Form 990 Instructions

Form 990 Instructions - Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web for paperwork reduction act notice, see instructions. Information relevant to paper filing. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Related organizations and unrelated partnerships pdf. Schedule g (form 990) 2022 omb no. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Go to www.irs.aov/form990 for instructions and the latest information. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

Schedule g (form 990) 2022 omb no. Go to www.irs.aov/form990 for instructions and the latest information. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web for paperwork reduction act notice, see instructions. Information relevant to paper filing. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Related organizations and unrelated partnerships pdf.

Schedule g (form 990) 2022 omb no. Web for paperwork reduction act notice, see instructions. Related organizations and unrelated partnerships pdf. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Information relevant to paper filing. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Go to www.irs.aov/form990 for instructions and the latest information. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust.

form 990 schedule m instructions 2017 Fill Online, Printable

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Related organizations and unrelated partnerships pdf. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Schedule g (form 990).

2010 Form IRS 990 Schedule A Fill Online, Printable, Fillable, Blank

Go to www.irs.aov/form990 for instructions and the latest information. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or.

Irs Form 990 Ez Schedule A Instructions Form Resume Examples

Related organizations and unrelated partnerships pdf. Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total.

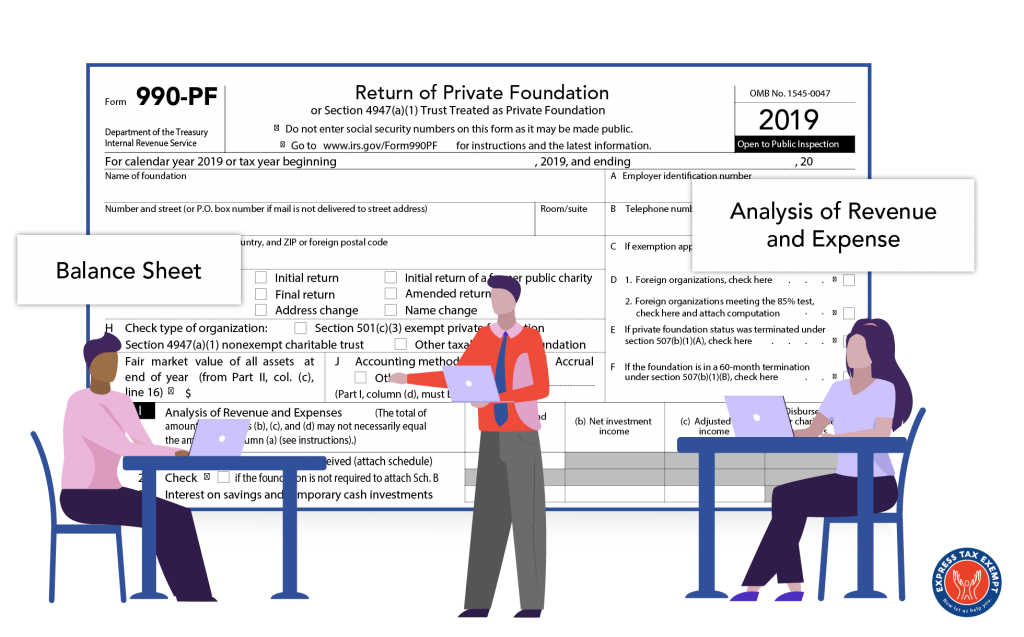

Instructions to file your Form 990PF A Complete Guide

Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Related organizations and unrelated partnerships pdf. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter.

form 990 instructions Fill Online, Printable, Fillable Blank form

Related organizations and unrelated partnerships pdf. Information relevant to paper filing. Web for paperwork reduction act notice, see instructions. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

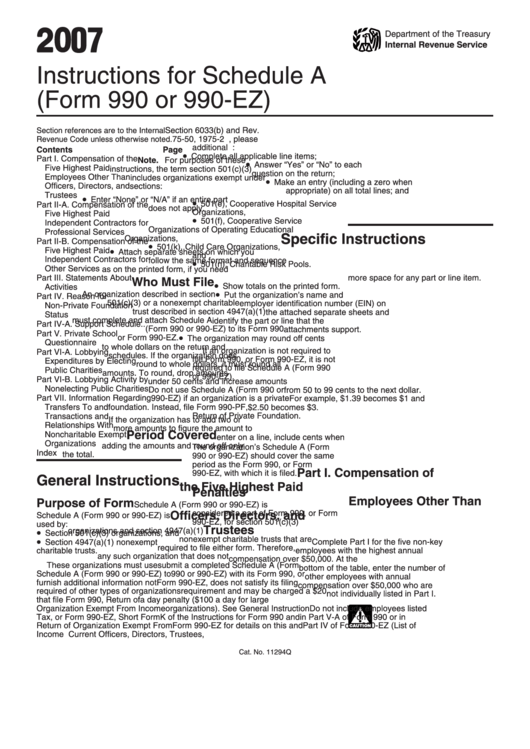

Instructions For Schedule A (Form 990 Or 990Ez) 2007 printable pdf

Information relevant to paper filing. Related organizations and unrelated partnerships pdf. Schedule g (form 990) 2022 omb no. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Related organizations and unrelated partnerships pdf. Web for paperwork reduction act notice, see instructions. Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Schedule g (form 990) 2022 omb no.

2010 FORM 990 INSTRUCTIONS 2010 FORM 990 INSTRUCTIONS

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described. Related.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Web for paperwork reduction act notice, see instructions. Web form 990 must be filed by an organization exempt from income tax.

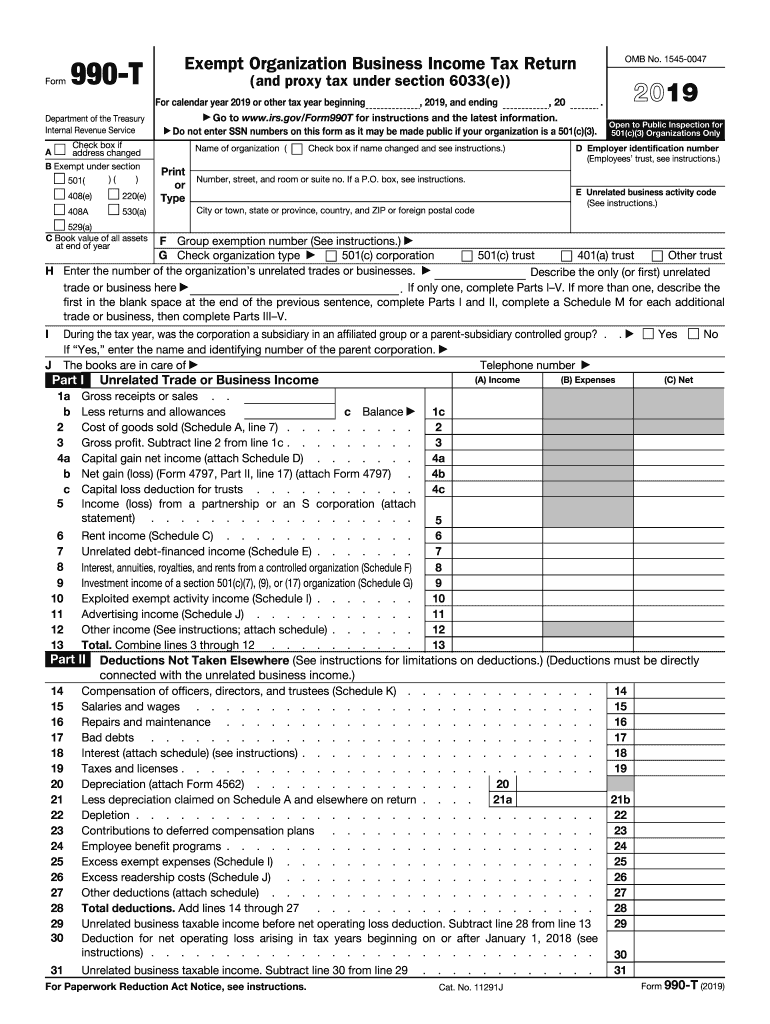

990 T Fill Out and Sign Printable PDF Template signNow

Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Supplemental information to form 990.

Information Relevant To Paper Filing.

Supplemental information to form 990 (instructions included in schedule) schedule r pdf. Schedule g (form 990) 2022 omb no. Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. Web form 990 return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public.

Web For Paperwork Reduction Act Notice, See Instructions.

Liquidation, termination, dissolution, or significant disposition of assets (instructions included in schedule) schedule o pdf. Related organizations and unrelated partnerships pdf. Go to www.irs.aov/form990 for instructions and the latest information. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either (1) gross receipts greater than or equal to $200,000, or (2) total assets greater than or equal to $500,000 at the end of the tax year (with exceptions described.