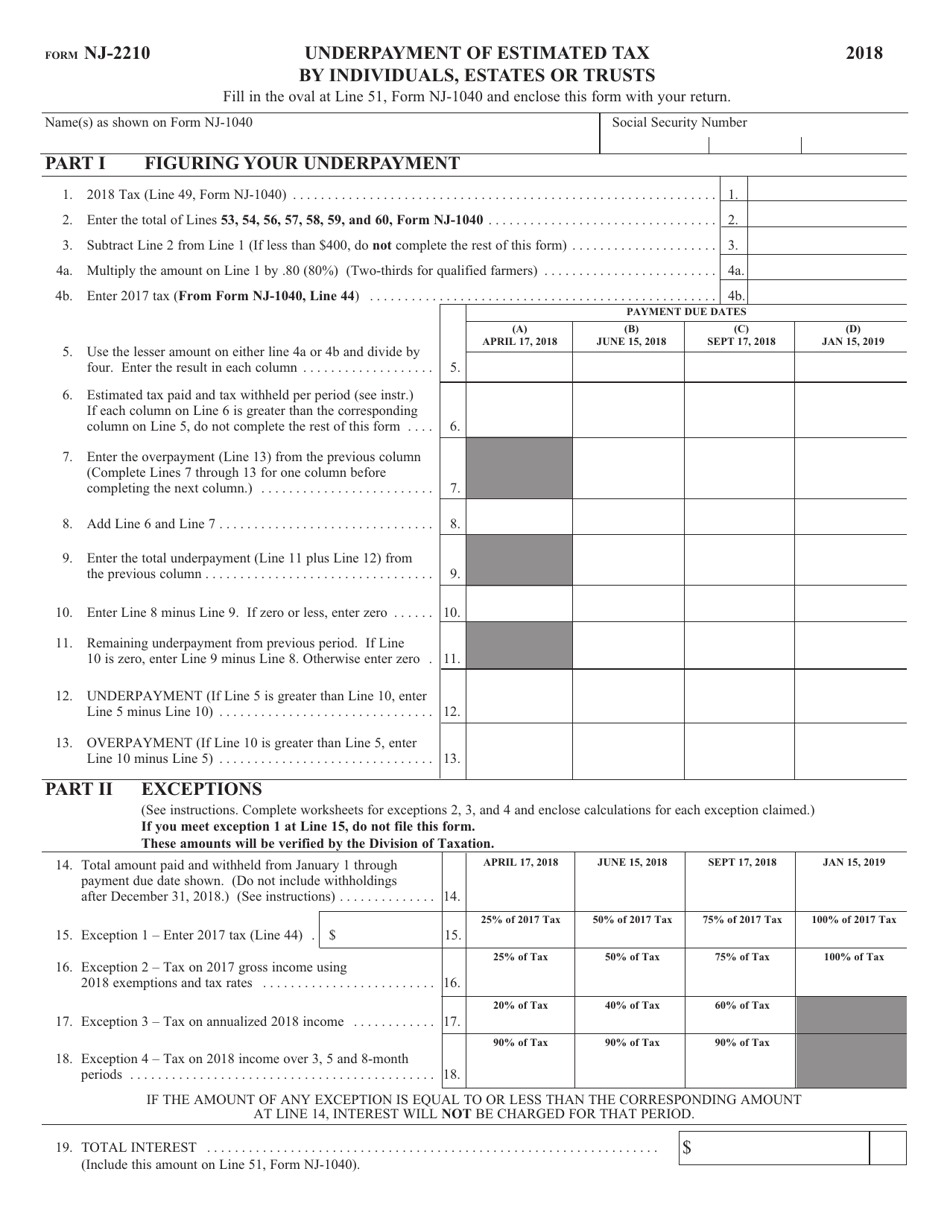

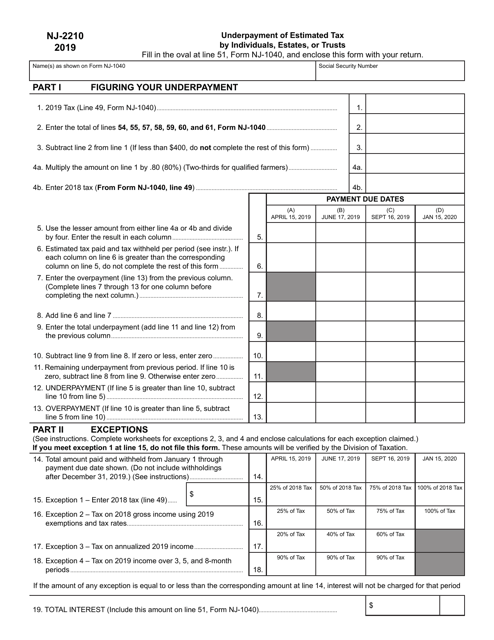

Form Nj 2210

Form Nj 2210 - Web estimated income tax payment voucher for 2023. Complete part i, figuring your underpayment, to determine if you have. Web follow the simple instructions below: • how interest is charged if you fail to. Complete part i, figuring your underpayment, to determine if you have. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: Business, legal, tax along with other electronic documents need an advanced level of protection and compliance with the law. Underpayment of estimated tax by individuals, estates, or trusts. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj.

Use get form or simply click on the template. Estates and trustsare subject to interest on underpayment of estimated. Web follow the simple instructions below: This form is for income earned in tax year 2022, with tax returns due in april. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj. The irs will generally figure your penalty for you and you should not file form 2210. Complete part i, figuring your underpayment, to determine if you have. Easily fill out pdf blank, edit, and sign them. • the estimated tax requirements; Estimated income tax payment voucher for 4th quarter 2022.

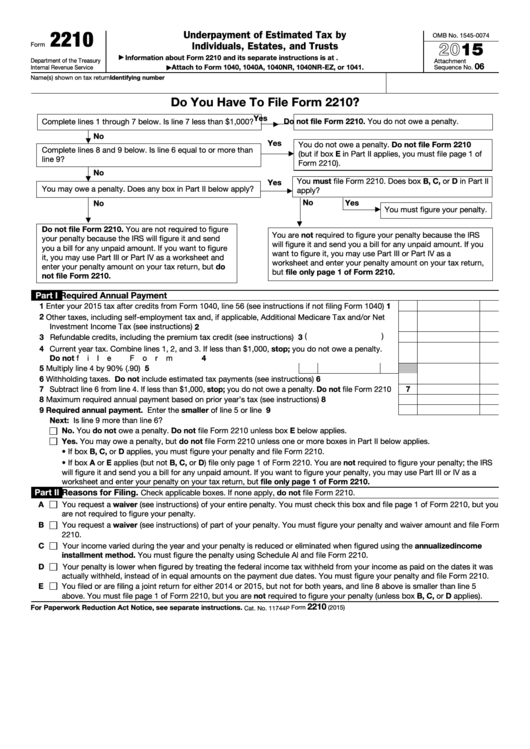

Web follow the simple instructions below: Estates and trustsare subject to interest on underpayment of estimated. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Save or instantly send your ready documents. • the estimated tax requirements; Business, legal, tax along with other electronic documents need an advanced level of protection and compliance with the law. Underpayment of estimated tax by individuals, estates, or trusts. Estimated income tax payment voucher for 4th quarter 2022. Estates and trusts are subject to interest on underpayment of estimated.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

Web follow the simple instructions below: Web estimated income tax payment voucher for 2023. • ways to make the payments; Estates and trusts are subject to interest on underpayment of estimated. Complete part i, figuring your underpayment, to determine if you have.

Instructions for Form De2210 Delaware Underpayment of Estimated

Estimated income tax payment voucher for 4th quarter 2022. • how interest is charged if you fail to. Estates and trusts are subject to interest on underpayment of estimated. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Business, legal, tax along with other.

Ssurvivor Form 2210 Instructions 2018

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web follow the simple instructions below: Estates and trusts are subject to interest on underpayment of estimated. Underpayment of estimated tax by individuals, estates, or trusts.

Ssurvivor Irs Form 2210 Instructions

Business, legal, tax along with other electronic documents need an advanced level of protection and compliance with the law. Web follow the simple instructions below: • the estimated tax requirements; Underpayment of estimated tax by individuals, estates, or trusts. Save or instantly send your ready documents.

Instructions for Federal Tax Form 2210 Sapling

Estimated income tax payment voucher for 4th quarter 2022. Complete part i, figuring your underpayment, to determine if you have. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj. Estates and trustsare subject to interest on underpayment of estimated. Easily fill out pdf blank, edit, and sign them.

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

• ways to make the payments; Complete part i, figuring your underpayment, to determine if you have. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj. Easily fill out pdf blank, edit, and sign them. Web use form 2210 to determine the amount of underpaid estimated tax and.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Use get form or simply click on the template. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete part i, figuring your underpayment, to determine if you.

2011 Form NJ DoR NJREG Fill Online, Printable, Fillable, Blank pdfFiller

Complete part i, figuring your underpayment, to determine if you have. The irs will generally figure your penalty for you and you should not file form 2210. Finding a authorized professional, creating a scheduled visit and going to the workplace for a personal meeting makes doing a nj. Save or instantly send your ready documents. Complete part i, figuring your.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web follow the simple instructions below: Easily fill out pdf blank, edit, and sign them. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete part i, figuring your underpayment, to determine if you have. Complete part i, figuring your underpayment, to determine if.

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

• how interest is charged if you fail to. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete part i, figuring your underpayment, to determine if you have. Estates and trustsare subject to interest on underpayment of estimated. Web follow the simple instructions.

Save Or Instantly Send Your Ready Documents.

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete part i, figuring your underpayment, to determine if you have. Underpayment of estimated tax by individuals, estates, or trusts. • ways to make the payments;

Web Follow The Simple Instructions Below:

• the estimated tax requirements; Web follow the simple instructions below: Web estimated income tax payment voucher for 2023. Estates and trustsare subject to interest on underpayment of estimated.

Business, Legal, Tax Along With Other Electronic Documents Need An Advanced Level Of Protection And Compliance With The Law.

This form is for income earned in tax year 2022, with tax returns due in april. Complete part i, figuring your underpayment, to determine if you have. • how interest is charged if you fail to. Estimated income tax payment voucher for 4th quarter 2022.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Use get form or simply click on the template. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. Estates and trusts are subject to interest on underpayment of estimated.