Heloc Application Form

Heloc Application Form - Find out about home equity rate and apply online today. Complete your application and provide financial documents; The amount of equity you have in your home. First you find a heloc lender , and they’ll take your application verbally, or will instruct you to fill out a form online. From the main menu, select explore accounts & offers. It takes minutes to apply and decisions are quick. Web what you need to know about applying for a home equity loan or home equity line of credit (heloc), including current lender requirements. Web a home equity line of credit (heloc) provides the flexibility to use your funds over time. Whether or not the property is held in trust. The name of the agency that holds the homeowner's insurance policy.

A processor will be assigned to review your application and will contact. Web apply now how your home's equity can make it happen. The names of the people listed on the title of the collateral property. To qualify for a heloc, you’ll need a fico score of 660 or higher. Web for the best mobile banking experience, we recommend logging in or downloading the u.s. From the main menu, select explore accounts & offers. Web there is not a big difference in how to apply for a home equity line of credit versus how to apply for a traditional mortgage. Homeowner's insurance and property tax information. Complete your application and provide financial documents; Whether or not the property is held in trust.

Web what you need to know about applying for a home equity loan or home equity line of credit (heloc), including current lender requirements. Bank also looks at factors including: Web qualifying for a heloc. Only borrow what you need. Find out about home equity rate and apply online today. A processor will be assigned to review your application and will contact. Close on the loan and pay any upfront fees Scroll down and select home equity. First you find a heloc lender , and they’ll take your application verbally, or will instruct you to fill out a form online. The name of the agency that holds the homeowner's insurance policy.

Chase stops accepting HELOC applications HousingWire

Wait for approval, including underwriting and appraisal; Bank also looks at factors including: Web there is not a big difference in how to apply for a home equity line of credit versus how to apply for a traditional mortgage. To qualify for a heloc, you need to have available equity in your home, meaning that the amount you owe on.

Heloc Heloc Application

First you find a heloc lender , and they’ll take your application verbally, or will instruct you to fill out a form online. The name of the agency that holds the homeowner's insurance policy. The amount of equity you have in your home. Web qualifying for a heloc. From the main menu, select explore accounts & offers.

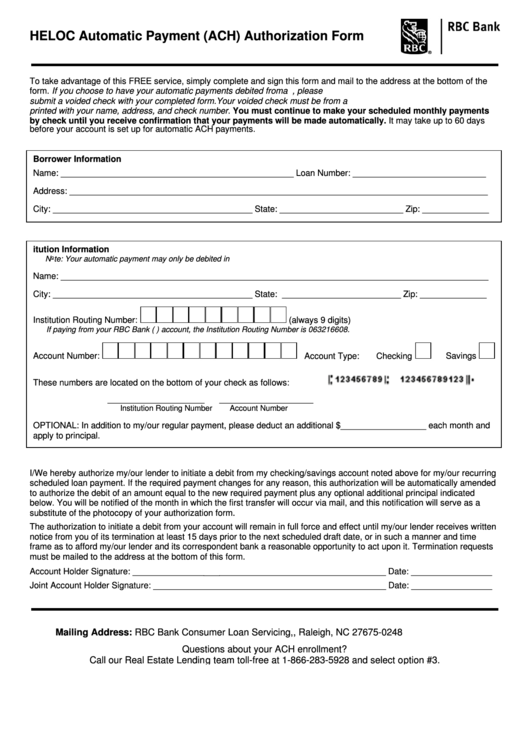

Heloc Automatic Payment (Ach) Authorization Form printable pdf download

The names of the people listed on the title of the collateral property. Web apply now how your home's equity can make it happen. Web a home equity line of credit (heloc) provides the flexibility to use your funds over time. Homeowner's insurance and property tax information. The name of the agency that holds the homeowner's insurance policy.

Heloc Online Heloc Application

Your credit score and history. Homeowner's insurance and property tax information. Web monthly payment and mortgage information. Details about any second mortgage you have on the property. It replenishes as you repay it—and you choose fixed or variable rates.

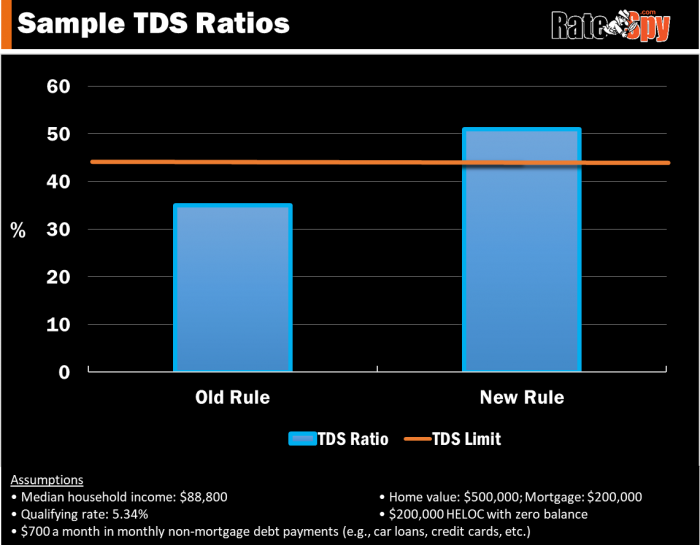

Got a HELOC? Your Mortgage Options Are About to Shrink

The amount of equity you have in your home. Bank also looks at factors including: It takes minutes to apply and decisions are quick. Homeowner's insurance and property tax information. Web requirements to get a heloc.

Home Equity Line of Credit (HELOC) MACU

To qualify for a heloc, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. You can typically borrow up to 85% of the value of. Select home equity line of credit. To qualify for a heloc, you’ll need a fico score of.

HELOC Application Process How to Apply for Home Equity Line of Credit

Web a home equity line of credit (heloc) provides the flexibility to use your funds over time. Scroll down and select home equity. Whether or not the property is held in trust. It replenishes as you repay it—and you choose fixed or variable rates. Web apply now how your home's equity can make it happen.

Applying of a HELOC? Do It Sooner Rather than Later

The name of the agency that holds the homeowner's insurance policy. Web there is not a big difference in how to apply for a home equity line of credit versus how to apply for a traditional mortgage. Your credit score and history. Wait for approval, including underwriting and appraisal; The amount of equity you have in your home.

Homeowners Are Rushing to Get HELOCs—Should You Do It, Too? Home

To qualify for a heloc, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. Web qualifying for a heloc. Put away the credit card and tap into your heloc. Select either lean more or apply now to begin the application process. Web.

A simple guide to getting a HELOC on a rental property

A processor will be assigned to review your application and will contact. Web complete and submit your home equity loan or heloc application. Web compare heloc rate quotes ; The names of the people listed on the title of the collateral property. Web qualifying for a heloc.

Find Out About Home Equity Rate And Apply Online Today.

Only borrow what you need. Bank also looks at factors including: It replenishes as you repay it—and you choose fixed or variable rates. You can typically borrow up to 85% of the value of.

Web Requirements To Get A Heloc.

From the main menu, select explore accounts & offers. Whether or not the property is held in trust. A processor will be assigned to review your application and will contact. It takes minutes to apply and decisions are quick.

Web Complete And Submit Your Home Equity Loan Or Heloc Application.

Web qualifying for a heloc. Close on the loan and pay any upfront fees Details about any second mortgage you have on the property. The names of the people listed on the title of the collateral property.

Web A Home Equity Line Of Credit (Heloc) Provides The Flexibility To Use Your Funds Over Time.

Web compare heloc rate quotes ; Web monthly payment and mortgage information. Web for the best mobile banking experience, we recommend logging in or downloading the u.s. Homeowner's insurance and property tax information.