How To File Form 8812

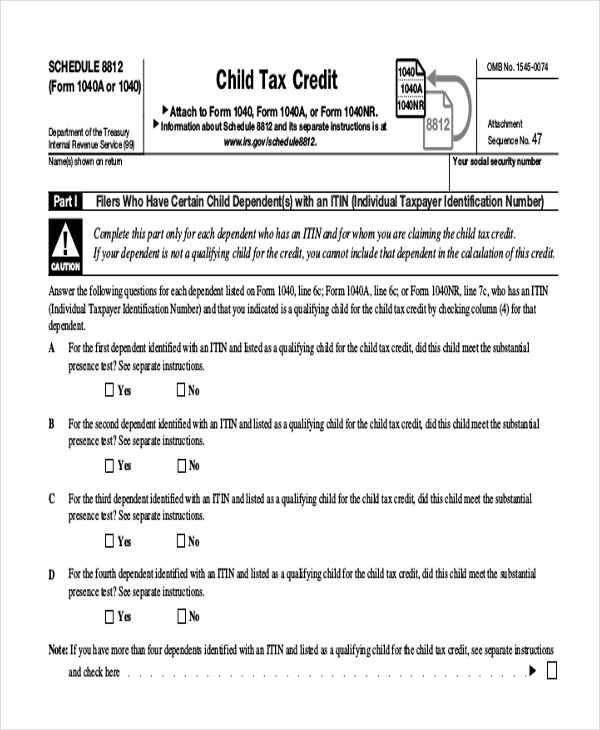

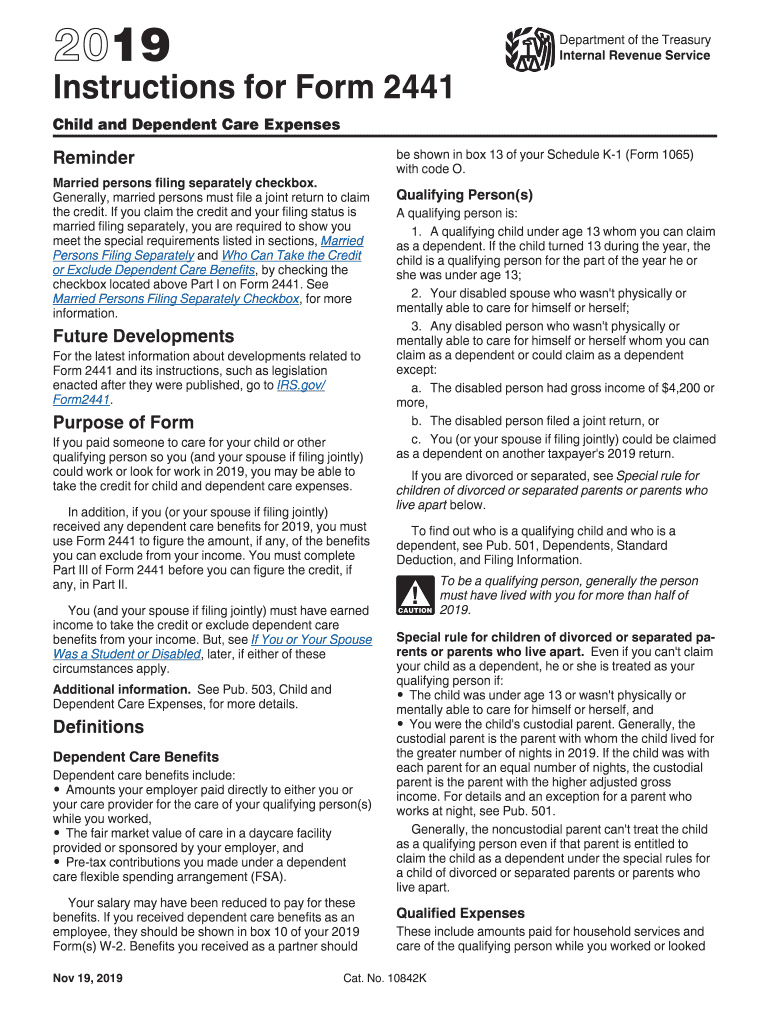

How To File Form 8812 - Solved•by intuit•proconnect tax•40•updated january 10, 2023. Web go to www.irs.gov/schedule8812 for instructions and the latest information. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web how can i file a schedule 8812 (form 1040) for the remaining half of the child tax credit from 2021? Use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; Web up to $40 cash back prepare a file. Choose the correct version of the editable pdf. Complete, edit or print tax forms instantly. I am eligible for the credit for the remaining half.

Choose the correct version of the editable pdf. You should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Use the add new button. Or form 1040nr, line 7c; Web up to $40 cash back prepare a file. Generating the additional child tax credit on form 8812 in proconnect. Web how can i file a schedule 8812 (form 1040) for the remaining half of the child tax credit from 2021? Use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c; Web how to file 2021 child tax credit with letter 6419 explained!

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax. Go to www.irs.gov/schedule8812 for instructions and the latest information. Ad complete irs tax forms online or print government tax documents. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Web follow this guideline to quickly and accurately complete irs 8812. Complete, edit or print tax forms instantly. Web how to file 2021 child tax credit with letter 6419 explained! The best way to submit the irs 8812 on the internet: Choose the correct version of the editable pdf. I am eligible for the credit for the remaining half.

Ssurvivor Form 2555 Ez Instructions 2018

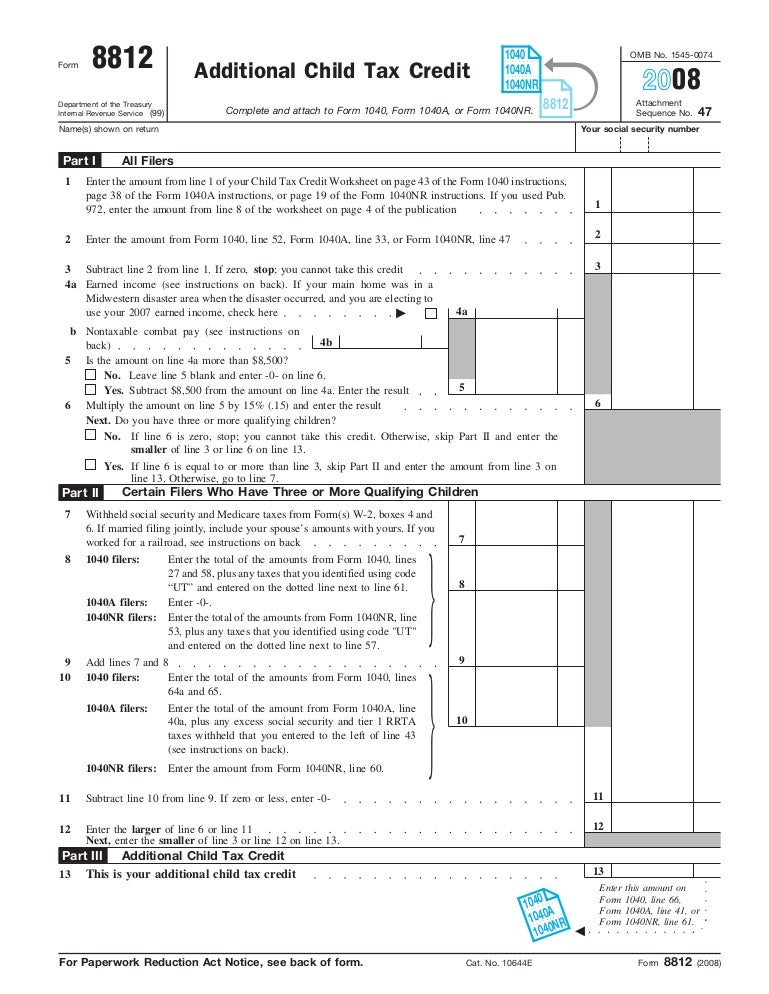

Generating the additional child tax credit on form 8812 in proconnect. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Complete, edit or print tax forms instantly. Web how to file 2021 child tax credit with letter 6419 explained! (form 8812) 55,452 views premiered feb 13, 2022 2021 child tax credit explained as we discuss an.

IRS Form 8821 Tax Information Authorization

Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its url. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you.

2019 Form IRS 1040 Schedule 8812 Instructions Fill Online, Printable

Try it for free now! Web filing schedule 8812 (form 1040) when should i file? Web tax breaks internal revenue service 1/9 (image credit: You should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Don't miss this 50% discount.

Form 8812Additional Child Tax Credit

I am eligible for the credit for the remaining half. Click the button get form to open it and begin editing. Web filing schedule 8812 (form 1040) when should i file? Generating the additional child tax credit on form 8812 in proconnect. Web tax breaks internal revenue service 1/9 (image credit:

Form 1040 U.S. Individual Tax Return Definition

Web follow this guideline to quickly and accurately complete irs 8812. Upload, modify or create forms. Solved•by intuit•proconnect tax•40•updated january 10, 2023. The best way to submit the irs 8812 on the internet: Go to www.irs.gov/schedule8812 for instructions and the latest information.

Child Care Tax Credit Calculator 2022 • cafetiereitalienne 2023

Ad complete irs tax forms online or print government tax documents. Web filing schedule 8812 (form 1040) when should i file? The best way to submit the irs 8812 on the internet: Don't miss this 50% discount. Complete, edit or print tax forms instantly.

8812 Worksheet

Web how can i file a schedule 8812 (form 1040) for the remaining half of the child tax credit from 2021? Generating the additional child tax credit on form 8812 in proconnect. You should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Complete, edit or print tax forms instantly. Go to www.irs.gov/schedule8812.

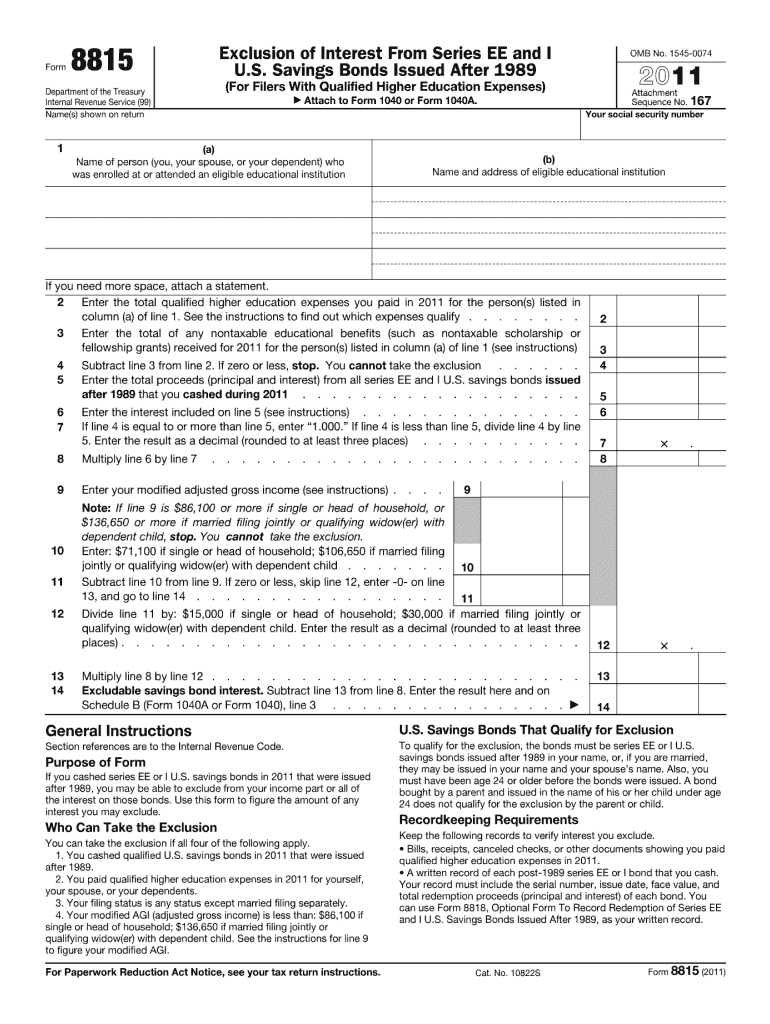

Form 8815 Instructions Fill Out and Sign Printable PDF Template signNow

Web tax breaks internal revenue service 1/9 (image credit: Try it for free now! Getty images) 2021 child tax credit changes question: You should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Web schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents (odc),.

Form 8812 Form Fill Out and Sign Printable PDF Template signNow

Try it for free now! Ad complete irs tax forms online or print government tax documents. Upload, modify or create forms. I am eligible for the credit for the remaining half. Generating the additional child tax credit on form 8812 in proconnect.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Web up to $40 cash back prepare a file. Web follow this guideline to quickly and accurately complete irs 8812. Ad complete irs tax forms online or print government tax documents. Getty images) 2021 child tax credit changes question: Ad complete irs tax forms online or print government tax documents.

Web Up To $40 Cash Back Prepare A File.

Try it for free now! Solved•by intuit•proconnect tax•40•updated january 10, 2023. Web go to www.irs.gov/schedule8812 for instructions and the latest information. Click the button get form to open it and begin editing.

What Changes Were Made To The 2021 Child Tax.

Web how to file 2021 child tax credit with letter 6419 explained! Web how can i file a schedule 8812 (form 1040) for the remaining half of the child tax credit from 2021? Generating the additional child tax credit on form 8812 in proconnect. Use part i of schedule 8812 to document that any child for whom you entered an itin on form 1040, line 6c;

Then Upload Your File To The System From Your Device, Importing It From Internal Mail, The Cloud, Or By Adding Its Url.

Use the add new button. I am eligible for the credit for the remaining half. Web schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). (form 8812) 55,452 views premiered feb 13, 2022 2021 child tax credit explained as we discuss an example of.

Getty Images) 2021 Child Tax Credit Changes Question:

You should complete file irs schedule 8812 (form 1040) when you complete your irs tax forms each year. Don't miss this 50% discount. Web tax breaks internal revenue service 1/9 (image credit: Upload, modify or create forms.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)