Form Ct-W4

Form Ct-W4 - Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined. Web quick guide on how to complete ct w4 2023 pdf. Your withholding is subject to review by the irs. Forget about scanning and printing out forms. 2023 connecticut quarterly reconciliation of withholding. (a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse; Your withholding is subject to review by the irs. You are required to pay connecticut income tax as income is earned or received during the year. Use our detailed instructions to fill out and esign your documents online.

Your withholding is subject to review by the irs. Your withholding is subject to review by the irs. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined. 2023 connecticut quarterly reconciliation of withholding. Forget about scanning and printing out forms. You are required to pay connecticut income tax as income is earned or received during the year. Web quick guide on how to complete ct w4 2023 pdf. Use our detailed instructions to fill out and esign your documents online. (a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse;

2023 connecticut quarterly reconciliation of withholding. (a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse; Your withholding is subject to review by the irs. You are required to pay connecticut income tax as income is earned or received during the year. Use our detailed instructions to fill out and esign your documents online. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined. Your withholding is subject to review by the irs. Forget about scanning and printing out forms. Web quick guide on how to complete ct w4 2023 pdf.

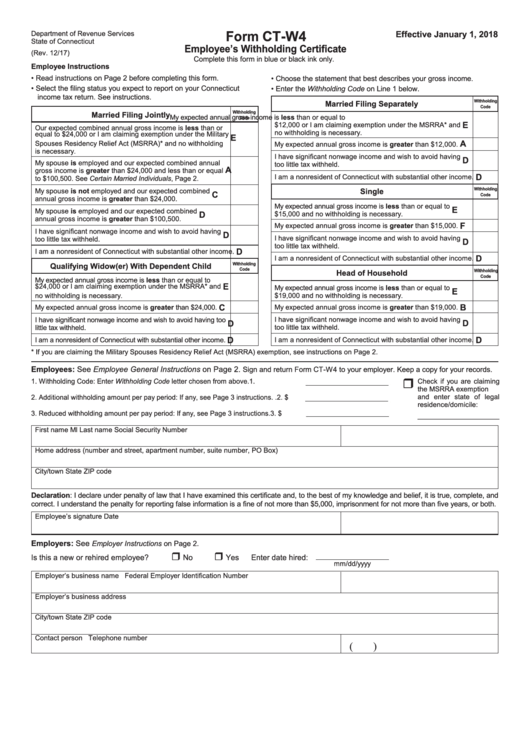

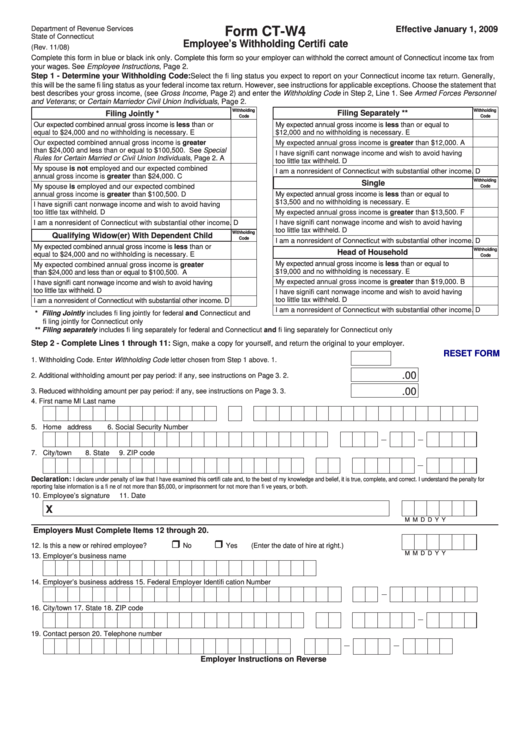

Download Connecticut Form CTW4 (2013) for Free TidyTemplates

Forget about scanning and printing out forms. Your withholding is subject to review by the irs. Use our detailed instructions to fill out and esign your documents online. Web quick guide on how to complete ct w4 2023 pdf. You are required to pay connecticut income tax as income is earned or received during the year.

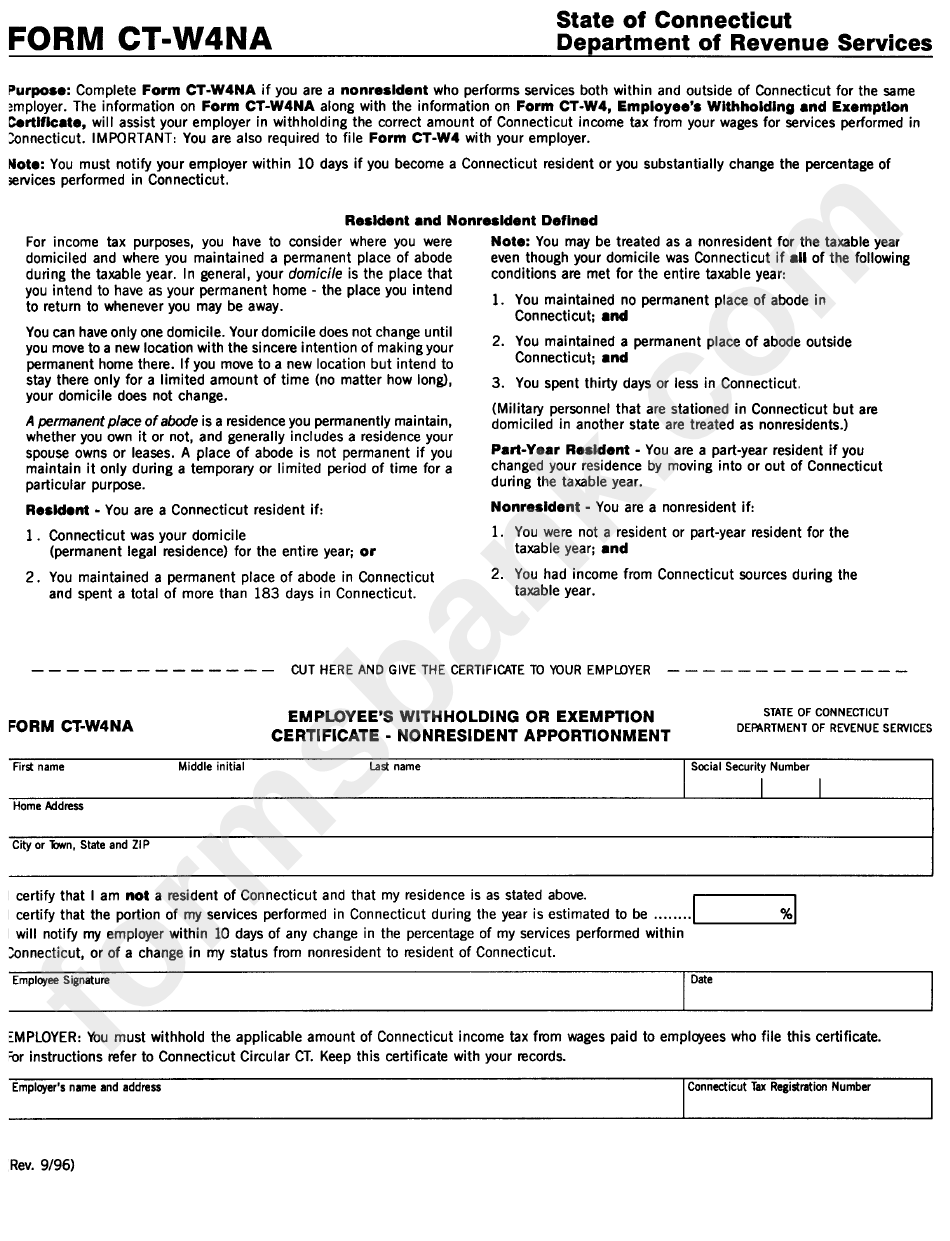

Fillable Form CtW4na Employee'S Withholding Or Exemption Certificate

2023 connecticut quarterly reconciliation of withholding. Use our detailed instructions to fill out and esign your documents online. Web quick guide on how to complete ct w4 2023 pdf. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined. Forget about scanning and printing out forms.

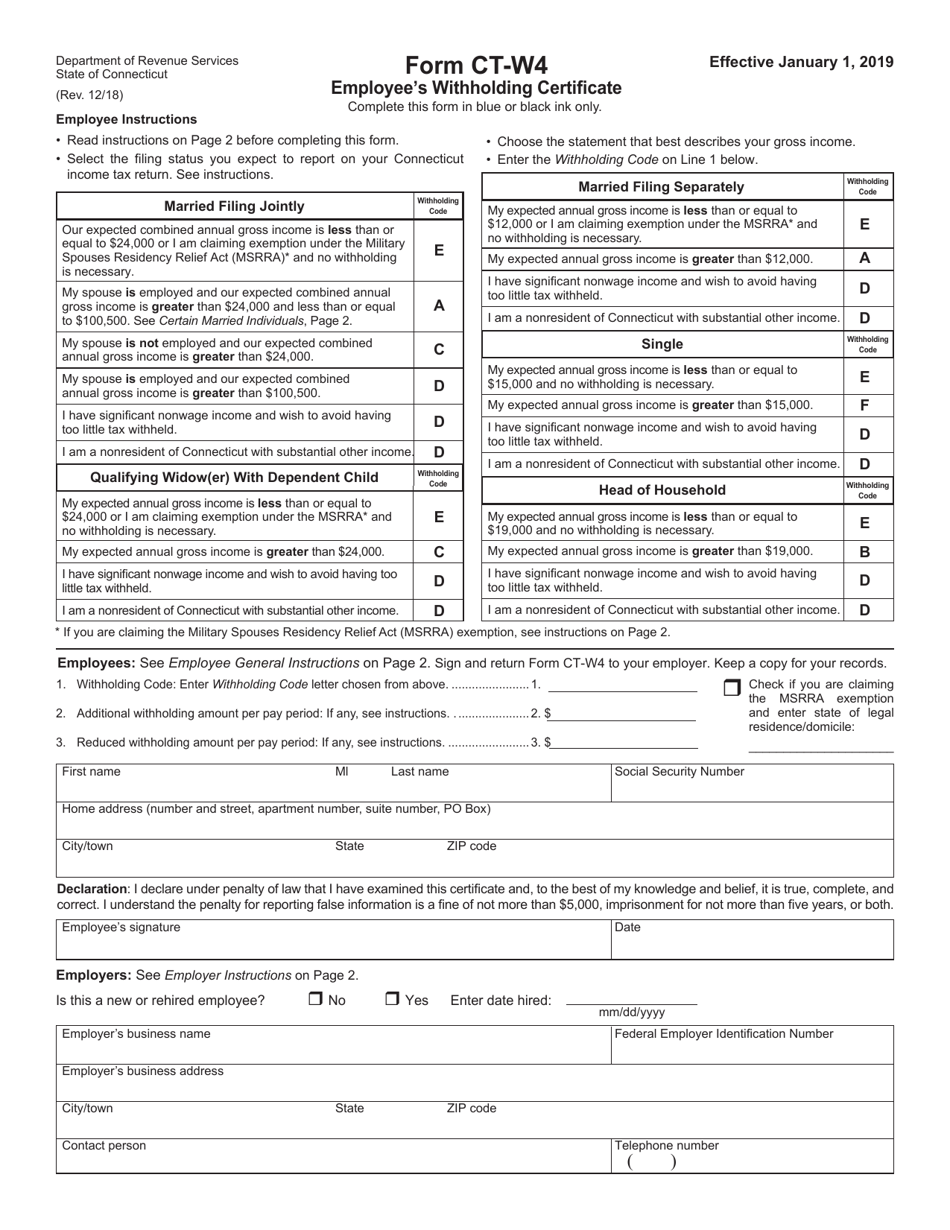

Form CTW4 Download Printable PDF or Fill Online Employee's Withholding

Use our detailed instructions to fill out and esign your documents online. Forget about scanning and printing out forms. Web quick guide on how to complete ct w4 2023 pdf. Your withholding is subject to review by the irs. You are required to pay connecticut income tax as income is earned or received during the year.

Form CtW4 Employee'S Withholding Certificate printable pdf download

Your withholding is subject to review by the irs. Use our detailed instructions to fill out and esign your documents online. You are required to pay connecticut income tax as income is earned or received during the year. (a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from.

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

(a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse; Forget about scanning and printing out forms. Your withholding is subject to review by the irs. Or is married and filing a federal income tax return jointly with his or her spouse who is.

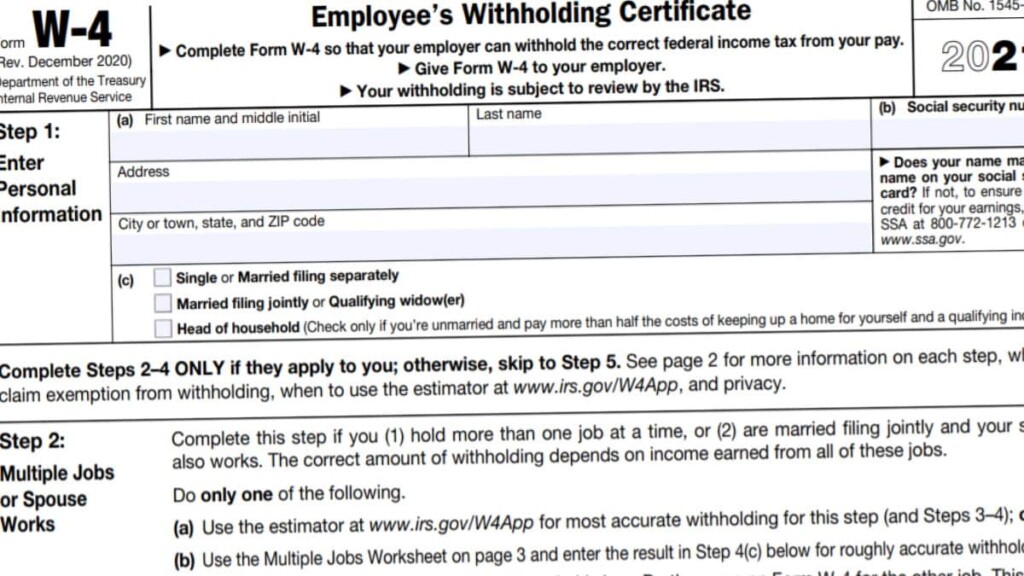

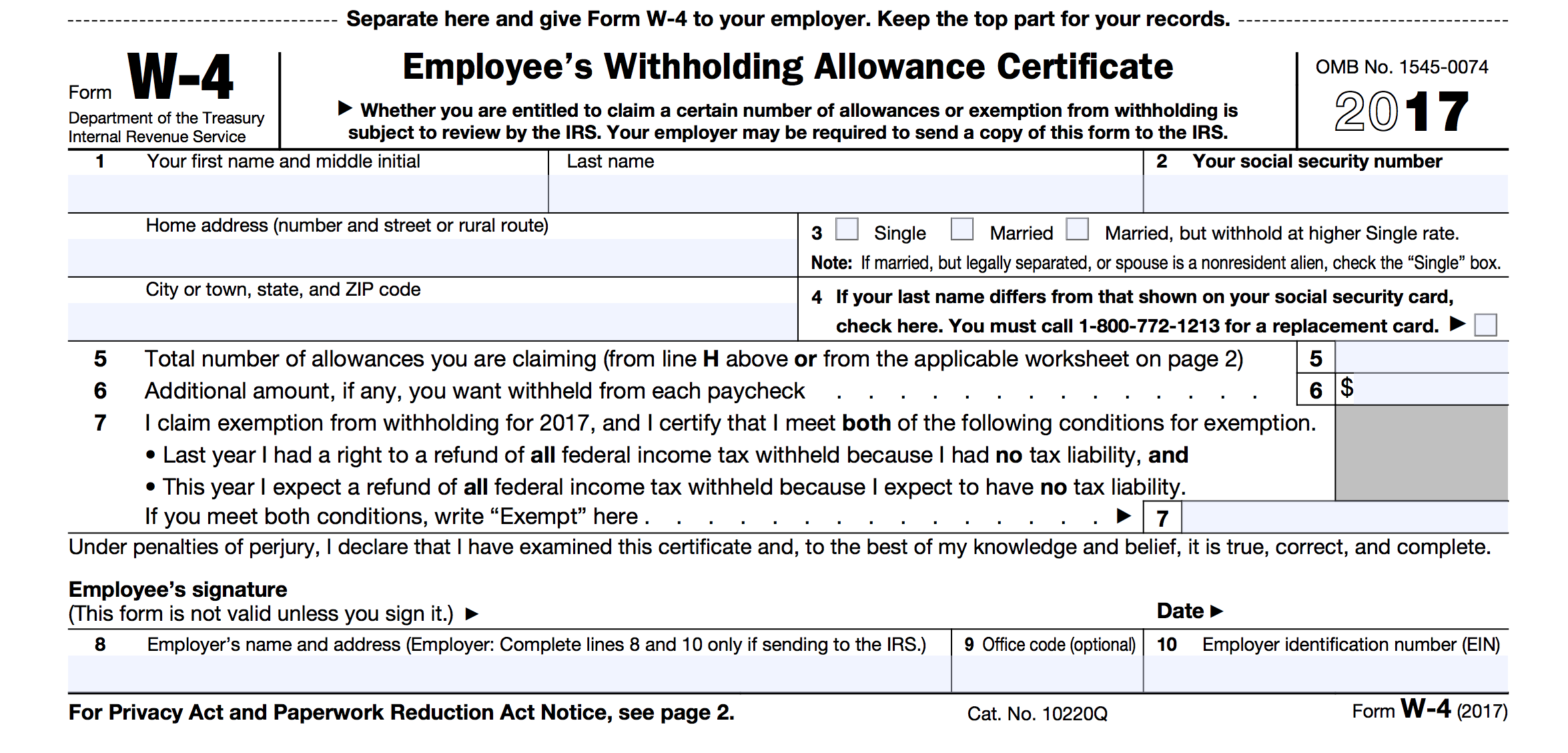

W 4 Form Help Examples and Forms

(a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse; Use our detailed instructions to fill out and esign your documents online. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined..

W4 Form How to Fill It Out in 2023

Use our detailed instructions to fill out and esign your documents online. Web quick guide on how to complete ct w4 2023 pdf. Your withholding is subject to review by the irs. Your withholding is subject to review by the irs. 2023 connecticut quarterly reconciliation of withholding.

1+ Connecticut Do Not Resuscitate Form Free Download

(a) filing status ''a'' is to be claimed if an employee is married but filing a federal income tax return separately from his or her spouse; Your withholding is subject to review by the irs. You are required to pay connecticut income tax as income is earned or received during the year. Web quick guide on how to complete ct.

W4 Form 2022 Instructions W4 Forms TaxUni

2023 connecticut quarterly reconciliation of withholding. Your withholding is subject to review by the irs. You are required to pay connecticut income tax as income is earned or received during the year. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined. Web quick guide on how to.

Printable W 4 Forms 2022 W4 Form

Forget about scanning and printing out forms. Use our detailed instructions to fill out and esign your documents online. 2023 connecticut quarterly reconciliation of withholding. Your withholding is subject to review by the irs. Web quick guide on how to complete ct w4 2023 pdf.

Forget About Scanning And Printing Out Forms.

You are required to pay connecticut income tax as income is earned or received during the year. Web quick guide on how to complete ct w4 2023 pdf. 2023 connecticut quarterly reconciliation of withholding. Or is married and filing a federal income tax return jointly with his or her spouse who is employed and their combined.

(A) Filing Status ''A'' Is To Be Claimed If An Employee Is Married But Filing A Federal Income Tax Return Separately From His Or Her Spouse;

Your withholding is subject to review by the irs. Your withholding is subject to review by the irs. Use our detailed instructions to fill out and esign your documents online.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)