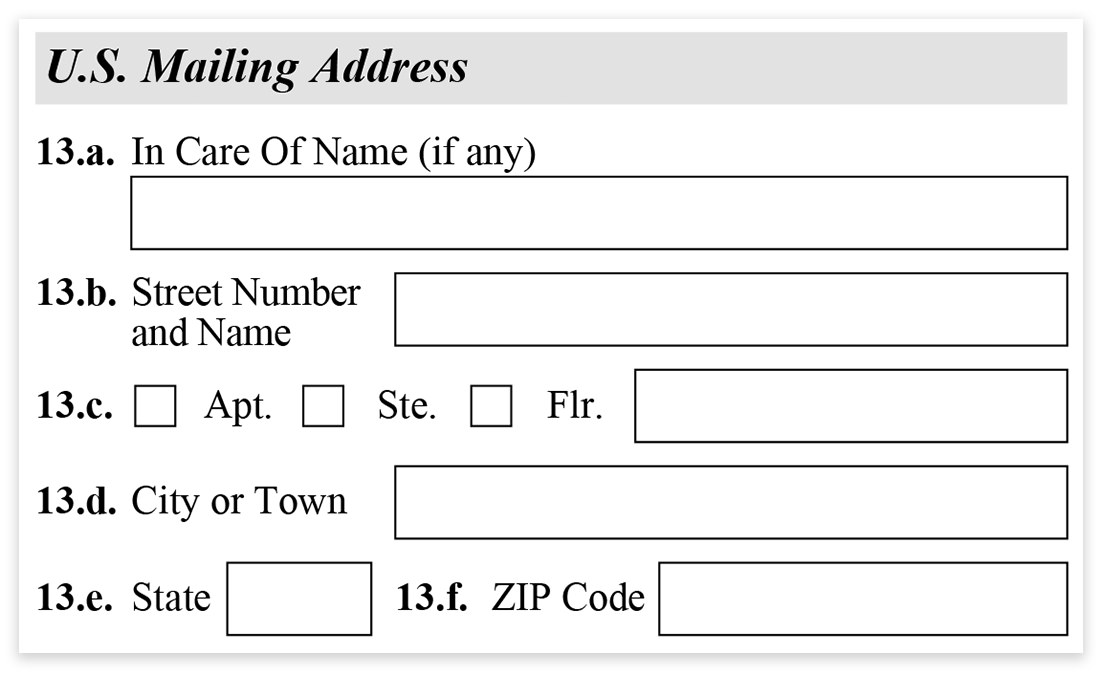

Form 966 Mailing Address

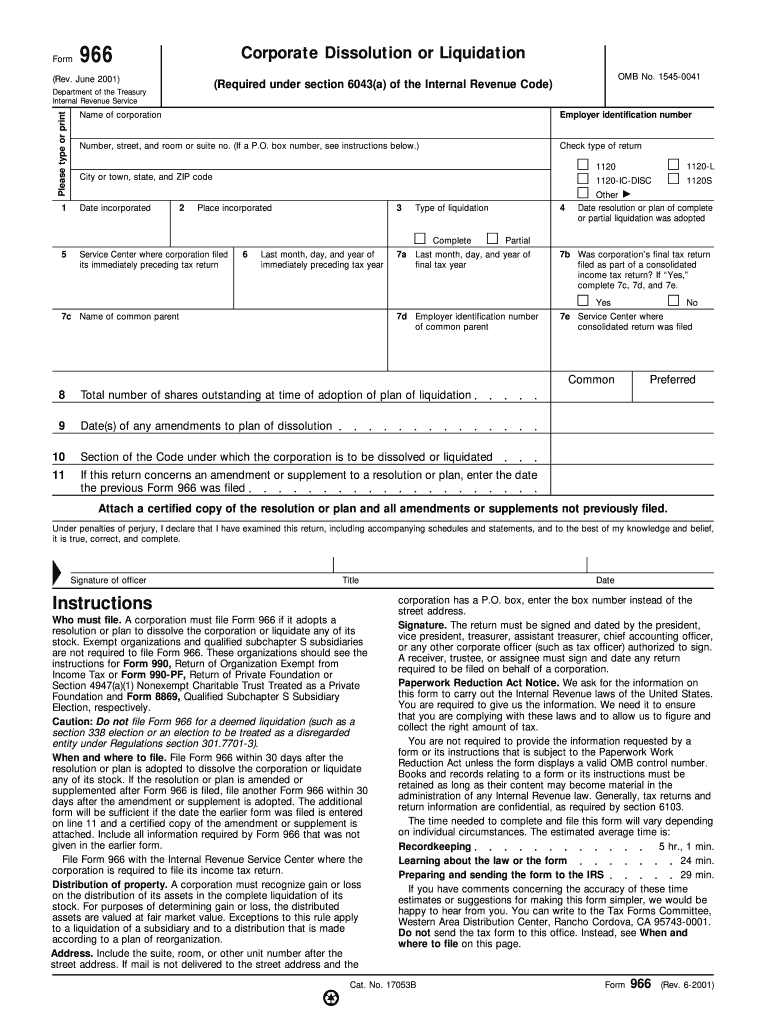

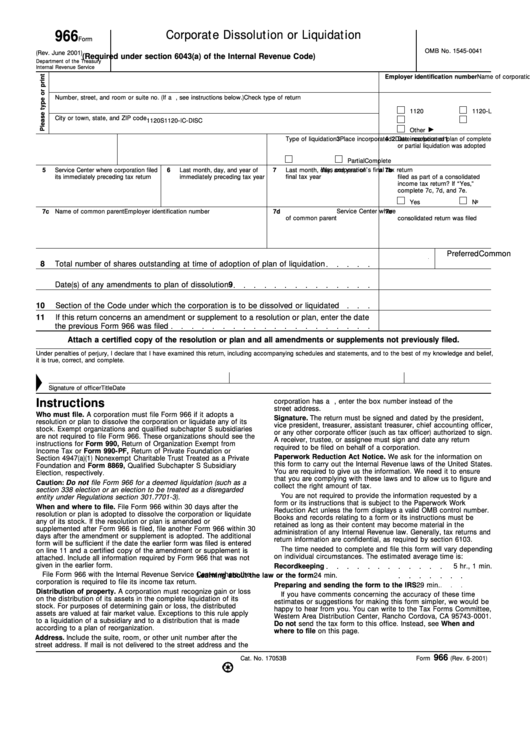

Form 966 Mailing Address - Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. These where to file addresses. Web at the address where the corporation (or cooperative) files its income tax return. Edit your printable form 966 online type text, add images, blackout confidential details, add comments, highlights and more. In this situation, you are responsible for notifying all. Exempt organizations and qualified subchapter s subsidiaries should not file form 966. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web form 8966 (2022) page. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Web a qi, wp, or wt must file form 8966 to report on its accounts, partners, beneficiaries, or owners, as applicable and as provided in its qi, wp, or wt agreement.

These where to file addresses. ( to obtain a copy of a form, instruction, or publication) address to mail form to. Web 45 rows addresses for forms beginning with the number 1. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire,. Form 966 instructions are to file it where the corporation files its income tax. Web form 966 irs filing address. Edit your printable form 966 online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type. In this situation, you are responsible for notifying all. The specific mailing address depends on the state where your corporation is based.

