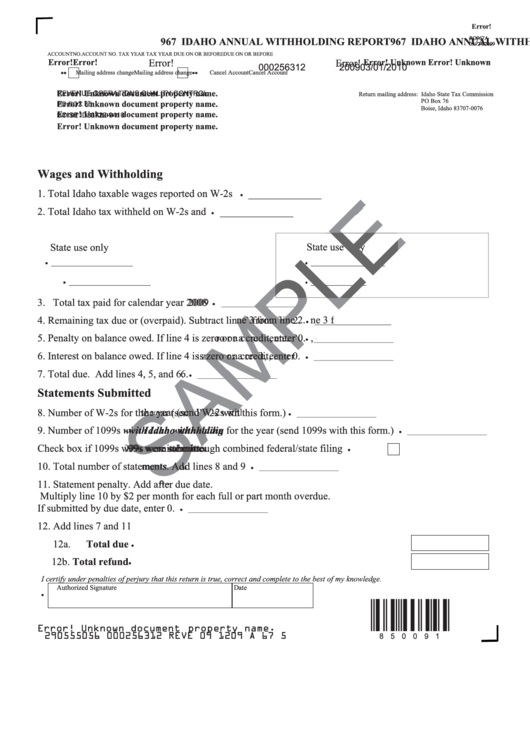

Form 967 Idaho

Form 967 Idaho - Idaho has a state income tax that ranges between 1.125% and 6.925% , which is administered by the idaho state tax commission. (return) payment for my filed tax return 2. Also, you can file annual withholding form 967. Web what is a 967 form in idaho? Employers are required by idaho law to withhold income tax from their employees’ wages. Web for this tax type: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web payments must be reconciled on form 967, idaho annual withholding report, at the end of the year. Choose from one of these payment types: Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip.

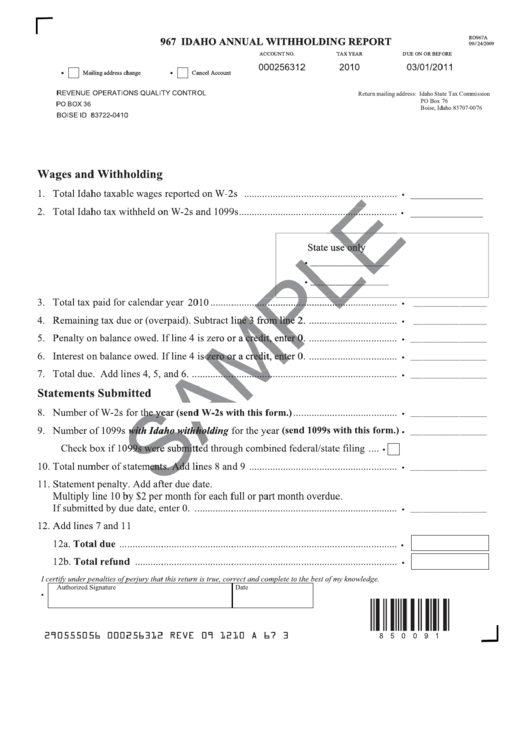

Our platform gives you an extensive. Web sample form 967 amended mailing address change 967 idaho annual withholding report account no.tax year 0028382842018 cancel account 0. Farmers who are required to file with the idaho department of labor. Web what is a 967 form in idaho? Web the suspect in a quadruple homicide that occurred at the university of idaho last year did not provide an alibi by monday’s deadline despite a demand from the state of Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Web follow the simple instructions below: Web form 967 is january 31, 2023. Web forms 40 or 43. Employers are required by idaho law to withhold income tax from their employees’ wages.

Employers can file online today by logging into their. Farmers who are required to file with the idaho department of labor. Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Our platform gives you an extensive. Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. The deadline for filing the form 967, idaho annual withholding report is january 31. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web forms 40 or 43. Web sample form 967 amended mailing address change 967 idaho annual withholding report account no.tax year 0028382842018 cancel account 0. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip.

Sponsors — Loaves & Fishes

You must also include in the form 967 totals the amounts from any 1099s with idaho. Web payments must be reconciled on form 967, idaho annual withholding report, at the end of the year. (return) payment for my filed tax return 2. Employers can file online today by logging into their. Our platform gives you an extensive.

Form Ro967a Idaho Annual Withholding Report printable pdf download

(period) payment for my past due. Farmers who are required to file with the idaho department of labor. If you withheld idaho income tax or have an active withholding account, you must include. Web sample form 967 amended mailing address change 967 idaho annual withholding report account no.tax year 0028382842018 cancel account 0. Web go to the taxpayer access point.

