Form Il-1040-Ptr

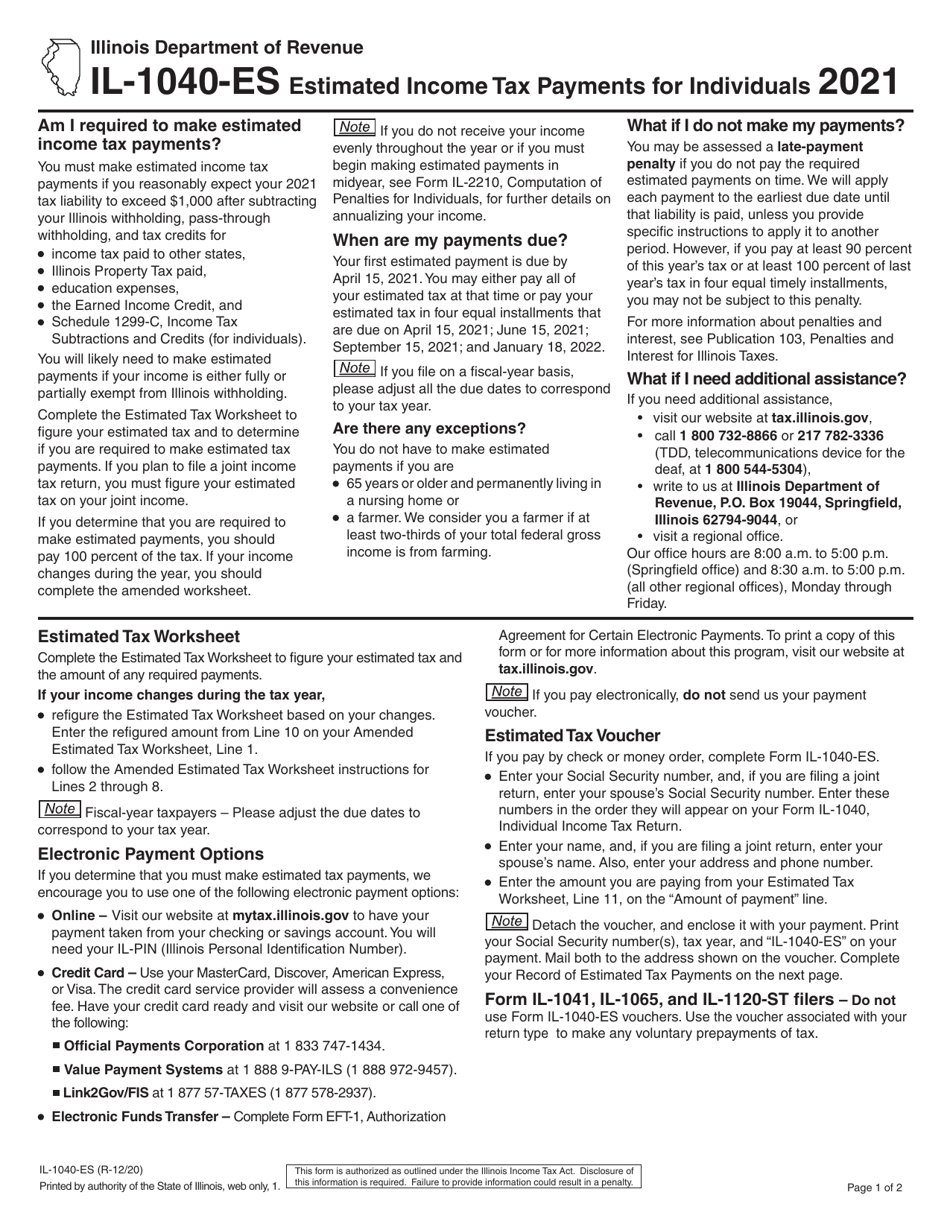

Form Il-1040-Ptr - Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one. A hard copy of the form can be. This form is for income earned in tax year 2022, with tax returns due in april. This makes it important for taxpayers to file their 2021 il. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web no filing extensions are allowed. Enter your filing status in the appropriate box. 2023 estimated income tax payments for individuals. Federal adjusted gross income from.

Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. This form is for income earned in tax year 2022, with tax returns due in april. Taxpayers eligible for both rebates will receive one. Federal adjusted gross income from. Enter your filing status in the appropriate box. Enter your name, address, and social security number at the top of the form. Enter your total income from all. This makes it important for taxpayers to file their 2021 il. 2023 estimated income tax payments for individuals. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and.