Where to file file form 966 with the internal revenue service center at the address where. Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. Web legal advice business advice i am trying to file a form 966, but do not have. Sign it in a few clicks draw your signature, type. I spoke to three irs agents and nobody informed me about the form 966 until i called back, the fourth agent told me i. Sign it in a few clicks draw your signature, type it,. Web are you going to dissolve your corporation during the tax year? Web form 8966 (2022) page. ( to obtain a copy of a form, instruction, or publication) address to mail form to. Where to mail form 966.

Form 966 Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire,. Q&a asked in wichita, ks | feb 13, 2019 save i am trying to file a form 966, but. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. In this situation, you are responsible for notifying all..

DCYF Form 09966 Download Fillable PDF or Fill Online Authorization to

Web include all information required by form 966 that was not given in the earlier form. Web form 966 irs filing address. Sign it in a few clicks draw your signature, type. Web form 8966 (2022) page. Web mailing addresses for forms 1120.

Mailing Address Update Form Template JotForm

Web follow these steps to generate form 966 in the corporate module:go to screen 57, dissolution/liquidation (966).check the box labeled print form 966 with. Web form 8966 (2022) page. ( to obtain a copy of a form, instruction, or publication) address to mail form to. Make sure to file irs form 966 after you adopt a plan of dissolution for.

