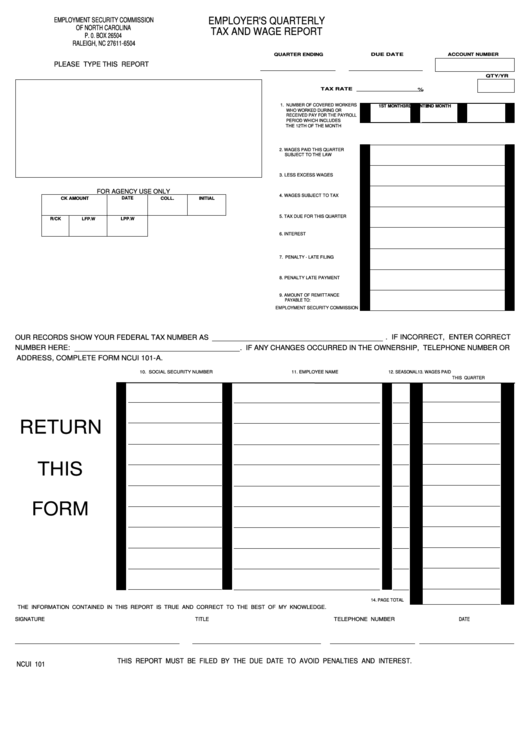

Form Ncui 101

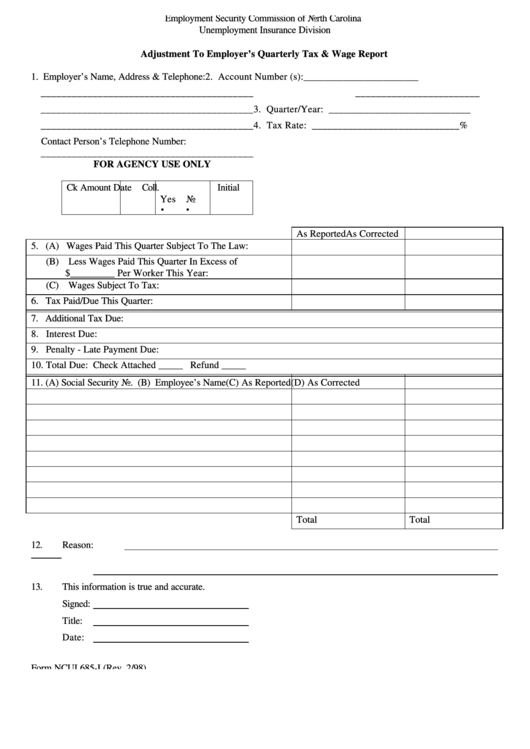

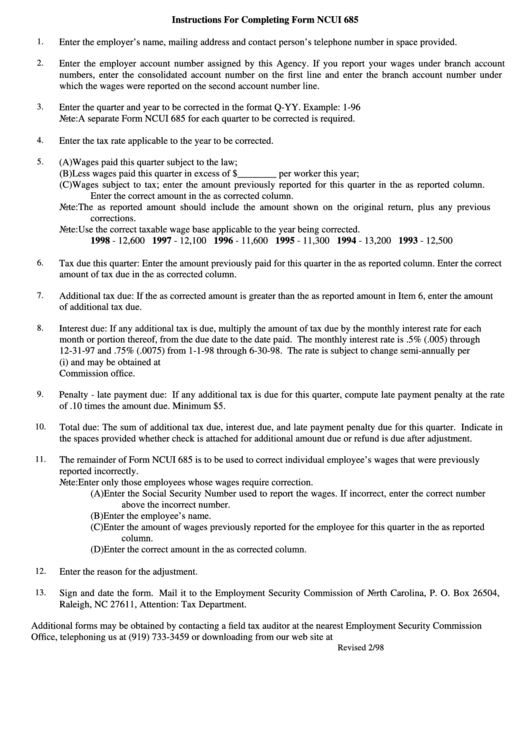

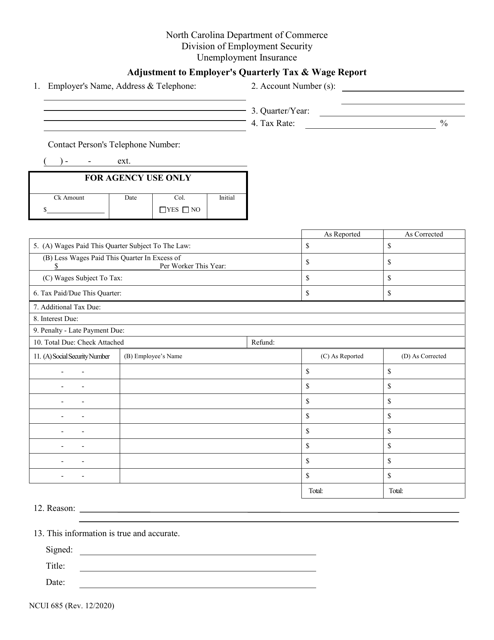

Form Ncui 101 - Enter the employer account number assigned by this agency. If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Web (form ncui 685) 1. This option is only available to employers who have nine or less employee wage items. Web our records show your federal tax number as number here: Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). Enter the employer's name, mailing address and contact person's telephone number in space provided. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. See the online filing support menu in the form module. 09/2013) change in status report account number employer name and address:

Of commerce division of employment security p.o. Sold or otherwise transferred all or part of the business to: Web (form ncui 685) 1. Enter the employer account number assigned by this agency. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Tax computation data must be reported by using the appropriate n record contained in this guide. Enter the employer's name, mailing address and contact person's telephone number in space provided. Web our records show your federal tax number as number here: If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the.

Web (form ncui 685) 1. Submitting the n record along with employee wage details eliminates the need for filing a paper return. Enter the employer account number assigned by this agency. Tax computation data must be reported by using the appropriate n record contained in this guide. This option is only available to employers who have nine or less employee wage items. Sold or otherwise transferred all or part of the business to: Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). Enter the employer's name, mailing address and contact person's telephone number in space provided. See the online filing support menu in the form module. Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the.

Ncui 101 Form 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Sold or otherwise transferred all or part of the business to: You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number.

Fillable Form Ncui 101 Employerr'S Quarterly Tax And Wage Report

See the online filing support menu in the form module. Web our records show your federal tax number as number here: You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. This option is only available to employers who have.

Form Ncui 685I Adjustment To Employer'S Quarterly Tax & Wage Report

Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which 09/2013) change in status report account number employer name and address:.

Instructions For Completing Form Ncui 685 printable pdf download

Enter the employer account number assigned by this agency. You can file this report online at des.nc.gov quarter ending due date account number qty/yr tax rate % number of covered workers who worked during or received pay for the. Tax computation data must be reported by using the appropriate n record contained in this guide. If you report your wages.

Form NCUI685 Download Printable PDF or Fill Online Adjustment to

This option is only available to employers who have nine or less employee wage items. Enter the employer's name, mailing address and contact person's telephone number in space provided. Web our records show your federal tax number as number here: If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter.

