How To File Form 15Ca

How To File Form 15Ca - Web you can fill and submit form 15ca through the following methods: Since the ca has now been added successfully, the rest of the process. Web form 15cb the “add ca” requisite has to be completed first. Web you can fill and submit form 15ca through the following methods: Can i file form 15ca online only? The xml(s) to be zipped in a folder. While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. Provide financial year, filing type and submission mode “offline/bulk”. For tan users dsc is mandatory to file form 15ca. Such taxpayer needs to file form 15ca and form 15cb.

Web you can fill and submit form 15ca through the following methods: The xml(s) to be zipped in a folder. Can i file form 15ca online only? Web step 1 fill form 15ca in the downloaded offline utility for forms submitted manually earlier and generate xml(s). When should i file this form? Web form 15ca cb must be filed with the income tax department, and 15cb should be accompanied by a ca certificate. Under the “my account” tab, the “add ca” option is to be selected. No time limit is prescribed for filing this form. While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. Faqs what is form 15ca and 15cb?

Step 2 taxpayer on selection of form 15ca, pan/tan of assessee is auto populated. For tan users dsc is mandatory to file form 15ca. Web step 1 fill form 15ca in the downloaded offline utility for forms submitted manually earlier and generate xml(s). Web you can fill and submit form 15ca through the following methods: No time limit is prescribed for filing this form. Alternatively, the utility can also be downloaded. While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. The offline utility service enables you to file form 15ca in the offline mode. Step 3 taxpayer download the form 15ca offline utility. Provide financial year, filing type and submission mode “offline/bulk”.

All You Need To Know About Form 15CA And 15CB InCorp Advisory

Faqs what is form 15ca and 15cb? Under the “my account” tab, the “add ca” option is to be selected. This form can be filed in both online and offline modes. Alternatively, the utility can also be downloaded. No time limit is prescribed for filing this form.

How To File EForm 15CA And 15CB Applicability & Procedure

Provide financial year, filing type and submission mode “offline/bulk”. Web how to file form 15ca and 15cb? The xml(s) to be zipped in a folder. Web you can fill and submit form 15ca through the following methods: Here, the membership number of the ca has to be entered.

Download manual format of Form 15CA Faceless Compliance

This form can be filed in both online and offline modes. Web you can fill and submit form 15ca through the following methods: The xml(s) to be zipped in a folder. Can i file form 15ca online only? Web form 15cb the “add ca” requisite has to be completed first.

File Form 15CA and 15CB Learn by Quicko

This form can be filed in both online and offline modes. However, it should be filed before the remittance is made. No time limit is prescribed for filing this form. Web step 1 fill form 15ca in the downloaded offline utility for forms submitted manually earlier and generate xml(s). Web form 15cb the “add ca” requisite has to be completed.

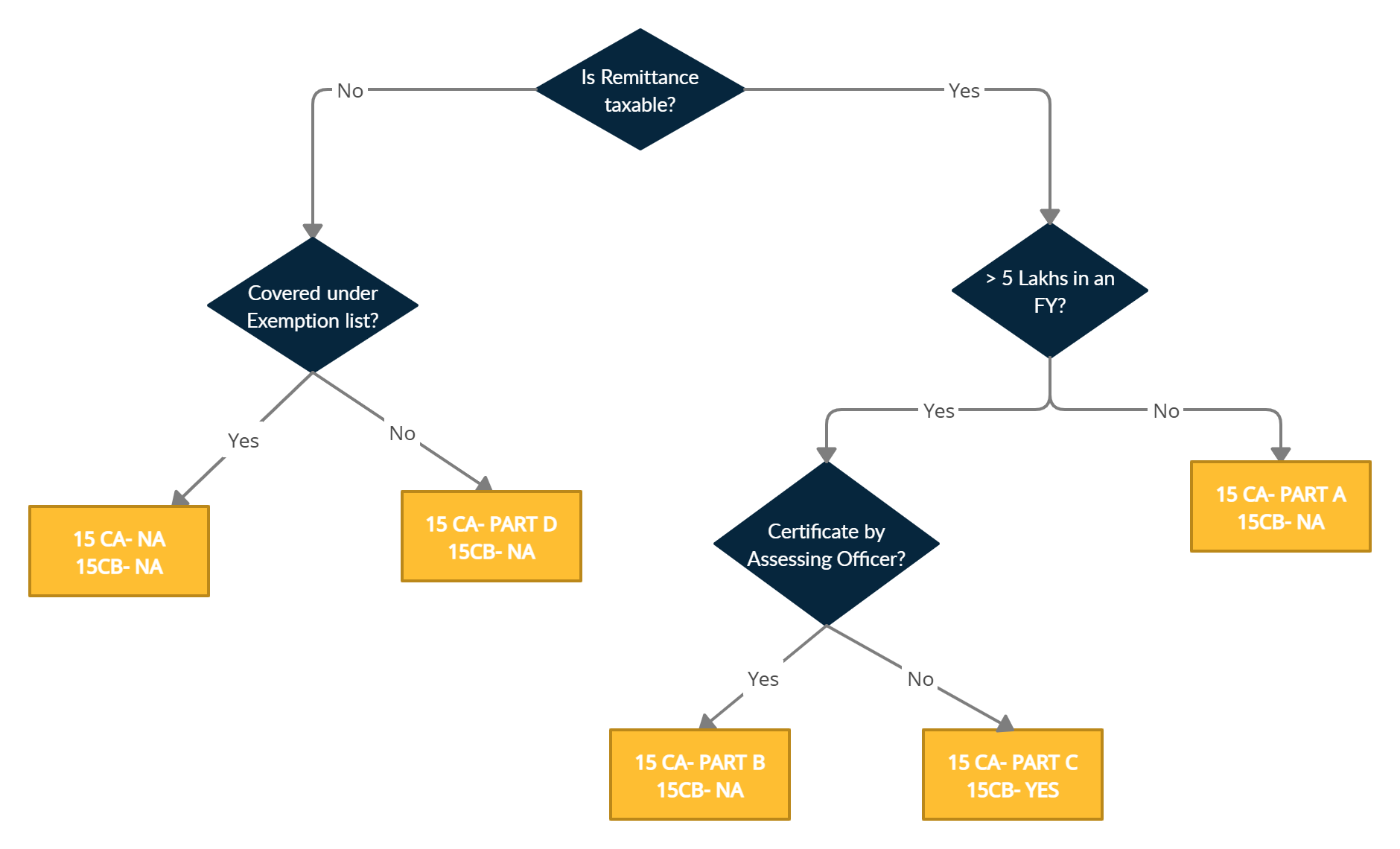

Form 15CA, Form 15CB When To File Form 15CA, Form 15CB?

Web you can fill and submit form 15ca through the following methods: When should i file this form? Step 2 taxpayer on selection of form 15ca, pan/tan of assessee is auto populated. Step 3 taxpayer download the form 15ca offline utility. While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant.

HOW TO FILE FORM 15CA STEP 3 YouTube

Alternatively, the utility can also be downloaded. Web form 15ca cb must be filed with the income tax department, and 15cb should be accompanied by a ca certificate. The xml(s) to be zipped in a folder. While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. Under the “my account” tab, the.

How to File 15CA and 15CB Online in 2016

Web you can fill and submit form 15ca through the following methods: Web form 15ca cb must be filed with the income tax department, and 15cb should be accompanied by a ca certificate. The form number is to be entered next as 15cb. The offline utility service enables you to file form 15ca in the offline mode. Under the “my.

Form 15ca and 15cb When & How to file by NRIs and Resident Indians?

Web you can fill and submit form 15ca through the following methods: Faqs what is form 15ca and 15cb? The xml(s) to be zipped in a folder. Web you can fill and submit form 15ca through the following methods: Alternatively, the utility can also be downloaded.

How To File EForm 15CA And 15CB

The xml(s) to be zipped in a folder. Web form 15ca cb must be filed with the income tax department, and 15cb should be accompanied by a ca certificate. Web you can fill and submit form 15ca through the following methods: Alternatively, the utility can also be downloaded. However, it should be filed before the remittance is made.

File Form 15CA and 15CB Learn by Quicko

While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. Here, the membership number of the ca has to be entered. Such taxpayer needs to file form 15ca and form 15cb. However, it should be filed before the remittance is made. Faqs what is form 15ca and 15cb?

Faqs What Is Form 15Ca And 15Cb?

While form 15ca is the remitter's declaration, form 15 cb is the certificate issued by a chartered accountant. Web how to file form 15ca and 15cb? The form number is to be entered next as 15cb. This form can be filed in both online and offline modes.

Alternatively, The Utility Can Also Be Downloaded.

Step 2 taxpayer on selection of form 15ca, pan/tan of assessee is auto populated. Under the “my account” tab, the “add ca” option is to be selected. Step 3 taxpayer download the form 15ca offline utility. Since the ca has now been added successfully, the rest of the process.

No Time Limit Is Prescribed For Filing This Form.

The offline utility service enables you to file form 15ca in the offline mode. Here, the membership number of the ca has to be entered. For tan users dsc is mandatory to file form 15ca. Web you can fill and submit form 15ca through the following methods:

Web Form 15Ca Cb Must Be Filed With The Income Tax Department, And 15Cb Should Be Accompanied By A Ca Certificate.

Web form 15cb the “add ca” requisite has to be completed first. Log in to the relevant account with the appropriate login credentials. Such taxpayer needs to file form 15ca and form 15cb. However, it should be filed before the remittance is made.