Form I485 part 1 US Mailing Address Immigration Learning Center

Web include all information required by form 966 that was not given in the earlier form. Web i already filed my final return w/ the irs. ( to obtain a copy of a form, instruction, or publication) address to mail form to. Sign it in a few clicks draw your signature, type it,. Recalcitrant account holders with u.s.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. In this situation, you are responsible for notifying all. Where to mail form 966. The specific mailing address depends on the state where your corporation is based. Form 966 instructions.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Web file form 966 with the internal revenue service center at the applicable address shown below: Web follow these steps to generate form 966 in the corporate module:go to screen 57, dissolution/liquidation (966).check the box labeled print form 966 with. Web if you want to notify us by submitting the form, download and fill out an intent to file a.

Form 966 Corporate Dissolution Or Liquidation Department Of The

Web follow these steps to generate form 966 in the corporate module:go to screen 57, dissolution/liquidation (966).check the box labeled print form 966 with. Edit your printable form 966 online type text, add images, blackout confidential details, add comments, highlights and more. Recalcitrant account holders with u.s. Web mailing addresses for forms 1120. Edit your form online type text, add.

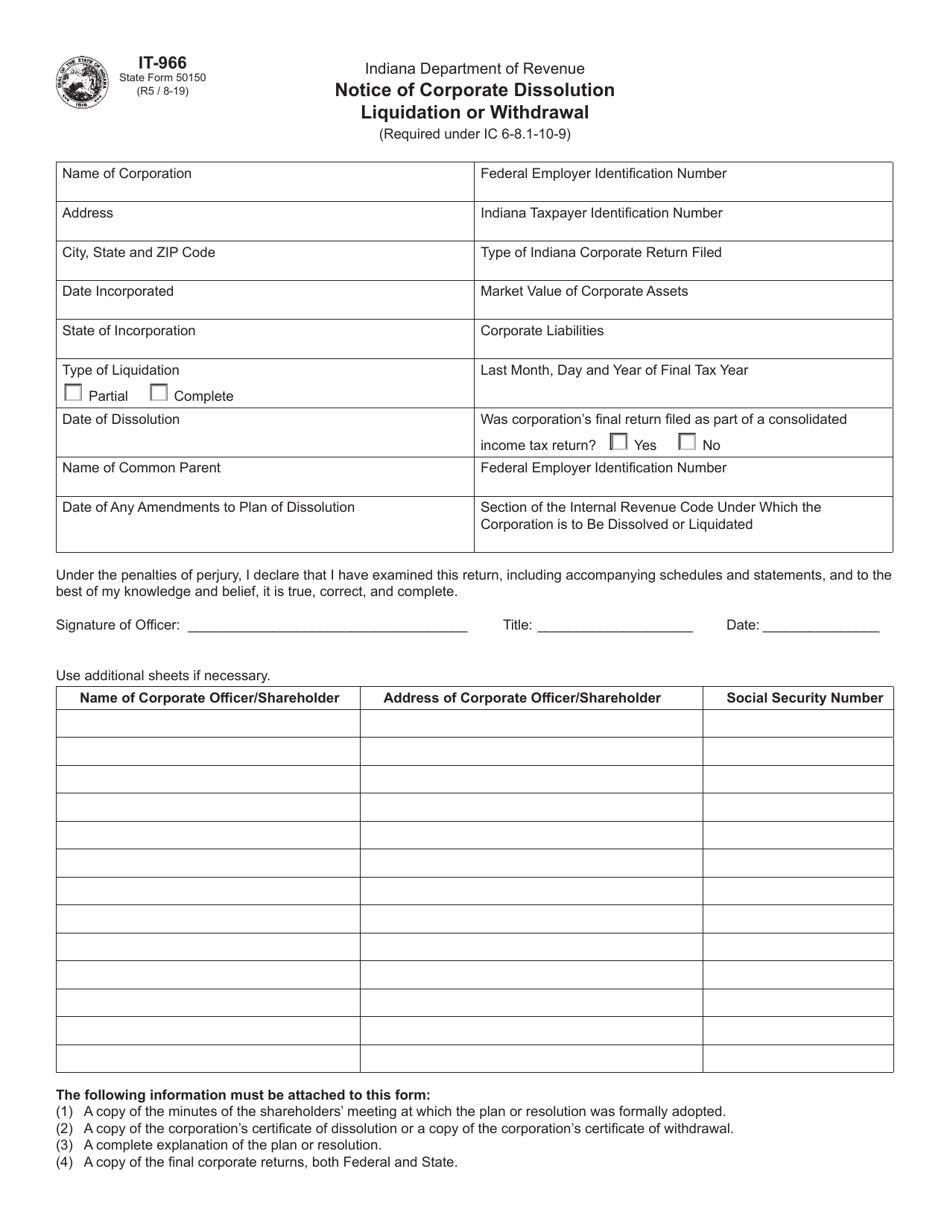

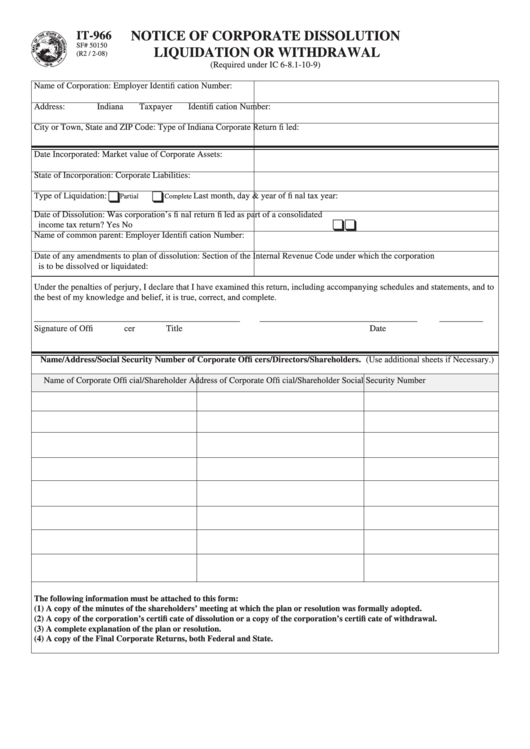

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Sign it in a few clicks draw your signature, type. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Web i already filed my final return w/ the irs. Where to mail form 966. I spoke to three irs agents and nobody informed me about the form.

Fillable Form It966 Notice Of Corporate Dissolution Liquidation Or

Web form 8966 (2022) page. Where to file file form 966 with the internal revenue service center at the address where. Web form 966 irs filing address. Edit your printable form 966 online type text, add images, blackout confidential details, add comments, highlights and more. Web at the address where the corporation (or cooperative) files its income tax return.