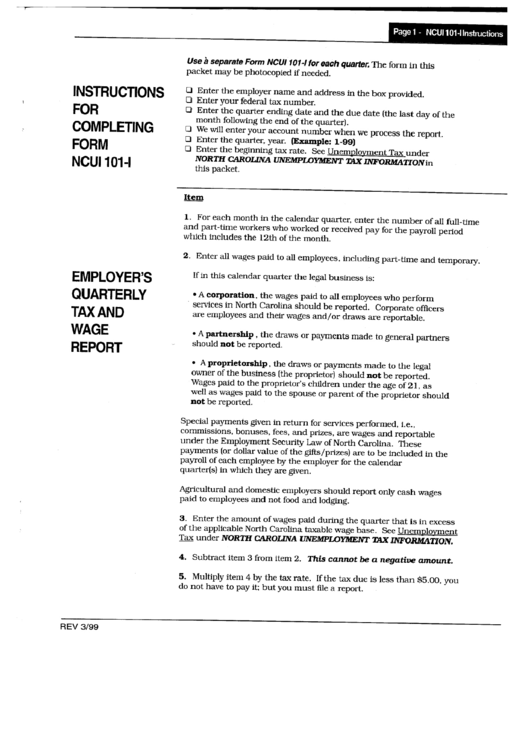

Instructions For Form Ncui 101I Employer'S Quarterly Tax And Wage

Web our records show your federal tax number as number here: 09/2013) change in status report account number employer name and address: Tax computation data must be reported by using the appropriate n record contained in this guide. Submitting the n record along with employee wage details eliminates the need for filing a paper return. Enter the employer account number.

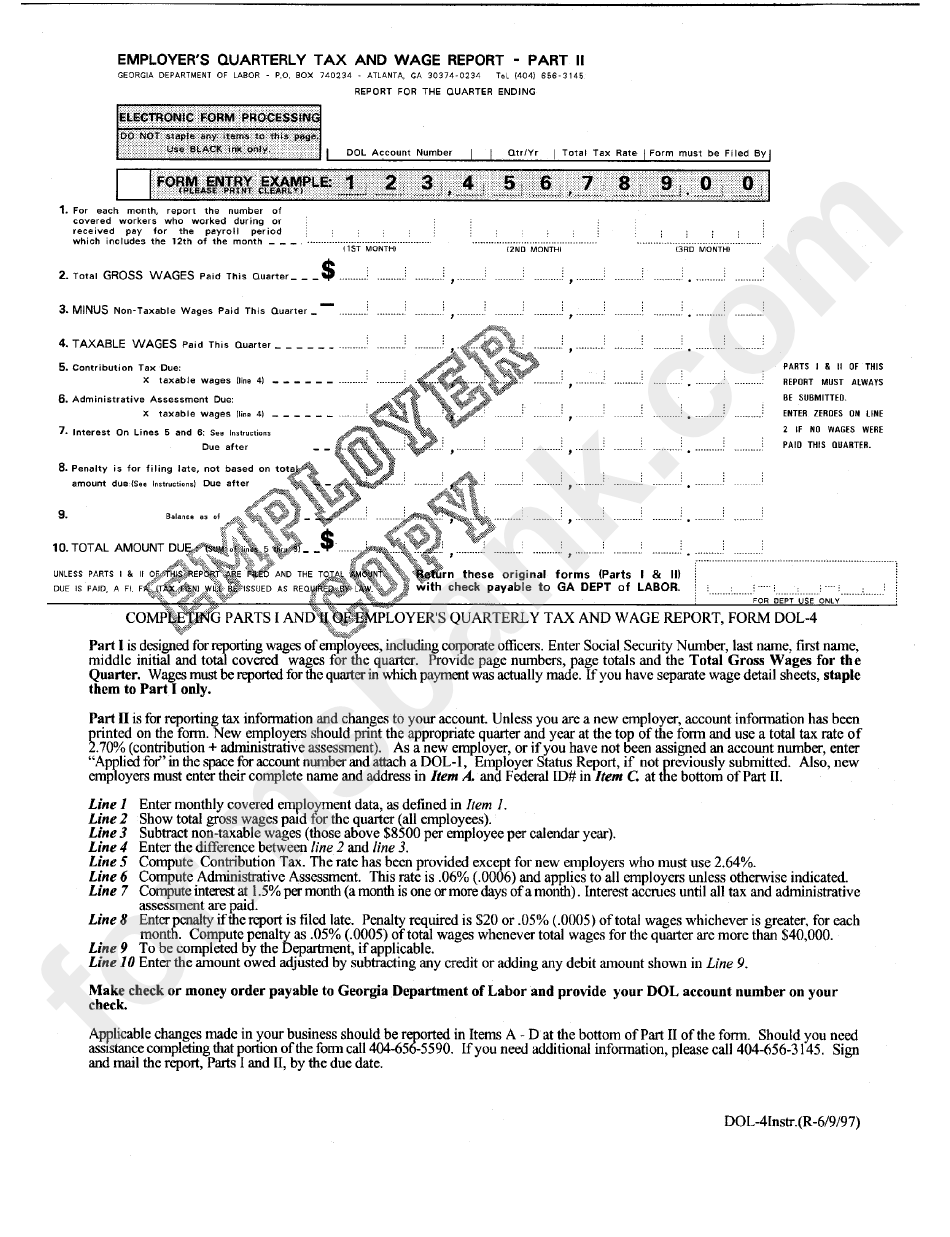

Form Dol4 Employer'S Quarterly Tax And Wage Report Part Ii

Web (form ncui 685) 1. If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Submitting the n record along with employee wage details eliminates the need for filing a paper return. See the online filing support menu in the form module. Quarter ending.

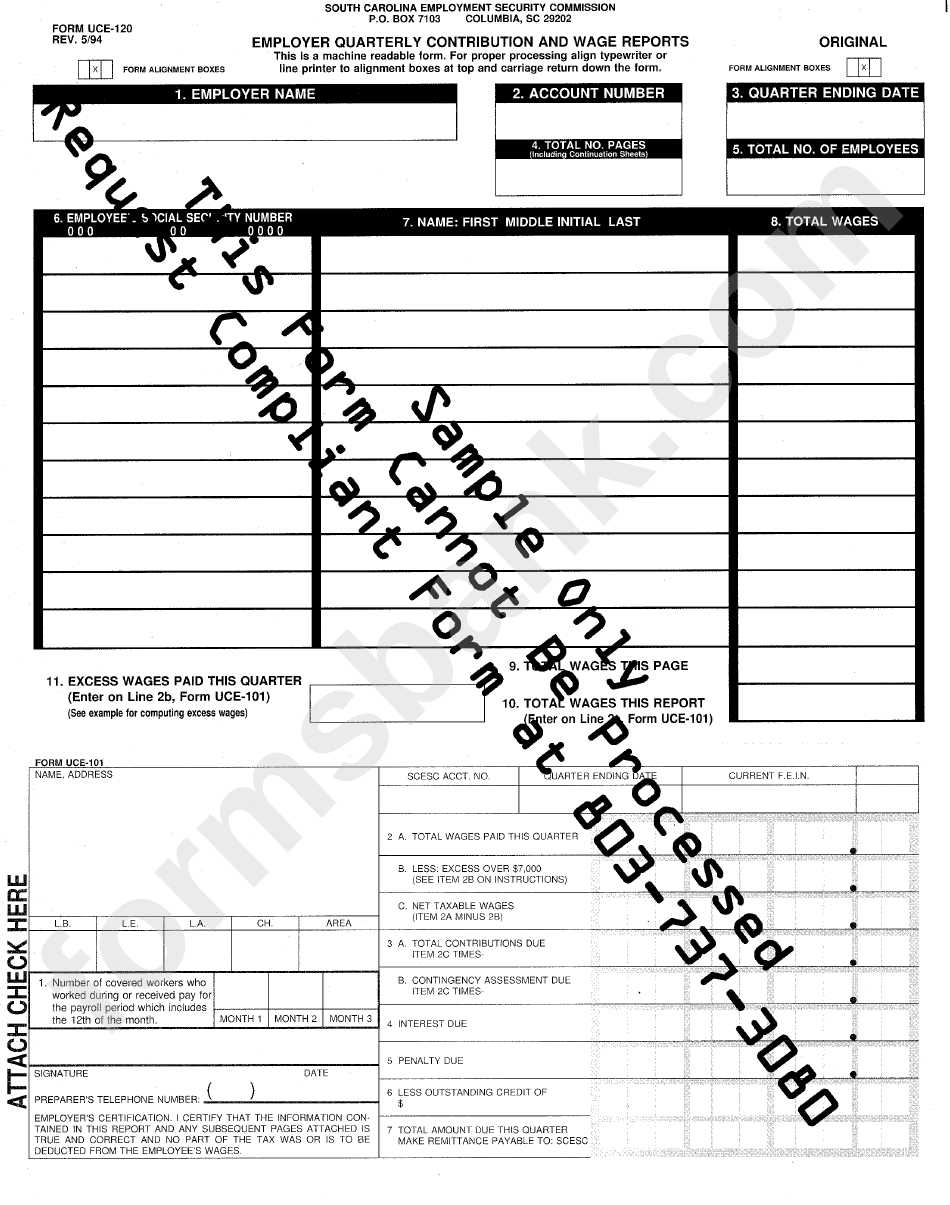

Form Uce120 Employer Quarterly Contribution And Wage Reports

Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which Enter the employer account number assigned by this agency. You can.

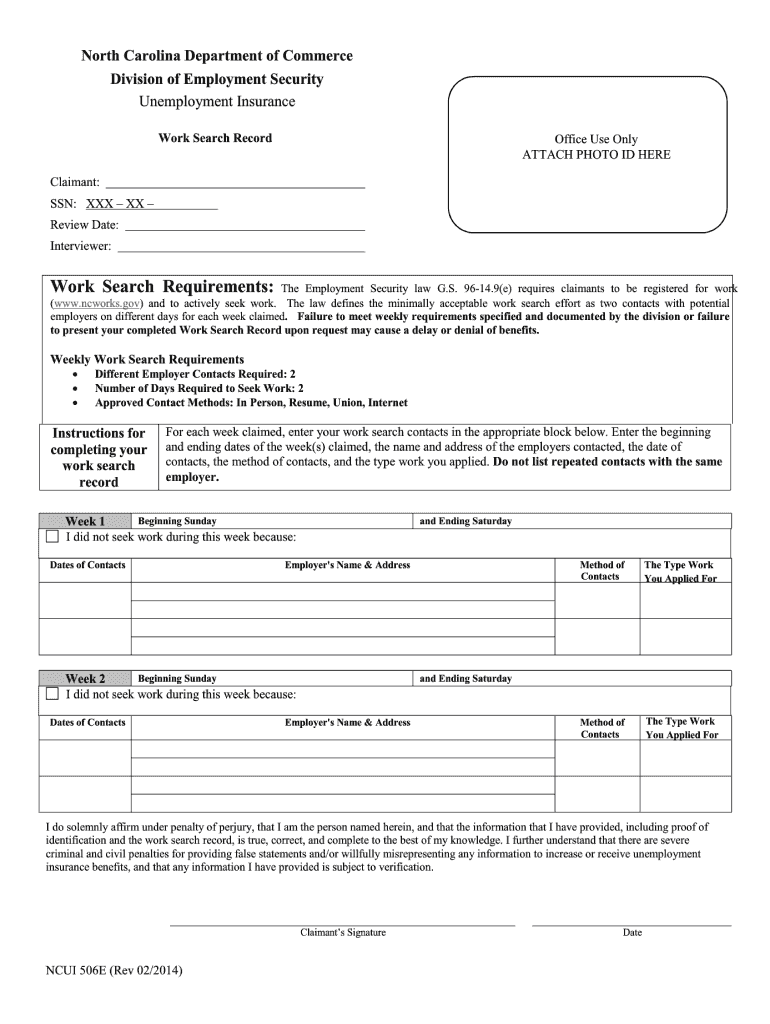

2014 Form NC NCUI 506E Fill Online, Printable, Fillable, Blank pdfFiller

Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). Web our records show your federal tax number as number here: Of commerce division of employment security p.o. Web our records show your federal tax number as number here: Quarter ending due date account number qtr/yr tax.

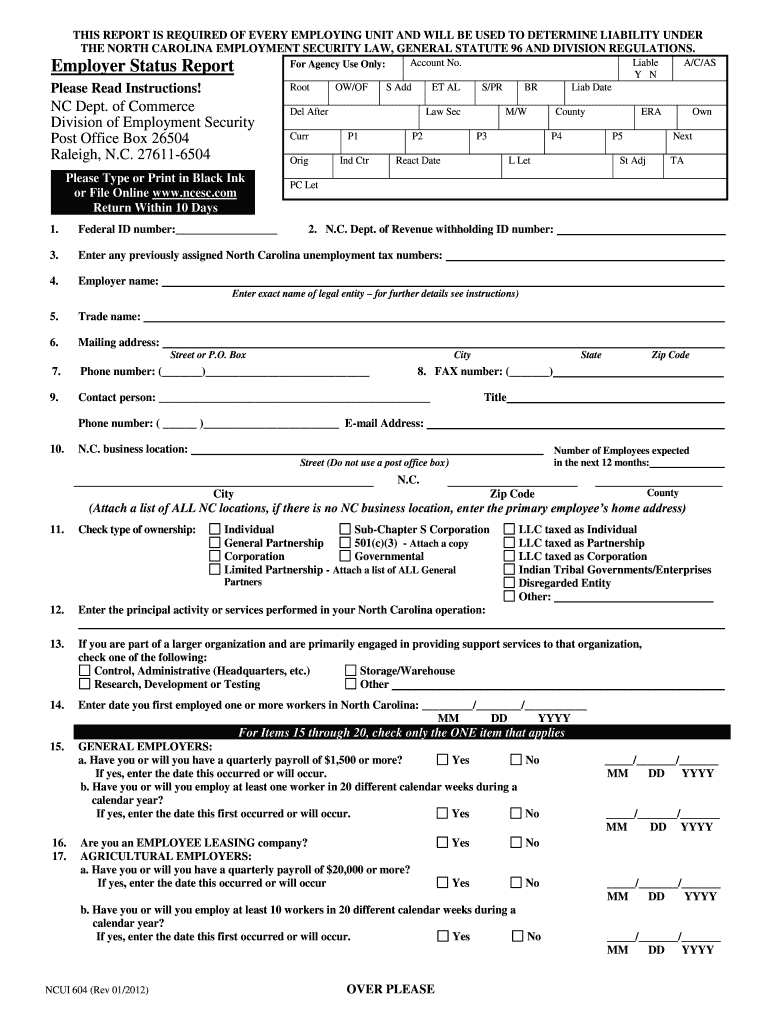

Ncui 604 Form Fill Out and Sign Printable PDF Template signNow

09/2013) change in status report account number employer name and address: Web our records show your federal tax number as number here: Tax computation data must be reported by using the appropriate n record contained in this guide. Sold or otherwise transferred all or part of the business to: If you report your wages under branch account numbers, enter the.

This Option Is Only Available To Employers Who Have Nine Or Less Employee Wage Items.

Of commerce division of employment security p.o. Web our records show your federal tax number as number here: Web our records show your federal tax number as number here: If you report your wages under branch account numbers, enter the consolidated account number on the first line and enter the branch account number under which

Tax Computation Data Must Be Reported By Using The Appropriate N Record Contained In This Guide.

Quarter ending due date account number qtr/yr tax rate % number of covered workers who worked during or received pay for the payroll period which includes the 12th of the. Web (form ncui 685) 1. Enter the employer account number assigned by this agency. Submitting the n record along with employee wage details eliminates the need for filing a paper return.

You Can File This Report Online At Des.nc.gov Quarter Ending Due Date Account Number Qty/Yr Tax Rate % Number Of Covered Workers Who Worked During Or Received Pay For The.

Enter the employer's name, mailing address and contact person's telephone number in space provided. Web form ncui 101, employer’s quarterly tax and wage report, must be submitted for each employer account number with payment (if any due). See the online filing support menu in the form module. 09/2013) change in status report account number employer name and address: