Form It 6Wth

Form It 6Wth - Other payments/credits (enclose supporting documentation) 19.00 20. Web government form cch axcess input worksheet section field; Web find and fill out the correct indiana form it 6wth. If a partnership fails to withhold, it will be assessed a penalty. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. The filing frequency assigned to. Calculating corporate income tax rate. This form is to be filed with the income tax return of the withholding. Will be remitted by using. Using entries from the federal return and on the indiana worksheet, the following forms.

There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Tax computation form for electing partnerships. Calculating corporate income tax rate. This penalty is 20% plus interest, in addition to the amount. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Using entries from the federal return and on the indiana worksheet, the following forms. Schedule ez 1, 2, 3, enterprise zone credit. This form is to be filed with the income tax return of the withholding. Entity name or first name. If a partnership fails to withhold, it will be assessed a penalty.

Web government form cch axcess input worksheet section field; Other payments/credits (enclose supporting documentation) 19.00 20. The filing frequency assigned to. Using entries from the federal return and on the indiana worksheet, the following forms. Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. This penalty is 20% plus interest, in addition to the amount. Entity name or first name. If a partnership fails to withhold, it will be assessed a penalty. Schedule ez 1, 2, 3, enterprise zone credit.

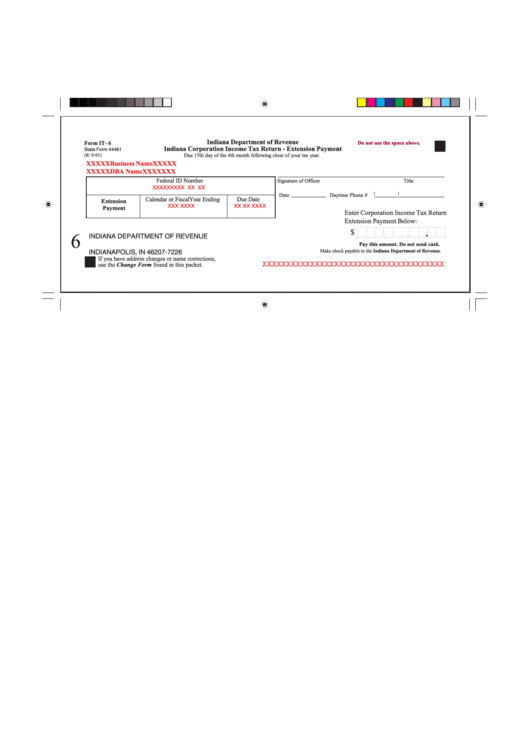

Form It6 Indiana Corporation Tax Return Extension Payment

Choose the correct version of the editable pdf form. Using entries from the federal return and on the indiana worksheet, the following forms. Web government form cch axcess input worksheet section field; Entity name or first name. This form is to be filed with the income tax return of the withholding.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

Schedule ez 1, 2, 3, enterprise zone credit. Choose the correct version of the editable pdf form. Web government form cch axcess input worksheet section field; Other payments/credits (enclose supporting documentation) 19.00 20. Entity name or first name.

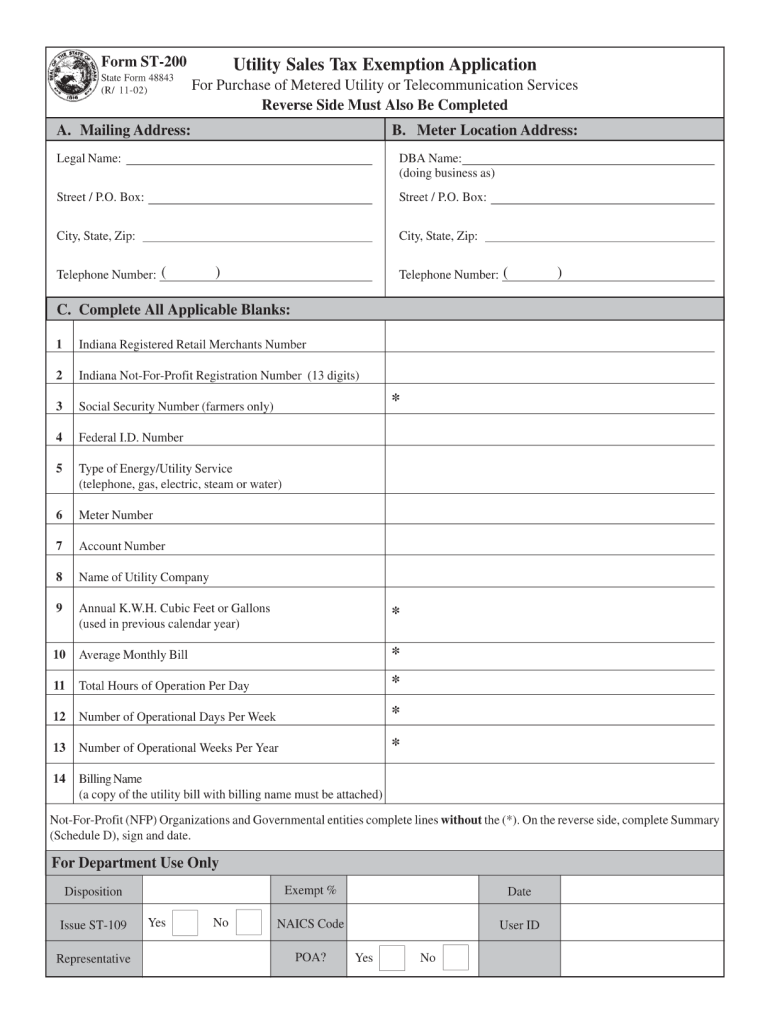

IN DoR ST200 2002 Fill out Tax Template Online US Legal Forms

Other payments/credits (enclose supporting documentation) 19.00 20. This penalty is 20% plus interest, in addition to the amount. Choose the correct version of the editable pdf form. Using entries from the federal return and on the indiana worksheet, the following forms. If a partnership fails to withhold, it will be assessed a penalty.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Schedule ez 1, 2, 3, enterprise zone credit. Web government form cch axcess input worksheet section field; Other.

Ribbon Diagrams on Twitter "6WTH Fulllength human ENaC ECD https

Other payments/credits (enclose supporting documentation) 19.00 20. Schedule ez 1, 2, 3, enterprise zone credit. Choose the correct version of the editable pdf form. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or. Web government form cch axcess input worksheet section field;

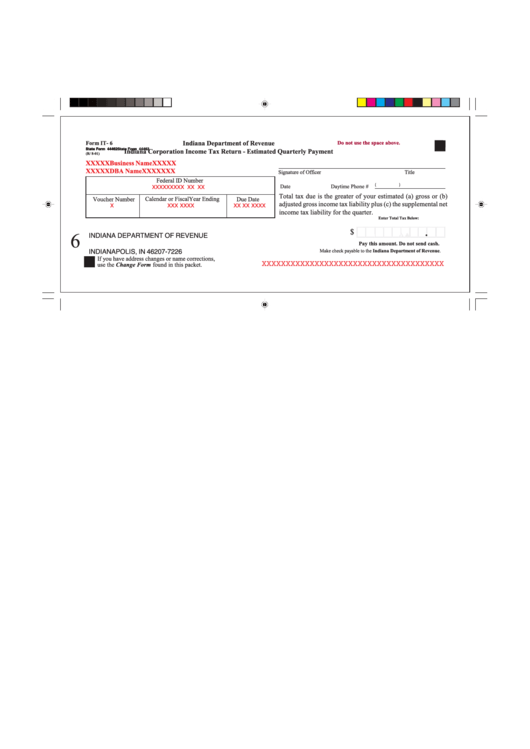

Form It6 Indiana Corporation Tax Return Estimated Quarterly

Calculating corporate income tax rate. Will be remitted by using. Other payments/credits (enclose supporting documentation) 19.00 20. Using entries from the federal return and on the indiana worksheet, the following forms. Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships.

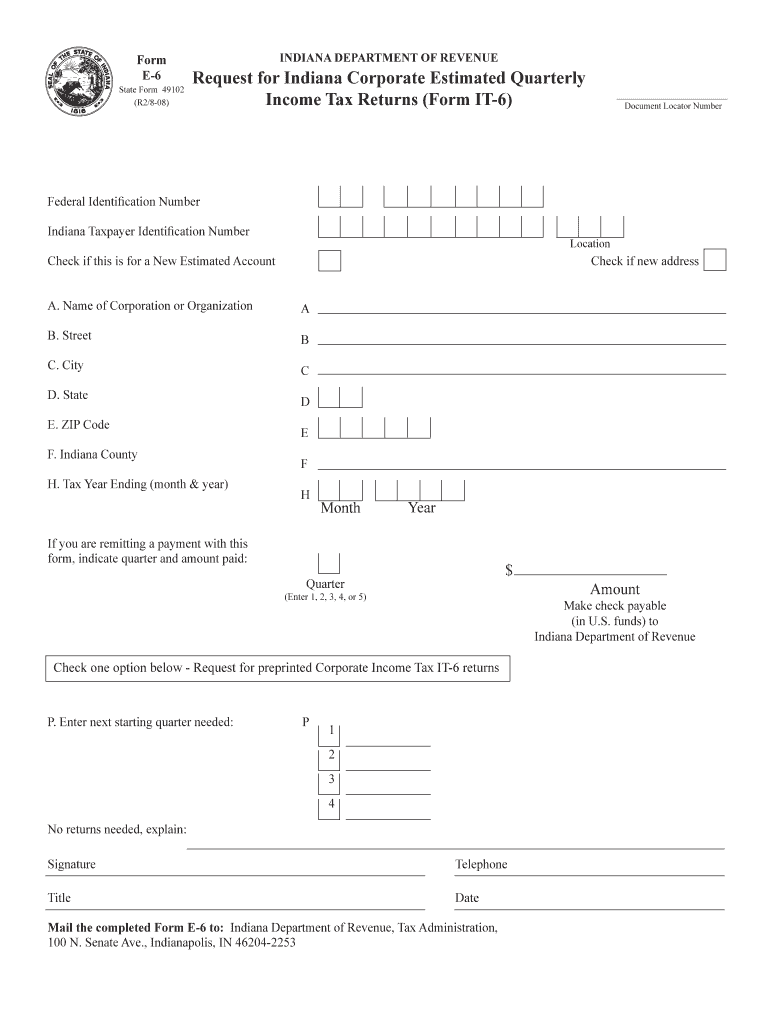

Indiana Fillable E 6 Form Fill Out and Sign Printable PDF Template

Using entries from the federal return and on the indiana worksheet, the following forms. Will be remitted by using. Other payments/credits (enclose supporting documentation) 19.00 20. If a partnership fails to withhold, it will be assessed a penalty. The filing frequency assigned to.

New 2022 Ford Ranger Sport 6WTH Cooma, NSW

Schedule ez 1, 2, 3, enterprise zone credit. The filing frequency assigned to. Web government form cch axcess input worksheet section field; If a partnership fails to withhold, it will be assessed a penalty. This penalty is 20% plus interest, in addition to the amount.

GES LED Bulbs E27 6Watts, 1Year Warranty, Model MECQ6WTH Shopee

Will be remitted by using. This form is to be filed with the income tax return of the withholding. Web find and fill out the correct indiana form it 6wth. Intime is dor’s preferred method of payment as it reduces the risk of late or misapplied payments due to incorrect or illegible forms. Choose the correct version of the editable.

PDB 6wth gallery ‹ Protein Data Bank in Europe (PDBe) ‹ EMBLEBI

Using entries from the federal return and on the indiana worksheet, the following forms. Calculating corporate income tax rate. Entity name or first name. Web government form cch axcess input worksheet section field; If a partnership fails to withhold, it will be assessed a penalty.

Using Entries From The Federal Return And On The Indiana Worksheet, The Following Forms.

The filing frequency assigned to. Other payments/credits (enclose supporting documentation) 19.00 20. Will be remitted by using. There is no penalty for underpayment of estimated tax, except to the extent the underpayment fails to equal or.

Calculating Corporate Income Tax Rate.

Web the indiana partnership return is prepared for calendar, fiscal, and short year partnerships. Web government form cch axcess input worksheet section field; Schedule ez 1, 2, 3, enterprise zone credit. Choose the correct version of the editable pdf form.

Intime Is Dor’s Preferred Method Of Payment As It Reduces The Risk Of Late Or Misapplied Payments Due To Incorrect Or Illegible Forms.

This form is to be filed with the income tax return of the withholding. Entity name or first name. If a partnership fails to withhold, it will be assessed a penalty. This penalty is 20% plus interest, in addition to the amount.

Web Find And Fill Out The Correct Indiana Form It 6Wth.

Tax computation form for electing partnerships.