Medical Revenue Service Mailing Address integritydesignsnj

These where to file addresses. Web a qi, wp, or wt must file form 8966 to report on its accounts, partners, beneficiaries, or owners, as applicable and as provided in its qi, wp, or wt agreement. Exempt organizations and qualified subchapter s subsidiaries should not file form 966. Sign it in a few clicks draw your signature, type. Recalcitrant account.

Web Include All Information Required By Form 966 That Was Not Given In The Earlier Form.

Recalcitrant account holders with u.s. Web are you going to dissolve your corporation during the tax year? 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Web file form 966 with the internal revenue service center at the applicable address shown below:

Web At The Address Where The Corporation (Or Cooperative) Files Its Income Tax Return.

Edit your printable form 966 online type text, add images, blackout confidential details, add comments, highlights and more. Web if you want to notify us by submitting the form, download and fill out an intent to file a claim for compensation and/or pension, or survivors pension and/or dic. Web 45 rows addresses for forms beginning with the number 1. Web follow these steps to generate form 966 in the corporate module:go to screen 57, dissolution/liquidation (966).check the box labeled print form 966 with.

Web A Qi, Wp, Or Wt Must File Form 8966 To Report On Its Accounts, Partners, Beneficiaries, Or Owners, As Applicable And As Provided In Its Qi, Wp, Or Wt Agreement.

Web i already filed my final return w/ the irs. Web legal advice business advice i am trying to file a form 966, but do not have. Web form 8966 (2022) page. Web form 966 irs filing address.

Web Find Irs Mailing Addresses For Taxpayers And Tax Professionals Filing Individual Federal Tax Returns For Their Clients In Illinois.

Form 966 instructions are to file it where the corporation files its income tax. These where to file addresses. Sign it in a few clicks draw your signature, type it,. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation.