Housing Deduction From Form 2555

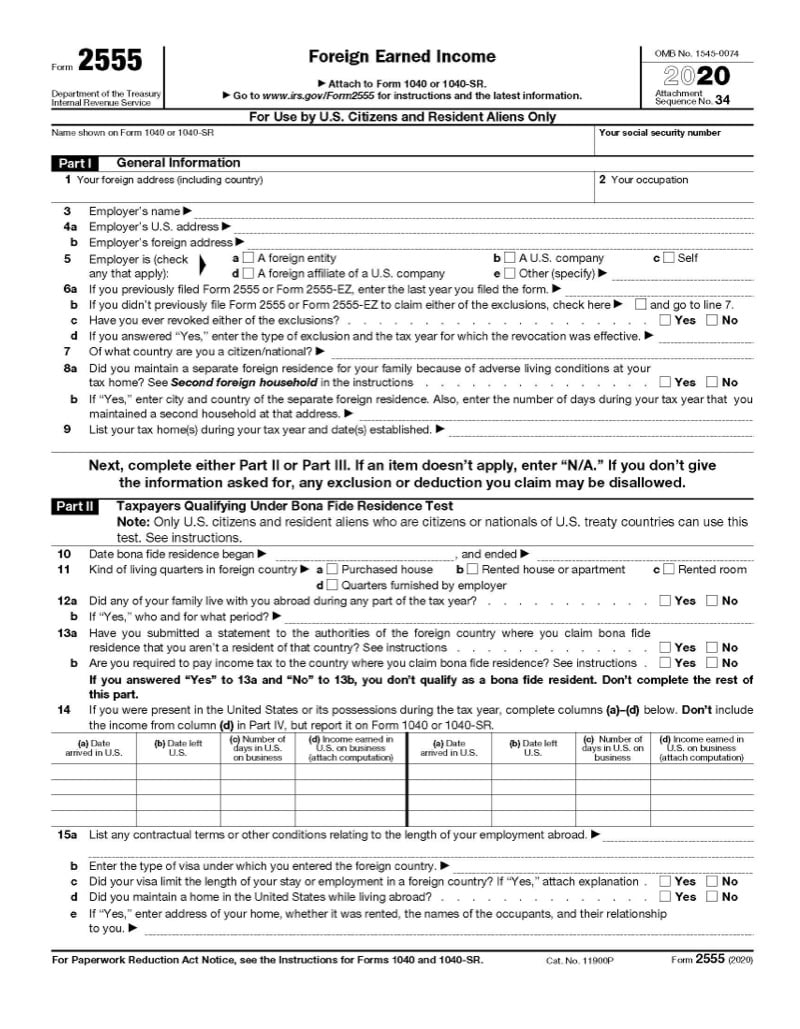

Housing Deduction From Form 2555 - If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. The foreign housing deduction is reported on form 2555 part vi and ix. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web yes no are you required to pay income tax to the country where you claim bona fide residence? If you qualify, you can use form. Web foreign housing exclusion and deduction. Review that the entity number for the interview form m. In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your.

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The exclusion is available only for wages or self. If you are married and you and your spouse each qualifies under one of the tests, see. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. Yes no if you answered “yes” to 13a and “no” to 13b,. Review that the entity number for the interview form m. The foreign housing deduction is reported on form 2555 part vi and ix. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. Web the foreign housing deduction is reported on form 2555 part vi and ix. Web the housing deduction is figured in part ix.

Review that the entity number for the interview form m. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Yes no if you answered “yes” to 13a and “no” to 13b,. If you qualify, you can use form. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Web yes no are you required to pay income tax to the country where you claim bona fide residence? If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. If you are married and you and your spouse each qualifies under one of the tests, see. Web the housing deduction is figured in part ix.

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt

The foreign housing deduction is reported on form 2555 part vi and ix. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. Web yes no are you required.

Foreign Housing Deductions & Exclusions US Expats Tax Form 2555

Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the housing deduction is figured in part ix. In addition to the foreign.

Instructions for form 2555 2013

Yes no if you answered “yes” to 13a and “no” to 13b,. These two exclusions help us taxpayers abroad capitalize on. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. If you are married and you and your spouse each qualifies under one of the tests, see. In addition to the foreign earned.

Housing Allowance Back Pay 2020 Fill Online, Printable, Fillable

Go to www.irs.gov/form2555 for instructions and the. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web the foreign housing deduction is reported on form 2555 part vi and ix. You cannot exclude or deduct more than the. These two exclusions help us taxpayers abroad capitalize on.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

You cannot exclude or deduct more than the. Go to www.irs.gov/form2555 for instructions and the. In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Yes.

US Tax Abroad Expatriate Form 2555

Yes no if you answered “yes” to 13a and “no” to 13b,. If you qualify, you can use form. These two exclusions help us taxpayers abroad capitalize on. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Web foreign housing exclusion and.

Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad

This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. Review that the entity number for the interview form m. The exclusion is available only for wages or self. Web the foreign housing deduction is reported on form 2555 part vi and ix. In addition to the foreign earned income exclusion, you can.

3.21.3 Individual Tax Returns Internal Revenue Service

If you are married and you and your spouse each qualifies under one of the tests, see. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. In addition to the foreign earned income exclusion, you can also claim an exclusion or a.

IRS Form 2555 and the Foreign Earned Exclusion A Practical

Web yes no are you required to pay income tax to the country where you claim bona fide residence? These two exclusions help us taxpayers abroad capitalize on. Yes no if you answered “yes” to 13a and “no” to 13b,. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web.

Housing Recovery All of a Sudden Looks Strong

The foreign housing deduction is reported on form 2555 part vi and ix. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web foreign housing exclusion and deduction. Web the housing deduction is figured in part ix. Web information about form 2555, foreign earned income, including recent.

Web Foreign Housing Exclusion And Deduction.

Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. Review that the entity number for the interview form m. Yes no if you answered “yes” to 13a and “no” to 13b,.

In Addition To The Foreign Earned Income Exclusion, You Can Also Claim An Exclusion Or A Deduction From Gross Income For Your.

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The exclusion is available only for wages or self. Web the housing deduction is figured in part ix. Web yes no are you required to pay income tax to the country where you claim bona fide residence?

If You Are Married And You And Your Spouse Each Qualifies Under One Of The Tests, See.

If you qualify, you can use form. Web the housing deduction is figured in part ix. Web the foreign housing deduction is reported on form 2555 part vi and ix. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix.

The Foreign Housing Deduction Is Reported On Form 2555 Part Vi And Ix.

If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. You cannot exclude or deduct more than the. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits.