Harris County Quit Claim Deed Form

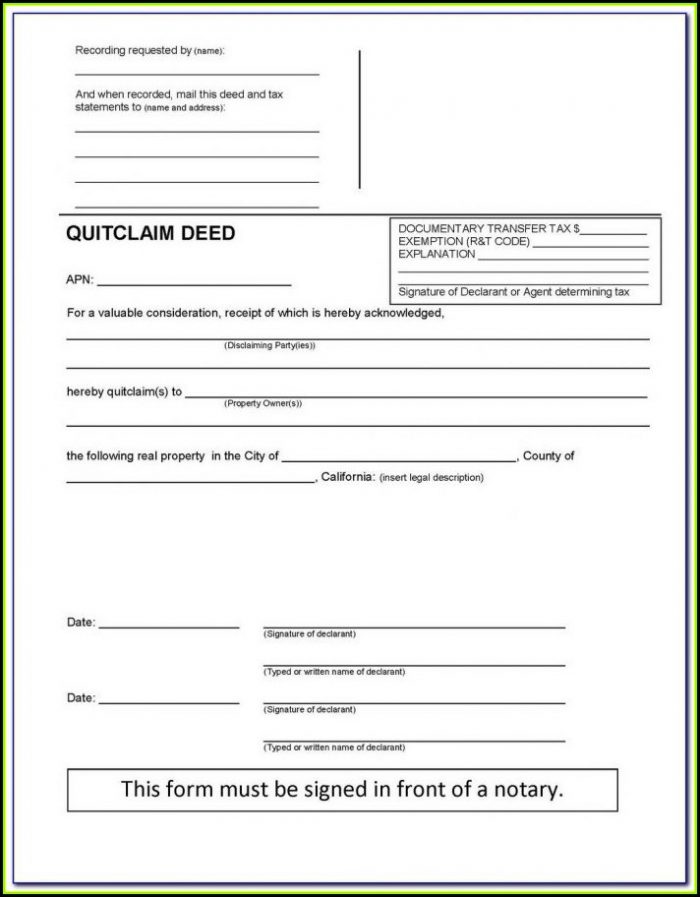

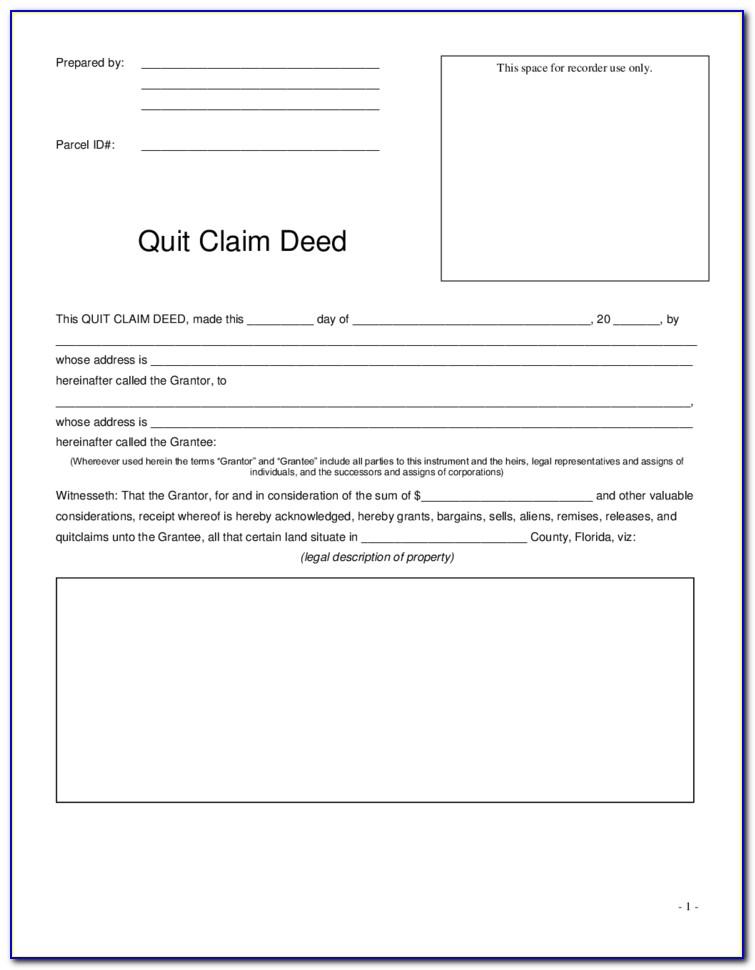

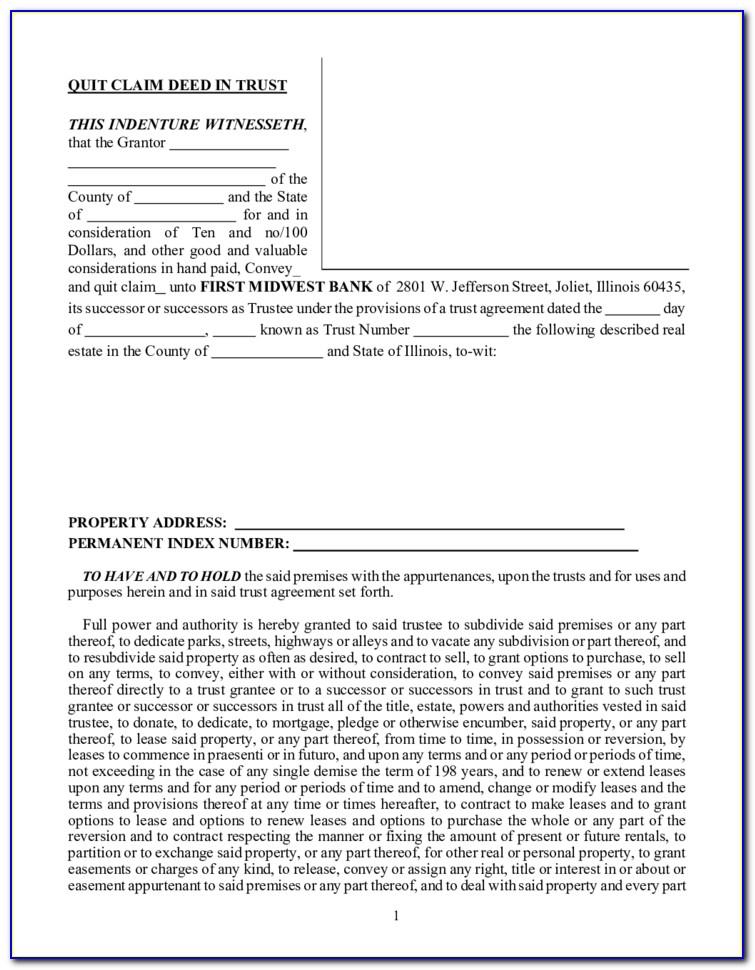

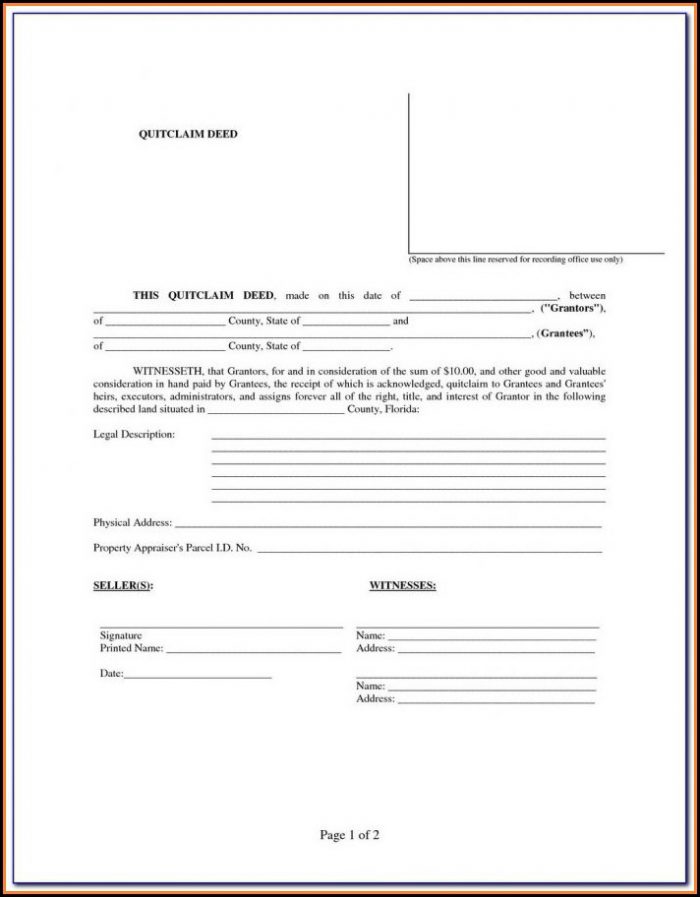

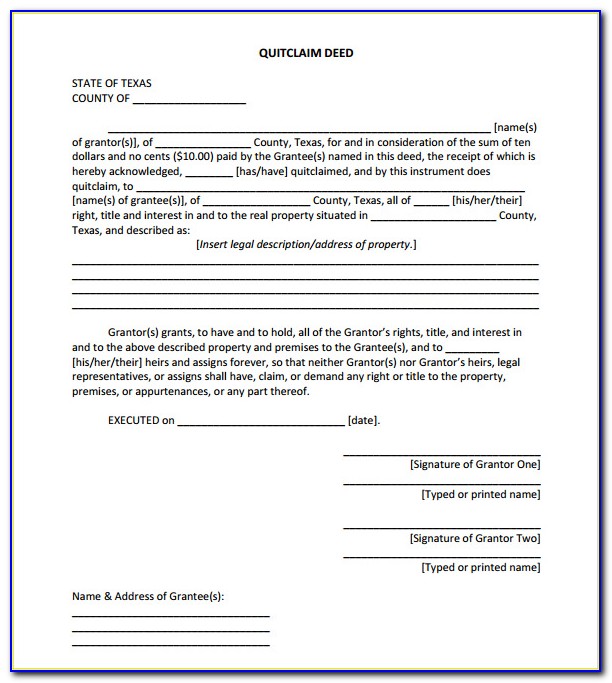

Harris County Quit Claim Deed Form - An instrument executed after december 31, 1981, conveying an interest in real property may not be recorded unless: Web harris county district clerk 201 caroline | p.o. Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. For district clerk’soffice use only. At deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of. Web it is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).create a new deed.sign and notarize the deed.file the documents in the county land records. You need to record the completed and notarized quitclaim deed form. Web $18.00 for the first page $4.00 for each additional page $0.25 for each name in excess of five name that has to be indexed grantee's address per texas property code section. You will likely need to pay a filing fee determined by the county clerk.

At deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. Web it is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).create a new deed.sign and notarize the deed.file the documents in the county land records. Web harris county district clerk 201 caroline | p.o. Will not maintain this information on your behalf. Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of. You need to record the completed and notarized quitclaim deed form. It’s important that you keep this form for your own personal records as the dco. For district clerk’soffice use only. Web updated july 17, 2023.

You need to record the completed and notarized quitclaim deed form. An instrument executed after december 31, 1981, conveying an interest in real property may not be recorded unless: Web it is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).create a new deed.sign and notarize the deed.file the documents in the county land records. Web $24.97 delivery immediate download payment information credit card type credit card number expiration month expiration year card security code last name back to texas back to texas mineral quit claim deed included forms all harris county specific forms and documents listed below are included in your immediate download package: Web harris county district clerk 201 caroline | p.o. Web get your harris county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. Included document last updated 4/3/2023 It’s important that you keep this form for your own personal records as the dco. Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of.

Quit Claim Deed Form Texas Tarrant County Universal Network

Included document last updated 4/3/2023 Web updated july 17, 2023. Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. You need to record the completed and notarized quitclaim deed form. Web $18.00 for the first page $4.00 for each additional page $0.25 for each name.

Quit Claim Deed Form Clark County Nevada Form Resume Examples

It’s important that you keep this form for your own personal records as the dco. Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. Web updated july 17, 2023. Will not maintain this information on your behalf. However, before using a quitclaim deed in the.

Beneficiary Deed Form Colorado Free Form Resume Examples goVL7PpYva

Web $24.97 delivery immediate download payment information credit card type credit card number expiration month expiration year card security code last name back to texas back to texas mineral quit claim deed included forms all harris county specific forms and documents listed below are included in your immediate download package: You need to record the completed and notarized quitclaim deed.

Texas Quit Claim Deed Form Bexar County Universal Network

You will likely need to pay a filing fee determined by the county clerk. Web harris county district clerk 201 caroline | p.o. Web get your harris county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. Web $24.97 delivery immediate download payment information credit card type credit card number expiration month expiration year card.

Quit Claim Deed Form County

Web $18.00 for the first page $4.00 for each additional page $0.25 for each name in excess of five name that has to be indexed grantee's address per texas property code section. An instrument executed after december 31, 1981, conveying an interest in real property may not be recorded unless: It’s important that you keep this form for your own.

Quick Claim Deed Form Harris County Texas Universal Network

Web harris county district clerk 201 caroline | p.o. Web $18.00 for the first page $4.00 for each additional page $0.25 for each name in excess of five name that has to be indexed grantee's address per texas property code section. For district clerk’soffice use only. Will not maintain this information on your behalf. The form must be completed with.

Free Quit Claim Deed Form Illinois Cook County Form Resume Examples

You will likely need to pay a filing fee determined by the county clerk. For district clerk’soffice use only. An instrument executed after december 31, 1981, conveying an interest in real property may not be recorded unless: At deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or.

Free Quit Claim Deed Form Texas Form Resume Examples EZVgPyJ2Jk

The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of. Web texans can find quitclaim deed forms at a variety of places from county clerk’s offices to online providers of legal forms. Web harris county district clerk 201 caroline | p.o. It’s important that.

Maricopa County Quit Claim Deed Form Pdf Form Resume Examples

Web harris county district clerk 201 caroline | p.o. You will likely need to pay a filing fee determined by the county clerk. Web updated july 17, 2023. Web $24.97 delivery immediate download payment information credit card type credit card number expiration month expiration year card security code last name back to texas back to texas mineral quit claim deed.

Quit Claim Mineral Deed Form Texas Form Resume Examples aZDYzqZ579

Included document last updated 4/3/2023 You need to record the completed and notarized quitclaim deed form. The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of. Web it is best to begin with a copy of the most recent deed to the property (the.

Web Harris County District Clerk 201 Caroline | P.o.

Per texas property code § 11.001, submit the deed to the recorder’s office in the county court clerk’s office where the property is located. Web it is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor).create a new deed.sign and notarize the deed.file the documents in the county land records. Web $24.97 delivery immediate download payment information credit card type credit card number expiration month expiration year card security code last name back to texas back to texas mineral quit claim deed included forms all harris county specific forms and documents listed below are included in your immediate download package: You will likely need to pay a filing fee determined by the county clerk.

For District Clerk’soffice Use Only.

You need to record the completed and notarized quitclaim deed form. The form must be completed with the individual who prepared the document, the parties’ names (grantor (s) and grantee (s)), and a detailed legal description of. Web texans can find quitclaim deed forms at a variety of places from county clerk’s offices to online providers of legal forms. Web get your harris county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks.

Web Updated July 17, 2023.

It’s important that you keep this form for your own personal records as the dco. At deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. An instrument executed after december 31, 1981, conveying an interest in real property may not be recorded unless: Web $18.00 for the first page $4.00 for each additional page $0.25 for each name in excess of five name that has to be indexed grantee's address per texas property code section.

Will Not Maintain This Information On Your Behalf.

However, before using a quitclaim deed in the state of texas, residents should be aware that real estate attorneys and insurance companies do not favor them. Included document last updated 4/3/2023