How To Fill Out 1042-S Form

How To Fill Out 1042-S Form - Web understanding when u.s. From within your taxact return ( online or desktop), click federal. Source income to a nonresident. Person must be reported on a. This is the most important part of the form, and you must provide the right code. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. Web provide the income code for the type of income you’re reporting. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Person or company that makes payments of u.s. In this video, i cover a.

Complete, edit or print tax forms instantly. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Person must be reported on a. Web provide the income code for the type of income you’re reporting. In this video, i cover a. On smaller devices, click the menu. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Fill in the gross income with the. Source income to a nonresident.

Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Source income subject to withholding, to report amounts paid to. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. From within your taxact return ( online or desktop), click federal. In this video, i cover a. Web understanding when u.s. Person or company that makes payments of u.s. Ad access irs tax forms. Person must be reported on a. Get ready for tax season deadlines by completing any required tax forms today.

Instructions for IRS Form 1042S How to Report Your Annual

Complete, edit or print tax forms instantly. Fill in the gross income with the. This is the most important part of the form, and you must provide the right code. In this video, i cover a. Source income to a nonresident.

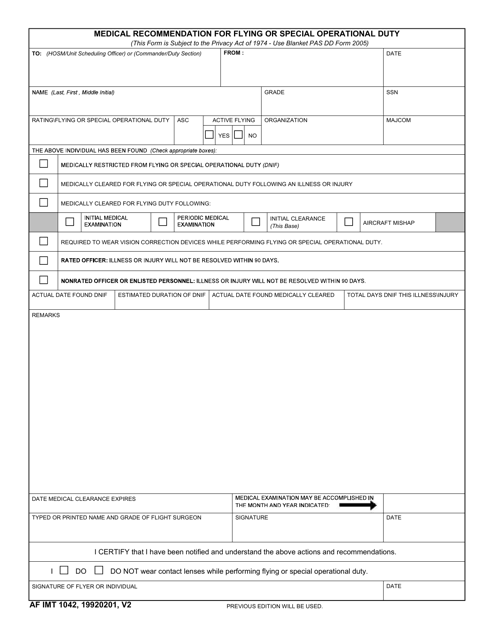

AF IMT Form 1042 Download Fillable PDF or Fill Online Medical

Web provide the income code for the type of income you’re reporting. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. Source income subject to withholding, to report amounts paid to. From within your taxact return ( online or desktop), click federal. In this video, i cover a.

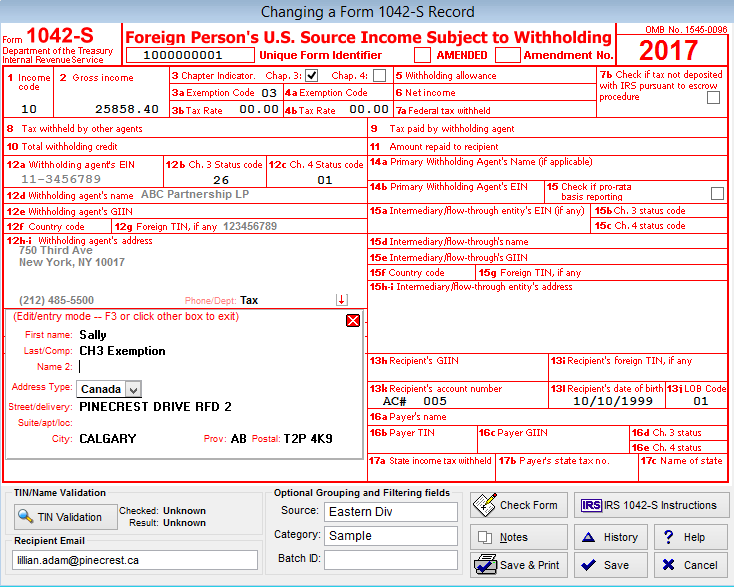

1042 s 2017 form Fill out & sign online DocHub

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, to report amounts paid to. In this video, i cover a. Web understanding when u.s.

1042S Software, 1042S eFile Software & 1042S Reporting

Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. In this video, i cover a. Web understanding when u.s. Source income subject to withholding, to report amounts paid to.

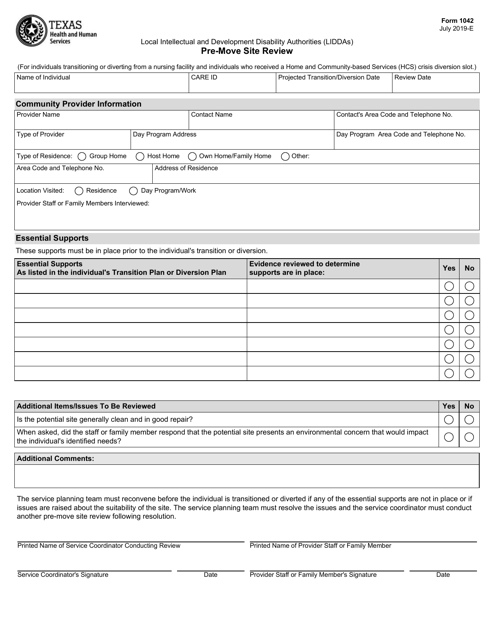

Form 1042 Download Fillable PDF or Fill Online Premove Site Review

Source income subject to withholding, to report amounts paid to. From within your taxact return ( online or desktop), click federal. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. Source income to a nonresident. Person must be reported on a.

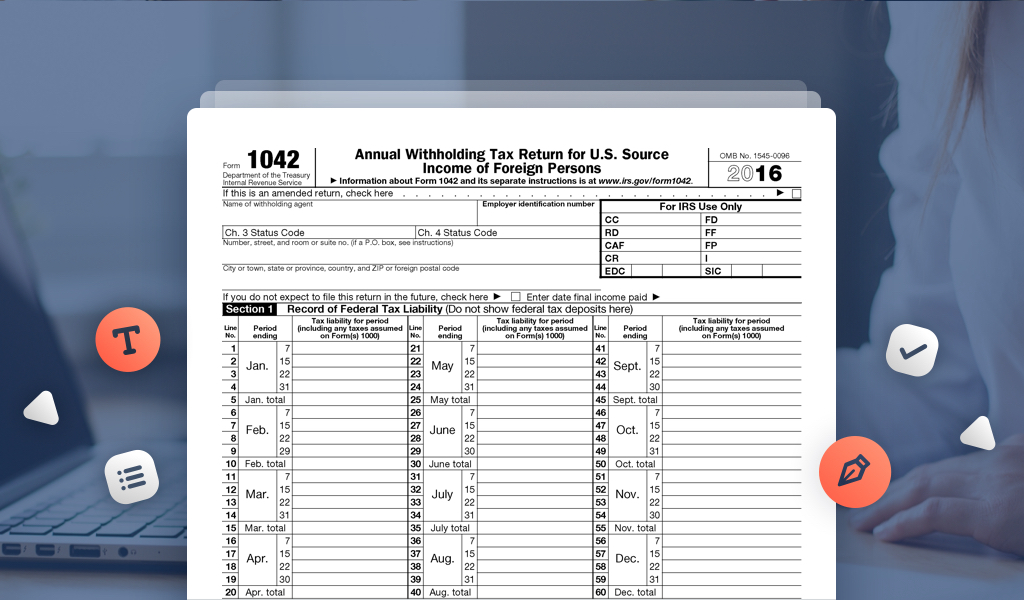

3.21.110 Processing Form 1042 Withholding Returns Internal Revenue

Web understanding when u.s. Source income to a nonresident. Source income subject to withholding, to report amounts paid to. Get ready for tax season deadlines by completing any required tax forms today. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign.

68 [pdf] 1042S FORM BANK PRINTABLE HD DOWNLOAD ZIP * BankForm

Web provide the income code for the type of income you’re reporting. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. On smaller devices, click the menu. Source income subject to withholding, to report amounts paid to. Ad access irs tax forms.

2019 2020 IRS Form Instruction 1042S Fill Out Digital PDF Sample

Person must be reported on a. Source income subject to withholding, to report amounts paid to. Ad access irs tax forms. Source income to a nonresident. Get ready for tax season deadlines by completing any required tax forms today.

Irs 1042 s instructions 2019

From within your taxact return ( online or desktop), click federal. Person must be reported on a. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Source income subject to withholding, including recent updates, related forms, and.

Filling Out The Form 1042s Stock Photo Image of large, paying 63611036

Get ready for tax season deadlines by completing any required tax forms today. Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. This is the most important part of the form, and you must provide the right code. Complete, edit or print tax forms instantly. Web understanding when.

Source Income Subject To Withholding, To Report Amounts Paid To.

On smaller devices, click the menu. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Person or company that makes payments of u.s. Person must be reported on a.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

In this video, i cover a. Complete, edit or print tax forms instantly. Web understanding when u.s. From within your taxact return ( online or desktop), click federal.

Web Provide The Income Code For The Type Of Income You’re Reporting.

Using the boxes reported on the 1042s as a guideline, within turbotax you will enter them as a type of foreign. Ad access irs tax forms. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Fill in the gross income with the.

This Is The Most Important Part Of The Form, And You Must Provide The Right Code.

Source income to a nonresident.

![68 [pdf] 1042S FORM BANK PRINTABLE HD DOWNLOAD ZIP * BankForm](https://c8.alamy.com/comp/GDTMCE/filling-out-the-form-1042-s-which-confirms-the-payment-of-the-tax-GDTMCE.jpg)