This makes it important for taxpayers to file their 2021 il. This form is for income earned in tax year 2022, with tax returns due in april. Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Federal adjusted gross income from. Enter your name, address, and social security number at the top of the form. A hard copy of the form can be. Taxpayers eligible for both rebates will receive one. Web no filing extensions are allowed. 2023 estimated income tax payments for individuals.

Form IL1040ES Download Fillable PDF or Fill Online Estimated

Enter your total income from all. Taxpayers eligible for both rebates will receive one. Figure your 2021 illinois property tax rebate. Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. Web no filing extensions are allowed.

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

Enter your name, address, and social security number at the top of the form. Enter your total income from all. Taxpayers eligible for both rebates will receive one. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web filing online is quick and easy!

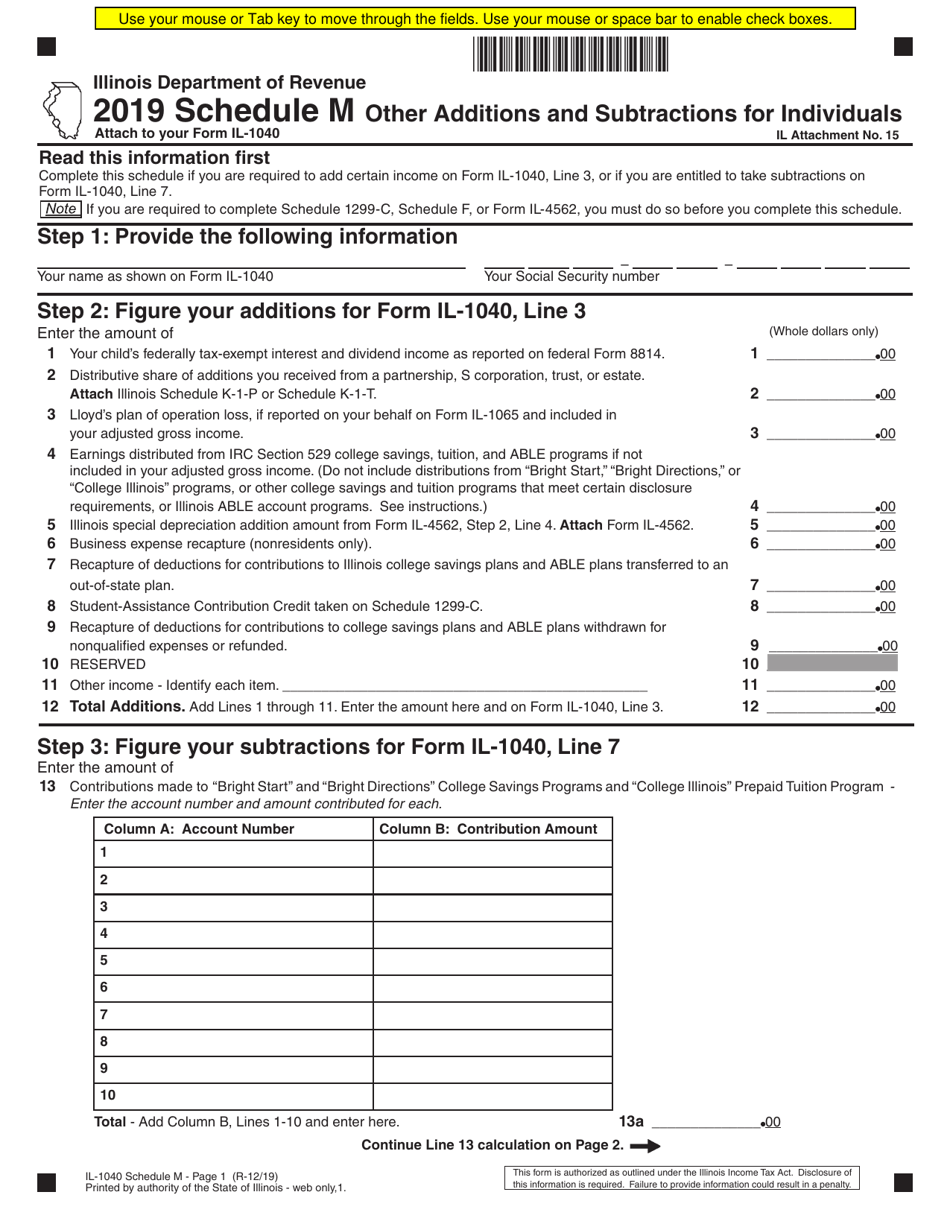

Form IL1040 Schedule M Download Fillable PDF or Fill Online Other

Web no filing extensions are allowed. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. This form is for income earned.

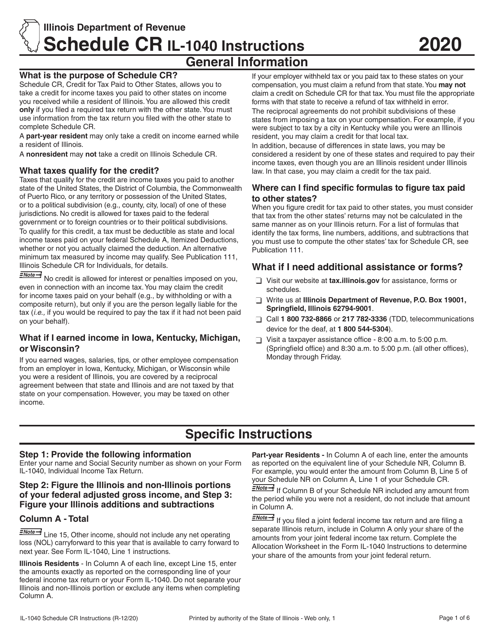

Download Instructions for Form IL1040 Schedule CR Credit for Tax Paid

Web no filing extensions are allowed. Web filing online is quick and easy! 2023 estimated income tax payments for individuals. Enter your filing status in the appropriate box. Enter your name, address, and social security number at the top of the form.

20172019 Form IL DoR IL1040 Fill Online, Printable, Fillable, Blank

Enter your name, address, and social security number at the top of the form. Federal adjusted gross income from. Taxpayers eligible for both rebates will receive one. A hard copy of the form can be. Web filing online is quick and easy!

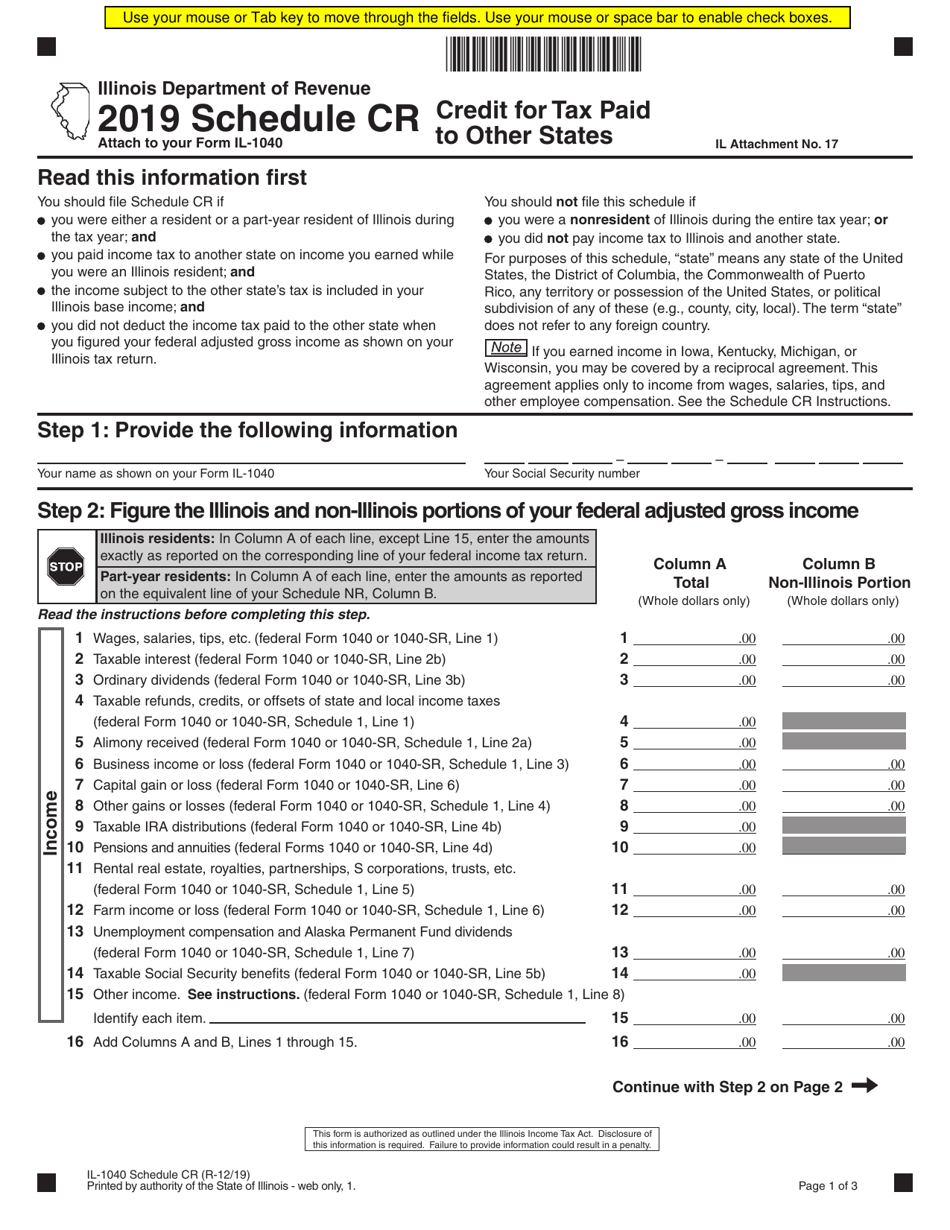

Form IL1040 Schedule CR Download Fillable PDF or Fill Online Credit

This form is for income earned in tax year 2022, with tax returns due in april. A hard copy of the form can be. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Enter your filing status in the appropriate.

IRS Instructions 1040A 20172022 Fill and Sign Printable Template

Web filing online is quick and easy! A hard copy of the form can be. If you were not required to file a 2021. This form is for income earned in tax year 2022, with tax returns due in april. 2023 estimated income tax payments for individuals.

Form 1040 R.I.P. Internal Revenue Service United States Economic Policy

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web filing online is quick and easy! Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Enter your name, address, and.

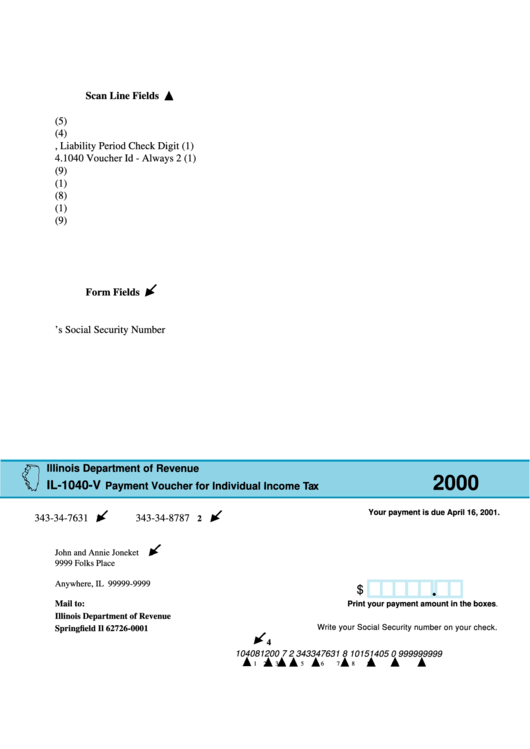

Form Il1040V Payment Voucher For Individual Tax Illinois

2023 estimated income tax payments for individuals. Taxpayers eligible for both rebates will receive one. Enter your name, address, and social security number at the top of the form. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Enter your.

2017 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Taxpayers eligible for both rebates will receive one. Web no filing extensions are allowed. Taxpayers eligible for both rebates will receive one. Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not.

A Hard Copy Of The Form Can Be.

Taxpayers eligible for both rebates will receive one. Taxpayers eligible for both rebates will receive one. Processing of rebates and issuance of payments will continue after october 17, until all have been issued by the illinois comptroller’s office. Federal adjusted gross income from.

Taxpayers Eligible For Both Rebates Will Receive One.

This form is for income earned in tax year 2022, with tax returns due in april. This makes it important for taxpayers to file their 2021 il. Figure your 2021 illinois property tax rebate. If you were not required to file a 2021.

Taxpayers Eligible For Both Rebates Will Receive One.

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Enter your name, address, and social security number at the top of the form. 2023 estimated income tax payments for individuals. Enter your total income from all.

Web No Filing Extensions Are Allowed.

Web the illinois department on aging (idoa) is encouraging older adults and retirees who were not required to file an illinois income tax return for 2021 to claim their. Enter your filing status in the appropriate box. Web filing online is quick and easy!