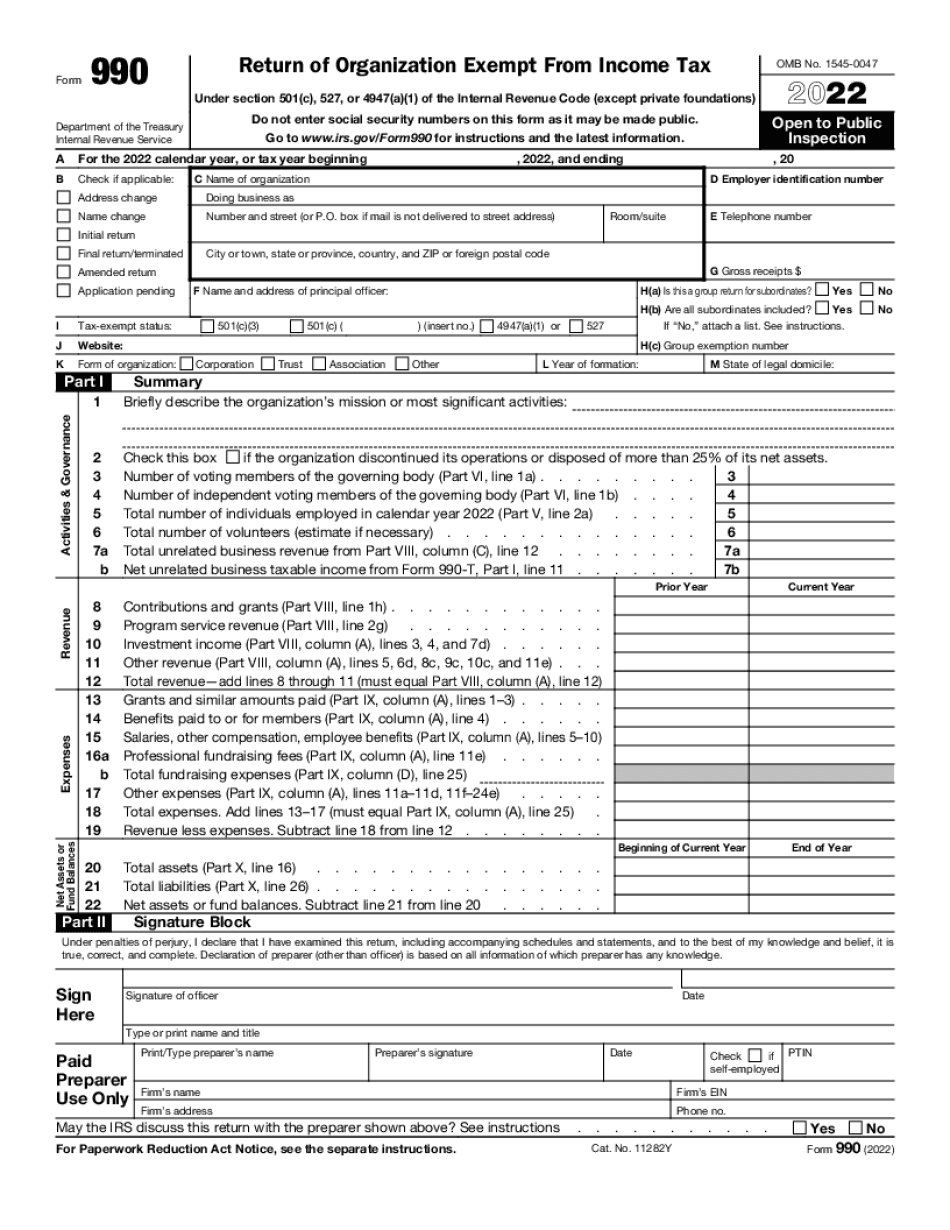

How To File 990 Ez Form

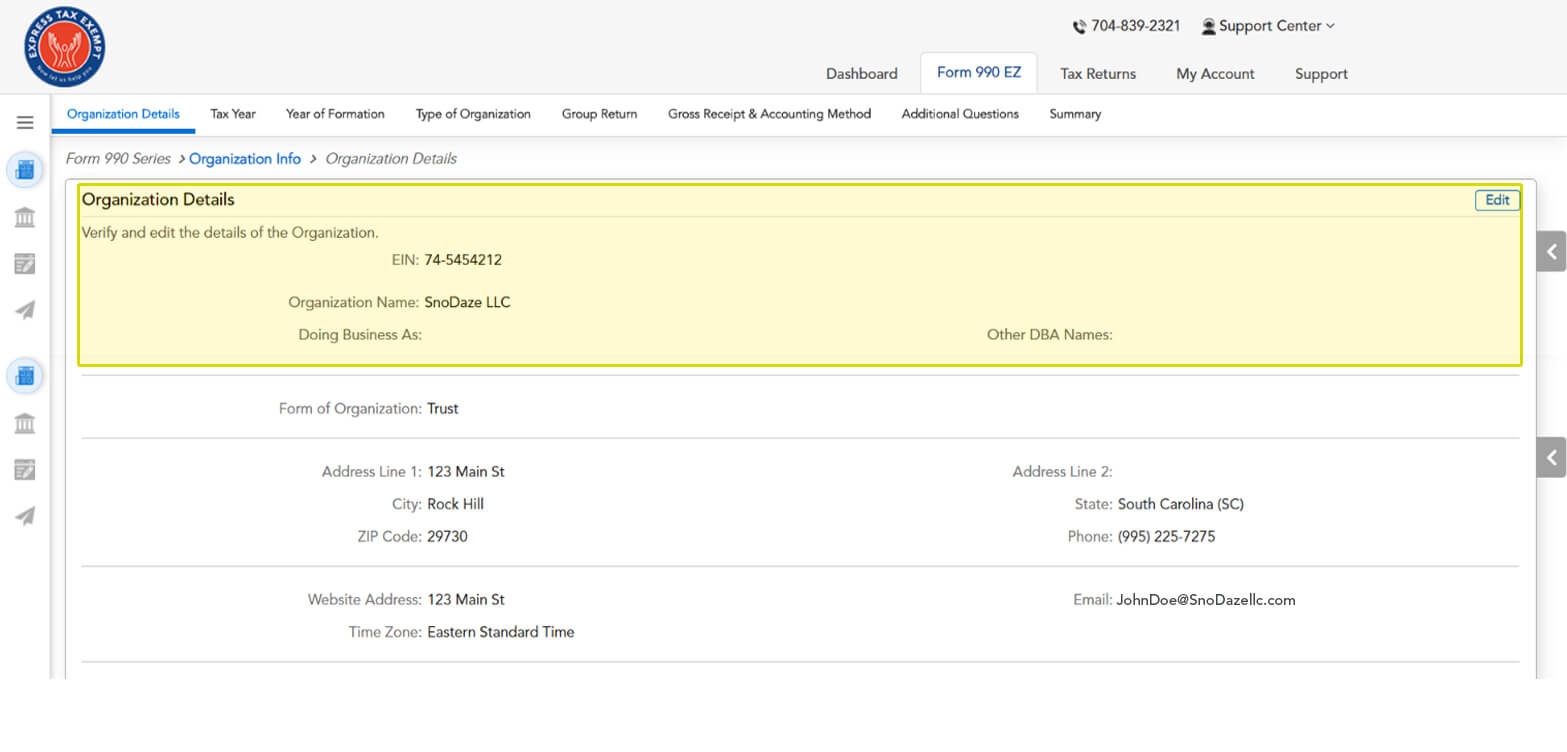

How To File 990 Ez Form - For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web 1 add organization details. The irs requires a login.gov or. Search your organization ein step 2 : Ad get ready for tax season deadlines by completing any required tax forms today. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Instructions on how to complete. Try it for free now! The following are examples when form 990 return of organization. Web secure with irs efile.

The irs requires a login.gov or. Upload, modify or create forms. The irs asseses penalties for failure to file in three ways. Search for your ein to import your organization’s data. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; 5 transmit to the irs. Instructions on how to complete. Penalties against an organization unless the organization can show that. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Search your organization ein step 2 :

Search for your ein to import your organization’s data. Ad get ready for tax season deadlines by completing any required tax forms today. The following are examples when form 990 return of organization. The irs asseses penalties for failure to file in three ways. Penalties against an organization unless the organization can show that. Sign in/create an account with login.gov or id.me: Web 1 add organization details. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Instructions on how to complete. Web most form 990 returns are due by the 15th day of the 5th month following the end of your tax year.

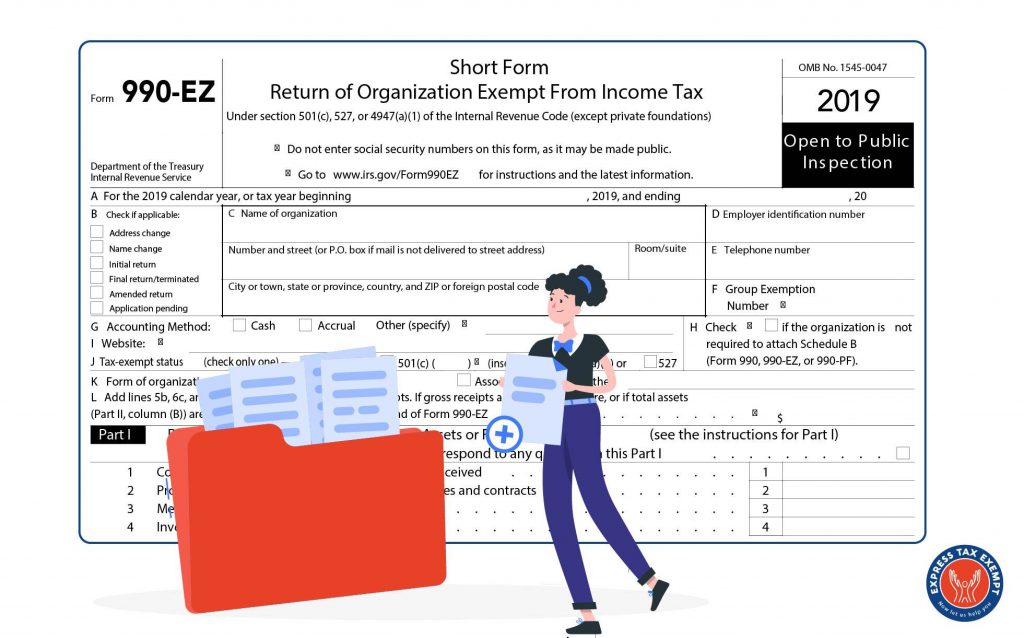

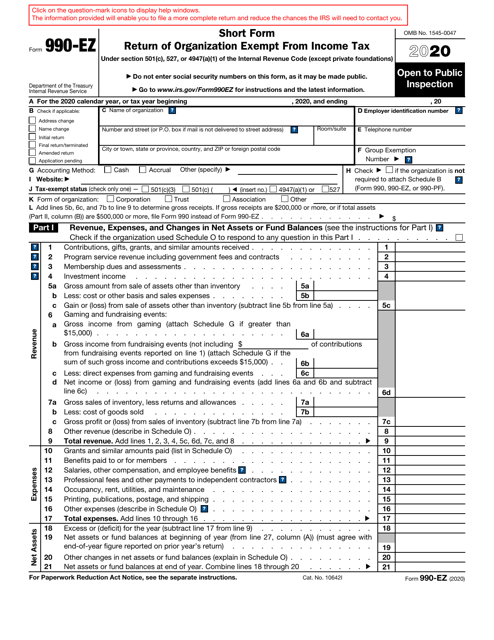

Form 990EZ Instructions 2021 Form 990EZ Filing instructions

Instructions on how to complete. Search your organization ein step 2 : The irs asseses penalties for failure to file in three ways. Search for your ein to import your organization’s data. The following are examples when form 990 return of organization.

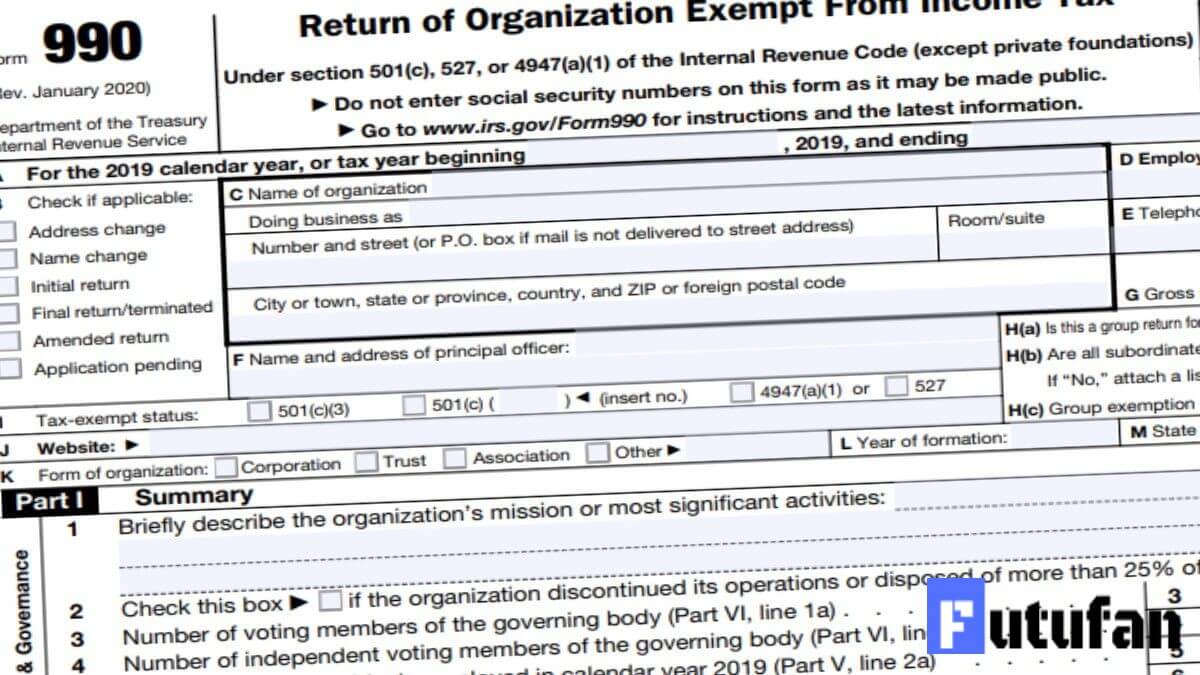

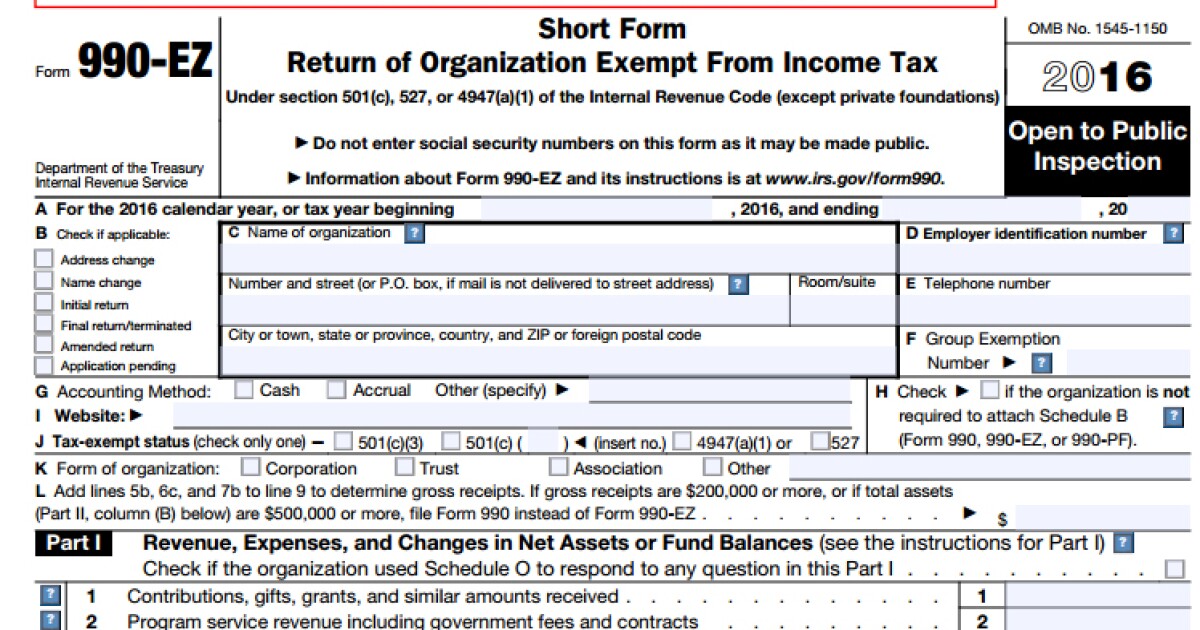

Irs Form 990 ez 2023 Fill online, Printable, Fillable Blank

Keep all of your organization’s tax records in our system indefinitely and securely, so you never have to worry about it again. The following are examples when form 990 return of organization. Search your organization ein step 2 : Web 1 add organization details. 5 transmit to the irs.

What Is The Form 990EZ and Who Must File It?

Web secure with irs efile. Keep all of your organization’s tax records in our system indefinitely and securely, so you never have to worry about it again. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Instructions on how to complete. Web an organization that isn’t covered by the general rule.

Form 990N ePostcard

Search your organization ein step 2 : The following are examples when form 990 return of organization. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Sign in/create an account with login.gov or id.me: The irs asseses penalties for failure to file in three ways.

File 990EZ Online Efile 990 Short Form 990EZ Filing Deadline

The following are examples when form 990 return of organization. Keep all of your organization’s tax records in our system indefinitely and securely, so you never have to worry about it again. Sign in/create an account with login.gov or id.me: 5 transmit to the irs. Try it for free now!

IRS Form 990EZ Download Fillable PDF or Fill Online Short Form Return

Ad get ready for tax season deadlines by completing any required tax forms today. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Try it for free now! The following are examples when form 990 return of organization. Search your organization ein step 2 :

File Form 990EZ Nonprofit 990EZ Returns Online Efile 990EZ

Web secure with irs efile. The following are examples when form 990 return of organization. Ad download or email irs 990ez & more fillable forms, register and subscribe now! The irs asseses penalties for failure to file in three ways. Search your organization ein step 2 :

Efile Form 990N 2020 IRS Form 990N Online Filing

Upload, modify or create forms. Keep all of your organization’s tax records in our system indefinitely and securely, so you never have to worry about it again. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web secure with irs efile. The irs requires a login.gov or.

Form 990EZ for nonprofits updated Accounting Today

The following are examples when form 990 return of organization. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Search your organization ein step 2 : 5 transmit to the irs. Web secure with irs efile.

Web An Organization That Isn’t Covered By The General Rule And/Or The Special Rules Doesn’t File Schedule B (Form 990), But It Answer No On Part Iv, Line 2, Of Its Form 990;

Web most form 990 returns are due by the 15th day of the 5th month following the end of your tax year. Search for your ein to import your organization’s data. Ad get ready for tax season deadlines by completing any required tax forms today. Sign in/create an account with login.gov or id.me:

The Following Are Examples When Form 990 Return Of Organization.

The irs asseses penalties for failure to file in three ways. Search your organization ein step 2 : Ad download or email irs 990ez & more fillable forms, register and subscribe now! Try it for free now!

Web Secure With Irs Efile.

Web 1 add organization details. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Penalties against an organization unless the organization can show that. Keep all of your organization’s tax records in our system indefinitely and securely, so you never have to worry about it again.

Instructions On How To Complete.

Upload, modify or create forms. 5 transmit to the irs. The irs requires a login.gov or.