Home Heating Credit Form

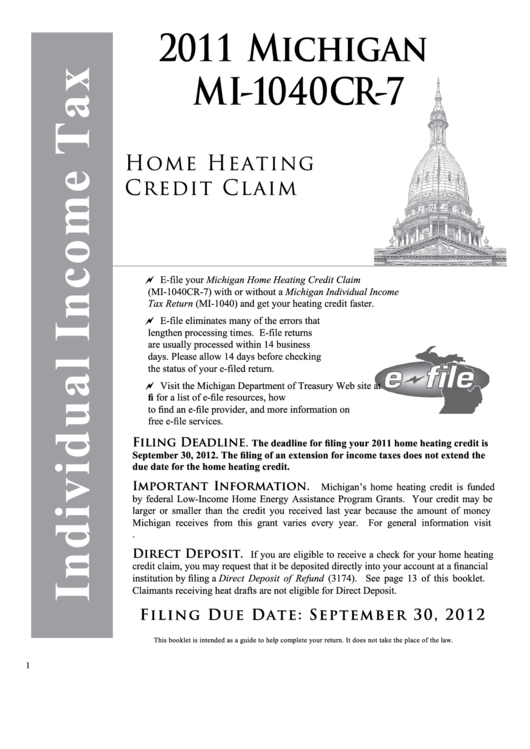

Home Heating Credit Form - Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Web our online form is the quickest way to get information to our crews. Web the deadline for submitting this form is september 30, 2022. 1, 2023, you may qualify for a tax credit. Online from the michigan department of. You must check this box to receive a. Web faqs how do i file for a home heating credit? Web if you have more than four (4) household members, complete home heating credit claim : For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. You can download or print.

Web faqs how do i file for a home heating credit? Use get form or simply click on the template preview to open it in the editor. Type or print in blue or black ink. Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web home heating credit claim: Online from the michigan department of. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. Ecip is designed to provide financial assistance to households in a.

Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web the ea benefit amount is based upon household size, income and the type of fuel used for home heating. Web our online form is the quickest way to get information to our crews. Issued under authority of public act 281 of 1967, as amended. Fill out the application below. Web michiganders who need help with their energy bills can now apply for the home heating credit, according to the michigan department of treasury (treasury). Online from the michigan department of. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web the deadline for submitting this form is september 30, 2022. 1, 2023, you may qualify for a tax credit.

Michigan Home Heating Credit Calculator Fill Online, Printable

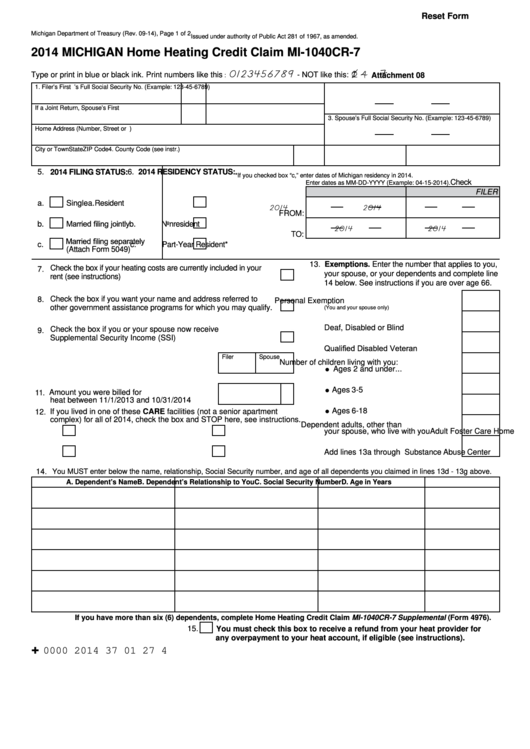

1, 2023, you may qualify for a tax credit. Home heating credit claim instruction book: Issued under authority of public act 281 of 1967, as amended. Web home heating credit claim: Type or print in blue or black ink.

1999 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Issued under authority of public act 281 of 1967, as amended. Web faqs how do i file for a home heating credit? Web our online form is the quickest way to get information to our crews..

288,000 Michigan Residents to Receive Additional Home Heating Credit

Web home heating credit claim: Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. You must check this box to receive a. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web application for financial help to heat or cool your home low.

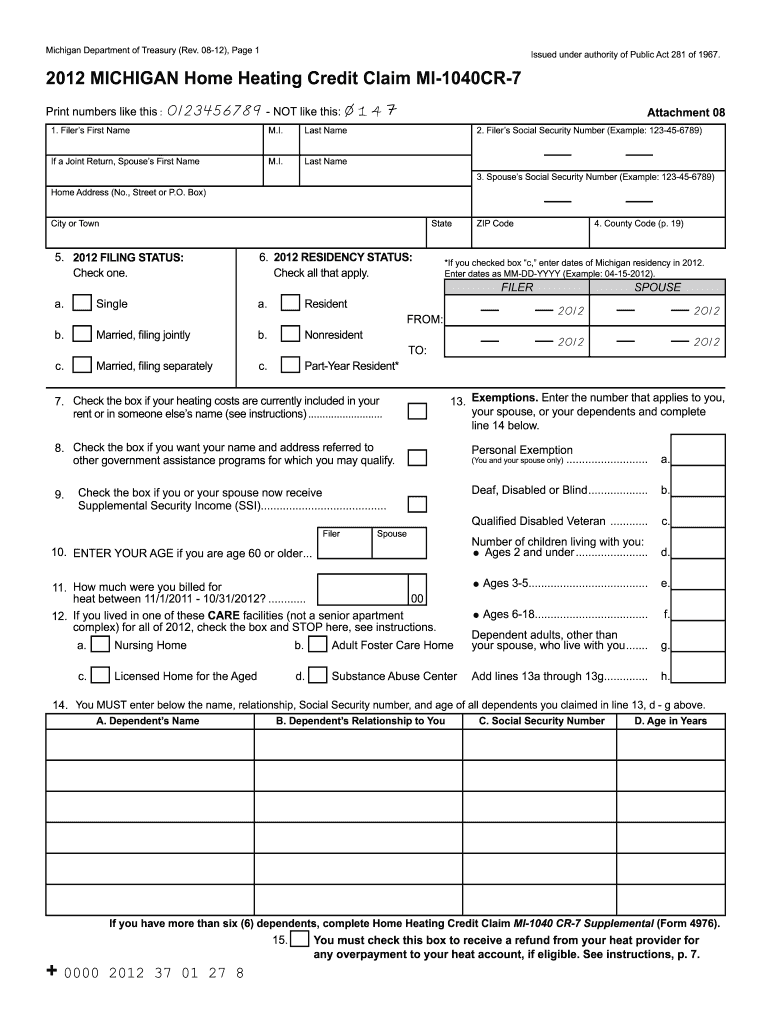

Fillable Form Mi1040cr7 Michigan Home Heating Credit Claim 2014

Web if you have more than four (4) household members, complete home heating credit claim : For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. You must check this box to receive a. Fill out the application below. Issued under authority of public act 281 of 1967, as amended.

Maintain your comfort throughout 2020 by following through on these New

Home heating credit claim instruction book: Issued under authority of public act 281 of 1967, as amended. Web if you have more than four (4) household members, complete home heating credit claim : Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. You must check this.

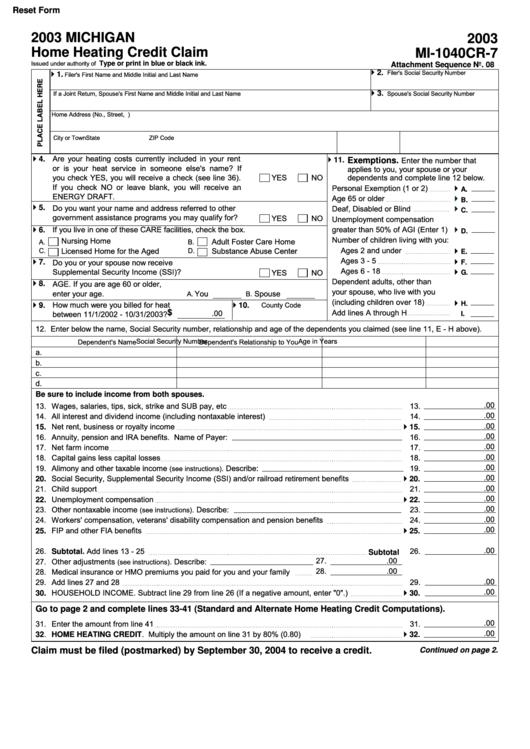

Fillable Form Mi1040cr7 Home Heating Credit Claim 2003 printable

You may qualify for a home heating credit if all of the following apply: 1, 2023, you may qualify for a tax credit. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. You must check this box to receive a. Form 8908 is used by.

Instructions For Form Mi1040cr7 Michigan Home Heating Credit Claim

Home heating credit claim instruction book: Ecip is designed to provide financial assistance to households in a. Fill out the application below. Issued under authority of public act 281 of 1967, as amended. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information.

Home Heating Credit Form 2020 Fill and Sign Printable Template Online

Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. You can download or print. Issued under authority of public act 281 of 1967, as amended. You may qualify for a home heating credit if all of the following apply: Type or print in blue or black.

Efficient Home Heating Systems Richair

Web if you have more than four (4) household members, complete home heating credit claim : You may qualify for a home heating credit if all of the following apply: Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Fill out the application below. Visit the.

Fillable Online Printable 2020 Michigan Form 4976 (Home Heating Credit

Form 8908 is used by. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. You may qualify for a home heating credit if all of the following apply: Web if you have more than four (4) household members, complete home heating credit claim : Online from the michigan department of.

Online From The Michigan Department Of.

You may qualify for a home heating credit if all of the following apply: Web our online form is the quickest way to get information to our crews. Ecip is designed to provide financial assistance to households in a. Web faqs how do i file for a home heating credit?

Web If You Have More Than Four (4) Household Members, Complete Home Heating Credit Claim :

Web the deadline for submitting this form is september 30, 2022. Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. 1, 2023, you may qualify for a tax credit. You can download or print.

For Example, If You Purchased Fuel That Was Taxed At $0.195 Per Gallon And Fuel.

Web michiganders who need help with their energy bills can now apply for the home heating credit, according to the michigan department of treasury (treasury). Form 8908 is used by. Type or print in blue or black ink. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Web Form 5695 2021 Residential Energy Credits Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form5695 For Instructions And The Latest Information.

Fill out the application below. You must check this box to receive a. Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. Web the ea benefit amount is based upon household size, income and the type of fuel used for home heating.