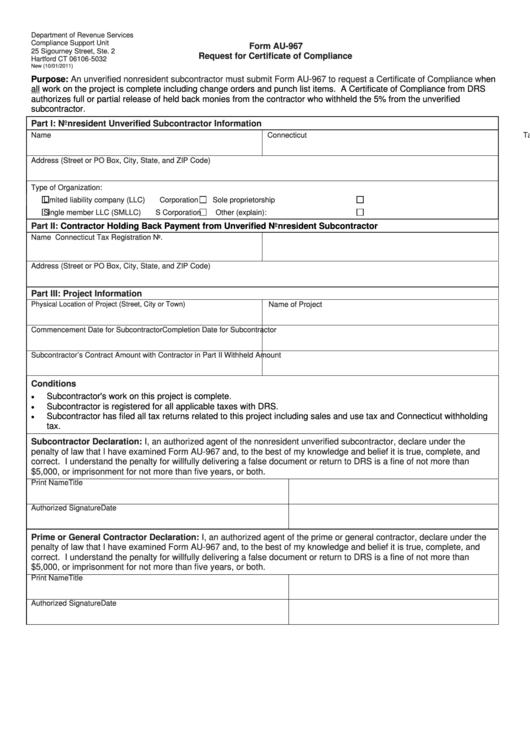

Form Au967 Request For Certificate Of Compliance printable pdf download

Use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and. If you’re an employee, your employer probably withholds. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Forms 41, 41s,.

Form Ro967a Idaho Annual Withholding Report printable pdf download

Web for this tax type: Web form 967 — instructions annual withholding report available at tax.idaho.gov/taxpros. Web sample form 967 amended mailing address change 967 idaho annual withholding report account no.tax year 0028382842018 cancel account 0. The deadline for filing the form 967, idaho annual withholding report is january 31. Web follow the simple instructions below:

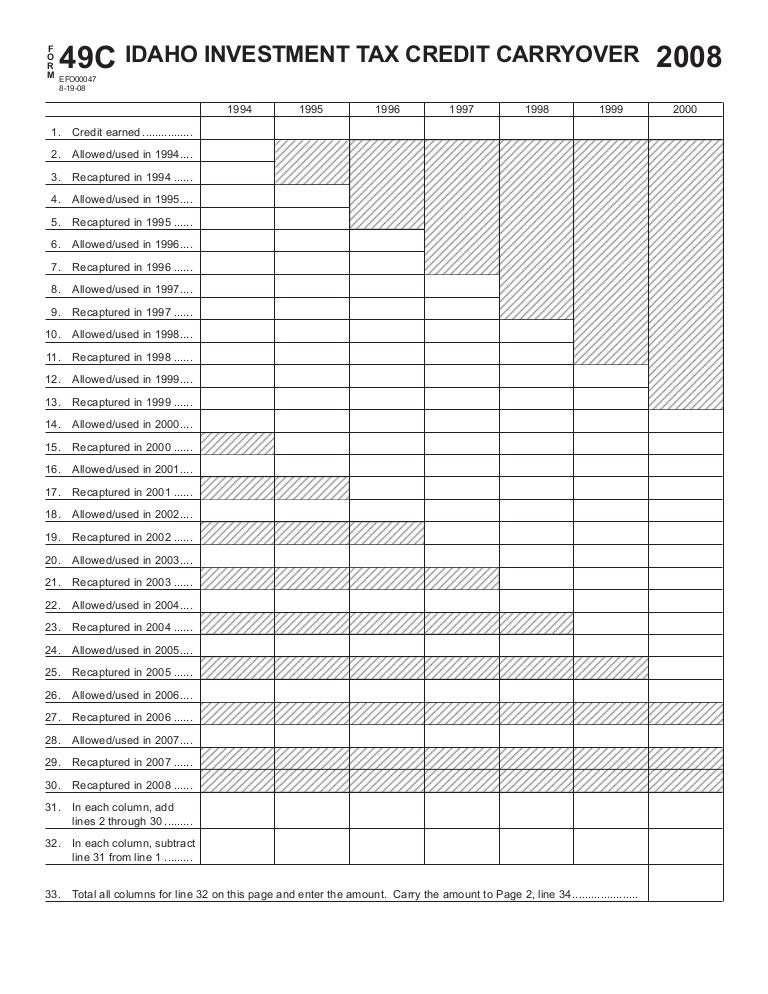

tax.idaho.gov EFO00047_081908

Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. You must also include in the form 967 totals the amounts from any 1099s with idaho. Web payments must be reconciled on form 967, idaho annual withholding report, at the end of the year. Web sample form.

Download Idaho Affidavit of Inheritance (Transportation Department

The deadline for filing the form 967, idaho annual withholding report is january 31. (return) payment for my filed tax return 2. Farmers who are required to file with the idaho department of labor. Are you seeking a fast and convenient solution to complete idaho form 967 at a reasonable cost? Web form 967 is january 31, 2023.

Form Ro967a 967 Idaho Annual Withholding Report 2009 printable pdf

If you withheld idaho income tax or have an active withholding account, you must include. Web sample form 967 amended mailing address change 967 idaho annual withholding report account no.tax year 0028382842018 cancel account 0. Web form 967 is january 31, 2023. Don’t wait until the deadline. Web go to the taxpayer access point (tap) introduction and registering getting started.

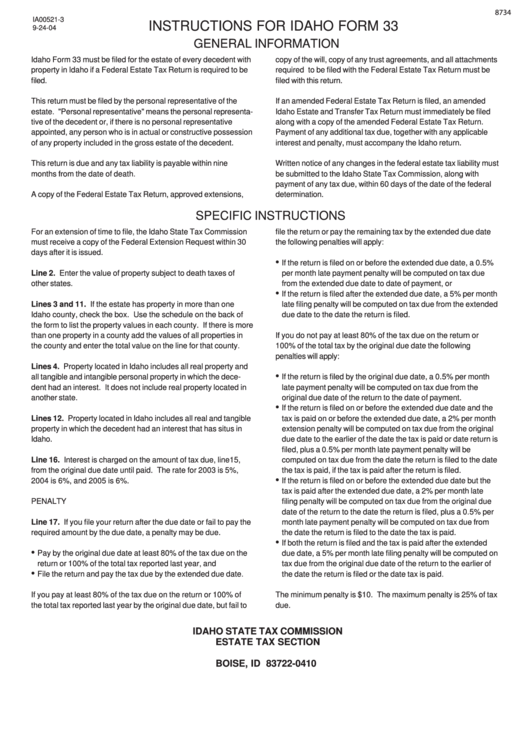

Instructions For Idaho Form 33 Idaho State Tax Commission printable

Web we last updated the idaho annual withholding report instructions in february 2023, so this is the latest version of form 967, fully updated for tax year 2022. Choose from one of these payment types: Use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld,.

StepbyStep Guide to Forming an LLC in Idaho

Web the suspect in a quadruple homicide that occurred at the university of idaho last year did not provide an alibi by monday’s deadline despite a demand from the state of Forms 41, 41s, 65, or 66. Web go to the taxpayer access point (tap) introduction and registering getting started tap availability when can you file your return or pay.

Idaho form 967 Fill out & sign online DocHub

Web follow the simple instructions below: Web we last updated idaho form 967 in february 2023 from the idaho state tax commission. Are you seeking a fast and convenient solution to complete idaho form 967 at a reasonable cost? (period) payment for my past due. Web payments must be reconciled on form 967, idaho annual withholding report, at the end.

Web Friday January 14, 2022.

Employers can file online today by logging into their. Web follow the simple instructions below: Web forms 40 or 43. (return) payment for my filed tax return 2.

Web Form 967 Is January 31, 2023.

Web the suspect in a quadruple homicide that occurred at the university of idaho last year did not provide an alibi by monday’s deadline despite a demand from the state of Idaho has a state income tax that ranges between 1.125% and 6.925% , which is administered by the idaho state tax commission. Web what is a 967 form in idaho? Web payments must be reconciled on form 967, idaho annual withholding report, at the end of the year.

Choose From One Of These Payment Types:

If you’re an employee, your employer probably withholds. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated the idaho annual withholding report instructions in february 2023, so this is the latest version of form 967, fully updated for tax year 2022. Use this form to report the idaho income tax you withheld, reconcile payments you made during the year with the amount of tax you withheld, and.

Don’t Wait Until The Deadline.

The deadline for filing the form 967, idaho annual withholding report is january 31. Our platform gives you an extensive. Web go to the taxpayer access point (tap) introduction and registering getting started tap availability when can you file your return or pay in tap? (period) payment for my past due.