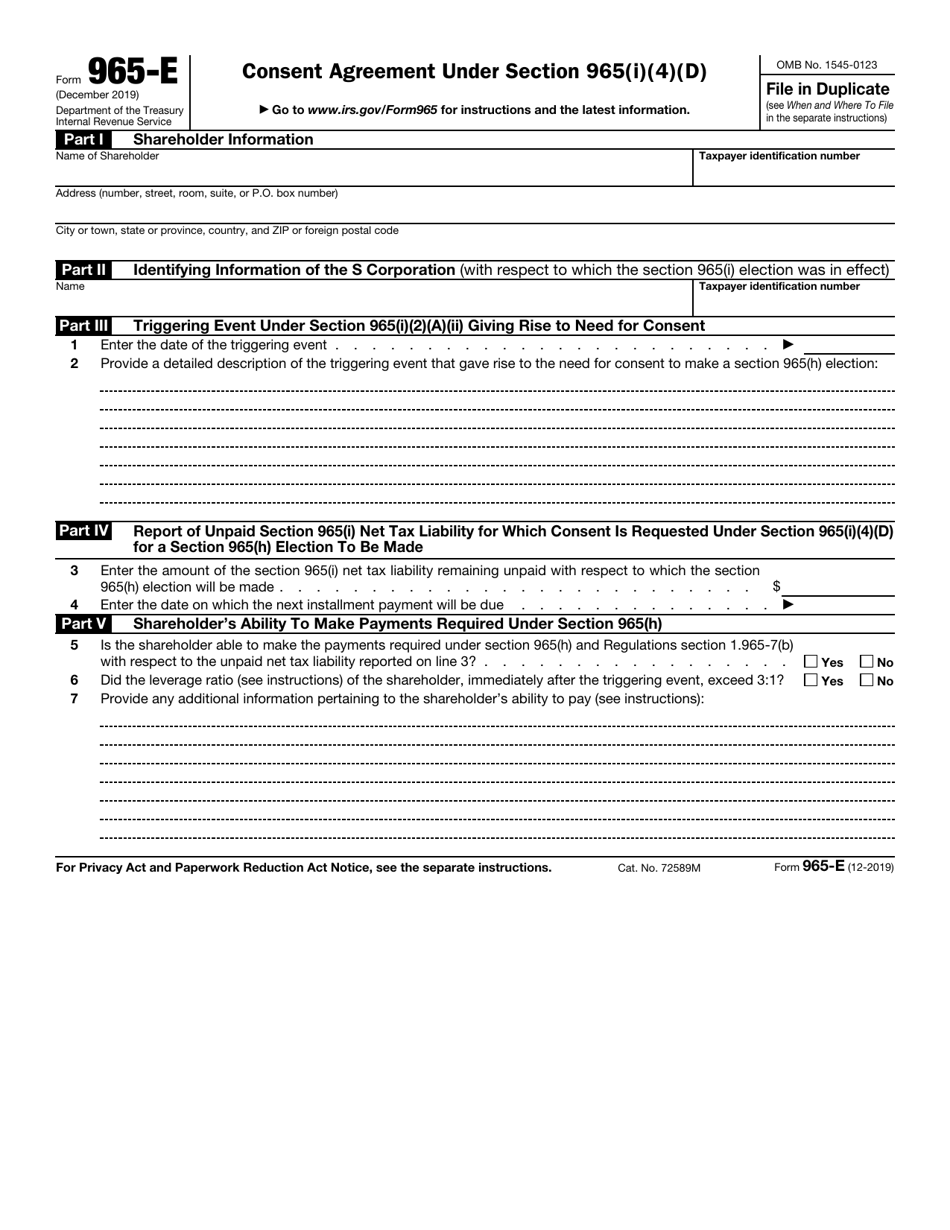

IRS Form 965E Download Fillable PDF or Fill Online Consent Agreement

Enter the sum here and on your tax return as follows. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in pass. Bad investments have left thurrock council effectively bankrupt..

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

Web the person’s total deduction under section 965(c) of the code. Bronagh munro reveals how a businessman spent council. Web treatment of deferred foreign income upon transition to participation exemption system of taxation § 965 i.r.c. Web 1 day agothe millionaire who cheated a council. Web 956a who should use this form?

Download Instructions for IRS Form 965C Transfer Agreement Under

This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Appointing an authorised recipient to receive. Web most of the lines on form 965 are reserved. January 2021) form 965 inclusion of deferred foreign income upon transition to participation exemption. Enter the line 3 total on form 1120, schedule c, line.

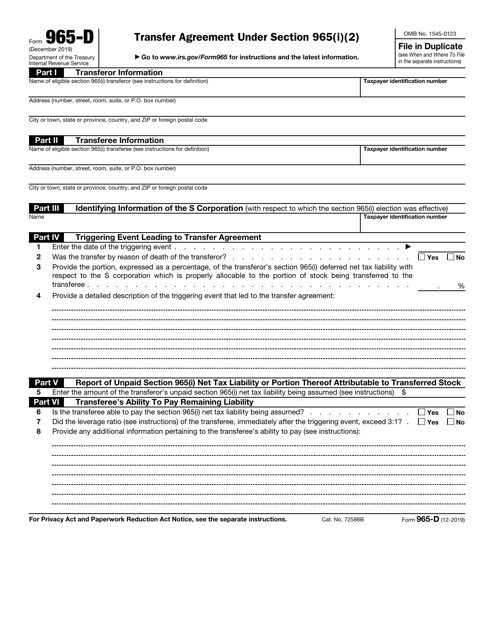

IRS Form 965D Download Fillable PDF or Fill Online Transfer Agreement

Web 1 day agothe climate scientist has tied her political fortunes to mexico’s leftwing president as she runs as the favourite to win next month’s ruling morena party nomination for. Enter the sum here and on your tax return as follows. Web 501(a) is required to complete form 965 only if the section 965 amounts are subject to tax under.

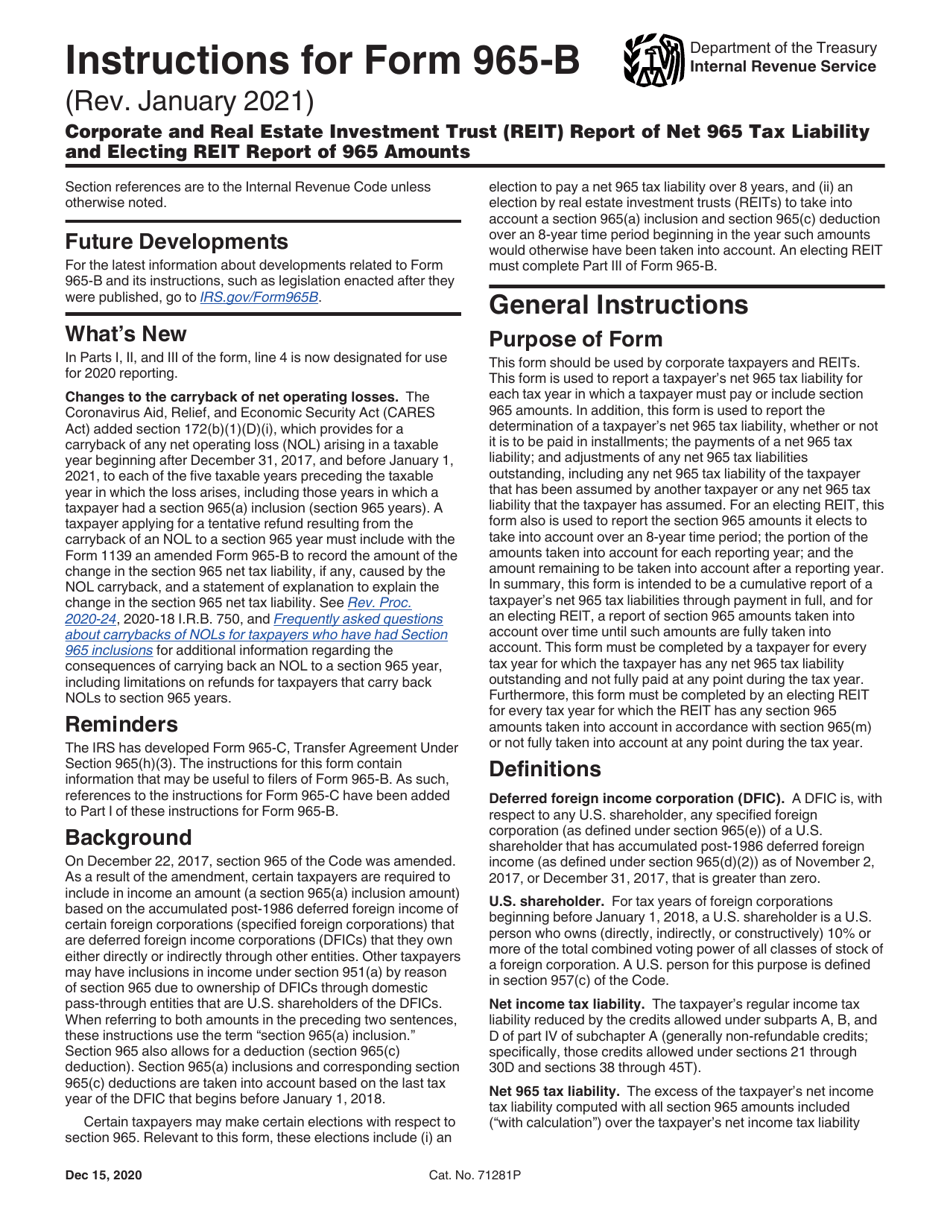

Download Instructions for IRS Form 965B Corporate and Real Estate

§ 965 (a) treatment of deferred foreign income as subpart f. January 2021) form 965 inclusion of deferred foreign income upon transition to participation exemption. The person’s deemed paid foreign taxes with respect to the total amount required to be included in. When and where to file. Section 965(a) inclusion amounts, section 965(c) deductions, foreign taxes deemed paid in connection.

Appointing An Authorised Recipient To Receive.

Web this form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in pass. Web 1 day agothe climate scientist has tied her political fortunes to mexico’s leftwing president as she runs as the favourite to win next month’s ruling morena party nomination for. Web 956a who should use this form?

This Form Is Used To Report A Taxpayer’s Net 965 Tax.

Bronagh munro reveals how a businessman spent council. Shareholder's section 965(a) inclusion amount form 965 (rev. § 965 (a) treatment of deferred foreign income as subpart f. Web most of the lines on form 965 are reserved.

Web Treatment Of Deferred Foreign Income Upon Transition To Participation Exemption System Of Taxation § 965 I.r.c.

Web purpose of form use form 965 to compute: Bad investments have left thurrock council effectively bankrupt. Enter the line 3 total on form 1120, schedule c, line. Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of.

Web Section 965 Requires United States Shareholders (As Defined Under Section 951 (B)) To Pay A Transition Tax On The Untaxed Foreign Earnings Of Certain Specified Foreign Corporations As.

The person’s deemed paid foreign taxes with respect to the total amount required to be included in. When and where to file. Web name of taxpayer with a net 965 tax liability. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates).