Ga Ad Valorem Tax Exemption Form

Ga Ad Valorem Tax Exemption Form - Web it would clarify that two individually qualifying family farm entities that have merged to form a singular entity would still qualify for ad valorem tax exemption on certain farm products. Gdvs personnel will assist veterans in obtaining the necessary. Tax credits georgia tax center help tax faqs, due dates and other resources important updates x. Offers in compromise, bankruptcy, treasury refund offset, and releases of property subject to state tax liens. Web georgia sales and use tax exemptions; Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Web vehicles purchased on or after march 1, 2013 and titled in georgia are exempt from the sales and use tax and the annual ad valorem tax. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Web all tax forms check my refund status. Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes.

Web the ad valorem tax rate is calculated by the funding required by the tax districts or municipality divided by the tax base, which is the assessed value of all the taxable. Web i claim exemption from georgia personal property taxes by the virtue of the soldiers' and sailors' civil relief act of 1940, as amended. Web georgia sales and use tax exemptions; Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Vehicle identification number year make. Title ad valorem tax (tavt) faq; Offers in compromise, bankruptcy, treasury refund offset, and releases of property subject to state tax liens. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes. Web vehicles purchased on or after march 1, 2013 and titled in georgia are exempt from the sales and use tax and the annual ad valorem tax.

Web georgia sales and use tax exemptions; Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Offers in compromise, bankruptcy, treasury refund offset, and releases of property subject to state tax liens. Vehicle identification number year make. Title ad valorem tax (tavt) faq; Web vehicles purchased on or after march 1, 2013 and titled in georgia are exempt from the sales and use tax and the annual ad valorem tax. Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Web the ad valorem tax rate is calculated by the funding required by the tax districts or municipality divided by the tax base, which is the assessed value of all the taxable.

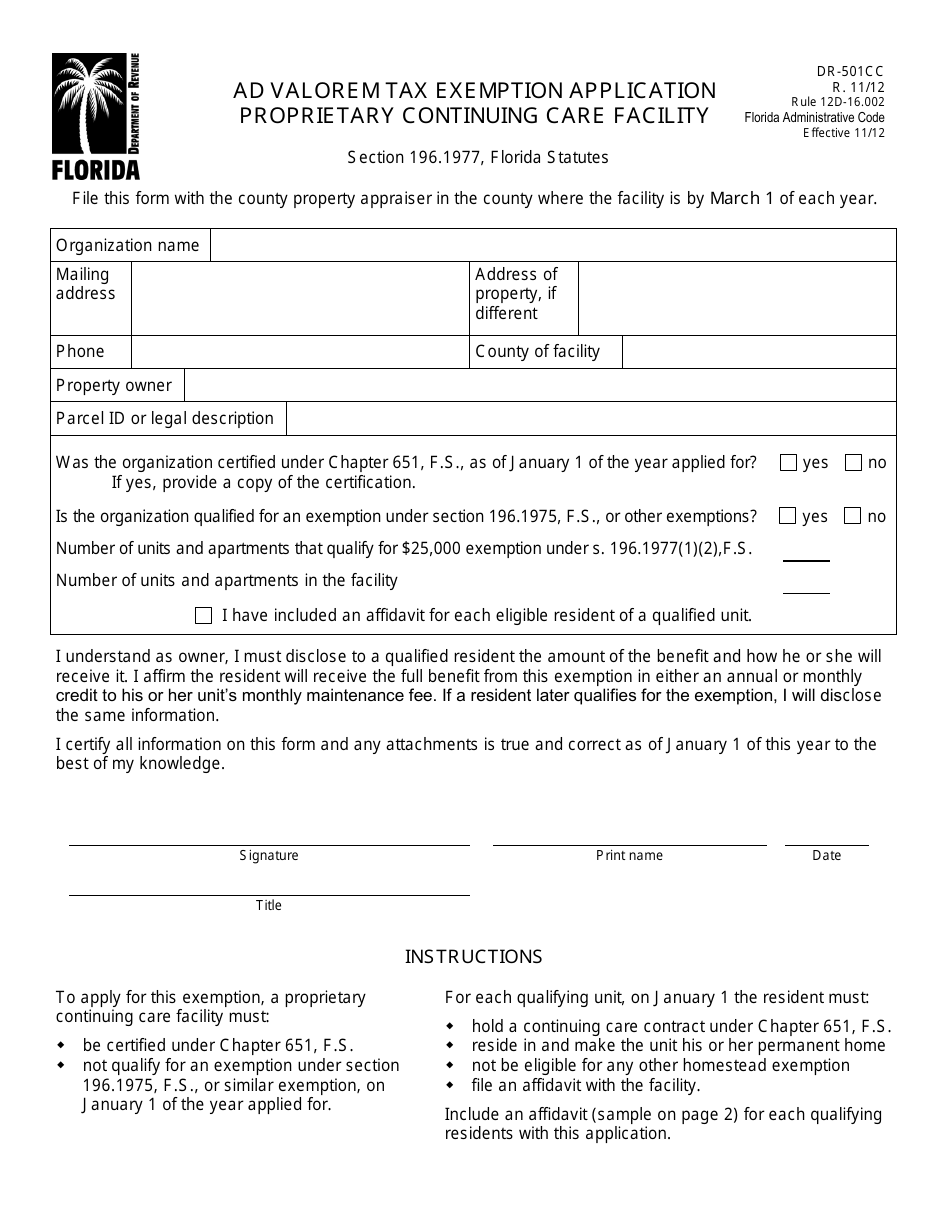

Form DR501CC Download Printable PDF or Fill Online Ad Valorem Tax

Web it would clarify that two individually qualifying family farm entities that have merged to form a singular entity would still qualify for ad valorem tax exemption on certain farm products. Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Web the ad valorem tax rate is calculated.

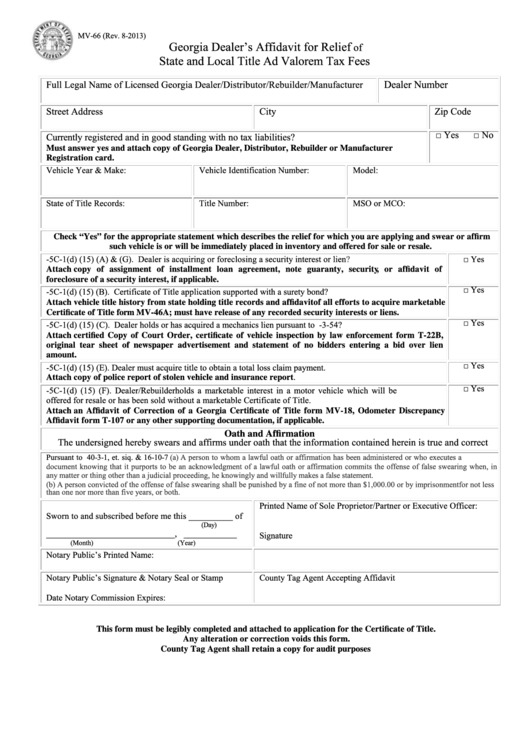

Fillable Form Mv66 Dealer'S Affidavit For Relief Of State

Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Web it would clarify that two individually qualifying family farm entities that have.

Highlands County Economic Development Ad Valor Em Tax Exemption Fill

Web it would clarify that two individually qualifying family farm entities that have merged to form a singular entity would still qualify for ad valorem tax exemption on certain farm products. Web all tax forms check my refund status. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Web georgia sales and.

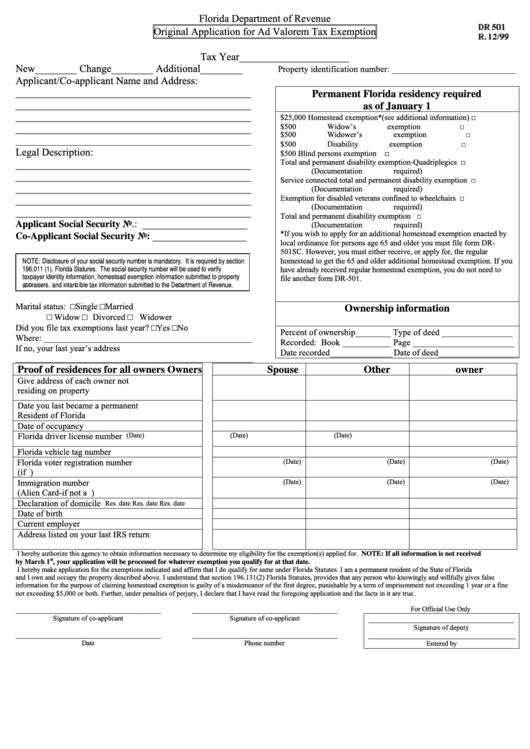

Original Application Form For Ad Valorem Tax Exemption Florida

Web the ad valorem tax rate is calculated by the funding required by the tax districts or municipality divided by the tax base, which is the assessed value of all the taxable. Web all tax forms check my refund status register a new business. Title ad valorem tax (tavt) faq; Web georgia sales and use tax exemptions; Offers in compromise,.

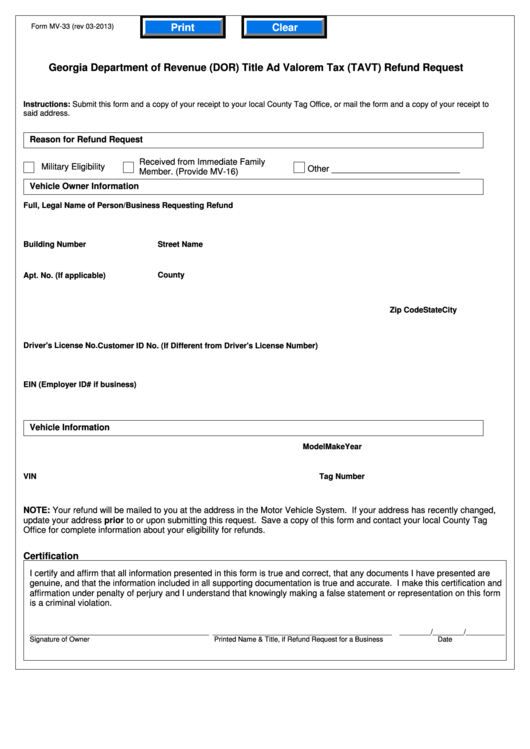

Fillable Form Mv33 Department Of Revenue (Dor) Title Ad

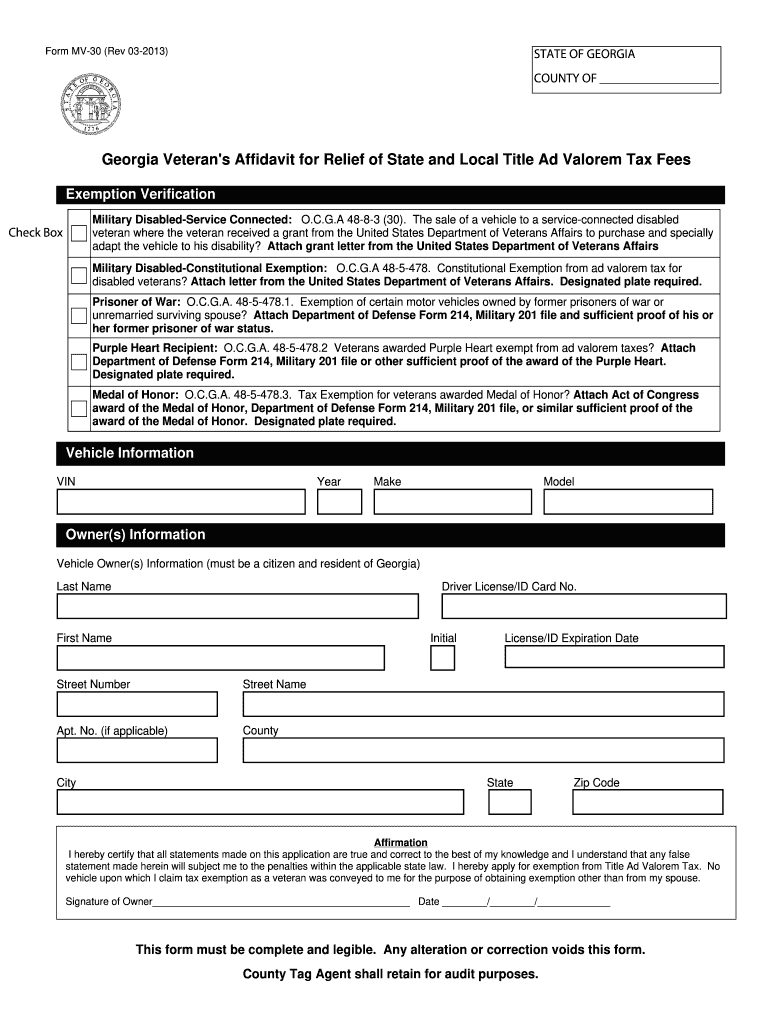

Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes. Gdvs personnel will assist veterans in obtaining the necessary. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Web i claim exemption from georgia.

Tax Rates Gordon County Government

Web it would clarify that two individually qualifying family farm entities that have merged to form a singular entity would still qualify for ad valorem tax exemption on certain farm products. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Web all tax forms check my refund status. Web i claim exemption.

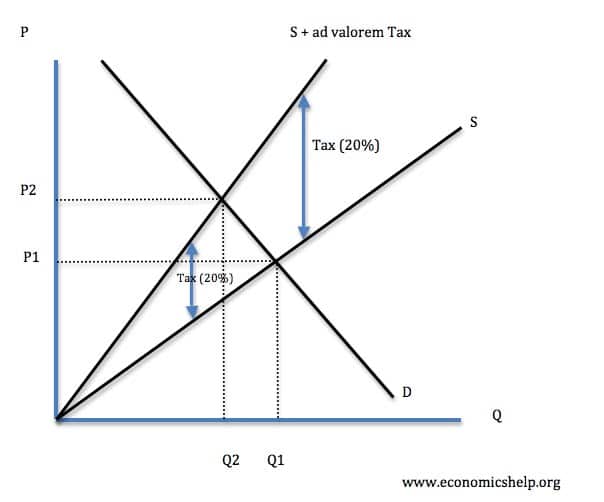

Indirect taxes Economics Help

Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Web vehicles purchased on or after march 1, 2013 and titled in georgia are exempt from the sales and use.

Mv 30 Fill Online, Printable, Fillable, Blank pdfFiller

Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Offers in compromise, bankruptcy, treasury refund offset, and releases of property subject to state tax liens. Web georgia sales and use tax exemptions; Gdvs personnel will assist veterans in obtaining the necessary. Web any qualifying disabled veteran may be granted an exemption of.

Top 32 Sales Tax Form Templates free to download in PDF format

Web the ad valorem tax rate is calculated by the funding required by the tax districts or municipality divided by the tax base, which is the assessed value of all the taxable. Gdvs personnel will assist veterans in obtaining the necessary. Web it would clarify that two individually qualifying family farm entities that have merged to form a singular entity.

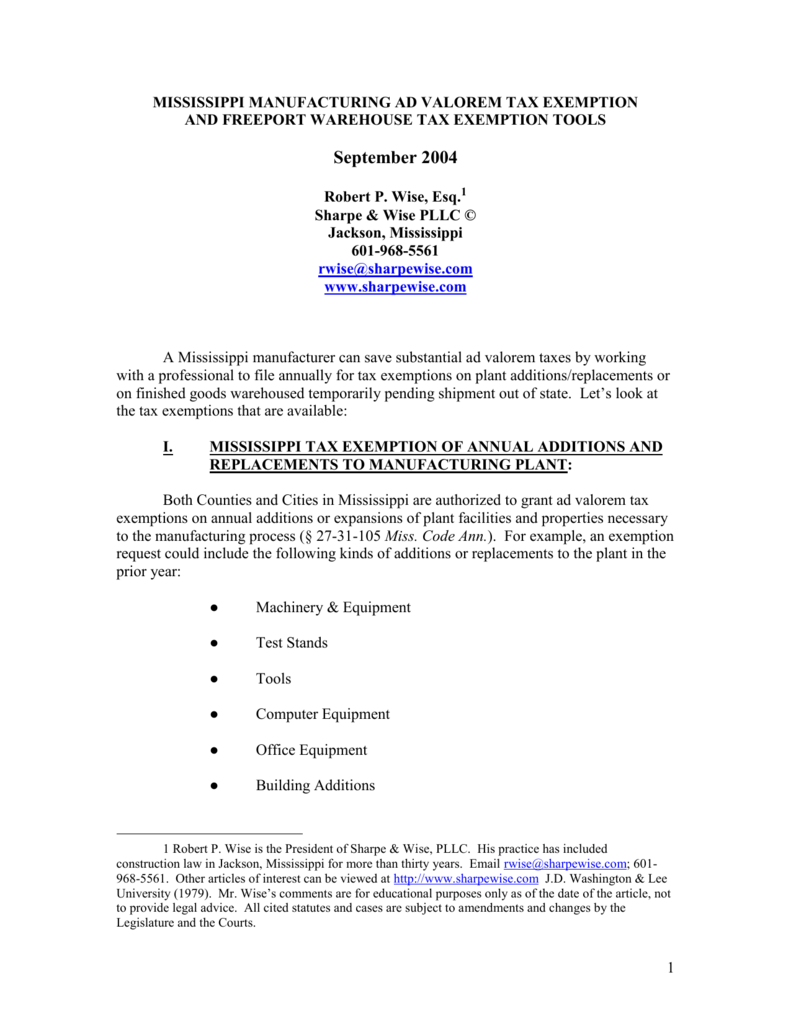

A MISSISSIPPI MANUFACTURER`S AD VALOREM TAX EXEMPTION

Tax credits georgia tax center help tax faqs, due dates and other resources important updates x. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties. Web vehicles purchased on or after march 1, 2013 and titled in georgia are exempt from the sales and use tax and the annual ad valorem tax..

Web Vehicles Purchased On Or After March 1, 2013 And Titled In Georgia Are Exempt From The Sales And Use Tax And The Annual Ad Valorem Tax.

Web i claim exemption from georgia personal property taxes by the virtue of the soldiers' and sailors' civil relief act of 1940, as amended. Web all tax forms check my refund status. Offers in compromise, bankruptcy, treasury refund offset, and releases of property subject to state tax liens. Web the ad valorem tax rate is calculated by the funding required by the tax districts or municipality divided by the tax base, which is the assessed value of all the taxable.

Gdvs Personnel Will Assist Veterans In Obtaining The Necessary.

Tax credits georgia tax center help tax faqs, due dates and other resources important updates x. Web any qualifying disabled veteran may be granted an exemption of up to $60,000 plus an additional sum from paying property taxes for county, municipal, and school purposes. Web all tax forms check my refund status register a new business. Web georgia sales and use tax exemptions;

Web It Would Clarify That Two Individually Qualifying Family Farm Entities That Have Merged To Form A Singular Entity Would Still Qualify For Ad Valorem Tax Exemption On Certain Farm Products.

Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Vehicle identification number year make. Refunds audits and collections tax rules and policies power of attorney tax credits georgia tax center help tax faqs, due dates. Web the administration of tax exemptions is as interpreted by the tax commissioners of georgia’s 159 counties.